Just shoot me:

A fiscally conservative Democrat who chairs the U.S. Senate’s budget committee on Wednesday said he supports extending all of the tax cuts that expire this year, including for the wealthy.

“The general rule of thumb would be you’d not want to do tax changes, tax increases … until the recovery is on more solid ground,” Senator Kent Conrad said in an interview with reporters outside the Senate chambers, adding he did not believe the recovery has come yet.

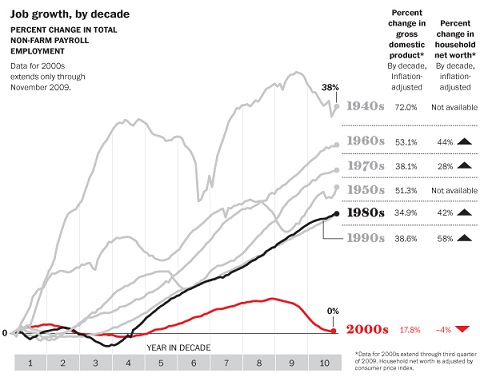

Can Kent Conrad please explain to me why we should keep the Bush tax cuts in place, when there was absolutely ZERO job creation during the last ten years:

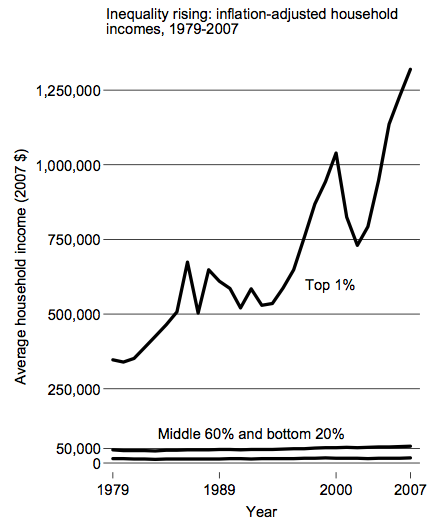

On the other hand, this DID happen:

And this is what happens if we don’t let the tax cuts expire:

We enacted these tax cuts, there was no job creation, debt exploded, and only the wealthiest of the wealthy profited. So tell me, Mr. Fiscal Conservative Kent Conrad, why should we not let the tax cuts for the rich expire?

And if it is not evident to you by now, the best way to get our finances back in order is to systematically ignore anyone who calls himself a fiscal conservative. If I could find a bank run by dirty hippies I would put my money there, because I just don’t trust these people in pinstripes anymore.

schrodinger's cat

I personally prefer credit unions.

JR

When you find that bank run by the DFH, let me know. I’m stuck down here in Tejas with the insane people.

aimai

At the time it was pointed out that Tax Cuts to Tax Cutters were a universal panacea. In good times, with (say) Clinton’s surplus, they “gave the money back to the people/the government didn’t need it” and in bad times, apparently, they “give the money back to the people/the government needs the trickle up effect so badly.” There’s no arguing with these assholes. Until we can pass a law that no Senator or House member can vote on any Tax bill that personally affects their income, or that of their close family members, we won’t get rid of these incubi.

Obama, Pelosi, and Reid have to step it up and insist that “We are all in this together! Rich families will just have to “tighten their belts” just like the government and the poor. Ordinary people–the working class and the middle class have been fighting and dying in the wars. Now the least the Rich can do is pay a little bit in taxes to pay for the wars and the social fallout from their tanking of the world economy. If Conrad doesn’t like the word tax, lets call it a “fee” for letting them live.”

aimai

Alex S.

It’s really inexplicable…

Agoraphobic Kleptomaniac

Credit Unions Seconded.

This is why Democrats are losing this November, and if they keep this up, they deserve to.

Everybody squeeze into that handbasket, we’re going for a ride!

Omnes Omnibus

@aimai: But… but… but some poor people pay no income tax and are freeloaders. Rich people pay more in taxes. It isn’t fair.

/glibertarian response

General Stuck

Luckily, the rarified wanking of Mr. Conrad will have no effect. The House liberals/Marxists won’t have any of it. It will take affirmative action to keep the tax cuts in place. IOW”s, libtards will fiddle while Nero burns. Only the most middle class tax breaks will get extended. And maybe not even them. At least I hope not. Time for everyone to ante up for this neverending game of high stakes poker, before the Chinese turn us into Soylent Stir Fry.

sukabi

you know what would shut these cut-the-deficit-by-extending-tax-cuts-for-the-rich-only assholes up? A thorough audit of their families personal finances over the last 10 years… then we could see in black, white and green just who’s benefited the most from these insane policies.

Comrade Mary

There’s the short, punchy message the Democrats need to hammer over and over again in the media and in the fall campaign commercials.

And that’s great, too, aimai.

Why, oh why, can’t we have better messaging?

danimal

Fiscal conservatives support endless war, propose irresponsible tax cuts, demagogue Medicare and student load cuts, and preen for the cameras without ever proposing an actual plan for addressing deficits. I’d like to punch Conrad right now, and he’s usually one of the good guys.

Corner Stone

@Comrade Mary: Class Warfare-ist!!

twiffer

other than the 10th Doctor and myself (when i need to actually wear one of my 2 suits), i agree on not trusting those in pinstripes.

Mike G

Still waiting for the Deficit Chickenhawks and the Tealiban to express their outraged opposition to the Bush tax cuts, obscene levels of military and war spending, and the absence of Public Option health insurance, all of which add massively to the deficit.

** chirping crickets **

Martin

And what I don’t get is that I know a guy with a higher net worth than probably the whole GDP of North Dakota. The Bush tax cuts help all of 9 people in his state – why the fuck does he care?

rickstersherpa

Senator Konrad, as well as Senator Nelson, come from the two states, North Dakota and Nebraska, with the lowest unemployment rates in the country. And the have plenty or rich constituents who they interact with daily, as millionaires themselves, who don’t want their taxes going up. A politician reflecting his local constituency is a shock. Does not make it forgiveable, but it is not surprising. Also, Senator Konrad is very tight with, and sees his state, North Dakota, benefiting from the “Finance Interest.” What is that?

From the blog Econospeak, via Angry Bear (this is from 21 May 2010)

“…What got us into this mess in the first place, and what now threatens to throw us back into the maelstrom, is the political hegemony of the “finance perspective”, the interests and outlook of those whose main concern is maximizing (and now simply protecting) the value of their financial assets.

Within the world of elite interests, this is almost a mass constituency. While the bulk of such assets are held by an infinitesimal few, perhaps the top 10-20% of the population in the industrialized countries have significant financial wealth and actively monitor their returns. Their understanding of how economies work and what priorities policy-makers should adhere to follow from their personal position. Inflation is a constant threat to asset-holders. They fear the laxity of central banks as well as the buildup of government debt, which can serve as an incentive to future inflation. They want their portfolios to have a component of absolutely risk-free government securities, and the very whisper of sovereign default chills them to the core. They believe in the inherent reasonableness of financial markets and believe that anyone who wishes to borrow from them should demonstrate their prudence and fiscal rectitude. They were willing to relax their principles temporarily during the panic, but now that they have caught their breath they want to see a return to “sound” practices. Governments will bend to their wishes not because they have better arguments, but because they hold power.

Don’t get me wrong. I am not making the crude claim that policy is driven directly by interests. In fact, I believe that, if they get their way, holders of financial assets will suffer along with the rest of us. (Not as much, of course: succumbing to a haircut because of debt deflation cannot be compared to losing one’s job and not being able to meet basic needs.) The process is more complicated: where one sits in society and the kinds of problems one typically has to solve leads to a way of thinking, and this manner of thinking then informs politics. For centuries, the finance perspective has played a central role in economic theorizing, and there is ordinarily a body of research to support it. What I am proposing is this: economic orthodoxy is regaining control over policy because it reflects the outlook of those who occupy the upper reaches of government and business…”

By the way, explains the currrent prominence of Niall Ferguson, who is currently the most articulate spokesperson for the “Finance Interest” in the Anglo-American world.

TenguPhule

Conrad needs a good swift kick to his junk bonds.

Corner Stone

@sukabi:

What’s wrong with making a little money?

If I work hard and get the government out of my way, pretty soon I’m going to be in that bracket too. And I sure as hell don’t want the government taxing my hard earned money!

sstarr

Top marginal tax rates (for the very wealthiest Americans) in the first year of each decade:

1940: 81%

1950: 81%

1960: 91%

1970: 71%

1980: 70%

1990: 28%

2000: 39%

Odd how the lowest rates fail to correspond to the highest growth…..

Kyle

But… but… but some poor people pay no income tax and are freeloaders.

I’d like to see the real details of the screaming-headline 47% PAY NO INCOME TAX.

My income as a single person (thankfully augmented with parental support) was near poverty level for several years after college in the crap job market of early-90s California, and I still ended up paying some.

ChrisS

And here’s the kicker:

Most likely you will not. Thanks for playing, suckers.

sven

When any journalist uses the term ‘fiscally conservative’ they should be forced to run a caption to the side of the story explaining what they mean. It is one of those phrases political reporters throw around endlessly but is in fact totally meaningless….

other favorites:

‘tough on crime’ (the soviets, drugs, etc.)

‘everyman quality’

‘the heartland’

There must be dozens more…

Peter

Out of curiosity, does anybody here know why the ‘without tax cut extensions’ portion of that last graph actually drops until 2025, before accelerating upwards?

I’m sure there’s a reasonable explanation, I just don’t know what it is.

SpotWeld

Those first and second charts pretty much destroy the trickle down idea of economic recovery.

Second chart shows lots of money moving to the upper levels of the income scale. According to right-ring monetary theory this means they are all primed to start investing in American and start creating jobs.

The first chart shows what happened. No jobs created (or at least not a pass faster than they were lost.)

Whatever your theory the facts are there. Stimulus to the “top” doesn’t do much for the US economy as a whole.

Mnemosyne

@Kyle:

I, too, would like an explanation of that, because I make under $40K a year and I have a little box on my W-2 that says, “Income Tax Paid” with a dollar amount in it. Either the government is lying to me and I’m not really paying income taxes (and the money is being burned in a furnace somewhere) or somebody at the Cato Institute is a fucking moron who needs to be whapped upside the head.

I’m pretty sure I know the answer, though.

Corner Stone

@ChrisS:

If the government would stop stealing my hard earned money, only to give it to people too lazy to do for their own, I’d probably finally be able to get ahead. I’m a better judge of how to use my money than any damn bureaucrat.

Then I could decide which charities or churches I wanted to donate to, and they could help people.

sukabi

@Omnes Omnibus: you know what’s so funny about that “argument”? It’s never followed up with an example of the percentage of income the poor pay in other taxes… social security, medicare, L & I, property taxes, sales tax, gas tax, ect. If you contrasted that with the percentage of income the rich pay in taxes I think the argument would change….

There is never an honest discussion about taxes or tax rates in this country. It’s always skewed from the outset in favor of the wealthy. Just ask someone that’s complaining that the tax rate of 35% on the top bracket is too high…. then ask them if that rate is prior to deductions being taken or after deductions are taken… like all the other tax brackets it’s after deductions…. The fact that Warren Buffett has come out and shown that he pays less income tax than his secretary because of what he can deduct should show anyone how skewed in favor of the wealthy the tax system is.

licensed to kill time

Those two flat lines for the middle 60% and bottom 20% are just depressingly sad. We’re flatlining, and someone needs to call a Code Blue.

rikyrah

the truth is that all these deficit bullshitters are shown to be the bought-and-paid for clowns that they’ve always been. them being so nekkid and unable to hide this time behind the lies is a positive.

cat48

But, but “small business.”

Comrade Kevin

The best trick “fiscal conservatives” have ever pulled was getting the media to refer to them as “fiscal conservatives”.

Corner Stone

@sukabi:

Less on a percentage basis, not total amount.

Not to be nitpicky, but that is actually an important data point.

sukabi

@Corner Stone: I was talking specifically about the Kent Conrads… he’s busy making and pushing legislation that will benefit himself and very few other folks… that’s not the job of a senator. His job is to make and push policies that will benefit the country at large, not just a small sector of it.

Mnemosyne

@Peter:

I’m guessing it’s Social Security and having the elephant of the retiring Baby Boomers pass through the system, creating a scary-looking (but, by its nature, temporary) bulge in the system.

sukabi

@Corner Stone: not nearly the 35% tax bracket that his income would fall under.

17.7% is the rate that Buffet pays in actual taxes…

Hal

I was watching some Fox “business” show this morning, can’t remember the name; the one with the English guy and token black conservative, and according to them, “everyone” knows tax cuts do not create revenue. Also, most people who would have their taxes increased are small business owners, and they won’t create more jobs if their taxes are raised.

So there!

cleek

@Kyle:

here ya go.

sven

@sukabi: It hardly a coincidence that conservatives spend all their time complaining about the one progressive tax we have in the United States. But boy, they sure do like the consumption tax don’t they?

Comrade Dread

Fiscal conservatism is the very definition of newspeak.

There’s nothing conservative (in the dictionary defined sense of the word) about running up massive debts, ignoring military spending, cutting revenues and increasing overall spending while claiming that you’re making money.

Proponents of this are either cynical fucks who are in on the gag or hopelessly naive idealists (fools) who likely also believe that clapping your hands will save a faerie.

Mnemosyne

@cleek:

You’d think the writer of an article like that might think, “Hmm, all of my quotes and statistics are from right-wing sources, maybe I should try and get another opinion.”

Apparently not.

Agoraphobic Kleptomaniac

And I’m often surprised at how many Adults don’t understand the basics about tax rates. I can’t tell you how often I’ve had to explain that Tax brackets only apply to the money earned within that bracket, not all of your money.

cleek

@Mnemosyne:

here’s a better article on it.

Kered (formerly Derek)

Graph #2: MY HEAD A SPLODE

LGRooney

Transfer as much debt as you can, to remain responsible, to the credit unions. Anything you can’t transfer, you stop paying. Household wealth in this country is ludicrously concentrated in that top 1% and much of that wealth has been/is ownership of financial institutions. Stop paying the banks, stop paying the criminals. Stop paying the criminals, they stop paying their lobbyists. Stop paying the lobbyists, our legislators will actually have to work. Our legislators actually have to work, we’ll have more intelligent legislators (b/c pinheads looking for an easy ride will no longer look to a seat on the GOP ticket as an easy route fortune). More intelligent legislators, more intelligent legislation. More intelligent legislation, the greater benefit for us all.

Okay, okay, it may mean we only get smart financial industry/ economic legislation but it’s a start.

Agoraphobic Kleptomaniac

@Cleek: Holy cow that MSNBC story is a biased pile of garbage.

Public safety and educational fees are mostly paid for by local taxes, not Federal tax. Infrastructure is mostly paid for by other taxes (I have a local sewer/utility/natural gas tax) and Gasoline taxes. They have a point on National Defense being paid for by federal money.

The fact that the percentage of federal taxes paid by the top 10% of america just shows how much less money there is in the lower 90%.

WereBear

At this point it would take very, very little for me to put some heads in a wine press; metaphorically, of course.

I have no respect for these financial giants. They had no compunction about running housing prices out of the reach of most people and using their credit cards to charge interest the Mafia used to be arrested for.

They aren’t even smart enough to realize that if they collapse the world financial system their money would be worthless, too.

Forget the rusty pitchforks. Get me a sleek new John Deere!

R-Jud

@Peter:

If you click through to the linked NYT article, there’s an explanation. Health care costs are the main driver in the projected acceleration.

Kristine

Conrad walked it back somewhat.

Agoraphobic Kleptomaniac

@Kristine: Ah yes. The “We’ll fix this in 2 years” defense for awful economic policies. In my entire life, this has been the most persistant lie in government, which is how things have gotten this bad, and why the financial regluation bill sucks (it essentially kicks these regs down the road 2 years, during which time they can be neutered).

Stefan

Also, most people who would have their taxes increased are small business owners, and they won’t create more jobs if their taxes are raised.

How do they even think this works??? Why would small business owners not create more jobs in their businesses (assuming their businesses were growing and needed additional help to produce additional goods/services) if the business owners’ personal income taxes were raised?

Do these morons really not understand (or, perhaps as likely, pretend not to understand) the difference between (i) the taxes a business owner pays as an individual on the income they draw out of the business and (ii) the taxes the business as a corporate entity itself pays? They’re not at all the same thing.

In fact, if the business owner would pay more tax as an individual, wouldn’t he have even more incentive not to draw money out of the business to pay himself, but to leave it in the business, thereby increasing the amount of money available for expansion and add’l jobs?

Sometimes I want to bang my head against the wall until I pass out, I really do….

Peter

@Mnemosyne:

@R-Jud:

Ah, thank you! Knew I was missing something.

Kat

@Corner Stone:

If the government would stop stealing my hard earned money, only to give it to people too lazy to do for their own…

Yep – I wouldn’t mind seeing Paris Hilton hold down a real job, myself.

/snark

If money ‘works’ (so the people who own it won’t have to), it ought to pay the same tax rate as the rest of us.

Kristine

@Agoraphobic Kleptomaniac: Yes, but he also said that faced with the choice, he is for ending the tax cuts for the rich now.

Church Lady

@sukabi: Because something like 99.99% of his income is derived from capital gains, not wages. Now if the Democrats want to start debating an increase in the capital gains tax, particularly any amount over a reasonable threshold, I am all ears.

Church Lady

@Stefan: Most small business owers (i.e., the self-employed) business profits ARE their personal income. Ever heard of a Schedule C? It is a small percentage of all small businesses that are incorportated.

Sly

@sukabi:

Even the ones that are ostensibly geared toward the middle class end up benefiting the wealthy. The mortgage deduction is a great example, as it encourages large scale household debt among the middle class through the tease of homeownership.

@Agoraphobic Kleptomaniac:

On a note related to people not knowing how marginal rates work, I found this story from last year to be pretty fucking hilarious. In the respect that the Attorney and Dentist mentioned in the story should probably fire their accountants.

ThatLeftTurnInABQ

@Kristine:

Paging Thomas Friedman, paging Thomas Friedman, answer the white courtesy telephone please…

So 1 Conrad Unit equals 3-4 F.U.’s

Sounds about right.

sukabi

@Church Lady: and that 99.9% of his income isn’t “real money”, so therefore shouldn’t be taxed like he’s going to actually use it?

Money that you don’t do anything to actually “earn” should be taxed at a much higher rate than money you actually work for.

Sanka

BUT….BUT……Obama gave the middle class a tax-cut remember?? He DID! A whole $13 worth…….that WORKED RIGHT?? RIGHT??

Remember?? When the unemployment rate was 5.8% when he took office and now it’s…..er, it’s……

SARAH PALIN IS DUMB!!

Sly

@Church Lady:

37% is not a small percentage, and the trend has been moving upwards due to a variety of factors that have made incorporation more attractive. I suspect the health benefits deduction is one of the largest.

Besides, I find the whole argument about non-incorporation to be somewhat absurd. “If you don’t let me avoid paying my taxes, how will I avoid paying my taxes?”

Zach

It’s amazing that it’ll probably be easy to get 60 votes to extend the cuts in the upcoming budget, yet Democrats can’t successfully harangue Republicans for opposing one of the largest tax cuts in history that went to 95% of American families.

If the DNC weren’t so afraid of tweaking Blue Dogs, they’d be ahead of the issue with an ad saying, “The GOP voted against tax cuts for 95% of Americans – tax cuts that are a vital component for economic stimulus that’s created millions of American jobs. They voted against tax credits that make health care affordable for everyone. Now, the GOP’s ready to vote for tax cuts, but only for millionaires. On Nov. 2, tell the GOP that this won’t help you, won’t help our economy, and won’t help America.”

Zach

@Sanka: Yes, actually it did work. In fact, it worked better because no one knew about it. Can anyone imagine the GOP passing a tax cut and not making a big deal out of it?

Zach

Last thing, a Georgia (I think) Congressman (R) was on Washington Journal with a pretty killer line: “People want a paycheck; not an unemployment check!”

His solution is applying all unspent stimulus funds to lowering the corporate tax. The economic nonsense of this notwithstanding, it’s a pretty killer line that Dems will have to find an answer to seeing as how facts and actual economics don’t appear to matter.

Zach

@Kyle:

It’s actually true. It’s 47% of tax units and not tax payers, though, and that doesn’t include trust fund taxes, state taxes, sales taxes, etc. The actual tax burden as a fraction of income goes up until you get to levels well below the poverty line. You paid taxes because you were single and only had the standard deduction.

Agoraphobic Kleptomaniac

@Kristine:

I think you’re reading something in there that I’m missing about increasing taxes now. TPM’s whole story he is saying “I’m not a republican; but no new taxes.”

Mark S.

God those are damning graphs. I’ve seen similar graphs to 2 and 3, so they didn’t surprise me to much. The first one, on the other hand, was quite eye-opening. Even without the meltdown, this was shaping up to be the shittiest decade by far since the Great Depression. Well, unless you were in the top 2%, then it was great.

We are really paying for our Idiocracy.

Mikey

I’m far from rich, but some of the provisions that are scheduled to sunset on 12/31/10 will still raise my taxes. Two of the most significant are the reduction of the child tax credit from $1000 per child back to $500. That won’t affect the rich at all, because they don’t qualify, but a family of four with an income of $45K will lose a thousand bucks next April. Another is the scaling back of the deductions for college tuition and student loan interest, which will affect anyone who is paying for college. Also returning is the marriage penalty, and the tax on long-term capital gains will rise from 15% to 20%, which affects every investor regardless of their wealth status (or lack thereof).

Hopefully, the President and Congress will work to limit these “sunsets” to upper-income earners, but at this point it does not appear they will do so–it will be all or nothing.

There’s a lot more to this than “tax cuts for the rich.” Congress issues a document detailing the tax provisions set to expire in any given year: Very interesting reading.

Crockpot

What is the source of that second graph?

Pangloss

We’ve been down this road many times before:

In the 1890s, Republicans had the White House and Congressional majorities for most of the decade, and we got Robber Barons and child labor. Liberal Republican Teddy Roosevelt was the first President of either party to institute socio-economic reforms that curbed the excesses of Big Business, but some of that was given back during the much less progressive Taft administration. It took Democrat Wilson to permanently institute many of the reforms, such as income tax, the Food and Drug Administration, etc.

In the 1920s, Republicans elected three massively-pro business, anti-regulation presidents and held huge margins in Congress. It took 8 years and a World War to fully recover.

And then there is the Republican criminal conspiracy from 1968-2008, in which Republicans held the presidency for 28 out of 40 years, and never produced a balanced budget for even ONE of those 28 budgets (while Democrats had balanced budgets/surplusses for 3 of their 12 years) and much higher job growth.

When I hear them use the words “fiscal conservative” in a sentence, it makes me want to throw my shoe.

Kered (formerly Derek)

@Agoraphobic Kleptomaniac:

Oh my god, I feel like a dumbass right now. I honestly didn’t know this. Embarassing.

It makes me EVEN MORE FURIOUS THAT THE TAX RATES ARE AS AMAZINGLY LOW AS THEY ARE.

Kristine

@Agoraphobic Kleptomaniac

OK, what am I misreading?

******************

What that says to me is that while he would rather give the tax cuts a sunset period of 18-24 months, that may not be the choice he is given. If given the choice between indefinite extension and ending the cuts now, it sounds as though he would agree that the cuts should be ended now.

Church Lady

@sukabi: I guess you didn’t read the next sentence. Pay attention!

Zach

@Mikey:

If they’re smart, they’ll be able to do so. A few rounds of Republicans voting for tax increases for 97 to 98% of Americans and the GOP will cave. Take the GOP narrative of failing to extend unfunded tax cuts as a tax increase and throw it back at them.

Even better, propose to use the revenue gained from sunsetting the top bracket cuts to extend the Making Work Pay credit. Then it’s actually a tax cut for the vast majority of people regardless of how you spin it.

Note that the difficulty in my plan is actually getting a budget like this out of committee and onto the floor.

burnspbesq

@TenguPhule:

We in the tax geek community have known for years that Conrad is an idiot. Glad to see that the rest of y’all are catching up.

cmorenc

@Sukabi

Irrefutable exposure of the fraudulent misrepresentations and outright lies in-service-of right-wing propaganda has done very little to shut up Andrew Breitelbart, Glenn Beck, Sean Hannity, or Rush Limbaugh. Nor has it yet visibly eroded their following among wingnut/Tea Party sheeple.

So why exactly again do you think this audit would shut up any of these tax-cuts-for-the-rich assholes, instead of merely provoking them bark even louder and more viciously? It’s like trying to “persuade” a small utterly spoiled yap-dog to shut up barking at you. Good luck without a piece of luscious meat (tax cuts or money) in your hands to feed it a treat.

burnspbesq

Conrad’s bio on Wikipedia says he favors letting the Bush tax cuts expire. Guess he woke up today and found a dead horse’s head in his bed, or got a visit from Rino Tomasi, or something.

Fucker.

Chuck

How is letting tax cuts sunset INCREASING taxes?

Nick

@Chuck: by tax cut, essentially it’s a change in the tax rate.

So say the tax rate was 35%, Bush’s “tax cuts” brought them down to say 28%, once they expire, it goes back to 35%, so it’s technically a tax hike.

sukabi

I just don’t trust these people in pinstripes anymore.

would you trust them more if they were in prison stripes?

sukabi

@cmorenc: if Conrad’s PERSONAL finances were exposed at the present, he’d be more likely to quit pushing the current nonsense that he’s pushing….

there is absolutely nothing that can be done to “embarrass” Beck, O’Reilly, Limbaugh or their ilk… they get paid to do exactly what they’re doing.

Neo

Just wait for the end of the year capital gains sell off, as investors lock in the current 15% rate before it goes to 25%

Bark Off Reviews

As a brand new pet owner I value all the advice listed here. I want my puppy to be very well trained and have a healthy and balanced setting to live in. Bless you for the information.