In a chaotic scene characterized by shouting more typical of the British parliament, the Republican Study Committee’s (RSC) alternative to Rep. Paul Ryan’s (R-Wis.) 2012 budget went down in a 119-136 vote.

It was gaveled shut only after Democratic leaders started pushing members to switch their “no” votes to “present,” in order to force a face-off between conservatives and the Republican leadership. A total of 176 lawmakers voted “present.”

That’s from the Hill.

To illustrate just how dishonest the Republican budgets really are, read Jason Kuznicki’s “Return to Normalcy” budget:

It’s got four basic parts:

- Return to Clinton-era rates of taxation, or at least something like them. As Ezra Klein has noted, this is very likely to happen in any event, because we’d need sixty Senate votes to extend the Bush tax cuts. We’ll just let them expire. As we’ll soon see, our Senators will be busy enough elsewhere.

- Remove the cap on the Social Security payroll tax. Yes, that means raising taxes. Yes, on the rich. Someone call the Koch brothers!

- Cap Medicare spending at GDP plus 1%. This is a doozy, I know. Can we do it? We’ll probably have to, like it or not, in any balanced budget plan.

- Reduce military spending to 1990s levels. In other words, bring the troops home. From everywhere. Let the force shrink by attrition. Cut spending on new weapons systems. Tell the world — much of it industrialized and friendly — that they will have to pay for their own defense, because we can’t afford it anymore. We’ve been doing way more than our fair share for way, way too long, and they can hardly say otherwise.

More or less, the plan would look like this.

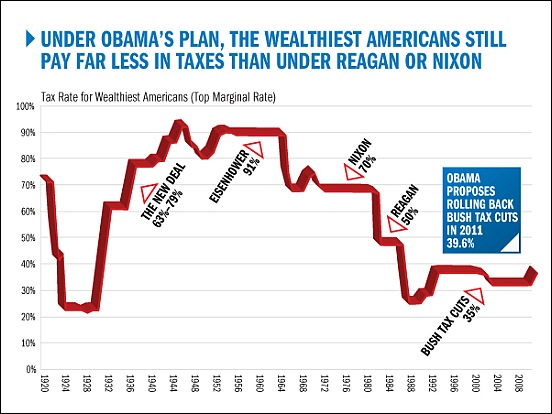

This is similar to John’s do-nothing budget, or the do-nothing budgets of Annie Lowrey or David Leonhardt, or my budget. All these budgets have one thing in common: the end of the Bush tax cuts. To help illustrate where that will put us in the Big Scheme of Things, a chart!

Surely letting the cuts expire will lead to America becoming Somalia. A much more Serious idea would be to let the poor and elderly fend for themselves and get rid of all these pesky healthcare entitlements.

aimai

I love the jaunty little arrows. I’d like to see the arrow under Obama look more like the arrow under Eisenhower. Imagine what a paradise we’d live in then? And I’m not joking. We’d have enough money to put everyone back to work rebuilding the country, pay the teachers enough to shrink class sizes, rebuild the schools and give every kid a computer.

aimai

"Serious" Superluminar

Good post. Expect hijacking by Hermione_chan in 3..2..1..

Corner Stone

It’s my contention that renewing the Bush Tax Cuts, for virtually any reason, was a disastrous decision.

MikeJ

@Corner Stone: I take it you were receiving unemployment at the time.

Bob

I read Jason’s post last night. Wow! I really respect him for putting things in there that run counter to his philosophy.

Calouste

In the House of Commons there might be a lot of raised voices during debates, but not during formal votes. In fact, changing your vote is almost impossible during a vote in the Commons, as the vote is done by the MPs leaving the chamber and reentering it via either the Yes or the No lobby.

"Serious" Superluminar

@Corner Stone

I’m not sure that’s so, if the alternative was everyone’s taxes going up during an unsteady recovery. Lesser of two evils, I’d say.

E.D. Kain

@aimai: We could probably get away with lower than Eisenhower and still go way up from where we’re at and retain strong growth. The Laffer Curve, if it exists at all, is still WAY WAY up there. We have a long ways to climb.

Brachiator

The top marginal rate is not the same thing as the effective tax rate or the taxes actually paid by the wealthiest taxpayers. Just sayin’

burnspbesq

And if anyone suggests that Americans and U.S. businesses are overtaxed, show them this.

E.D. Kain

@Bob: I know. Kudos to him in a very big way. I think he sees that it’s just dishonest to say we can balance the budget any other way.

E.D. Kain

@Brachiator: Very true. Good point.

PeakVT

Returning to the Clinton-era rates is a very important step, but there’s no reason that people earning $250,000 should be taxed at the the same rate as people earning $2,500,000 or $250,000,000.

Here’s the same graph as above with another line for the top bracket cutoff, and the same graph for post 1945-rates.

Violet

Since the mythical 1950’s that all Republicans seem to want to return to was the era where Eisenhower was president, let’s have those tax rates.

Corner Stone

@MikeJ: No, and I’m not gay currently serving in the military, and I’m not a missile inspector nor a sitting judge.

freelancer

Christ, I’ve been saying to “Conservatives” for some time that I’m slightly to the right of Eisenhower, economically speaking. And if that’s the case, what the hell did the Democratic Party’s platform look like in the 50s?!

Corner Stone

@ “Serious” Superluminar at #7

I would argue that increased revenue, across the board, would be a better overall stimulus for the economy.

Both short term and mid-term.

E.D. Kain

@PeakVT: I agree. More brackets at the top are needed.

Stillwater

@E.D. Kain: He’s also feeling the pinch of when ideological abstractions take a concrete form.

ETA: Not that there’s anything wrong with that…

Corner Stone

@PeakVT: Here’s my suggestion for graduated rates for high earners:

From 250,000 to 1M = 39%

From 1M to 10M = 50%

From 10M and up = 90%

Roger Moore

@Violet:

The key word is mythical. The Republicans don’t want to return to the real 1950s. They want to return to the mythical 1950s, which are much like today except that women, brown people, and unbelievers knew their place and we were afraid of being blown up by scary Russians rather than scary Muslims. ETA: And gays didn’t exist.

Omnes Omnibus

@Corner Stone: I could very easily sign on to that.

cleek

sadly, even this chart is misleading in the way that nearly all charts and discussion about taxes are: it doesn’t explain what a “marginal rate” is. people will read this and think “the rich were paying 50, 70, 90 percent in taxes?! that’s obscene! the government sucks!”

Stillwater

@Omnes Omnibus: Agreed. I also think that income from non-productive activities (eg, shorts, CDOs, currency speculation) ought to be taxed at 50% or higher.

Martin

@E.D. Kain: Actually, I think that misses the point. Nobody earns income much above $1M. It’s all cap gains. If we just treated cap gains like income and nuked the deductions against it like proceeds from a home sale, we could keep the top rate at 35% and we’d probably be golden. Short term cap gain rate is currently 28% and long term is 15%. That flat 15% and the exemptions for home sales is what’s killing revenues.

Brachiator

@E.D. Kain:

The link that burnspbesq provided includes a useful chart of the decline in effective tax rates on the top 400 households and households with incomes over $1 million since 1992. Very illuminating.

To put this into some perspective. Say that in 2010 a married couple with 2 kids gets $100,000 in capital gains distributions from dividends from granddaddy’s trust. Their tax is $900. Say the same couple gets their income from wages. Their tax is $10,069.

Martin

@Stillwater: No, treat those also like income, but add in a transaction fee. So much of that activity takes advantage of tiny little gains that are leveraged to the 9s. A small transaction fee against the tiny little gain makes the gain go away, and therefore so does much of the activity.

Violet

@Roger Moore:

Oh, I know that. I just find that when you first mention the 1950’s to a Republican, and let them gush about how fantastic that era was, it sets the stage nicely for recommending we go back to Eisenhower-era tax rates. After they’ve spent time gushing about the era, it’s a little harder for them to justify why the tax rates made it so terrible for everyone.

@PeakVT:

Agreed that more tax brackets at the top are needed. It’s ridiculous that someone making $250,000 and someone making $10 million are in the same tax bracket.

burnspbesq

@Corner Stone:

Overkill. There are other revenue sources available.

I could go with 45 and 60, add a 13-15 percent VAT, dial the estate, gift, and generation-skipping transfer taxes back up to at least 55 percent, and uncap the FICA wage base.

Do all of that, and you can care fuck-all about raising revenue from a corporate income tax. Drop the corporate rate to 18 percent, get rid of Subpart F which is nothing but a source of complexity and compliance costs, and make the system territorial by way of an exemption for foreign dividends and royalties instead of a foreign tax credit which is also more complicated than it’s worth. Corporations don’t really bear the burden of the corporate income tax, anyway; they just bake it into the price of their goods and services.

MattR

@Martin: Thanks for the reminder that I still need to file an ammended tax return for this year. I realized that something I sold qualified as long term but I listed it as short term (I used the date the stock was transferred as a result of corportate merger rather than the date I acquired it).

But I do agree that cap gains should be taxed as regular income.

Stillwater

@Martin: I’m down with whatever works to a) compel the wealthy to try to make money the old fashioned way, ie., create jobs for people and then exploit the shit outa them, and b) if they choose to make money (in this even more old fashioned way), they pay the appropriate (and fair, of course) price.

Martin

@Brachiator: Yes, the problem is that we’ve made it so that ‘work’ is what’s punished. And not only does it infect the tax code, but now everything else – as the war against unions illustrates.

burnspbesq

@Martin:

Wait, are you saying do away with the concept of basis? Because if you do that, you no longer have an income tax. What you have is a gross receipts tax, which is a very different animal.

eyelessgame

Good post, but there’s a typo somewhere. “Cap Medicare spending at GDP plus 1%.” There’s some elision, at least, because he must have meant somethign else. If we really spent 1% more than GDP on Medicare, it would … ahem … be bad.

Roger Moore

@Violet:

I expect they’ll just pull some lame-ass “well, not everything was perfect” line as a reason we can’t do the same thing now- the same way they would if you pointed out that life was pretty miserable for anyone who wasn’t a WASP male. It’s the same thing as the Republican belief that the USA is the best at everything and we don’t need to see how any other country does it. They’re happy to make exceptions when the other countries are proof that the Republicans are right about something, e.g. France and nuclear power.

MattR

@Brachiator: @burnspbesq: Related is the last chart on this Mother Jones page that shows what percentage of federal tax revenue has come from individual taxes, the payroll tax and corporate taxes. (And the other charts on the page give good indicators of the growing wealth inequality in our country)

"Serious" Superluminar

@Corner Stone

ok, but when the extension was passed, the GOP was about to become the House majority, so I’m not seeing those spending increases actually happening (much though I agree they should’ve). I think it woukd’ve been a fucking joke to extend if the Dems had continued in control of the House, but those weren’t the cards the leadership had.

burnspbesq

@eyelessgame:

Yup, there’s an elision there. What that really means is keep the rate of increase in health care spending down to the rate of increase in GDP plus one percent. Which is still bad, because it means that the share of GDP going down the health-care hole continues to rise.

Martin

@burnspbesq: Honestly, we don’t need to go anywhere near that high. Even if the top marginal rate was 35% but that was levied against *everything* (including inheritance) and went after offshore dollars by US citizens, we’d quite easily hit the 22% GDP revenue number without having to ask more of lower income folks.

At that point I’d turn to mopping up the disaster that is the corporate tax system and aim for something similar – higher effective rates and probably lower top marginal ones. There’s $1T in corporate profits sitting overseas that will never come home because of that top marginal rate. That needs to be addressed. That’s more stimulus money than the government can possibly put out there, and right now we’re collecting exactly $0 in revenue on it.

eric k

Martin is right the key is treating dividends and capital gains like income.

Here is my proposal

Capital Gains and Dividiends up to $50K, tax free, raise that every year by inflation.

CG and D above $50K = normal income

brackets for income, no hcnages up to $250K

$250K-500K 39%

$501k-$600k 40% increase every $100K by 1% until 50%, everyone is using SW at that level anyway, so multiple small brackets is no big deal.

The other big change is on the deduction side. Eliminate most of them. Just keep medical, charity, credit for each kid and mortage interest but limit it to one house and cap it at a value of $600K, again indexed up for inflation each year.

E.D. Kain

@Martin: We should implement a much more progressive tax system on capital gains as well. And jack up the estate tax. Yes, there’s lots of ways we could shore up revenue other than simply repealing the Bush cuts.

E.D. Kain

@burnspbesq: great suggestions.

burnspbesq

@Martin:

Don’t get me started on enforcement issues. The so-called “tax gap” is currently somewhere between 300 and 400 billion a year. An investment in IRS enforcement resources (i.e., people like Yutsano) shows an ROI of about 900 percent (ten dollars collected for every dollar of investment). And yet … neither party is willing to spend that money.

Brachiator

@Martin:

What? There’s tons of executives, athletes, entertainers, authors and others who earned salaries in excess of $1 million in 2010 and earlier years.

Anyone who wants to wade in the numerical waters can do so here, SOI Tax Stats – Individual Income Tax Return (Form 1040) Statistics

Turgidson

@E.D. Kain:

Yawp. And it’s not like the only option would be to start the highest bracket at 200k. Just add some more progressive rates all the way up to 10mil or whatever. And doing something similar with the estate tax would be prudent as well. But pigs will fly first. Sigh.

edit: PeakVT raised the issue first. Word.

daveNYC

@freelancer: I suspect that anti-communism was a much bigger item in the party platform. Plus the Dixiecrats were still in the party. Not to mention that Eisenhower was the same guy who gave that military-industrial complex speech.

I don’t think you can really compare the political situation in the 50s with what we have now. Back then, the two parties were relatively sane. Now both the neo-confederates and the McCarthy types have moved into the Republican ranks.

Roger Moore

@Martin:

I’ve said it before, and I’ll say it again. If we’re going to follow the Neocons’ lead and invade a small country once in a while to show the world who’s the boss, could we make it an off-shore tax haven next time? I’m guessing that occupying the Cayman Islands would be a lot easier than Iraq, and it would be one invasion that really would pay for itself.

Martin

@burnspbesq: No, keep basis. Doing away with basis would be catastrophic. But your profits from the transaction should just be treated as income.

PeakVT

@Martin: Both equalizing the treatment of different types of income and setting up new brackets should be done. Given a either/or choice, I’d take equalizing the treatment, but that certainly wouldn’t be my ideal policy outcome.

Brachiator

@E.D. Kain:

The Bush tax cuts included gradually dropping the Estate Tax to zero for 2010, which also proved that the Deity is a Yankees fan who smiled on the estate of George Steinbrenner. Congress, both parties, made sure to build in some goodies when they “compromised” and brought back the estate tax as part of the last minute Obama deal with the GOP over taxes.

It will be interesting to see if Congress really has what it takes to seriously tackle the issue of taxes.

Martin

@eric k:

KISS.

No exception for cap gains and dividends. If you want to protect those dollars for lower income folks, just stretch out the lower brackets a bit.

Bottom line – earnings due to labor should be taxed no higher, and ideally lower than earnings due to anything else. Always reward work over non-work. That should be progressive rule #1, and every policy conversation should start with it.

Martin

@Brachiator: Ok, there’s 4.4M returns filed in 2007 out of 145M that had AGIs over $200K. $13M were from $100K to $200K, so doubling the income cut the number of returns by a factor of 3. I bet from $200K to $1M (a 5x increase) that number drops by at least a factor of 10.

400,000 returns out of 145M. 0.3%. That’s a pretty small number. And for those 400K, what do you think the cap gains/income split was? I’d wager it was better than 1:1.

Brachiator

@Martin:

From an article about 2007 incomes by David Cay Johnston, who writes regularly on these issues:

There is a lot of good analysis of what is happening with income in this country, and it is not particularly hard to find.

But it’s not just ordinary income vs capital gains. Individual and corporations are able to leverage all kinds of techniques, from NOLs to bonus depreciation and various credits, to considerable advantage. Note that I am not just lumping this stuff in as “loopholes,” simply adding to the picture of what the tax code is all about.

By the way, I would pay good money to the reporter or writer who could identify the corporation that managed to get a huge break on depreciation nestled in the December tax compromise, and who they bribed to get it.

Corner Stone

@Martin:

Let me introduce you to a few thousand people I know, through work.

Corner Stone

@burnspbesq: I won’t be the tax maven you or Brachiator are, but IMO, the starting point should have been the expiration of the BTC. That would have sent the signal for a lot of other decisions.

Brachiator

@Corner Stone:

A quick thing here. Unfortunately, for whatever reason, the Democrats and Obama let this opportunity slip through their hands. They had to make a deal or else 2010 taxes would have been a mess, because of expiring provisions, alternative minimum tax problems and expired estate tax provisions.

Again, as I’ve noted a number of times, there was never the option of simply letting the Bush tax cuts expire without dealing with these other issues. Couldn’t be done.

The thing to watch for now is what Obama and everyone does going forward.

Caz

Overlay your chart on one that shows revenues, rather than just tax RATES, and you’ll see that with all this up and down moving of the rates, the REVENUES usually stay about static, around 17% of GDP or something like that. This is consistent with the analysis of Art Laffer. So raising taxes is not going to increase revenues. It will only penalize those who are not able to employ experts for tax avoidance techniques.

Brachiator

@Caz:

Sigh. You’re mixing up a lot of stuff here. Again, marginal tax rates don’t tell you much about effective tax rates, and even revenues don’t tell you what deductions and credits corporations used.

And if revenues simply stayed static, wouldn’t this be a refutation of Laffer, who claims that tax revenues increase when you cut taxes?

You’re also missing other analyses that show job contraction and wage stagnation, even as GDP increases.

MattR

@Brachiator:

It depends where you are on the curve. Laffer also admits that there are points where increating taxes will increase tax revenues.

Personally, I view the Laffer Curve as a self evident truism that has been abused and misused to justify all sorts of economic hanky panky. (According to the Wiki the consensus is that 70% tax rate is roughly the point at which revenue will start to decrease. But if you listened to modern Republicans you would think it was 7%)

burnspbesq

@Caz:

That’s not an inevitability, it’s a choice. See the chart I linked to in my first comment on this thread. There are countries that routinely collect more than 50 percent of GDP in taxes. They tend to be pretty nice places to live, with thriving market economies AND social safety nets.

The only thing standing between us and a tax system that collects enough revenue to balance the budget, and does so efficiently, is lack of political will.

Anoniminous

@MattR:

It’s one thing to state (A) the rate of taxation affects tax revenue and quite another to say (B) the Laffer Curve is an accurate representation and prediction of how the rate of taxation affects tax revenue.

Most people accept A. (Where “most” means “everybody except a few nutters.”

In order to accept B you have to also explain the economic causes of the Great Depression and the Post World War II boom. The onset of the GD happened during an unprecedented explosion in goods and services and relatively low rates of taxation. The second was the fastest growth of the US economy in US history under the highest taxation rates in US history.

Looking at ALL the evidence it is clear under non-confiscatory and even some confiscatory, e.g., the Soviet Union, tax environments the taxation rate is not predictive of economic activity.

ranger3

It worked so well after WWI… what could possibly go wrong?

Hermione Granger-Weasley

@E.D. Kain: We already discussed this once.

This is the Pretend 8 Years of Bush Never Happened Plan, endorsed by glibertarians everywhere, and that you already talked about this here. TWICE, actually, because this is your Free Market Fantasy Forest all over again.

This is just another freemarket solution.

The middle class has ALREADY shrunk, jobs have ALREADY flown offshore, the inequality GAP has ALREADY grown, America is ALREADY 25th in math and 20th in science.

There have to be social justice solutions to problems that were CREATED by freemarket policies.

Freemarket solutions do not work. Remember how you couldn’t come up with a single example?

And this is for the Hall Monitor Nation.

I don’t hate EDK personally. I hate him because he is a gibertarian freemarket fucktard and glibertarian freemarket fucktards have nearly destroyed this country. And I dont think they should get a do over.

If Cole brought on another glibertarian freemarket fucktard I would hate on him too. I hate Kuznicki too, because Jason is another glibertarian freemarket fucktard. And the LoOG is a simply awful blog and you people shouldn’t let EDK link whore his other blogs here.

Hermione Granger-Weasley

And for the semanticians in the Balloon Juice Hall Monitor Nation, the THEORETICAL Free Market is a well-defined construct that has not existed and probably cannot exist in any known society.

Freemarket policies, freemarket solutions, market-based policies, market-based applications are ALL the same thing–ALL applications of Freemarket THEORY made into practice, the only difference being the amount of regulation leveled on the market..

The opposite of market-based or freemarket solutions (same thing) which at best rely on the action (invisible hand) of the market to deliver social justice as a trickle-down or side-effect, are social justice solutions, which DO attempt to directly deliver social justice with safety nets, redistribution (in islam we call that zahat, catholics call it tithing), childhood nutrion and pre-natal nutrition programs, etc.

When President Obama actually used the words “social compact” in his speech that was revelation. He gets it. He may pay lip service to the “free market” for the bubba consumption, but we are starting to get there.

People like EDK actually think there is no alternative to blind market-worship of the freemarket god.

There are many alternatives, for example evolutionary economics.

Hermione Granger-Weasley

Pardon, my speeling.

zakhat

what can i say? arabic is not my first language.

;)

THE

HG-W

I think part of the problem that I am having understanding you, and perhaps part of the way you are confusing yourself, is that you are really mixing up two different uses of the term “free market”.

1. Free market as a platonic ideal where absolutely free agents interact in an environment of perfect knowledge.

2. A politically unregulated market, which can never be a platonic free market, if for no other reason because of massive information asymmetries. There is no perfect knowledge. Insiders have more knowledge than outsiders, etc.

So much of market regulation is about how to create a flat playing-field, with informed players, how to overcome the information asymmetry problem. So that we can get closer to a well-functioning free market.

You cannot achieve a free market without regulation. Because information asymmetries benefit the rich and powerful insiders.

Someone, perhaps the government, has to help the little guy to make informed decisions.

So you have health regulation, safety regulation, mandatory disclosure laws, these are ways we force the big players – the insiders to give up their information advantage.

Hermione Granger-Weasley

@THE: that is what I am saying. The free market is THEORETICAL and freemarket or marketbased policies are just applied theory.

The basic problem is marketbased policies cannot repair damage caused by marketbased policies.

There has to be applied social justice for that.

;)

THE

See, I would distinguish between a well functioning free market which i support, (as a platonic ideal) and an unregulated market which would be hell on earth.

THE

It’s also the reason why you have to have protection for children, the old, the disabled.

You cannot have a free market where everyone is a fully empowered, infinitely free agent – infinitely informed. Unless we really are equal.

But we are not equal. This is biological reality.

In the real world, with all its inequalities and asymmetries, an unregulated market would lead to ruthless exploitation of every vulnerable player.

Hermione Granger-Weasley

@THE: I agree with you, but that is not the topic.

Like Dr. Pournelle said,

The topic is EDK bringing up for the THIRD TIME here the glibertarian freemarket fucktard plan “Pretend 8 Years of Bush Never Happened” .

Hermione Granger-Weasley

Wallah, you fucking simps.

The Kain/Kuznicki Pretend 8 Years of Bush Never Happened Plan would work like a charm if only time travel to the past was possible.

It is not, because of closedform timecurves.

All this is is just. another. fucking. do-over.

Hermione Granger-Weasley

@”Serious” Superluminar – this is not a good post. This is the THIRD presentation on this blog of the Kain/Kuznicki Pretend 8 Years of Bush Never Happened Plan.

This is a stupid post.