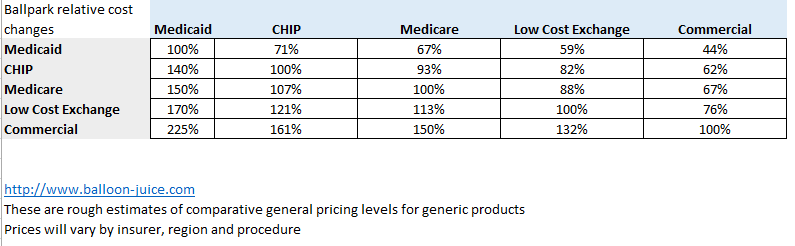

There are three major types of pricing variations in healthcare. The first is general product level pricing variations. Medicaid tends to pay less than Medicare which tends to pay less than large group Commercial.

There is also regional variation. New York City is more expensive than its suburbs. North Dakota and other very rural places which have a hard time attracting and holding onto docs are more expensive than medium sized cities.

Finally there is in-region, in-product idiosyncratic pricing variation. A new paper in Health Affairs looks at the pricing variance within markets and between markets for commercial insurers. **

Our study included prices for up to 242 services in each of forty-one states and the District of Columbia. Prices for 162 of these services were reportable in all forty-one states and the District of Columbia. We found that the ratios of average state prices to the average national price for these 162 services varied from a low of 0.79 in Florida to a high of 2.64 in Alaska. Ratios at the twenty-fifth and seventy-fifth percentiles—Oklahoma (0.97) and New Mexico (1.25)—differed by 0.28….

Average prices were computed for 242 services, some of which are standardized collections of common groupings of diagnostic and procedure codes.9 Some services have a single code (for example, Current Procedural Terminology [CPT] code 76811 is for pregnancy ultrasound). Other services encompass an episode of care, such as knee replacement, which includes a specialist’s evaluation, surgery, physical therapy, and follow-up evaluation.…

Examining price variation by service provides an understanding of the impact of the variation on patients and insurers. We selected three services—pregnancy ultrasound, knee replacement, and, again, cataract removal—for this examination because they exemplify the range of services and the extent of price variation that exist for common medical services….

Based on the interquartile range ratio, knee replacement prices appear to have the least variation: 1.32, compared to 1.54 for pregnancy ultrasound and 1.47 for cataract removal (Exhibit 3). However, the national average price for knee replacement is more than a hundred times higher than the national average price for pregnancy ultrasound and ten times higher than the price for cataract removal (see the Appendix).11 Thus, even though knee replacement has less variation in price than the other two services do, its variation can have a substantial impact on total expenditures and on patient cost sharing….

Price variation within states was examined though MSA-level prices….We also found considerable variation in the average price for pregnancy ultrasound (Exhibit 6). The average price in Cleveland ($522) was almost three times that in Canton ($183), even though these two Ohio MSAs are only 60 miles apart. Conversely, Virginia Beach ($275) and Richmond ($271), both in Virginia and 107 miles apart, had nearly identical average prices.

I would want to overlay the pricing variations with some type of medical provider market concentration factor. I would bet that areas within a state that have higher levels of pricing than other areas in the state are also areas where the providers are relatively more concentrated than the payers. Elective procedures that are deferrable (knee replacements) and quasi-elective procedures that are fairly low skill and generic (pregnancy ultrasounds) should have variance in pricing due to local general price levels (New York City should be more expensive than Buffalo on this logic) but the wild swings should not be present if the medical services markets were vaguely efficient or functional.

** Newman, D., Parente, S. T., Barrette, E., & Kennedy, K. (2016). Prices For Common Medical Services Vary Substantially Among The Commercially Insured. Health Affairs, 35(5), 923-927. doi:10.1377/hlthaff.2015.1379

Kirk Kuli

just going to shamelessly copy and paste a comment a post I made on MH’s Vital Signs Blog: Hospitals prosper on commercial payers as Medicare margins sink to -9%

“Why should it be assumed that employer sponsors of health plans, especially ASO plans, will continue to tolerate being on the losing end of provider’s ‘Golden Age’ of 7% annual compound growth. With all the initial risk of $6-$10k/employee flowing from 401ks to HSAs annually, the pitchforks are destined to come out soon!”

Capri

Is there any indication that physicians know what is being charged for the services they perform? That is the first disconnect that should be addressed.

Richard Mayhew

@Capri: Fuzzy as hell… docs at a true solo practice have a decent idea, or at least their office manager has an excellent idea about the financial case mixture. Docs at Big City Medical Group with 800 other docs have no idea who is paying what to them.

Capri

@Richard Mayhew: So in the minds of those who believe medical care is subject to the same market forces as light bulbs, when I’m told by my physician I need an MRI, I will ask him what it costs at his institution and at other places he may have privileges. I will then tell him I’ll get back to him after calling 5 of his competitors and getting their prices as well. In reality, his answer is “I have no idea” and when I ask the office or hospital staff their answer will be “it depends.” Expecting health care to be sensitive to price is absolutely nuts unless it is restructured from the ground up.

Richard Mayhew

@Capri: It should be not be absolutely batshit crazy… slightly bizarre would be a major improvement

dr. bloor

@Capri: If you have insurance, the answer @Capri:

The most likely answer will be “what’s your copay, and do you have a deductible to meet?”, and you’ll get the same answer at all five offices you call.

The actual cost and cost-shopping for the procedures takes place a few levels up, i.e., what did your company’s HR department contract for, and what kind of deals has your insurer cut with providing physicians. Unless you’re paying out of pocket, price shopping on the patient level not only won’t happen, it’s not a rational action on the part of the customer.

Ella in New Mexico

@Richard Mayhew: Off track here, but will you be posting anything on this new by Democrats in Congress to effort to stop the Obama Administration plan to reduced the incentives doctors and outpatient clinics get for using certain medications? I’m confused as to how the new rules actually impact doc’s/facilities negatively and why Pelosi and the Dems are concerned enough to want to put a stop to the changes.

http://khn.org/news/medicare-to-test-new-payment-approaches-for-some-prescription-medications/

http://www.huffingtonpost.com/entry/house-democrats-hhs-drug-prices_us_5720e639e4b0b49df6a9c93f

Richard Mayhew

@Ella in New Mexico: I’ll read through that, but I am working on a couple of big posts that are eating up my brain space right now… so I don’t know.

Capri

@dr. bloor: Great point. My own HR department offered a feature called “Spotlight” that did comparison shopping for you. You’d type in what you were looking for and they’d spit out what it costs at local providers. They are going to stop paying for it because nobody used it.

Brachiator

@dr. bloor:

Great point.

But this only means that medical care actually is subject to market forces, but that the decision point is not at the consumer level.

dr. bloor

@Brachiator: Oh, agree completely, although there are going to be limits to smoothing costs, and limits to how low prices can go without materially affecting care. Cleveland and Canton might be 60 miles apart as the crow flies, but that doesn’t capture differences in talent levels, teaching costs, infrastructure costs, etc.

Richard Mayhew

@dr. bloor: For high end care, I agree, I want to be shot in Cleveland rather than Canton.

For common care which a knee replacement or an ultrasound, there should be a reasonably smooth cost curve with a local peak in Cleveland and then another peak in Pittsburgh and Columbus