Got a couple of early morning meetings and don’t have much free thinking time, so a couple of quick hitters.

1) Covered California came out with their preliminary rate increases. (PDF) The top line number is roughly a 13.5% increase which is high but below the national average. More interestingly to me, at least, is the proliferation of a Silver Gap strategy.

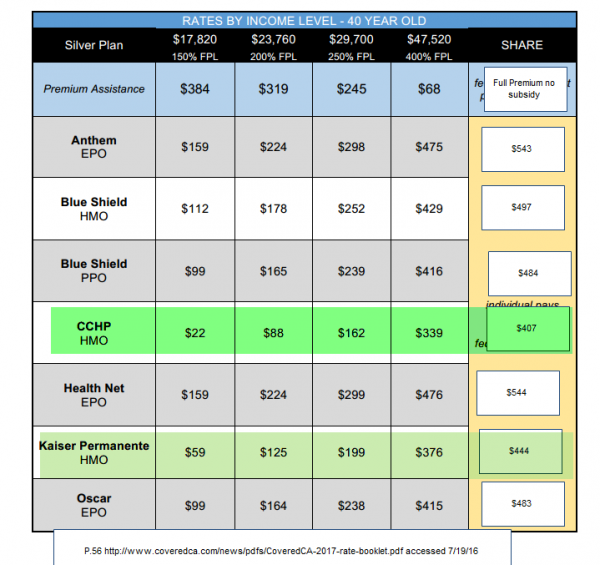

The low cost Silver plan has a significant gap between it and the #2 Silver. The #2 Silver (Kaiser) is from a different company because Covered California is an active purchaser model which disallows for quite a few games. The most obvious game for CCHP in a clearinghouse model would have been to offer another Silver priced at $435 so that would have been the benchmark Silver. The second most obvious game would have been to clone an isomorph of the cheapest plan and price it a buck more so that any cost sensitive buyer would have had to have gone to CCHP. Now, only most cost sensitive buyers will go to CCHP, Kaiser will get a decent share of membership.

The Active Purchaser model most likely increases federal spending on Advanced Premium Tax Credits (APTC) as the prohibition on these games increase the benchmark subsidy point. But this model provides an actual choice for consumers and keeps insurers healthier.

The active purchaser model gives consumers meaningful choices. They can choose a cheap but low quality Molina plan for significant cost savings as it is the #1 Silver with a wide spread between its price and the benchmark Silver price. Or they can choose a higher quality Silver that is fully subsidized as that high quality Silver is the benchmark Silver. That decision process falls apart in an active purchaser exchange once there are two MCO based Exchange carriers, but the large gap between the first and second Silver gives consumers significant choices.

2) Oscar is expanding to San Francisco. They are offering a narrow(ish) network and not particularly amazing pricing. I don’t expect them to get much membership in this region for 2017. I’ve had a couple of interesting discussions about Oscar and the comparison of them and Theranos has come up. That is not fair to Oscar.

Theranos had a great story that was complete and absolute fabricated bullshit.

Oscar is fundamentally doing what it says it should be doing — collecting premiums and paying claims. They have not been able to sprinkle magic pixie dust on that mundane activity. I think they have played buzzword bingo well to tickle VC money and there is a good amount of hot air and puffery involved but they are fundamentally delivering to the consumer what they promised. They have just not done that profitably (yet).

Since they have deep capital reserves (because of the VC money), they can actually afford to learn by doing/learn by screwing up. That I think is the biggest difference between them and the co-ops that have failed.

Eric S.

Richard,

I’ve been working as a 1099 contractor and buying a single policy on the open market. Yesterday, I just accepted a full time job that will providentify employer insurance from day 1. Now day 1 is not quite defined yet. 8/1 or 8/8 are the likely dates.

I’m receiving some on going treatment from a doc not accepting insurance. I will have 3 or 4 outstanding claims with BCBSIL at switchover.

You said you were busy and I don’t want to be the anonymous Internet guy distracting from real work. If you have time to offer any advice on making the transition and getting the outstanding claims paid I’d appreciate it.

Thanks,

E

Richard Mayhew

@Eric S.: E-MAIL ME, CONTACT FORM IN THE DROP DOWN WIDGET

japa21

Richard,

did you read that the DOJ is probably going to try to block the Aetna-Humana and Anthem-Cigna mergers-purchases? Even if they agree to sell assests?

I can now say that I am just retired form one of those companies and am not surprised.

Richard Mayhew

@japa21: I saw, and I don’t have much interesting to say beyond “good”… although these mergers have given me a good anti-trust education which has moved me off of my 800 pound gorilla cage match stance that I started with here a couple of years ago.

japa21

@Richard Mayhew: Yes, “good” is an appropriate response. I have a feeling a different DOJ would have no problem approving. Another reason to make sure the Dems win.

christopher murphy

The idea that someone making less than $18k a year has to pay even a penny for health insurance is nothing less than obscene.