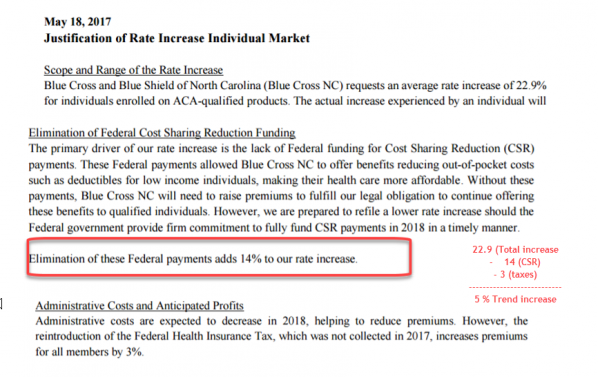

Blue Cross and Blue Shield of North Carolina just filed their initial rates for the ACA individual market for 2018. The headline will be that they are asking for a 22.9% average rate increase. The second headline is that they assume that Cost Sharing Reduction subsidies will not be paid. That assumption drives 61% of the rate increase. The SERFF filing is here.

There is subtle good news in the rate filing. Another 13% of the rate increase is driven by the reinstitution of the 3% Health Insurance Premium tax. That is a one time hit that is to be baked into the cake of future rates. This means only 26% of the entire rate increase or roughly five percentage points is due to increased medical costs or service utilization. Trend and morbidity is under control. Below are segments of the consumer justification.

5% trend is a healthy trend. That is a the trend of a market that is fairly stable and reasonably priced.

There are a few other North Carolina notes for the individual markt. Aetna is withdrawing. This should allow Blue Cross and Blue Shield to play aggressive subsidy attachment point games even as they seem to be adapting a single index rate that spreads the CSR compensation costs to all metal bands. Subsidized buyers have the chance of seeing excellent deals on the Exchanges if BCBS-NC prices in the same manner as BCBS-Tennessee prices in their single carrier counties.

daveNYC

5% is also double the inflation rate.

Is it possible for the 22.9% rate increase to be approved and BC/BS gets the CSR subsidies too? Or would that 61% of the rate increase be stripped out if those subsidies are paid out?

randy khan

5% is a lot less than typical annual increases in the past, so I guess the message to our friends in the Senate is that keeping the CSR is critical.

Walker

If Aetna keeps withdrawing from markets, what are they doing? Employer health insurance? Because my employer dropped them and replaced them with something better.

David Anderson

@daveNYC: It depends

If there is a black letter law appropriation before September, that 61% would be stripped out. If there was either an appropriation, the Court of Appeals bounces the case because the states intervene, or Trump keeps on paying after September, the rates would be locked in for 2018. Most of the excess cash flow would flow straight to BCBS-NC as the MLR rules allow for a three year look back. They have significant MLR credits from 2016 (lost a net of 2% of premium, so MLR was well north of 80%) and they might have some MLR credits from 2017. Members would get some money back as an MLR rebate.

Also remember that all else being equal, the insured population will be getting a scooch (highly technical term there) older every year as the country gets a scooch older every year. All else being equal, an extra year of average age in the risk pool is 3% to 5% more costs

David Anderson

@Walker: Employer, claims processing, Medicaid, and Medicare Advantage is Aetna’s gig

SiubhanDuinne

Gotta say, David, you are on a roll today. This is, what? your fifth post today so far, I think. Great jobs, all, but don’t deplete your precious bodily fluids through overexertion.

mai naem mobile

@Walker: Aetna is huge in the AZ privatized medicaid market. They have the majority of the market. Personally, i don’t think they should be allowed to participate in this piece of medicaid if they aren’t involved in the Exchange,

Mnemosyne

@David Anderson:

I think the technical term you’re looking for is spelled “skosh,” not “scoosh.”

David Anderson

@SiubhanDuinne: this is what happens when I don’t want to read an evaluation of risk adjustment models

Lee

I assume you have heard that BCBS is pulling out of the Exchanges in Kansas & Missouri.

David Anderson

@Lee: yep

TenguPhule

This isn’t good news.

This is “things could be worse” news.

Which is not the same thing.