As I was putting on my cap and my wife her kerchief before we settled down for a long summer nap, a health policy colleague messaged me. They were trying to wrap their head around the distributional consequences of a variety of Cost Sharing Reduction (CSR) loading schemes.

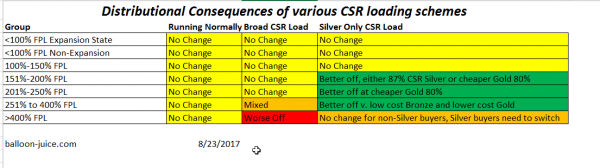

The short version is that people who make under 150% Federal Poverty Line (FPL) won’t be touched. After that it gets a little messy.

The three basic scenarios are business as usual. I don’t think think that will apply as Congress won’t have time to appropriate funding and insurers won’t have the time to change their pricing. The other two options are basically a broad load where the cost of CSR is placed into every plan. Every plan will increase by some percentage over and above the normal medical trend increases. The third option is to only load the cost of CSR subsidies to Silver plans. There is a sub-variant that only loads these costs to on-Exchange Silver but that is a minor albeit important variation.

So what happens?

If CSR costs are loaded onto every plan, people who are eligible for CSR will still get better actuarial value by staying in Silver. A few people at the top of the CSR eligible income range may move to Bronze plans that are relatively cheaper but not much is happening up to 250% FPL. People who make between 250% and 400% are in a mixed bag. Individuals who would have bought plans less expensive than the benchmark in the “running normally” scenario are better off. The absolute price of the premiums will have increased. However, assuming a uniform percentage surcharge, the spread between the benchmark Silver plan and the lower cost plans will increase. This means their premiums after the subsidy will go down. Buyers who wanted to buy the Benchmark Silver plan will be the same. The people who are hurt are the people who in the “running normally” scenario who wanted to buy more expensive plans. The relative spread in prices will have increased and thus their net premiums will increase.

People who make more than 400% FPL or who buy plans off the Exchange without any subsidy will be universally worse off no matter what plan they buy. Premiums will have increased for all options.

Some states are issuing guidance that they want plans to load all of the CSR uncertainty costs only onto Silver plans. This means Silver will be priced as if it is 90% actuarial value (AV). People who make under 150% FPL won’t change their decisions to buy Silver 94% AV. Some of the healthier people who make between 150% and 200% qualify for 87% AV CSR but they may buy 80% AV Gold plans at lower premiums. These individuals are no worse off and may be better off.

The first big change is the group of people who qualify for weak CSR. They make between 200%-250% FPL and can buy a 73% AV CSR Silver. The rational thing for this group to do en-masse is to abandon Silver CSR and migrate to Gold 80%. They get lower deductibles/out of pocket expenses and lower premiums. Silver is a dominated plan in this scenario.

People who don’t qualify for CSR but qualify for subsidies see significant changes. Almost no one should be buying Silver plans. Gold plans again are a better deal with lower total exposure and lower net premiums. Platinum plan buyers will see their relative prices post subsidy decrease significantly while many Bronze buyers will see their post-subsidy premium become cost-competitive with a cell-phone bill or less. People who previously had qualified for subsidies but stayed uncovered because the premiums were still too high after subsidy will take a new look at the market and the pricing. Some of these people will come in due to great deals.

Off-exchange, Bronze, Gold and Platinum buyers are no worse off compared to the business as usual scenario. People who in the “running normally” scenario who wanted to buy Silver are worse off as they will be priced out of Silver and either spend more to get a Gold plan or spend less to get a Bronze plan with higher out of pocket spending. If states allow insurers to only load CSR costs onto on-Exchange Silver plans only, all off-Exchange buyers are no worse off than the “running normally” case.

dr. bloor

The title of my autobiography is going to be “Life in the Red Box.”

Hafabee

Hey David, if you get a chance, where can I find the guidance, if any, issued by West Virginia? I have poked around http://www.wvinsurance.gov/ but I really do not know what exactly I am looking for. Thanks.

David Anderson

@Hafabee: I have not seen anything from West Virginia yet. I am waiting for final rate submissions and the public use files to be released.

Hafabee

@David Anderson: That figures, WV does not seem be in front of, well, anything, these days. Thanks.

Amir Khalid

You put on headgear to take a nap? Why?

Mnemosyne

@Amir Khalid:

It’s a play on one of the lines of “‘Twas the Night Before Christmas,” by Clement Moore.

? ?? Goku (aka The Hope of the Universe) ? ?

Hey David, you told me to give you a holler if you never got around to that Ohio drug pricing initiative.

David Anderson

@? ?? Goku (aka The Hope of the Universe) ? ?: Holler heard

rikyrah

MAYHEW,

please front page this:

Andy Slavitt lays it out:

The current plan to hurt Obamacare by taking away money from blue states:

https://mobile.twitter.com/ASlavitt/status/900324370060632064

Another Scott

@rikyrah: Thanks. I saw that tweet too and was just coming here to see what Richard-David has to say about it. Andy seems to be hair-on-fire about this stuff going on in the shadows while nobody else (that I’ve noticed) seems to be paying much attention.

Should we worry??

Thanks.

Cheers,

Scott.

David Anderson

@Another Scott:

The biggest argument against this theory is two fold:

1) Time — the FY-17 end date is 9/30/17. There are the regular appropriations, CHIP, debt ceiling, flood insurance that HAVE TO BE DONE by then. And right now none of them look easy. After FY17 ends, why would a FY17 reconciliation bill be available for use.

2) 20+ House Republicans are from California, Maryland and New York — they would be voting to kick their own voters in the balls to send money to Texas.