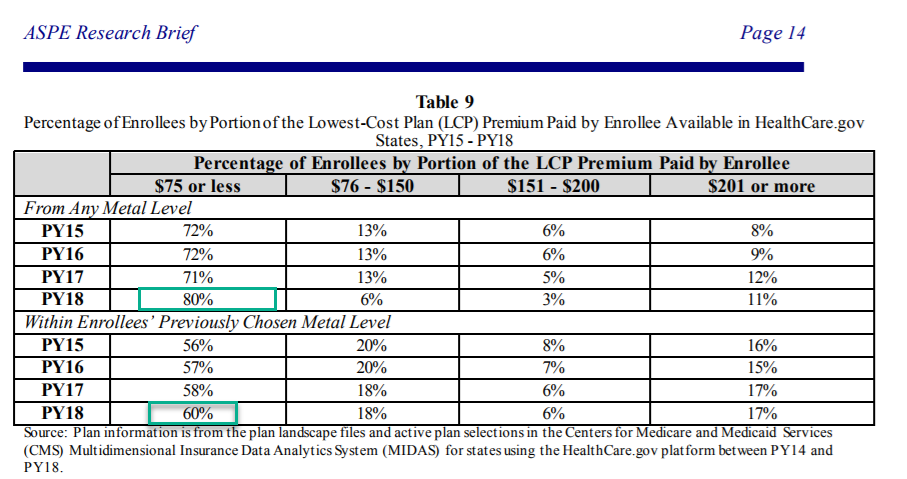

The Department of Health and Human Services released their 2018 ACA plan summary report earlier this week. This is the most important table in my mind:

The Silver Loading is making Bronze and Gold plans much cheaper. 9% more people who are subsidized are able to get low premiums plans. As we looked at earlier this week, Bronze can be good coverage and in the right circumstances, it can be the best choice.

Even if people want to stay in their metal levels more people are able to get slightly cheaper plans. This is because there are bigger Silver Gaps. Last year, Perry County, Tennessee had a $95 Silver Gap between the benchmark and least expensive Silver plan. This year, Perry County has a Silver Gap of over $200 for a single 40 year old. More importantly, Roane County had no Silver Gap last year and now has a $194 Silver Gap because of a new insurer with a different strategy.

If you are subsidized, there are very good deals out there because of the CSR Metal Madness. Take advantage of them.

Planetpundit

M(am 82 yo)y Gold plan with Health Partners in MN drops from $1130 this year to $921 next years sans CMS. Something went right. (Am 62 yo)

dr. bloor

Probably heading back to gold after spending a year at the silver level, although our family situation is a clown car full of uncertain medical and miscellaneous other variables. I might end up buying a Magic 8 Ball to decide for me.

David Anderson

@dr. bloor: e-mail me….

Bruce K

I can’t get to the exchanges (I’m an expat but I need to maintain US health coverage or I’ll be pre-existing-conditioned to death). I checked my current US provider, and they terminated my silver HMO completely, leaving me with the choice of a more expensive bronze EPO where I’ve got to pay fifty percent on some pretty expensive future medical procedures, or a silver EPO that’s almost forty percent more expensive.

I don’t know if it’s just me, but it feels like my native land is trying to either bleed me to death or kill me outright.

It’s literally reducing me to tears right now.

satby

@Bruce K: I feel the same. Every year I get more apathetic about whether I even have insurance or not, because in the end it doesn’t cover squat and I pay almost all of any cost I incure. When I have had health problems in the past is also when I didn’t have insurance pre-ACA. I just hate this system.

Kelly

I’m seriously considering a Bronze HSA plan. We never exceed the deductibles on our Silver plans so if the individual deductibles go from $2500 to $6550 we wouldn’t notice. We can spend the HSA money on dental and vision which we’ve spent more money on than medical the last few years.

Dental and vision not being considered medical really shows how quirky our system is.

Remember: If you hate your choice this year you can pick something else next year. Life should be an adventure!

Bruce K

@Kelly: I wish I could make that gamble, but if my pre-existing condition hits a point where I need surgery, then a bronze plan will land me right in the bankruptcy-or-death nightmare…

dr. bloor

@David Anderson: Oh, thanks for the offer, but not really necessary. Just doing the usual moaning and dithering out loud, complicated by the fact that Junior is spending four months of next year in Asia, four months at home, and four months at college, which will almost certainly be out of state.

As it turns out, it looks like the bronze HSA account will be best for us unless more than one of us gets hit by a bus full of hemophiliacs next year.

ProfDamatu

Only 5 plans from 1 insurer available in my area next year, which should make the choice easier. I’m still mystified why Optima even bothered with the Gold plan – its deductible is “only” $1550, the lowest among the 5 by over $1k, but its out of pocket max is the full $7350, and the premium is about $400/mo higher than the next most expensive. Maybe there’s a handful of people out there whose care usage hits an exact sweet spot where it would make sense, but you’d have pretty much no way of knowing that in advance.

I’m leaning toward the plan they’ve “mapped” me onto (a Silver with $2850 deductible, $5600 OOP), even though the estimated costs tool suggests that it could be more expensive overall than the two Bronze options. I’ll have some substantial medical costs next year, but (fingers crossed) won’t likely end up close to the out of pocket maximum. Those super-low bronze premiums are tempting, but the $6k deductibles aren’t…

Miss Bianca

OK, I’m thinking of making the jump away from my job sometime in the next year. I currently have insurance thru’ my job. Does this mean that if I buy on the Exchange next year in CO that I’ll be able to get a decent deal?

ETA: I currently have a *$6500* deductible! I’m not sure this even qualifies as Bronze – it seems more like Tin or Zinc to me. > : <

dr. bloor

@ProfDamatu: I had a similar experience w/the BC/BS Gold plan in my state. I initially thought it would be the way to go, but after gaming out a handful of expense scenarios, there weren’t any where it wasn’t a distant third to the Bronze and Silver options.

David would know better, but I suspect the low-deductible gold is most appealing to folks who quickly limit their costs to relatively nominal copays for what would otherwise be very expensive out-of-pocket costs if they were dealing with a large deductible plan.

ProfDamatu

@dr. bloor: I could totally see that, if the premium for the Gold plan offered here weren’t so high – $1,254/mo vs. $870 or less, pre-subsidy. That $870 silver has $1350 more in deductible costs, but $4600 less in premiums. I guess that’s the sweet spot – people who think their costs are going to be over $1500 but less than the approx. $3k gap between the premium difference and the deductible difference between the gold and silver; cost-sharing post-deductible is also 10% vs. 20%. And on a slightly unrelated note – the existence of a Gold plan with a $7350 out of pocket max just boggles me!.

It’s academic to me anyway; that $600+ post-subsidy premium takes the gold off the table before I even start playing with scenarios.

David Anderson

@Miss Bianca: That sounds like a Bronze plan to me.

If you quit/change jobs mid-year, you will qualify for a Special Enrollment Period (SEP). Colorado did a broad load on their exchange for CSR so there are no good Gold deals and some slightly better than normal Bronze deals. Depending on your age/income, staying on your employer’s plan via COBRA might be the better idea especially if you have already capped out on your deductible.

Julie

Here’s an example of how for some people, the silver loading has created a HUGE difference between the before-subsidy premium and the after-subsidy premium. Friends of mine checked the exchange today and they have a choice of two silver plans. Their income is low enough for cost sharing, so they need to pick a silver plan. The premium for the cheaper silver plan is close to $1,950 per month, which is more than their entire gross monthly income! But with the subsidy, they will pay a monthly premium of $3.85.

JaneSays

@Julie: I didn’t get that good of a deal, but my plan is actually going to cost me less next year than it did this year (same plan), even though: a) I increased my estimated income for next year by a few thousand dollars; and b) my unsubsidized premium price shot through the roof.

Nevertheless, I paid about $55/mo this year for my Cigna Silver plan in MO, and next year that will drop to about $45/mo for the same plan.