The individual mandate is gone. And this helps subsidized buyers.

The Congressional Budget Office thinks that the lack of a mandate will raise individual market premiums by 10% because healthier people who either receive low subsidies or no subsidies will leave the market. A sicker risk pool on average leads to higher premiums. The pain overwhelmingly falls on the non-subsidized as the subsidy eligible portion of the ACA market, those families who make between 100% and 400% ($12,020-$48,080 for a single adult) Federal Poverty Line could see even better subsidies.

I’ve been fascinated for years now that the relevant number for subsidized buyers is not the absolute premium but the spread between any plan and the Silver Benchmark. For plans that cost less then the Benchmark Silver, the subsidized buyer gets a better deal. The bigger the gap, the lower the monthly premium. The lower the monthly premium, the more likely a low utilizing individual will buy a plan. The lower the monthly premium, the more likely a low utilizer will stick with a plan for the entire year.

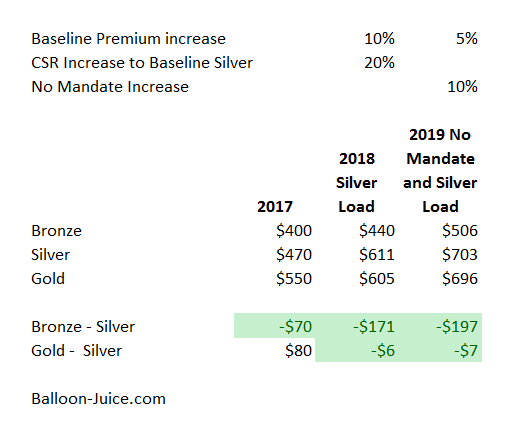

The graphic below is just a toy model with 2017, 2018 and 2019 pricing for a single county with a single insurer offering a single plan on a single network in Bronze, Silver and Gold. I am making up the baseline pricing for illustration and intuition.

Let’s work through this underneath the fold:

2017 was a normal pricing year. Bronze was less expensive than Silver which was less expensive than Gold. 2018 had normal pricing inflation with a trend increase of 5% to 7% and a one time 3% increase due to the Health Insurance Tax being reimposed. The health plan was a smart reader of either the Urban Institute or Balloon-Juice, and added a 20% charge to their Silver plan to cover the cost of CSR payments. In 2019, all plans face a trend increase of 5% plus an extra 10% due to a sicker risk pool because of the lack of a mandate.

So what happens?

In 2017, Bronze was $70 cheaper than Silver and Gold was $80 more expensive than Silver. The trade-off is more premium for lower out of pocket expenses.

In 2018, Bronze was $171 cheaper than Silver while Gold saw a significant swing to become $6 cheaper than Silver. Here the only people who should think about buying Silver are people who earn between 100% and 200% ($12,020-$24,040) as they can buy better actuarial value for slightly higher premiums. This is a legitimate and non-dominated trade-off. Bronze looks really attractive to healthy buyers.

In 2019, the Silver Load continues and it is built into the baseline premium. Every plan sees a 5% increase in premium due to normal medical trend. There is also a 10% increase that applies to every plan because the lack of a mandate makes the risk pool sicker. The differentials change. Bronze is now almost $200 cheaper than the Silver for the subsidized buyer. Gold becomes slightly less expensive relative to Silver for subsidized buyers in 2019 than it was in 2018.

There are two key insights from this toy model for subsidized buyers. First, percentage price hikes that apply to all products increases the absolute value of the spread in premium from the Silver Benchmark plan to any specific plan. Any subsidized buyer who wants to buy a plan that is less expensive than the Silver Benchmark plan is better off without the mandate because the relative spreads increase. Secondly, the people who get hosed are either the subsidized buyers who want to buy a plan that is more expensive than the Silver Benchmark as the absolute value of the spread will have increased or those people who get no subsidies as they eat the entire price hike.

NobodySpecial

So, in other words, a migration to the poles of the scale rather than a big clump in the middle?

David Anderson

@NobodySpecial: yes

Yarrow

So, I this means things are slightly less bad than they could be given who’s in office? I mean, there’s still a healthcare exchange and you are indicating there will still be subsides. So that’s good, right?

David Anderson

@Yarrow: yes, and if you qualify for subsidies and are willing to buy a plan less Expensive than benchmark you are better off ( assuming your county has an insurer)

StringOnAStick

@Yarrow: It seems like its good if you qualify for subsidies, and not so good at all if you don’t. What remains of the ACA helps people who were really up against the wall with regard to health care and insurance access. Back in the earky 1990’s when I was an unemployed geologist scraping by as a xeriscape landscaper, I was buying those 6 month “bridge” policies. I got caught by a bad pap smear in a 3 days uncovered period and was from then on uncoverable; that really brought home how being (1) poor and (2) not having access to an insured pool via a job meant I was this close to being utterly screwed financially and in health terms. Luckily Planned Parenthood offered affordable and effective treatment but I never forgot that lesson.

Any other western democracy doesn’t have an underclass too poor to receive health care or insurance, plus people priced out of health insurance due to pre existing conditions. Go to other countries and talk to people; they can’t believe we tolerate this crap. A liberal engineer friend of ours pointed out how our so called system stifles innovation and entrepreneurship. Why risk starting a new small company if you can’t afford insurance, have a pre existing condition or don’t want your family finances destroyed by unforseen illness? Our national mythology of rugged individuals and do it on your own entrepreneurship is such bullshit.

Betsy

@StringOnAStick: I’ve been through a variation of that experience and you nailed it, exactly, … all the things you said!

Now I’m looking at starting up my business again (which I closed 10 years ago bc o became potentially unisurable, and had to take a govt job for which. I was overqualified, just for the health benefit). It’s possible that if my income from Consulting is rather low the first couple of years, that it will actually benefit me because the ACA will let me get a decent policy for not a whole lot of money out of pocket. I can’t tell you what that does for me in terms of opening up a market for my consulting services and letting me go after work that is more dynamic than what I’m doing for the state. We’ll see what happens, but I was waiting for the Trump Fiasco to do what it would do its worst to the insurance act before going out on my own. Now that I’m hearing things settling down a little and ObamaCare seems to be mostly preserved and its original state, and the Republicans haven’t yet been able to peel it back to a great extent, I feel like it’s safe to start a business.

My friend who is a health insurance actuary and may even know David says that in fact there is a small but significant uptick in the rate of small business formation since the ACA went into effect and mitigated the ” job lock” that was paralyzing business formation at that level.

Kraux Pas

I’ve been wondering if Massachusetts would be affected differently because we already have an individual mandate to buy insurance. Also, what would happen if more states decided to pass similar laws?