Right now, Catastrophic plans are available to anyone under age 30 or individuals who have a prospective hardship exemption. They are high deductible plans that have low premiums through the combination of a young and healthy risk pool as well as no net outflows of catastrophic premiums to metal pool risk adjustment.

CMS may be opening up more pathways into Catastrophic plans with a laissez-faire attitude on exemption approval.

Right now, in quite a few counties, a Bronze plan with a $6,000 to $7,900 out of pocket maximum may be the optimal plan for two groups of people. The first group are people who expect to have low medical costs and who have assets or cash flow to cover a shock event. These folks are primarily buying on low premiums.

The second group is a far sicker group. This group is composed of sophisticated buyers who know that they are going to bust through the out of pocket maximum in a given year. This group includes people with certain types of cancer, coagulation disorders, cystic fibrosis, and unusual genetic disorders among other conditions. This is a small group of people who should be optimizing on a minimization function of total cost which is premium plus out of pocket maximum subject to the constraint that critical doctors/hospitals are in network. Here, Bronze ain’t bad in some counties and age combinations. Catastrophic at current premium differentials is even better.

The problem is that the catastrophic risk pools are often too shallow to absorb a few strategically chosen catastrophic plans. Let’s work through a couple of examples using interim 2017 risk adjustment average premiums and member months. The chooser will be “Ted” who is 31 years old. Ted has an unusual and ineffectively risk-adjusted condition that is a $100,000/month condition ($1.2 million in known costs per year). He has a good working knowledge of the health finance system and can credibly claim a hardship exemption to get into a Catastrophic plan. We should also assume that none of the insurers know about Ted.

In California, there were about 27,500 member years in Catastrophic. Catastrophic collected $55,000,000 in premiums. Adding Ted adds another $2,000 in premiums. He also adds an unexpected 2% of premium claim cost. 2% of premium is painful for the entire state pool. If there are multiple insurers, it is a very big hit that takes a lot of cash out of a sub-pool even after risk adjustment flows in. If Ted bought a Bronze plan, his unexpected expense increment is a rounding error out of a $10 billion dollar premium pool.

Now let’s look at a single insurer state like Delaware. If Ted buys Bronze, he adds half a percentage point to the Metal risk pool’s expense profile. An insurer should be able to handle a shock like that. In the Catastrophic pool of less than 200 people and less than $400,000 in premiums, Ted destroys that market.

Finally, in a state with two insurers like Louisiana, Ted is 1/10th of 1% of total premiums in the metal pool. An insurer can eat this cost as the pool is deep. In the catastrophic pool, the story is different. The entire premium pool is under $3 million dollars which means Ted would be a 40% miss. If both insurers are offering catastrophic plans, Ted kills one plan and the other is in good enough shape.

Now let’s imagine that there are a dozen people who make too much to qualify for subsidies, know that they are on track for a half million or a million dollar year and are optimizing their plan choice that leads to many buying Catastrophic plans as the solution to the min(OOP+Premium) problem. This leads to either Catastrophic plans lose their morbidity advantage against Bronze plans and thus lose most of their pricing advantage OR insurers losing a ton of money on voluntarily offered Catastrophic plans. In the second case, insurers will race to the metals where deeper risk pools can handle efficient plan choices better.

Catastrophic plans as a long term play only can exist if there are barriers to individuals with massive, recurring claims from entering. Right now, that barrier is mostly the age restrictions to enrollment as well as the lack of subsidies as it selects for young and reasonably high(ish) income (400% FPL or more) . If CMS passes out hardship exemptions out like candy at a Halloween party, then the age barrier will fall and more sophisticated buyers with significant health needs may switch from Bronze to Catastrophic.

And if that happens on a wide scale, then Catastrophic plans will disappear fairly quickly as the premium pools are too shallow to accommodate efficient choices by highly likely to be expensive buyers.

HeartlandLiberal

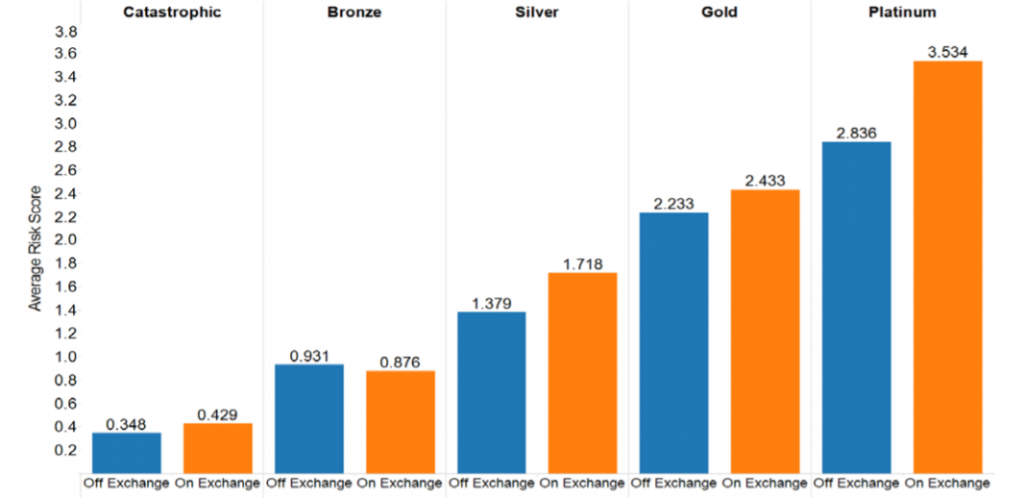

Their is an image embedded in the diary, but it is broken and invisible. When I click on view image, I get an error message that it cannot be displayed because it contains errors. FWIW.

David Anderson

@HeartlandLiberal: I’ve updated and embedded the image

Mike S

I switched from a silver plan to a bronze plan this year just for the reasons you state. I’m in southeast PA and get some (this year quite significant!) subsidy, but I lowered my premium and I expect only low to moderate health costs. My deductible is now about $7500 which is up from $6K or so, and my yearly drug and Dr visit costs are up from about $500 ($1.5 to 2K) but my annual premium cost has dropped $4900 (from about $6.4K to $1.5K)! I could take the deductible out of my savings if I had to. Halfway through next year I’ll make the switch to Medicare (I’ve already started to recieve the informational mailings from insurers) so I’m not sure what the best deal will be at all.

David Anderson

@Mike S: The big thing next year is that you will be facing two rounds of out of pocket costs. This might be an interesting post for tomorrow as it is an interesting scenario…

evap

a practical question: My 28-year-old daughter is currently going without health insurance as she looks for a job. She is in New York. How can she get a catastrophic health plan? She left a good job (with very good benefits) to move to NYC, and I fully support her reasons, but I am nervous about her going without health insurance. I’m sure she will find a job soon, but until then….

David Anderson

@evap:

She should sign in with the state Exchange and see if she qualifies for a special enrollment period. If yes, if she makes under ~$48,000 a year, she will be eligible for ACA subsidies to get a Bronze or Silver plan for far less (net of subsidy) than a Catastrophic plan. If she makes more than $48,000/year, she should look for a Catastrophic plan as it may be less expensive on net than a low premium Bronze plan.

If she does not qualify for a SEP, then cross your fingers until November when OPen Enrollment starts with coverage effective 1/1/19.