Aang asked a great question in comments yesterday:

How difficult would it be to make the benchmark plan the second cheapest gold plan? Would it be worthwile? Seems it would give bigger subsidies and less cost sharing for those who don’t qualify for CSR.

This is an important question because there is a wide variety of ACA 3.1 plans floating around out there. Most attempt to use an appropriation of CSR to pay for other things. Those plans attempt to hold harmless beneficiaries of Silverloading by either expanding CSR eligibility up the income scale or resetting the benchmark to a Gold plan instead of a Silver plan.

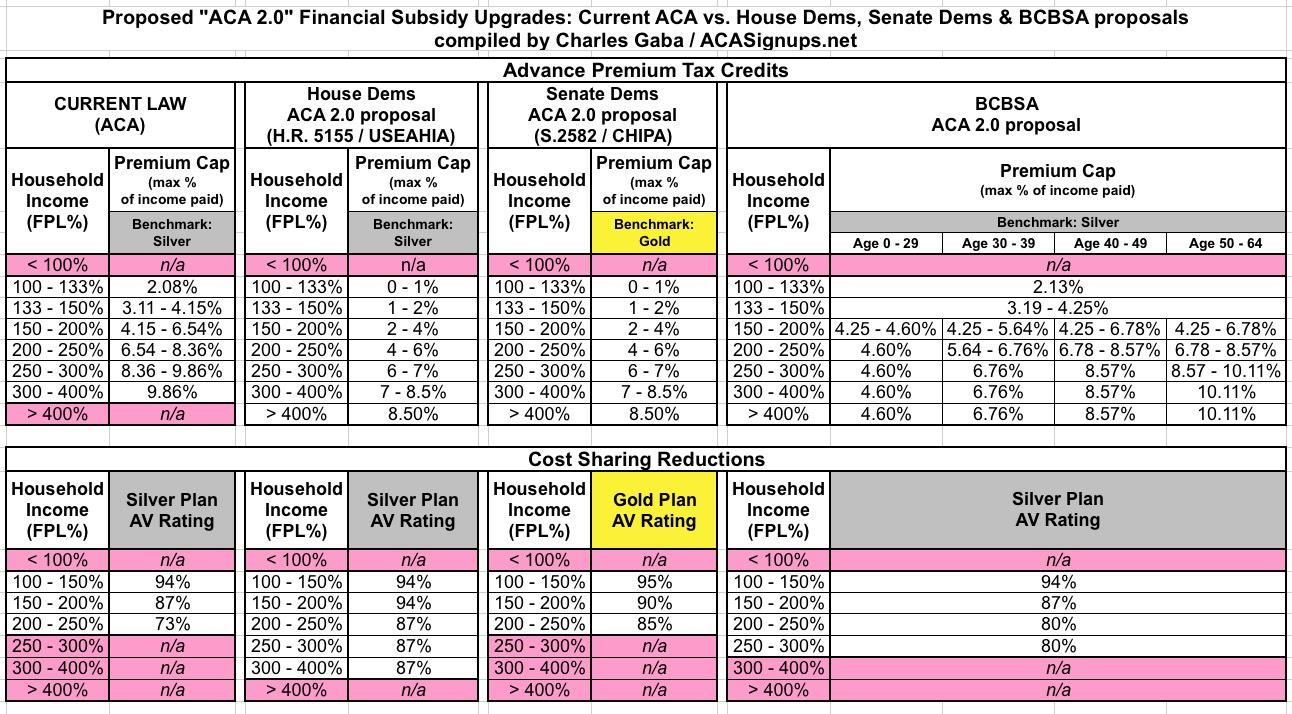

Charles Gaba has a great chart on the options.

There are trade-offs to beefing up a Silver benchmark with more CSR versus less CSR but resetting the benchmark to Gold.

Keeping the benchmark at Silver lowers average actuarial value for the lightly subsidized folks. There is a chance that these folks will see a below benchmark premium for a single Silver plan and an array of Bronze plans. There is little chance (using 2017 data to back out Silverloading) that someone making 400% FPL will see a Bronze plan for under $100 a month. And the people who will see that low cost Bronze plan will be married late 50s and early 60s in very high cost regions; they will not improve the risk pool.

Resetting the benchmark to Gold will make CSR less relevant as the benchmark is doing a lot of the work of upping actuarial value to middle income individuals and families. The market will be more sorted by health status as healthier buyers may choose to move from an 85% AV Gold CSR plan to a 70% Silver plan to save on premiums while individuals and families that anticipate high costs will stay in the CSR plans. This is a risk adjustment challenge but it is surmountable.

More importantly, for the families that are not CSR eligible, they will be exposed to far more zero dollar plans in Bronze. Zero premiums may matter for incremental enrollees who are flipping a coin between buying or not buying insurance. Dr. Coleman Drake of Pitt, and I have some preliminary work that we’ll be presenting at Academy Health’s Annual Research Meeting in June on this subject.

From a mechanical standpoint, insurers will want to know what the rules are a good nine to twelve months before open enrollment. Once they know what the rules are and are confident that they are stable for the upcoming policy year, the implementation of a Silver or a Gold benchmark should not matter too much to the insurers. At the policy level, it is a harder decision as Gold benchmarks, all else being equal, will lead to higher enrollment of the marginal buyer which means incrementally healthier risk pools.

On the Road and In Your Backyard

On the Road and In Your Backyard

Aang

Thank you. I wasn’t aware of the Senate bill that would set the benchmark to Gold.

Will any of the proposals allow people below 100%FPL to buy on the exchanges in states that haven’t expanded medicaid?

David Anderson

@Aang: No.

StringOnAStick

There’s a whole group of not at Medicare age people out here who would love to cut back to part time work and open up a job slot for a younger person, but can’t afford to do so because of the cost of health insurance. I wish someone would think about us when they are drafting possible legislation.

Jennifer Chumbley

@StringOnAStick: assuming part time for a couple puts them under $65K-ish in income, there are significant subsidy dollars available. I highly recommend looking at healthcare.gov to determine actual premium