The Senate Finance Committee just released their Medicare and Medicaid drug pricing bill. It contains a lot of interesting and useful policy proposals. The one that I am curious about is the proposed redesign of the Medicare Part D drug benefit.

Right now the benefit design is an initial deductible, a coinsurance phase, and a catastrophic phase with a much lower coinsurance. There is no out of pocket cap. For most people who are not on specialty drugs, the lack of an out of pocket cap is not relevant but it is a poor insurance design in a world where life sustaining drugs can cost the equivalent of a median price of a three bedroom pre-war house in an inner ring Pittsburgh suburb every year.

I told him those are the drugs I study

His reply was no way could he afford that. He would just have to die.— Stacie Dusetzina (@DusetzinaS) October 23, 2017

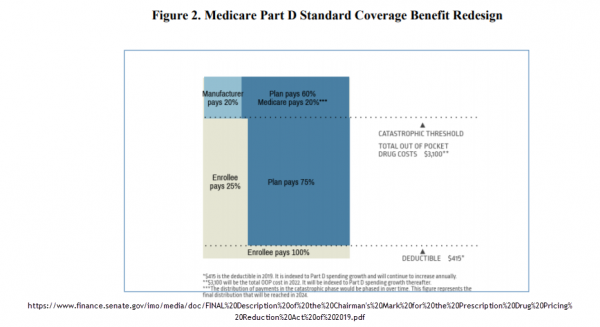

The Senate Finance Committee proposes to change this:

This provision would make substantial changes to the structure of the Part D benefit in order to simplify the benefit design and realign incentives to encourage more efficient management of drug spending. Starting January 1, 2022, it would: (1) change enrollee cost sharing in the initial coverage limit and the coverage gap; (2) cap enrollee cost sharing above the catastrophic out-ofpocket threshold; and (3) change the amount of annual out-of-pocket spending needed to trigger catastrophic coverage.

This change, if approved, actually makes Part D insurance against a catastrophic risk instead of cost assistance and insurance against moderate risk. This would be, in my opinion, by a good change.

As a side note, it is interesting to note that this would be another major technical revision of the Part D benefit since it was passed into law in 2003. This is a normal process for major social welfare and health system legislation. These types of things need to be tweaked and course corrected every so often. This is Congress responding relatively normally to a normal problem.

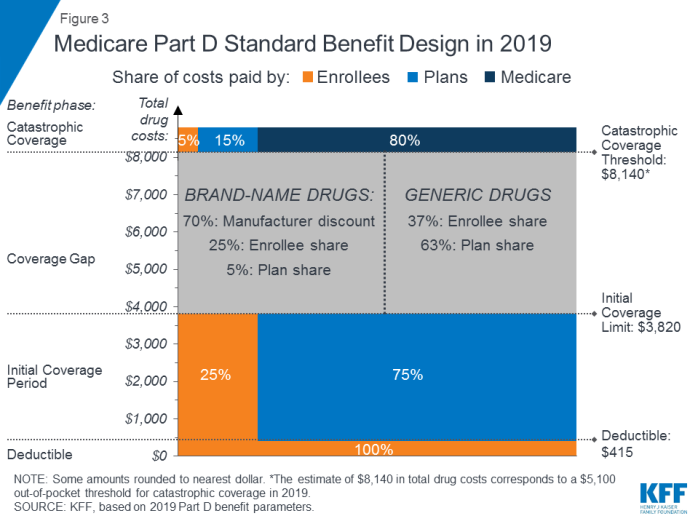

Update 1 Kaiser Family Foundation has a good explainer on the current Medicare Part D benefit structure:

Currently there is a $415 deductible, 25% co-insurance for all expenses between $415-$3,820 and then depending on the type of drug, another 25% to 37% coinsurance for claims between $3,820 and $8,140 (weird stuff happens here). For everything above $8,140 to infinity, the patient is on the hook for 5%.

Eric

Do you have a similar figure that shows the current cost breakdown similar to the figure that you have for this proposal?

StringOnAStick

This change is a good idea and yet it is something the R’s put together, which makes me suspicious. It must be an R proposal of else McConnell would have made it clear there will be no vote.

As Medicare Part D is currently structured, is there any cost sharing for beneficiaries starting at the first dollar? I’m thinking that for poor seniors (an ever growing group) coming up with the first $415 at the start of the benefit year is going to produce generalized screaming in a concentrated time frame instead of everyone hitting the donut hole at different times based on their own prescription profile. Your thoughts?

I’m still 4 years from Medicare so I’m not as clear on the benefits and ins and outs as someone defending on the system probably is.

Eric

I likely have a number of patients who would be (on average) better off with a plan like this. What I’d worry about is some patients rationing medications (and thus not being adequately treated) for the first few months due to cash-flow problems until the $415 cutoff is hit.

Its not uncommon for my patients to be on 2-3 different drugs for a single condition (to reduce the risk of slowly progressive, irreversible blindness). The first-line generic medications each cost around $70 a month. But those patients at most risk of rapid decline may be on 5 medications, the most expensive could run $300 a month (for one medication). These patients could easily hit the $415 deductible in one month. What I fear is that they’d ration medications to spread the cost over more than one month and suffer disease progression as a result (this already happens for a minority of my patients).

Aaron Shatzer

@Eric: This overview from the Kaiser Family Foundation has a diagram of the 2019 benefit about halfway down: https://www.kff.org/medicare/fact-sheet/an-overview-of-the-medicare-part-d-prescription-drug-benefit/ . The redesign is moving from four coverage phases to three.

@StringOnAStick: The $415 deductible is already part of the standard Part D benefit at present, so that’s not a change. There is a Part D low income subsidy program that reduces or eliminates premium, deductible, and other cost-sharing for low income seniors. The income threshold for LIS assistance is pretty close to Medicaid eligibility (maybe 130%ish of FPL?) and likely still leaves a lot of seniors over the threshhold who have trouble covering the full deductible at the start of the year though.

weavrmom

I was praying for this just yesterday, as Medi-Care age is fast approaching for me.

It’s actually astonishing that Medi-Care has NO catastrophic out-of-pocket caps, which I guess stems from it’s design back when medical care just wasn’t usually THAT expensive (yes, I’m old and I remember!) That keeps the thrill of potential medical bankruptcy going into our golden years, no?

OTOH, I’ve been gripped by reading a writer’s stuff on what Medi-Care covers, and if extra insurance is actually worth the cost: http://truecostofhealthcare.org/medicare-supplemental-insurance/ I might have even gotten that link here, don’t remember.

He also covers Part D drug ‘insurance’ coverage, and how it’s mostly a scam. So if Part D adds on catastrophic coverage, any reason I might have to get Part D supplemental insurance disappears completely. I won’t miss the anticipated horrific fights over drug insurance.

Most drug coverage seems like a scam, anyway. I got into a HUGE fight with a previous insurer over how a generic didn’t work for me, and that the brand name that did wasn’t covered. Finally, a pharmacist trapped in the middle who was overhearing the phone conversation quietly let me know that my meds would only cost me $15. So I had burst a blood vessel and had a long fight over this tiny amount, and was going to be charged MORE FOR THE GENERIC by my ‘insurer’. It’s a scam, my friends.

And Medi-Care covers so much, I’m really not certain that I actually need a ‘supplement’. The case studies at the link, showing actual out-of-pocket costs, such as for a liver transplant, are enlightening.

And don’t buy Med-Care Advantage plans! I had already figured that one out! I mean if you LOVE Kaiser, knock yourself out. But Medi-Care has the biggest network going. I’ll take it!

Sorry for the long post, but this is news I can use! Thanks so much!!!!

rikyrah

What’s the catch?

What is the scam?

I am sure that you understand my skepticism ??

weavrmom

@rikyrah: I share your skepticism, however I’ll take it.

I think the catch is charging that huge deductible up front? Anything that hurts the very poorest is always a plus to Rs. The fact that those worst off are largely POC and/or women is just gravy for them!

Also, maybe Rs want to do SOMETHING for seniors who tend to vote for them, and that can also give them at least ONE talking point against those devastating Dem health care attacks of the last election? They had absolutely nothing. Just my speculation…

David Anderson

@rikyrah: @weavrmom: AGreed, that the deductible is an issue for people who have multiple drugs and not a lot of cash.

The catch from rikyrah’s POV is that this benefits old people who are more likely to be frequent voters and it gives GOP reps a tangible benefit to brag about to a core voting constituency.

Steeplejack

@David Anderson:

Glad you dropped in. What do you make of weavrmom’s claim that one doesn’t need a Medicare Advantage plan?

Barbara

@Eric: Part D has a low income subsidy (LIS) program that basically does away with almost all cost sharing for people who qualify.

It is a bit confusing to determine who is eligible, but you can start here: https://www.ncoa.org/resources/part-d-lisextra-help-eligibility-and-coverage-chart/

Barbara

@Steeplejack: You don’t need a Medicare Advantage plan. If you don’t enroll in an Medicare Advantage plan, you will need to select a standalone Part D plan, and, most likely purchase Medicare Supplemental insurance, because standard Medicare has no maximum out of pocket limit, and all outpatient services carry a 20% deductible. For instance, if you are receiving an expensive injectable drug in your physician’s office, you would be responsible for paying 20% of the Medicare reimbursement amount for that drug no matter how expensive it is. The most important benefit to MA plans in my view is that there is indeed an out of pocket expense cap, at least for non-drug coverage. I can’t remember how it works for integrated Medicare Advantage/Part D plans (Part D currently has no out of pocket maximum).

Barbara

@David Anderson: The changes to the benefit structure are made possible by other significant changes that carry a potentially big impact on drug manufacturers, so it has a long way to go before it is enacted.

Barbara

@weavrmom: I strongly suggest you read “Medicare and You” because some of what you said seems inaccurate or based on some misunderstandings.

Unless you have privately sponsored retiree drug coverage, Part D is the ONLY way for Medicare beneficiaries to get prescription drug coverage. It is not a “supplement” to anything else. It is standalone and if you don’t have it you are paying for all outpatient drugs out of pocket. So-called Medicare Supplemental plans are no longer allowed to cover outpatient prescription drugs (except for cost sharing for Part B drugs, which are mostly those that are dispensed in a doctor’s office).

If you enroll in standard Medicare and don’t buy a supplemental plan, you will pay 20% copay for all outpatient services, and whatever cost sharing is currently required for inpatient care.

As I said above, the greatest benefit of MA is that there is a maximum out of pocket. Yes, Medicare has the biggest network, but you can often face challenges to seeing people within that network if you are trying to access benefits as an individual. So a lot of the advantages of various options depend on where you are in terms of location, health, etc. Right now, around 40% of Medicare beneficiaries enroll in an MA plan. I think the selling point for many are things like dental and vision benefits, that are in addition to what you can get in Medicare, as well as the maximum out of pocket spending.

Steeplejack

@Barbara:

Oops, sorry, I was unthinkingly using Medicare Advantage as a synonym for Medicare “supplement.” Point being you need something to protect against that 20% out of pocket if you have a significant medical issue. Weavrmom’s link seems to suggest no supplement is necessary, which sounds wrong.

weavrmom

@Barbara: Appreciate your feedback, Barbara. I do understand that one needs Part D coverage; is the only way to get Part D through supplemental insurance? The cost for Part D supplemental insurance is currently not burdensome, so I’m not entirely against it.

Re Medicare supplemental plans for outpatient services, I do understand the 20% copay for outpatient services. I’m just looking at the cost of the supplement vs what a high-use person like my 84 year old mother would actually pay, and I don’t see the savings, particularly at her age. She is completely risk averse and never wants to pay a single penny directly for health care, despite having plenty of money at this point. The truth is she would probably save over the long run just paying that 20% copay, despite a few hospital stays over the years.

Of course, there’s always that fear of needing above and beyond what’s covered, and one can’t put a price-tag on peace of mind. I’m just weighing my options, and again, appreciate feedback, and the excellent points you make. I do notice that Kaiser seems to do well by my mom’s very low-income friends. They also have a nice structure that seniors can be comfortable with once they learn to navigate it, which is important for many. So I don’t knock those plans for everyone. I’m just trapped in Kaiser right now, and it’s really not for me, personally. I happen to live in a metropolitan area with many other options, so you are right, my situation is not analogous to others’.

Again, appreciate your info.

Barbara

@weavrmom: Part D is not supplemental insurance. It is a standalone program. It’s going to confuse people trying to help you to mix and match the lingo like this. You enroll in Part D at the same time you decide to enroll in Medicare Part B. Enrollment in Part A (inpatient) is more or less automatic. When you enroll in Part D, your choices are to enroll for all of your Medicare coverage through an MA plan integrated with a Part D plan (MAPD) OR to enroll in a standalone Part D plan (PDP), at the same time you enroll in Part B in traditional Medicare (you should enroll in Part B unless you are employed and still enrolled in your employer’s health plan — retiree coverage does not count). So the possible combinations are:

MA + PD in a single plan.

Original Medicare + Standalone Part D

Original Medicare + Supplemental Insurance + Standalone Part D

If you are living in California, be prepared for the reality that even if you are not in Kaiser, you will most likely be encountering what we like to call Kaiser Light, where nearly anyone you see is going to try very hard to refer you to other service providers within their own set of linked provider relationships.

PS: the real decision with Medicare Supplemental is that it is still underwritten, so if you forego it now, you might not be able to get it later, and certainly, it will likely be more expensive.

Barbara

@Steeplejack: Well, nothing is strictly NECESSARY. A lot of people still have some employer provided retiree coverage, especially if they worked for a public employer, but that too is changing fast. Most people do not like doing without some kind of supplemental coverage, and if you are going to buy it, it will be cheapest and most available if you get it within the guaranteed issue period, and I can’t remember whether that is 3 months or 6 months after first becoming eligible for Medicare, but basically, when you turn 65. If you wait then it will get more expensive and is not necessarily guaranteed (they keep changing the rules).

Steeplejack

@Barbara:

Thanks for your very clear summation.

I opted for Kaiser’s Medicare Advantage plan when I turned 65 two years ago. Can’t remember the details of my decision—God, it was complicated—but I’m in pretty good health except for a history of skin cancer (basal cell carcinoma, the best kind to have) that needs to be checked regularly. (Seeing the dermatologist tomorrow, in fact.) And I like, or at least don’t mind, Kaiser’s one-stop approach. Didn’t have any previous primary-care physician that I was linked to. I haven’t had any occasion to use it for anything beyond flu shots, etc.

Barbara

@Steeplejack: If you are in an MA plan you don’t need Medicare supplemental insurance. Just in case that wasn’t clear enough!

Steeplejack

@Barbara:

I get it! My questions above were based on my impression that weavrsmom seemed to be seriously misinformed.