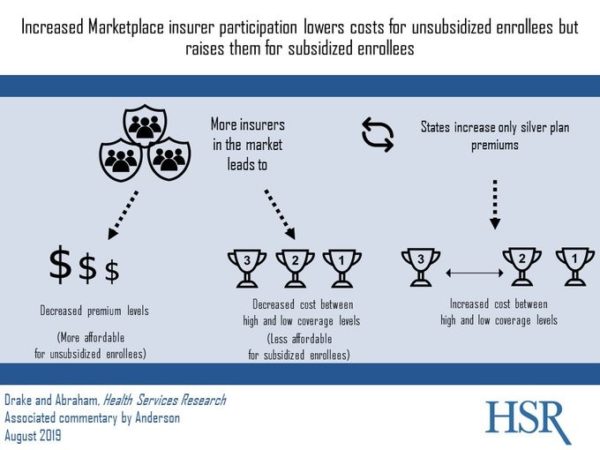

Health Services Research has selected an article by Coleman Drake and Jean Abraham that I then commented on for a visual abstract.

This all should be familiar to Balloon-Juice readers:

This is mathed up Balloon-Juice and my obsession on silver spread games that insurers can play to choose their own markets. The more competitive a market is when there are at least two insurers of the same type/price point, the more expensive the market is for subsidized enrollees in reasonably good health and the less expensive it is for non-subsidized enrollees. Monopolistic insurers have a great deal of option space to choose their own risk pools. Smart ones will maximize both revenue and enrollment by creating large spreads so that the the healthiest parts of a cohort are exposed to dirt cheap plans. Dumb ones will make insurance expensive for the healthiest groups.

Open Thread: Greenland Declines While Rolling Eyes

Open Thread: Greenland Declines While Rolling Eyes

MoxieM

My experience in a new state (CT) as a person with a lot of health stuff–chronic needs etc., and as a non-subsidized individual subscriber, is that I have two and only two insurers to choose from. Certain procedures are covered by neither, hence effectively unavailable to me (e.g., bariatric surgery) even if I need it as a precursor to spine surgery… I have premium choices from ~$700 to ~1,800 (if I can afford it), depended on metal level, coinsurance, deductible etc. But the basic bones of the policies seem achingly familiar.

Of course I just moved from a state with a cornucopia of choices ad generous coverages (MA)

The dilemma: I can live in MA with great insurance, but not afford to live near decent provider networks, or live in CT with crummy insurance but live near pretty damn good provider networks (e.g., Yale New Haven Hosp.).

I try to explain this to my German son in law and he quite literally cannot take it in. Not one bit. My daughter gets homesick, but I tell her to take her 6 weeks paid vaca and come visit, but live where she is….

Yarrow

@MoxieM: So sorry you’re dealing with this. It’s such a sad commentary on the state of health coverage in the US. It makes no sense at all. I know there are reasons for it but taking a step back and looking at it from a distance it’s just crazy.

jl

The robots breakfast of metals allows too much cream skimming, cherry picking, etc. to separate out healthy and less healthy people, especially in markets with an oligopoly or monopoly. This is less of a problem with competitive markets, except that, recalling the Rothschild-Stiglitz results in ‘Equilibrium in Competitive Insurance Markets’ a competitive equilibrium may not, probably does not, exist. So, we have endless churn in benefit packages and premiums. And normal everyday people who will get unpleasant surprises when they try to plan for medical expenses from year to year.

To improve PPACA, really need stronger Dutch or Swiss style absolutely uniform benefit package for the basic minimum insurance policy, and much stronger regulation of the insurance market. The US feds and states have been able to do this for life, property, and auto insurance, but something, wonder what it is, prevents it for health insurance. Couldn’t be corrupt interest group pressure on legislators, could it?

Main reason I am supportive of the various Medicare for All proposals, from incremental and moderate to quick and drastic, is that they show an alternative way to tackle these issues. Complete nothing from those who advocate for PPACA reform, just empty slogans. Whatever path the US chooses, we really need to get people’s costs down and predictability of costs up.

jl

Also need to eliminate the profit motive, in the sense that insurance companies have to be discouraged from making profits from cream skimming. This motive cannot be eliminated entirely but it can be controlled through market design and regulation. As I mentioned above, requiring an absolutely uniform benefit package for mandatory minimum coverage is a crucial part of market design.

It is said that in Switzerland the mandatory minimum coverage is required to be provided on a ‘non profit’ basis. Not sure if that is really accurate. More like they are allowed to only get what in econ is called a ‘normal profit’ that would be seen in hypothetical benchmark competitive market for managing the policies, which is small compared to the US. An analogy from the US is a large company or union that self-insures, but contracts out the management of their health insurance to an insurance company. Insurer gets a fee for managing it, but no role i n benefit design that they typically use for cream skimming.

Brachiator

@jl:

I am not sure that there is any such thing as eliminating the profit motive, or should be.

In Southern California, there may be a strike against the insurer Kaiser. Proponents of the strike claim that the chief executive makes $16 million and that the organization makes massive profits, even though I think it is supposed to be a non-profit organization. How does that happen?

In any event, maybe tighter regulation might be appropriate or effective.

jl

@Brachiator: “or should be”

Please explain your rationale for ‘should’ and ‘shouldn’t’

You limit the profit motive to what the insurance company would get if it were just managing a insurance policy with a given benefit design. That is done in health care frequently in the use. The insurance company is essentially hired to just manage.an insurance portfolio.

You let the insurance company profit from both management and benefit design, you are probably giving up existence of competitive equilibrium. That is a very important ‘should’ for systems that assume the existence of a competitive equilibrium, don’t you think?

Brachiator

@jl: I can agree with limiting or regulating profit.