Kevin Drum asked why no one is bragging about the drop in ACA premiums:

Obamacare premiums are down this year — but no one knows it https://t.co/lkay5YpGsI pic.twitter.com/s9iBlnc9vf

— Kevin Drum (@kdrum) November 21, 2019

There are two sets of inter-related answers. First is a political answer: ACA premiums are not particularly salient right now. Republicans are trying to kill the law in court and Democrats don’t want to give credit to HHS or Trump for spiking premiums in 2018, front loading several years of increases into a single year and getting flat rates for the next two years.

The other is pragmatic. For most people who stay in the same plan (major caveat), premiums are not decreasing by a noticable amount. There are a couple of reasons for this:

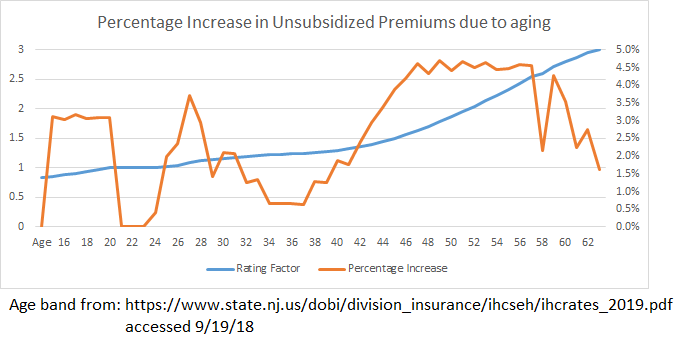

- Unsubsidized buyers may see a fixed age premium decrease get eaten up by age rating

- Subsidized buyers often see incomes change

- Subsidized buyers who have the same income as a function of FPL and who purchase the benchmark silver plan in both years won’t see more than nominal price changes

- Subsidized buyers who have the same income as a function of FPL and who purchase plans priced below the benchmark will see smaller spreads.

I have performed a premium spread analysis since 2016. I’ve used the landscape public use file and build my spreads on the basis of a single, non-smoking 40 year old. This is an arbitary choice. It allows for a consistent analysis over time. But as my ankle continues to remind me, 2019 Dave is several years older and significantly creakier than 2016 Dave. Age rating comes into play.

Almost every year after your mid-20s, there is a 1% to 4% increase in an unsubsidized buyer’s premiums just because they had a birthday. It is not a smooth curve with a constant increase. There are peaks and valleys with some hard spikes.

So when we use the language that premiums are increasing by 3% for a standardized population, we are assuming that everyone who buys insurance is a vampire who does not age.

Anyone who is not receiving subsidies is seeing a premium increase year over year in a year when all the analysts, wonks and press are proclaiming flat or tiny premium decreases.

So that is why most non-subsidized buyers will see premiums slightly increase. Let’s move onto subsidized buyers now.

The premium that a subsidized buyer pays is disconnected from the price level. The net of subsidy premium is related to the difference between the chosen plan and the benchmark plan. The benchmark plan is the second cheapest silver plan premium in an area available to the buyer at the time of purchase. The subsidy is a gap filler between the benchmark premium level and the buyer’s expected personal contribution. If the buyer chooses something less expensive than the benchmark, they pocket all the incremental savings down to a zero premium plan. If they choose a plan more expensive than benchmark, the buyer pays the entire incremental cost in additional to their expected family contribution.

Excluding tiny changes to the contribution level formula, someone who buys a benchmark plan in both years will see no change in premiums that they pay even if their is a 30% drop in premium or a 30% rise in premiums. Everyone else will see different premiums. If there is a uniform percentage drop in premiums, everyone who bought a plan priced less than the benchmark in the first year will pay more in the second year while those who bought plans more expensive than benchmark in the first year will pay a little bit less in the second year. Billy Wynne and I looked at this when we examined the public option proposal in Colorado:

Our analysis suggests that introduction of a single public option plan in each rating area of Colorado would reduce the contribution a sample subsidized consumer would need to make to the premium of the lowest-cost plan in each metallic tier by 40.0 percent to 73.4 percent. Introduction of multiple public option plans in each rating area would, by contrast, decrease net premium contributions by 6.5 percent for the lowest-cost gold plan while increasing the contribution required for bronze and silver plans by 15.7 and 0.7 percent, respectively.

Once we assume that the benchmark drops more than all the other plans, the spread compresses fast, so the cheapest plans are now relatively more expensive in the second year than they would have been in a uniform percentage decrease universe.

I think that most people on the ACA individual market won’t be aware of the lower premium levels as aging effects and benchmark spread changes dominate the change in the baseline premium levels. Now I am curious if there is a state based marketplace with up to date data that is available to test this hypothesis out.

Bruce K

Funny thing: as an American abroad who needs to maintain insurance Stateside in case of a medical condition becoming acute, every year for at least the past six or seven years, I’ve been told that my insurance company is terminating the entire plan that I’m on, forcing me to sign up for a new plan with increased premiums and/or reduced benefits. It’s insane, insanely expensive, and if not for generous support from my family back home, I’d be under constant threat of being forced to choose between destitution and death should my medical condition deteriorate to the point of needing surgery.

smintheus

@Bruce K: That’s terrible. You can’t count on medical care in the country where you are living?

By bad luck, or the machinations of the Trump administration, our premiums look like they will nearly double next year for the same plan.

Bruce K

@smintheus: In Greece, I’m covered for basics, but if I need surgical intervention, that’ll be back in the States.

I’m honestly not surprised that people are still getting gouged – the medical/insurance racket is looking for any way to make bank, and the GOP’s effectively giving them a green light. Free market solutions, my [censored]; when the choice is destitution or death, that’s not how the free market works.

Victor Matheson

“Unsubsidized buyers may see a fixed age premium decrease get eaten up by age rating.”

This is a huge item that I honestly had no idea about until I started paying age-rated premiums, despite the fact I actually have a Ph. D. in economics and actually work on health insurance issues on a regular basis.

Correct me if I am wrong, but this is my understanding of the issue. The ACA mandates a maximum 3x difference in premiums between the youngest and oldest buyers. The oldest buyers are 65. The youngest buyers might be as young as 1.

Just doing the math, everyone who actually has to cover the age-rating premium themselves is experiencing roughly a 1.75% price increase every year just because they are getting a year older (hopefully!) every year. This is before any normal CPI inflation (maybe 2%) and any medical inflation above and beyond CPI that have averaged another 1.5%. Therefore, even a great medical inflation year where average premiums go up 1% slower than CPI, would mean a person facing age-rating would have their own insurance prices rising by 2.75% (faster than CPI). Of course in a normal year, their insurance would be going up 1.75% (for age-rating) + 2% (for CPI) + 1.5% (for medical inflation premium) = 5.25%. No wonder this looks terrible for individual buyers.

Of course people getting insurance from employers don’t notice this because I think by law the companies can’t charge individuals within the company difference rates for the insurance, so people don’t face the age-rating. And the company as a whole likely has roughly as many old people retiring as they have new people coming on board so the average worker age is roughly constant year to year. Thus, employees only face the “normal” 2% + 1.5% = 3.5% spike in premiums every year, and not the extra 1.75% that individual buyers face. I have this right, don’t I?

Mart

@Victor Matheson: This year wife and I age 61 pay over 1,800/month in a non Medicaid expansion state. If we roll over the same plan next year it is $2,100/month at age 62. Up over 15% (math in my head). Told wife I was gonna look at changing plans and she started to puddle up after all the shit we went through finding new providers we are comfortable with this year. When I asked many referred providers if the accept Cigna Connect would get a chortle and a snotty no most of the time.

lurker3000

Kansas subsidized plans doubled in cost with BCBS. It was a bit of a shock since I was expecting the above. My premium went from 95/mo to 225/mo with no change in fixed income. (But I also know that these prices are fantastic for a 50 plus yr old individual. Compared to most people w/out subsidy.)

Don’t know if it is too late for you to see this comment. I have 2 options that are nearly identical, but one is called a HDHP. Presumably due to my subsidy, the deductible is only $200 more than the more standard 80/20 coverage: deductibles of $300 vs. $500 (with the HDHP). The premiums are 224/mo and 225/mo. No out of network benefits covered in either. And the HDHP is pretty much after deductible no charge for all the listed benefits with the ACA plan coverage lists. The standard plan is almost across the board 80/20 after deductible. The drug coverage is quite similar. The max out of pocket for the HDHP is $500 and for the standard is $600. I am baffled as to which to choose. It seems like the no charge after deductible is the better deal if something happened or I had to have surgery, in that lots of charges of 20% should end up to be more than the $200 difference in deductible. But it seems odd. Is this similarity purely due to the subsidy benefits I get? Any advice would be appreciated.

The only other reason I can think of for the premium increase is due to age. Went from 60 to 61. Would that double my premium?