I was recently speaking with Juicer who is shopping for an ACA plan. They are Cost Sharing Reduction (CSR) eligible and their projected income for 2020 is literally a point or two above a major CSR cut-off point where the benefit value changes dramatically. CSR benefits for people who are not American Indian/Alaskan Natives come in three bands.

| Start Income (FPL) | End Income (FPL) | Silver Actuarial Value |

| 100% | 149% | 94 |

| 150% | 199% | 87 |

| 200% | 250% | 73 |

| 250% | infinite | 70 |

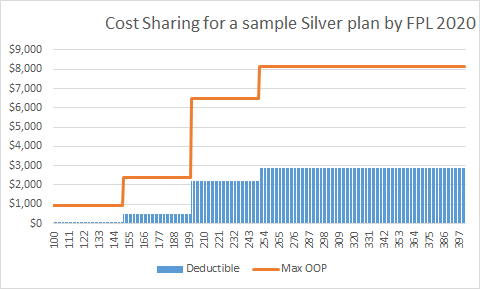

I converted those actuarial values into a real world example of how one Silver plan spreads out its cost sharing variants. Data is from the 2020 Landscape Public Use File:

We see significant discontinuities as income passes the CSR thresholds. CSR 94 has a $100 deductible while CSR 87 has a $500 deductible. The out of pocket maxes have bigger jumps.

Researchers have found that people have engineered their income to qualify for subsidies at 100% FPL and 399% FPL.

Financial engineering via tax records to keep income below 400%FPLhttps://t.co/raS4GZ7RP9

Spike of ppl making 100% FPL in non Expansion states https://t.co/0XMzr21wj6

— David Anderson (@bjdickmayhew) December 21, 2017

If someone knows that they are likely to have significant claims during the course of a year and they know that their unengineered reported/estimated income is really close to a threshold that triggers a significant reduction in cost sharing expenses, I would be surprised if there is not some financial engineering going on. There are a number of ways to legally reduce the income that is counted for ACA subsidies. One of the simplest is to increase any IRA contributions as Louise Norris explains:

If you’re not already contributing the maximum allowable amount to an individual retirement account (IRA), doing so would lower your MAGI (it has to be a traditional IRA; contributions to a Roth IRA are not tax deductible). You and your spouse can each contribute to an IRA, further lowering your total household MAGI.

[Note that the general MAGI calculations require you to add back traditional IRA contributions, but ACA-specific MAGI rules are different–your deductible traditional IRA contributions do lower your ACA-related MAGI.]

The exposure jump from 87% AV Silver plans at 199% FPL and 73% AV Silver plans at 201% FPL is huge. I would like to imagine that people are figuring out how to find ways to stay in higher actuarial value coverage without touching their quality of life or net of medical expenses available cash flow.

On The Road – ?BillinGlendaleCA – Star Trails

On The Road – ?BillinGlendaleCA – Star Trails

wmd

The table has a mixture of %FPL and income (well 100,000 looks like income). It would be of service to give both for a typical taxpayer.

dr. bloor

Alas, this is all likely to be little more than wonk-speak for 99% of exchange purchasers.

And the other 1% doesn’t have the spare change to engineer their incomes down by kicking into a retirement plan.

David Anderson

But this is useful information for navigators, assistors, brokers and the family member who helps everyone else with insurance over Thanksgiving weekend.

eclare

A good friend of mine is doing exactly this, engineering down to the minimum for subsidies. Her house is paid for, and she has substantial cash in reserve.

ProfDamatu

Not surprising at all, but looking at that graph really brings home the cruelty of the current CSR formulas – I mean, really, someone making 250% FPL plus $1 can afford an OOP max of $8150? I don’t think so! Or, more germane to the post – for someone at 300% of FPL, who probably can’t realistically engineer their income downward into CSR territory, that OOP max represents 23% of their gross income. Hell, even someone making 400% FPL can’t swing that on a year-in, year-out basis, as will be necessary if you’ve got a chronic condition.

I realize that when the ACA went into effect, OOP max numbers were more realistic, and that the 250% FPL cutoff for CSR subsidies was probably the best that could be achieved politically, but it still really sucks. As I’ve said before, we’re rapidly approaching a point where the insurance available on the exchanges will be unaffordable to use for almost everyone who doesn’t qualify for CSR subsidies (and, looking at the formulas, I would guess that many, many of those who qualify for the lower end of the subsidies will be in the same boat soon enough). Don’t get me wrong, it still beats being uninsured, but it’s scary to realize that even if you’ve saved up enough money to meet your cost-sharing, once that money is gone, it’s gone, and should you have another bad year, you’re looking at bankruptcy.

Chris Johnson

@ProfDamatu: Yeah, it’s a death sentence.

I inherited money in the last year since my parents died, that being about the only way anybody gets wealth today. Having gone from desperate poverty to ‘there is a zip code in my bank account’ (albeit on the extreme low five figures) has gentled my reactions to the insurance-industry posts a LOT. It’s just less upsetting to see when I’m not juggling bills and food and constantly having to think about the exact balance in my bank account vs. credit cards etc. and how to make it all work.

I still can’t have any sort of health care. Anything that might happen runs the risk of being an order of magnitude beyond what I can cover out of my newly-expanded bank account, so it’s still a complete non-starter.

I just have to exercise, eat right, lose weight, drive careful etc. and I can do that in better spirits since the price of good tools and good opportunities for progress is WAY LESS than the price of a medical disaster. So it’s basically keep my spirits up and hope to stay lucky. I can’t be mad at David anymore. It feels less like I’m being taunted with stuff I’m supposed to care about: now it’s become clear that the situation is untenable, and when I STILL can’t cover those situations I’m gonna just write them off completely. If I die, I die. Until then I’m going to try to help others and I’ll be in better spirits (much like David is trying to help others, just in a way that doesn’t have much to do with me)

Julie

For retired people older than 59 1/2, but younger than the Medicare age of 65, a way to engineer income down is to limit withdrawals from your IRA or 401(k). This strategy works best if you have extra cash sitting around to cover expenses over and above your MAGI. It helps to have low expenses (eg. a paid-off mortgage).

OldVet

I read this article even though it is not relevant to my life situation. The article seems like more reasons for Medicare for All.