Austin Frakt in a recent New York Times Upshot column looked at the health insurance choice menu:

So how many Americans actually have choices, and what type of freedom do choices provide?…

For instance, in the first year that drug plans were available to Medicare beneficiaries, economists have shown that 88 percent of them chose a more costly plan than they could have. This cost them 30 percent more, on average, and the tendency to select needlessly costly plans persisted in subsequent years. This is the kind of error, as other studies have found, that is easy to make when inundated by choices….

For instance, in the first year that drug plans were available to Medicare beneficiaries, economists have shown that 88 percent of them chose a more costly plan than they could have. This cost them 30 percent more, on average, and the tendency to select needlessly costly plans persisted in subsequent years. This is the kind of error, as other studies have found, that is easy to make when inundated by choices.

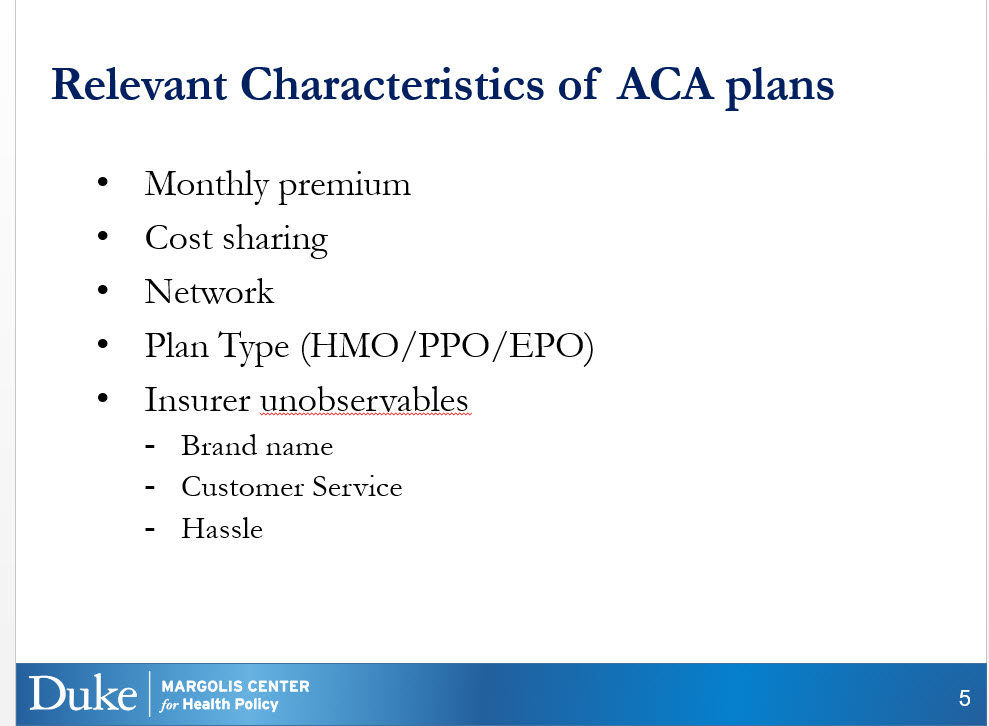

I presented some ongoing and future work on dominated plan choices at last week’s Duke Margolis health policy seminar series. Choosing insurance is tough.

My work on this topic is focused on California’s ACA markets because the rules for that marketplace wash away at least some of the complexity. And even within that simplified choice environment, people make expensively bad choices on a fairly frequent basis.

One of the comments from the seminar was if we could eliminate the display of objectively dominated choices, would that help? I think it would. We know in the Medicare Advantage context that too many choices leads to systemically worse average choice outcomes. Eliminating hideous choices from the choice menu would be the lowest hanging fruit to work to improve choice outcomes.

A secondary, niggling thought that is still stuck in my head is that inefficienct choice is profitable for insurers. An objectively bad choice leads to an individual either paying more in monthly premium or being exposed to more cost-sharing costs. If the individual has no claims, the excess premium is pure profit for the insurer and if the individual is paying minimum premium but not minimum cost-sharing, the insurer pays out a smaller fraction of the claim. There may be some odd incentive dynamics on the effect of excess cost sharing on the willingness to get healthcare that needs to be thought about, but the static analysis suggests that insurers have minimal motivation to make choice too easy, especially in a competitive market.

Choice is tough.

Barbara

I long ago concluded that the average human mind finds much about insurance to be counterintuitive, which leads to stupid decisions. However, there are a few consistent findings on why seniors make these mistakes in selecting Part D and MA plans.

The first problem is that many people focus on a definitive benchmark because it can be measured, and dismiss other factors that might be important to the overall outcome but that are hard to measure. So, basically, in this case, seniors look at the amount that has to be paid in monthly premium — a definite number that can be easily compared with any other plan — and cannot or do not try to put that number in context with the other numbers that might or might not be applicable to their personal experience. This is an even bigger problem when set beside another tendency, which is that many people consistently underestimate the amount of health care expenses they will incur in a given period, and overestimate their ability to control those expenses — even when experience has shown them that this is the case.

Every MA and PD plan knows that the majority of beneficiaries look at premium and jump at the lowest or zero dollar premium plans. This is so even though the Medicare Compare planning tool estimates the average out of pocket expenditures for each plan and encourages beneficiaries to choose based on that number. The “certain savings” of the low premium is simply too “real” to ignore, while the savings associated with more generous coverage is too uncertain for most people to measure.

In fairness to seniors, lots of other people, including experts, make similar mistakes. We have now all heard about Medicare’s star ratings for nursing homes, and how they seem not to be correlated with better outcomes during the pandemic. That’s because anybody who has waded deep in the weeds of these rankings has figured out that many of the measures that cumulatively add up to the final rating are like zero dollar premiums — chosen because they are easy to measure and compare across institutions, not because there is much if any evidence that they correlate with quality. They are also easy for institutions to game, but that’s a different problem.

StringOnAStick

David, what is the best approach to choosing an ACA plan when you are not quite Medicare age, is there a system or a designated professional service provider that can help with navigating the choices minefield? This will be coming up for us next spring and my husband has a pre-existing condition (CLL) and I have prescription medication needs.

Ohio Mom

Up until this post, I thought choosing a Part D plan was simple enough: open up the Part D site, type in your zip code and list what prescription drugs you take. Voila — your choice is practically made for you.

I thought the main catch-22 was when something new or different was prescribed to you mid-year (yes, that is happening to me).

Now I have to read this post more carefully, probably print it out too.

David Anderson

@StringOnAStick: I will have a post on that tomorrow!

The Castle

I agree with Barbara’s post.

This reminds me of three behavioral science findings

And of course, no insurance company will turn down extra money if you’re just giving it to them.

marklar

David,

I’m not sure if you’ve read much of Barry Schwartz’s work from a couple of decades ago, but he put out a trade book (The Paradox of Choice) that does a nice job summarizing the paralysis that we feel when faced with too many options. The book also makes some testable suggestions on how to help us improve our decision-making.

Barbara

@marklar: Just to add to this, it’s interesting to me that Medicare Supplemental benefits were organized on a very different paradigm which is to say, a fixed set of benefit models. You look at the differences between models and zero in on one or two that you think are likely to be the best, and then you compare prices across models. This seems to permit much more rational decision making because the price is the price for the same thing.

One thing Medicare Compare could do is organize information differently, so that premium is not front and center (it’s the very first item in the horizontal table of “key attributes.”) Whereas, the total estimated annual expenditures — the think CMS thinks should be most important — is last across the page.

Eunicecycle

@David Anderson: I will be anxious to see this, too! I am in my 3 month window to choose a plan and will probably go with a MA plan that is rated highly and has my doctors and hospital. But then which plan?? I think there are at least 4 with a drug plan, so I will pick one of those. But this one has x-rays at $10 copay and another has $25 copay. How many x-rays will I need next year? And so on.

Barbara

@Eunicecycle: Certainly, consider your expenses over the last few years, but look at the final Medicare Compare column that tells you on average you are likely to spend under the plan, and what the maximum spend would be. When you first enroll in Medicare you are more likely to be relatively healthy. You can switch MA plans as you find that you need higher levels of coverage.

boatboy_srq

What scholarship has there been into brand loyalty or brand aversion in health plan selection? There are likely a good number of customers with either good experience with an insurer that charges more, or bad experience with an insurer that charges less, that drives some of that selection decisionmaking.

marklar

@Barbara:

There is some work by Ellen Peters on health-care decision making in laypeople that shows precisely what you are suggesting. Limiting the key criteria upon which judgments are made to a handful, and ignoring all the rest, results in more optimal choices.

Cheryl from Maryland

@David Anderson: looking forward to it. We are in the planning stages for my husband going onto Medicare this June, and he has some important and expensive off label medications which at present his FEHB BC/BS is covering (after a great deal of work to convince them.)

Ruckus

One of the things is that health is all over the place for olds and that a lot of medicine needs can be relatively study, until they are not and that isn’t really predictive. I think I’ve told this before but between Oct 16 and Oct 18, 12 people I know passed away. Add in the brother of someone and it’s 13. Add in the prior year and the number is 14. Only one was older than me, by 1 yr. Two were about half my age. The rest were less than 5 yrs younger than me. Only two were surprises. My point is that as we age life options change rather radically. I spent 4 yrs seeing neurologists, being told I quite possibly had Parkinson’s or didn’t but come back in 3 months before I got a definitive no and those deaths were 2 yrs in the middle of that. My case does not seem to be all that out of the ordinary, so having to make sound economic health decisions at that point in one’s life is akin to throwing your last dollar away on a bad hand of 21 at Vegas, in the hope that you will win enough for a meal, it’s a shot in the dark. And while I don’t have to make health insurance financial decisions any more I used to have to purchase HC insurance for my employees and myself. I could study the quotes for hrs and never know the good and the bad because both were discussed in a manor meant to obfuscate any decision and the cost differences were significant.

IOW the presentation is meant to confuse people so that they make the most profitable decision for the seller, when given incomplete and/or unknowable and likely intentionally obtuse information. How is a reasonable decision ever made in HC? The only knowable is the monthly cost and the deductible.

Chris Johnson

Yes. That’s the whole point. It’s entirely on purpose.

That thought is sticking in your head because it’s the fundamental thing driving all this.

StringOnAStick

@David Anderson: Thanks! Wow, what service!

Adam Lang

How much of this is an effect of advertising, I wonder.

Also: I recall spending half a day doing a comparative analysis of our company’s PPO plan vs their high-deductible plan (there was no HMO) and concluding that there was literally no situation in which it was advantageous to pick the PPO. (The high-deductible wasn’t good but the PPO was that awful.) I posted my conclusions with calculations. Most people appreciated them but a couple still said “I appreciate the convenience of a PPO.” Even though convenience-wise they were literally identical.

BigJimSlade

Devo – Freedom of Choice

https://www.youtube.com/watch?v=dVGINIsLnqU

In ancient Rome

There was a poem

About a dog

Who found two bones

He picked at one

He licked the other

He went in circles

He dropped dead

Gotta love Devo.

Quaker in a Basement

@The Castle: I like your explanation. I think it’s necessary to add that people are risk-averse. They’d rather avoid a loss than have an equal chance of a gain.

When it comes to insurance, this tendency is reinforced by experience. Who hasn’t had insurance deny coverage for something we thought was covered? So given incomplete information, people choose more coverage than they need to minimize surprise losses.

What do you think?

Quaker in a Basement

@Chris Johnson: Correct answer! Inefficient consumer choices are the entire business model.

Sab

@Barbara: Yes! I make the decisions and I do not know what I am deciding. Also too, they lock us into our choice, but drug companies and insurance companies can change our choices any time in the next year, so our choices are a joke. The list of drugs they cover(syallabis) which we base our decision on irrevocably Jan 1, can change completely Jan 2. The whole choice process is a joke.

Barbara

@Sab: Late to this comment, but it is absolutely not the case that your plan can change anytime it wants. On this point, CMS is scrupulous: the only changes the plan can make are to add drugs or to incorporate new generic products into a benefit structure.