It appears that there is a short window for early voting in Illinois that begins on Sept 24. I had planned to vote by mail because of COVID, but I have decided to vote in person because that seems like the most surefire way to bank my vote in a way that cannot be fucked with.

September 24 is just one week from now, so I dutifully went online to find out who all the local candidates are, and discovered that there is a ballot initiative. I hate ballot initiatives because if you don’t do your homework ahead of time it’s nearly impossible to figure out the real impact.

Am I the only one who struggles with ballot initiatives?

If I’m not, and you want a place to talk about ballot initiatives in your state, this is where you can do it.

Since I live in Illinois, I’ll go first. When it comes to Ballot Initiatives, Ballotpedia is our friend.

It looks like this graduated tax should be a good thing, but these things are seldom as clear-cut as they seem.

What are the gotchas that I don’t know about? What are the less than obvious consequences of this constitutional amendment? Can they then decide to tax pensions? I don’t think they do now.

The last time we had one of these in Illinois, it was written to sound like a great deal, of course everyone should support it! Except that it would have opened the door to rewriting the constitution so they could take away pensions, etc. So these things always make me nervous.

Illinois Allow for Graduated Income Tax Amendment (2020)

The Illinois Allow for Graduated Income Tax Amendment is on the ballot in Illinois as a legislatively referred constitutional amendment on November 3, 2020.

A “yes” vote supports repealing the state’s constitutional requirement that the state personal income tax be a flat rate and instead allow the state to enact legislation for a graduated income tax.

A “no” vote opposes this constitutional amendment, thus continuing to require that the state personal income tax be a flat rate and prohibit a graduated income tax.

…..

What do we look at as we try to decide?

Contributions to the Committees!

Illinois Allow for Graduated Income Tax Amendment (2020)

Support: $58,420,503.02

Oppose: $21,390,000.00

(That much money tells me that this tax amendment is a big deal.)

Who is Behind the Campaigns that Support and Oppose

Support: Vote Yes For Fairness

Oppose: Coalition to Stop the Proposed Tax Hike and Say No to More Taxes

(Naming can be very misleading and not very elucidating, so not very helpful.)

Which of the Two Sides Hates Michael Madigan (politician names will very by state!)

The Oppose people hate him. Strike one.

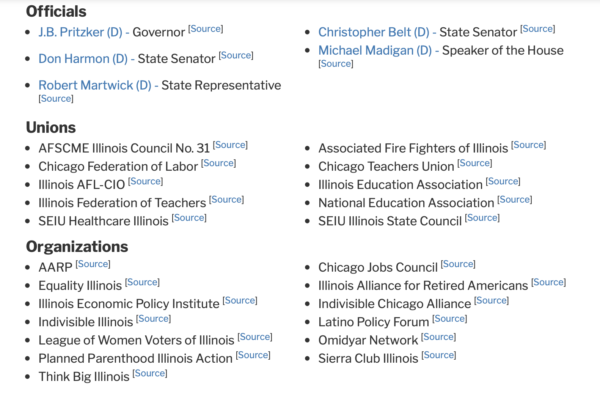

Who Supports the Ballot Initiative

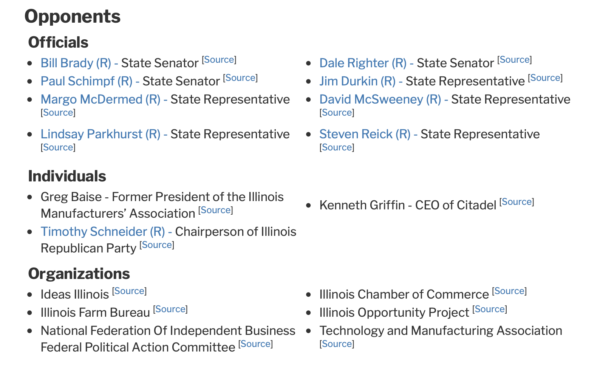

Who Opposes the Ballot Initiative

The Support people are Dems and the unions, the Oppose people are Republicans and conservative organizations. Strike two.

Arguments in Support

House Speaker Michael Madigan (D-22): “Middle-class families bear too much of the burden under the current tax system, and a Fair Tax will enable us to make the wealthy pay their fair share to balance the budget and invest in critical resources like education and health care — all while providing relief for 97% of taxpayers.”

Rev. Alan Taylor, senior minister of the Unity Temple Unitarian Universalist Congregation: “While overt racism seeks to prevent poor (often Brown and Black) people from voting in other states, here in Illinois, racism quietly masquerades as tax fairness. Worse, our state constitution ties the hands of legislators when it comes to revenue, allowing millionaires and billionaires to pay less in taxes as a share of their income than middle- and lower-income families. A flat tax appears fair on the face of it — everyone pays the same percentage to the state on their declared income. But drill down and look what families pay toward other kinds of taxes. The poor end up paying twice the percentage of their income in taxes — and are struggling just to make ends meet. Here in Illinois, there’s a huge gulf between the average Black family’s income and the average white family. Black people typically bear.”

Sen. Christopher Belt (D-57): “We are one of the few states in the country to still have a flat tax. We’re losing residents every year and they’re going to neighboring states that have a fair tax system. If we want to keep our residents in Illinois, we must adopt a fair tax or they are going to move to Minnesota, which is a leader in job creation because they have fair tax. It’s time for the wealthy in Illinois start paying their fair share and taxes be cut for working families.” [Source] Sen. Don Harmon (D-39): “If you’re saying the flat tax is a good idea, you are protecting the uber-rich, not the middle class. Because we can’t raise taxes on anyone without raising taxes on everyone, and that’s a protection for the richest among us.”

Trisha Crowley, president of the League of Women Voters of Champaign County: “In Illinois, the bottom 20 percent of wage earners currently pay almost twice as much of their total income for state and local taxes as the top 20 percent. This is an unjust burden on our poorest residents. As the income gap between rich and poor in the United States continues to grow, taxing our highest earners at a rate proportionate to their increasing concentration of income growth could also make a real difference in addressing the state’s well-known fiscal crisis. The proposed amendment will not itself change the current rates, but it will allow for them to be graduated.”

Bob Gallo, AARP Illinois State Director: “Illinois needs a plan to get out of the budget mess it has created, without shifting the burden to our older and middle-class residents. The Graduated Income Tax Amendment does not allow the state to tax retirement income, and it does not make it easier to tax retirement income in the future.”

Ralph Martire, executive director of the Center for Tax and Budget Accountability: “In what can only be described as piling on, the flat-rate income tax Illinois is constitutionally required to impose makes matters worse. Here’s why. All other taxes available to fund public services are “regressive,” meaning they take a greater portion of the earnings of low- and middle-income workers than affluent folks. The income tax is the sole tax that can be designed to offset the natural regressivity of every other tax, but only when levied using a graduated rate structure that comports with ability to pay, by imposing higher tax rates on higher levels of income, and lower rates on lower levels of income. … That sticks it to low and middle income workers in two key ways. First, it actually worsens the significant growth in income inequality that’s occurred over the last 40 years. Second, it exacerbates the economic harm wreaked by the pandemic.”

Arguments in Opposition

Sen. Dale Righter (R-55): “There are a handful who believe that the answer to government’s problems is simply to raise taxes. This will make it easier for those who believe that to reach into your constituents’ pockets and get more money.” [Source] Sen. Paul Schimpf (R-58): “Today’s Senate action continues to ignore the reality that Illinois politicians have an insatiable desire to spend more money and expand the size of government. Changing our taxing structure, without providing a means to limit spending or make it more difficult to raise taxes in the future, solves nothing. In fact, this plan will most likely only lead to more tax increases and higher spending in the future.” [Source]

Rep. Steven Reick (R-63): “This plan will not work. Do we need tax reform? You bet we do. This isn’t the way to do it. We need a global review of our entire tax system … with an operating system that tracks our economy, that doesn’t create class envy and class warfare and take money from those who are the most productive in our society.”

Mark Grant, Illinois State Director for the National Federation of Independent Business: “If approved by voters in the November election, Governor Pritzker’s progressive tax is going to harm small businesses and their employees. It would eliminate the state constitution’s flat tax protection and create multiple tax brackets and rates. That means the more you earn, the higher your tax rate. And unlike our current tax law, the income brackets and tax rates could be changed by a simple majority any time lawmakers feel the need to increase revenue. Based on past experience, there’s a real concern that the General Assembly will continue to pass tax increases in the coming years so they can keep spending on new programs without fixing the deficit. Small business owners understand that the General Assembly has to address Illinois’ financial calamity but raising taxes without making major spending reforms won’t make things better.”

Illinois Chamber of Commerce: The Illinois Chamber of Commerce released a statement opposing the graduated income tax amendment, which included, “Illinois’ current flat rate income tax is inherently more fair than a graduated income tax since everyone pays the same rate and tax increases uniformly impact everyone. A flat rate tax does not promote divisive class warfare rhetoric or purposefully attempt to re-distribute income according to a subjective fairness standard. A flat rate tax requires all taxpayers to vigilantly stand guard against excessive government spending.”

What say you Illinois peeps and other smart people who are good at reading between the lines?

What are the gotchas that I don’t know about? What are the less than obvious consequences of this constitutional amendment? Can they then decide to tax pensions?

Open Thread: Biden on Covid-19 and a Little Princess Bride Fun

Open Thread: Biden on Covid-19 and a Little Princess Bride Fun

Served

This is a must-pass for the state. It moves us from a regressive flat income tax to a progressive income tax that allows us to tax higher earners without punishing low-income households. If this fails, our already-decimated social services’ budgets will be slashed further, and taxes will go up more for everyone, not just those who can afford it.

Origuy

California has 12 propositions on the ballot this year. The one that appears to be getting the most attention is Prop 22, sponsored by Uber, Lyft, and Doordash, that would define app-based drivers as independent contractors.

Anonymous At Work

That initiative is as easy as they come. Vote YES.

I live in Florida and have deep ties to Arkansas. I can’t even begin to unpack some of those initiatives. Florida, of the famous, “Either allow offshore oil drilling or we’ll ban indoor vaping” Amendment. Arkansas manage to elevate a petty slap-fight between ophthalmologists and optometrists to Constitutional Crisis level.

Thankfully, Arkansas is easier on the other three ballot initiatives, all 3 being an easy vote against. Florida is more difficult. There’s a few rat-fraking initiatives, a few decent ones, a minor tweak that’s worth time, and one trying to deal with the commmittee that recommends amendments to the Lege that is supposed to be bipartisan appointees but is now 100% Republican rat-frakers.

Bo

No. And I strongly suspect that intentionally confusing ballot initiatives are features, not bugs, of our electoral systems.

Setting aside the use of the ballot initiative process by various groups who are intent on restricting the rights and freedoms of others (think “pro-life” groups attempting to define “personhood” or those who a few years ago attempted to use the ballot initiative process to restrict marriage to heterosexuals), consider the sabotage of the process by state legislatures.

As in the case here in MS, proponents of medical marijuana have managed to secure enough signatures to get Initiative 65 on this November’s ballot. The state constitutional allows the Legislature to offer an “alternative” initiative and, because REASONS, the MS Legislature has introduced Initiative 65A to confuse the issue.

Quite often, these alternative initiatives are title and/or written to muddy the water, pulling just enough voters away from the citizen-initiated initiative as to cause it to fail.

Again, that’s by design.

The bastards.

narya

I’ve been wondering about this one, too. I went to the “calculate your tax” page and my taxes would go down a little. I’ve also been seeing a lot of ads, and what I like about the supporters of the change is that they seem to be responding (more or less in real time) to the questions. I think the biggest problem is that everyone has kicked the can down the road, and then PANDEMIC. I mean, I think the state has to do SOMETHING, but I can’t tell if this is the thing.

LongHairedWeirdo

Well, first, this is a traditional tactic of cowards and… well, when I was growing up, the word for “absolutely *pathetic* wimp” was “pussy”, which, obviously isn’t a good word to use, given the obvious sexist (no, it does not stem from “pusillanimous”) etymology. I don’t have a word for “absolutely *PATHETIC* wimp” that has the same sense of scorn. Anyone have any suggestions?

Where was I? Right: the legislature had a job, and the Republicans, of course, wanted to hamstring it, so they made their standard, boilerplate objection:

This statement is semantically equivalent to “THEY WANT TO TAX YOU! OOGABOOGA!”. For me, if that’s your opening argument, you’re already sunk. For example: if a government has 10 set tasks to do, inflation, and increases in economic and social activity, will probably mean that the cost of those 10 set tasks will increase. So: a government that does *exactly* the same thing, in *exactly* the same way, is said to be “bigger”, because it needs to spend more money to do *exactly* the same thing. The moment someone tries to palm that card, claiming that a government that spends more to do the exact same thing is now magically “bigger”, I know they’re not just trying to fool me, those clever hands are also trying to pick my pocket of my American birthright: good governance.

This also blows the “against” argument out of the water:

The fact of the matter is, the wealthy benefit more from the government than the poor do. Being dirt-farmer poor is much the same in most places; being well-to-do often requires government support – most obviously, that fancy car is no good without cops who’ll keep it from being swiped and put in a chop shop in 20 minutes. The idea that a graduated tax rate is unfair is the sort of whiny-ass crap you get as Republican “intellectualism”. Some people would call it “conservative” but the Republicans are right wing, and stupid, but haven’t been “conservative” in a long time. Conservative people would recommend a mask mandate for any state not crushing community spread – Republicans scream that it’s an offense against freedom.

I can’t speak for the actual ballot initiative, but it’s the sort of initiative I knew would fail (because, face it, *no one* likes taxes), but, unless the graduated rates cut in way too early, and jumped significantly higher than the flat rate, significantly faster, I’d vote in favor.

charluckles

This is absolutely one of my favorite things about my states vote-by-mail and one of the biggest reasons I want to see it go national. I get to fill out my ballot at my dining room table with full access to the internet for any research and unlimited opportunities to run things by my smarter, better half.

FelonyGovt

I’m in California and I HATE our initiative process. I’m collecting Democratic voter guides and trying to study the propositions now, so they don’t slow me down once I get my ballot. I want to complete it and drop it off ASAP.

Fraud Guy

Biggest reason to vote in favor:

“This will raise taxes on the middle class!*”

*Middle class defined as anyone making over $250,000.

MazeDancer

From Ballot Initiatives to Biden, gotta make a Voting Plan.

Post it here and you will soon be joining the other 65 BJ Voters whose Illustrated plans, in the sidebar, are inspiring others across the internet.

phein61

You would think that if this amendment allowed taxing of pensions, or alteration of state pensions, that opponents would be using that as an argument against it (even if they are drooling to do both).

Wapiti

Here in WA, ballot initiatives were created as a way to bypass corporate ownership of representatives. Now it’s a way for corporate people to bypass the human people’s representatives. My default is “no”, with very few exceptions.

CaseyL

You do a lot of the same things as me when evaluating an initiative: see who is for it and against it.

A flat rate tax is inherently regressive, so a graduating scale is better, on the face of it. The only caveat I would look for is whether other taxes would be affected by it: e.g., would sales tax go up or down? Does the initiative address address any of that?

I generally ignore the squealing of the GOP, because as LongHairedWeirdo pointed out, that’s their automated response to any increase in taxes. Ditto the crocodile tears for the “small business owners,” when a graduated tax might turn out to be better for them.

In Washington state, we get initiatives by the quire every election. The state-published Voter’s Pamphlet is invaluable for assessing them. One thing people have been pushing for ages is a state income tax. While many, if not most, people are reflexively against a state income tax (particularly now that stae income taxes are no longer deductible on federal income tax returns), the taxes we levy to make up for the lack are ridiculous. Sales tax is higher than 10% in some areas; property owners are treated like cash cows; and a lot of “taxes” are hidden in things like telephone and cable fees. Washington is considered one of the most regressive states in terms of its tax structure and the unequal burden on lower income households.

I would support a state income tax in Washington ONLY if those other taxes were eliminated or greatly reduced. My fear is that wouldn’t happen: we’d get an income tax on top of all the other taxes.

WaterGirl

If any of you guys are willing to consider putting together some info on ballot initiatives for your state, I would happily publish them in individual state posts.

In any given month, we get 75,000 – 90,000 sets of unique eyeballs on Balloon Juice.

That’s potentially a lot of collective smarts! And a way to help tens of thousands of people who are likely facing ballot initiative questions in their own states.

We have 6 weeks or so left to do everything we can to make sure that the people who actually believe in government get elected in November. This is one thing that we can do to help the BJ peeps we know, plus all those lurkers that are out there, as well.

Let me know if you’re up for it.

Reboot

Having moved from FL to VA, I’m skeptical of appointment power as well as the provision that conditionally shunts redistricting to the state supreme court in the proposed Virginia Constitutional Amendment Question 1 “establishing a redistricting commission consisting of eight members of the General Assembly and eight citizens of the Commonwealth, [and] that … give[s] the responsibility of drawing districts to the Supreme Court of Virginia if the redistricting commission fails to draw districts or the General Assembly fails to enact districts by certain deadlines.” That supreme court provision is a big flashing red light to me.

Re: Illinois, according to my limited knowledge of economics, flat taxes are regressive and harder on people who have less money, and graduated taxes are progressive and spread the pain around more evenly. I’d probably vote for this initiative if I lived in Illinois.

Mary G

@FelonyGovt: This. The California ballot initiative has been ratfucking by misleading the public since the infamous Prop 13. While I derive a huge benefit from it, it is massively unfair. I’ve taken to voting no unless really convinced otherwise. WaterGirl’s seems to be one of those. It was written by the legislature, not a nutjob.

pacem appellant

@Origuy: I do a FB series every election cycle and do the homework for all of CA’s propositions. Lyft did the work for me this year by sending me an email demanding that I vote in favor on this prop. So yeah, I have a hard rec of No on 22.

pacem appellant

@WaterGirl: I do this already every election for CA, though I condense it into easily digestible FB posts.

The Moar You Know

I pretty much automatically vote “no” on all of them. Prop 13 seemed like a great idea at the time. People were losing their homes over being unable to pay tax bills that were rising every year as the value of their homes rose.

And it fucking destroyed California’s finances for thirty-plus years. It is still causing us non-trivial fiscal problems.

Of course, as a California homeowner, I don’t want it repealed. I’d end up losing my house as soon as my wife and I retire in a couple of years.

The long term effects are sometimes not obvious or knowable to anyone. So my default is “no”. And in CA, they are far harder to repeal than legislation.

Bond measures always get a no vote from me. I don’t care what they are for. Legislators need to make the votes and take their lumps, not dump the responsibility for issuing massive amounts of debt on the voters.

TEL

When they have an opinion, League of women voters is one of my go-to organizations that I look to for a good explanation about why they support (or don’t support) ballot initiatives. I nearly always end up agreeing with them.

phein61

@LongHairedWeirdo: You make an important point about use of gov’t resources. There is a corollary: Everyone in Illinois will be paying the same tax rate up to $250K in income.

Making more than that is a choice.

People could spend their efforts on family, community, or other pursuits, or they could try to make more money. Totally up to them.

sherparick

As a one time Illinois resident who remembers what a struggle it was by the Last Good Republican – Richard Ogilvie, to pass the state income tax. Ogilvie loss reelection as a Republican in 1972, the year of Nixon’s landslide win to Scott Walker, who had chaired a commission that looked at the civil disturbances & protests at the 1968 Democratic Convention in Chicago and called it a Police Riot & was hated by Mayor Daley as a result. That Walker won under these circumstances shows how much the new income tax was hated.

It should have been graduated at the time, but the rich blocked in the Constitutional Convention.

Looking at both the old language & the new, it does not affect how pensions are taxed or not taxed. To date, Illinois politicians have not wanted to commit hari kari & extend the flat rate to pensions, IRA distributions, etc., since old people vote. All the Constitutional change does is that if the legislature decides to change its mind, pensions would be taxed at the graduated rates.

Another Scott

As I’ve occasionally mentioned, Virginia has an amendment to the state constitution (this state is weird in that just about any measure that could be a normal state law seems to end up in the constitution instead) on redistricting procedures. It started out as a seemingly reasonable process, but the GOP-controlled legislature made 11-th hour changes to the legislation that turned it into a dog’s breakfast that is dangerous for real reform. It’s going to be difficult to defeat (apparently amendments routinely pass), especially since it sounds like reform on the surface, but I’ve been convinced that it’s a bad change.

Sam Wang has a long writeup at his site on why it’s a good bill in his view. (tl;dr – he thinks that the state supreme court won’t put their thumb on the scale, when they’re mostly Republicans on the bench). It’s an example of how people who really don’t understand a particular state’s politics should be humble in making pronouncements about it, probably.

The Pro-amendment side is receiving a lot of outside-the-state GOP money to get it passed. One should ask why, if it really is as fair as backers claim.

Some persuasive (to me) coverage of the issue:

https://bluevirginia.us/2020/06/va-dems-resolution-rejects-fatally-flawed-redistricting-amendment-urges-all-virginians-to-oppose-it-this-november

https://bluevirginia.us/2020/09/money-supporting-virginia-redistricting-amendment-pours-in-from-out-of-state-major-gop-donors-including-to-mitch-mcconnell-and-kevin-mccarthy

https://bluevirginia.us/2020/08/linda-perriello-after-devoting-eight-years-of-my-life-to-ending-partisan-gerrymandering-i-will-sadly-vote-no-on-the-amendment-this-november

Eternal Vigilance and all that.

Cheers,

Scott.

TEL

I’ll also chime in with the other California voters – the ballot initiative system is CRAZY here. My default is to vote no on all of them. Before I vote yes, I have to be convinced by the arguments and the organizations making the arguments to do so.

The Moar You Know

Not IL resident, but that support/oppose list would be all I’d need to see to decide. I assume there are not the votes, or some bullshit supermajority requirement for fiscal matters (like we have in CA, and what a bad fucking idea that was) to enact this through legislation.

narya

@Fraud Guy: In that case, I’m “poor” rather than “middle class.” And I am not poor.

You know what else? I actually don’t mind paying a little more in taxes (though I would not, in this case), if it means someone who has less has a little easier time feeding themselves or their family.

Fraud Guy

Additional bit; since this is a Constitutional Amendment in Illinois, it must be passed via ballot as opposed to directly by the legislature.

Hoppie

@Origuy: Voting NO on that one, also yes on Prop 16. Very pleased the RWNJs make it so easy to know the issues.

Jon Marcus

I am from Illinois. I have no idea re this initiative. But Don Harmon is speaking (via Zoom) at my synagogue at 1pm CDT (in about 2 hours!). Anyone smarter than I have a good question to ask him re this?

dnfree

I’m in Illinois. It turns out that the constitution of 1970, which in my youth I voted for, had a number of hidden “gotchas”. This flat tax rate is one of them, and the other big one that has come out in recent years is that once granted, no pension can ever be reduced. There have been a couple of attempts to get around that, but the Supreme Court has ruled they’re unconstitutional. And of course the government unions don’t want the constitution changed.

So I am voting yes (although I doubt it will pass because the requirements for passage are stringent). I agree that we need a progressive tax. But without changing the reasons the state is so much in debt, people who fear that eventually their taxes will go up even though they make less are probably correct. All of our taxes already have gone up, and public services have been cut, because of state pensions. My husband was in the mental health field, and that along with other social services have been cut repeatedly–but not pensions. They can’t be changed. They’re set in stone. They can’t even be changed for new employees going forward. There was an attempt a few years ago to give teachers, for instance, the individual choice between the current pension plan and having a more 401(k) type of arrangement. That didn’t even fly.

Here’s where we talk about what happened to state pensions. Back in the day when the constitution was written, many private sector workers had pensions, and the argument was that state workers didn’t make much and should have pensions too. So they were granted pensions. Now few private sector workers have pensions, and state workers aren’t really underpaid as they used to be, and the cost and value of public pensions have both soared. How did this happen? Public unions donated to the political campaigns of politicians. Politicians voted in hefty additions to pensions–like they are guaranteed 3% a year increase in the pensions, and they can retire after fewer years than in many jobs. Most teachers here retire in their mid-50s. But politicians didn’t vote to pay for the cost of the pensions, and now it’s quite evident that the bill has come due. The cost of police and fire pensions is taking up a huge percentage of the budget of most cities and counties.

Our daughter who is a teacher says that in her district (I don’t know if this is statewide), pensions are based on the last five years of work. So there are teachers who work part-time for the majority of their careers, and then work full-time the last five years. Local school boards have also taken actions like adding 20% to the salary of teachers in their last year or two, because it costs them only the salaries for that year or two, but it increases the pension for the teachers for 20-30 years or whatever (plus the 3% increase a year). We in Illinois even had two lobbyists who got the law changed to cover them, and they substitute-taught for one day and were entitled to pensions based on their lobbyist salaries. Nope, can’t be taken away from them–that’s in the constitution.

Many would not agree with me, but for exactly this reason I don’t think public sector unions should be able to contribute to the very people who then decide on their salaries and benefits. It’s been a great system for the politicians and employees, and a disaster for the state’s ability to fund other priorities.

pacem appellant

@WaterGirl: Here’s a sample of what I tend to write. This is for Proposition 15, another big deal here in CA this November:

Dorothy A. Winsor

We’ve decided we’re voting YES on allowing a graduated income tax. I think it’s the fairer tax option.

dfh

As an Illinois resident, I am in favor of the graduated tax and I will be voting Yes.

No living Republican will vote for it, and that’s one reason why I’m for it.

dnfree

@phein61:

Illinois does not tax pensions. The scary threat is that if this does not pass, they might have to start taxing pensions because our debt is so bad (even before Covid) for the reasons I stated above.

Illinois not only doesn’t tax pensions–it doesn’t even tax withdrawals from IRAs and 401(k)s, which should be taxed because they weren’t taxed when the money went in. Apparently this would bring in something like $2 billion a year but the state refuses to consider it. As a retiree, I pay almost no state income tax, and that’s pathetic.

The Moar You Know

@dnfree: But it’s OK for private sector unions to do so, and businesses, and business trade groups, and political groups to do so? You lose the right to contribute to a politician of your choice because of who you work for?

Can’t get on board with that argument. Your choice of employer shouldn’t mean that you lose basic rights.

LivingInExile

@WaterGirl: Also in Illinois. We got a pamphlet in the mail with pros and cons. No brainer for me, YES.

Jon Marcus

On the “Who supports/opposes”: Am I correct that you are more inclined to support this, because the people who oppose it also oppose Madigan? I’d like to offer a counter-argument to that specific point. (*NOT* in support or opposition of the larger question):

Mike Madigan is a Dem. That does *not* put him on the side of the angels! At all. Chicago/Cook County Dems are often both conservative and corrupt. There are credible allegations that Madigan has managed to violate Illinois’ ridiculously lax laws against corruption. I’d be comfortable saying that I oppose him.

That said, the people who oppose this sound like the usual Republican suspects, and that makes me more inclined to support it. And I think highly of Ralph Martire, who supports it. I’ll count that as two marks in it’s favor.

The Moar You Know

@pacem appellant: That’s one I’ll be voting yes on. Probably the first in 30 years I’ll be voting yes on. Your distillation of the issues is excellent. And also the core problem with prop 13; it wasn’t done for the benefit of homeowners, that’s simply how they sold it.

Jon Marcus

@LivingInExile: Pamphlet from which group?

Tom Levenson

Here in MA we have just two ballot questions. One is an obvious (to me) yes–ranked choice voting.

The other is trickier: a “right to repair” initiative that requires car manufacturers to move their computer diagnostic systems to an open platform that allows third party shops to access them–including remotely.

The idea is fine–I am a great believer in not taking my 22 year old BMW to the rapacious local dealer. But the timeline for the move is very short, and the language is broad and a little vague, and the argument from the bad actors–the car companies–is that the cybersecurity risks are very high. I don’t trust the messenger, but I really believe in that danger. Any thoughts, fellow MA jackals–or cybersecurity-knowledgeable folks?

MattF

There are four ballot initiatives on my local MD ballot. Two are from Robin Ficker, the ‘conservative gadfly’ who is generally looking to throw rocks into local governmental gears, and the other two are from local county government as ‘replies’ to the Ficker initiatives. Ficker #1 makes it impossible for the county government to raise property taxes, Ficker #2 is somewhat sneakier, making the County Council at-large seats into local seats. The WaPo editorializes against all four, and that is probably my default position.

And, OT, Jen Rubin disavows the ‘conservative’ label.

Elizabelle

@Another Scott: Yikes. Will take a look.

meander

I’ve lived in California for a while, so wading through piles of ballot initiatives is a regular event.

A friend from a former life used to have initiative parties, where attendees would volunteer to prepare a summary of each initiative — like we see in the post above — and then the attendees would discuss. Obviously this doesn’t work in person now, but perhaps an on-line event is feasible?

One of the things that bugs me about California initiatives is that limitations on taxing or fee power can be approved with a 50%+1 vote (e.g., banning the vehicle tax), but then to remove that limitation in the future, a 2/3+1 vote is necessary. In my view, if it will take 2/3 to remove, then it should take 2/3 to install.

One of the biggest deals on the CA ballot this year is Prop 15, which breaks Prop 13 into two parts (the “split roll”) by repealing some of the Prop 13 limitations from corporate property owners. Through various machinations, corps can maintain ownership of a property for decades, thus avoiding reassessments and locking in absurdly low property taxes. The Gov and many organizations have endorsed it, so perhaps it has a chance. (FWIW, to amend the residential part of Prop 13 would take another initiative, and I highly doubt that would have any chance of passing)

dnfree

@The Moar You Know: Private-sector unions (UAW etc.) contribute to politicians, but those politicians don’t directly affect their pensions and benefits. That’s the difference. The public-sector unions negotiate with the state for benefits, and they donate to the politicians who decide those benefits. If you squint, that could be seen as bribery.

I used to be on our local school board. One of the big surprises was how little we were able to negotiate with our own employees. Salary was about it. Everything else was already dictated by the state–number of sick days, pension benefits, how many days would be worked. And oh yeah, you can bank your (generous number of) sick days and add them to your pension. And if you had a year of maternity leave, you can pay a certain amount to add that year back to your years of service and increase your pension. None of that can be negotiated by your actual local employer, the local school board. It’s already set in stone by the state legislators.

pacem appellant

@The Moar You Know: I am a CA homeowner too, and though I don’t consume a ton of local media, I can guarantee that the NO campaign will be selling this on equivocation. “Small businesses will be forced to leave CA, then the nanny state will be gunning for your home next cycle.” Actually, I should work for the NO campaign :-) I feel like I could gin up some scary ads without much thought and the pay is probably insane.

pacem appellant

@meander: See my summary of prop 15 above.

Martin

Regarding ballot initiatives, I think direct democracy like that is a bad idea. So my default is to vote ‘no’ on every initiative. There are two exceptions:

But anything that goes on due to signatures that the legislature otherwise could do on their own is a ‘no’, if only to try and make it so that those kinds of initiatives always fail.

Edmund Dantes

@Tom Levenson: you should be for the right to repair. Note car companies are trying more and more to restrict what you can do to their cars by over the air updates.

even locking people out of using parts of the car if someone modified or used a non-oem part.

The car guys at Jalopnik are for the right to repair and other car enthusiast blogs I run across.

MattF

@MattF: I should add that there is a specific problem with the current County Council at-large membership: they all come from a single small neighborhood group of activists. But legislation is not the cure for that situation.

Martin

@meander: I would like to see a further split of Prop 13 so that rental properties didn’t get the tax protections, and the tax protections don’t carry over to inheritants. I can tolerate a primary residence getting the break, but those changes would really help move housing policy forward.

dnfree

The pension problem in Illinois explained. Our debt obligations for pensions exceeds what we are spending on education, as I understand it.

https://www.chicagobusiness.com/html-page/848696

Jon Marcus

@Tom Levenson: That argument stinks of bad faith to me. If the only thing keeping these diagnostic systems secure is that most people don’t have the documentation, you are less safe. The documentation is out there. Bad actors can get their hands on it. But if it’s behind a “locking device” security researchers can be sued for revealing flaws in the security. Security through obscurity doesn’t work.

I might be sympathetic to an argument that the rollout is on too short a schedule, but I’d want to see specific concerns that couldn’t be ameliorated

ETA: Agree with Edmund Dantes

Elizabelle

Yea. Breaking from the WaPost:

Pennsylvania Supreme Court strikes Green Party presidential ticket from ballot, clearing the way for mail ballots to be sent out

Martin

@pacem appellant: I don’t think that would work any more. How many small businesses own their property? Basically none.

And that’s why CA housing policy has gotten so fucked up. It’s turned every land owner in CA into a kulak and everyone else into a sharecropper. The degree of rent seeking and the aggressiveness these parties have toward sane housing policy is untenable.

VeniceRiley

OMG. Haven’t received my ballot yet. I’m going with CA “YES” on anything the D side voted to put on the ballot.

Now I recall posting here at BJ 4 years ago having found a site for conservatives and using it to opposite pick judges based on their ratings. I don’t remember the site! Does anyone? It was very handy.

I hope some lefty orgs or local Dems put up a sample ballot online someplace. I will spread that around. And I will vote their entire wish list and give presents out like Oprah.

Martin

@Elizabelle: That effort by Dems really pisses me off. We’re in a race to get ballots out and PA is a critical state. They were risking losing more votes to late ballots than to the green party voters. Plus, giving voters less choice is shitty.

Don’t get me wrong, this is a win at all costs election, but I don’t see how that suit helped Dems big picture.

way2blue

@The Moar You Know: I thought the chief issue with Prop 13 is that it applies to businesses as well as homeowners. And attempts to fix this haven’t succeeded.

Roger Moore

@Anonymous At Work:

That doesn’t seem like a very hard call; I don’t want either one of those things. But it points out what I see as the absolute worst part of ballot initiatives: they’re a take-it-or-leave-it proposition. The traditional legislative process gives legislators a chance to investigate the bills they’re voting on and amend them to make them better. It doesn’t always work as it should, but it makes it possible to find and fix problems before they’re enacted into law.

In contrast, ballot propositions are straight yes or no questions. There’s no way for people who like one part of an initiative but not another to jettison the bad part and keep the good part. Instead, there’s a strong motivation for people who want some awful, unpopular thing to package it in an initiative with something popular in the hopes the popular thing can drag it to success. It’s a terrible way to run a government.

prostratedragon

@Jon Marcus:

Illinois Secretary of State (I also got one this week.)

I’m voting yes, since it just enables a graduated tax by striking out the words in the present State Consitution that expressly prohibit one. There is no change in basis from this amendment, so any pension or other income that is currently not taxed won’t be affected by this amendment, and I suspect that others above who have said that any attempt in Springfield to do so by new laws will be, uh, memorable (chainsaws starting up on the soundtrack).

By the way, Ogilvie was defeated by Dan Walker, not Scott Walker.

Omnes Omnibus

@Martin: Don’t people need to follow the rules? If there was a set standard for how to qualify for the ballot and the Greens did not meet it, why should they be on the ballot?

LeftCoastYankee

Oregon has had much mischief happen through ballot measures in the last 20 years or so. There has been some improvements to the process, but there’s still some bad old measures on the books. My personal criteria:

Automatic NO:

Almost certain YES:

Everything else is usually an end-around on the legislative process, which means it wouldn’t enjoy majority support on it’s own. I almost always vote NO. We have legislators and representatives for a reason and if they don’t want to be accountable for voting on tough issues, they should be replaced.

Of course local peculiarities apply. I’m fairly sure Oregon will never have a sales tax, and we love our “kicker rebate” (the dumbest fucking idea in government funding EVER).

Carol

Colorado has 11 initiatives this year. Just went over them yesterday in Ballotpedia and the two most important to me are: An abortion proposal would place limit of 22 weeks with the only exception being the immediate life of the mother. A prohibited abortion means a Class 1 (most serious) misdemeanor. The woman would not be charged with a crime. The doctor would lose his license.

Another proposal Is called a Veto Referendum. The Colorado legislature passed a bill entering Colorado in the national interstate Popular Vote movement. The republicans have placed this Veto referendum on the ballot to do something they could not do in the legislature. Just like they’ve been trying to recall out Democratic governor for the last two years.

I really like Ballotpedia because it tells you what a yes and a no vote actually mean. It helps get through obscuration.

Martin

@way2blue: There’s nothing but problems with Prop 13, TBH. The main problem with it is that it subsidizes white flight. All of the infrastructure needed to build a suburb goes up before anyone moves in – and is paid for by the city people are fleeing from – and then people move in and immediately get their taxes frozen so they never have to actually pay for their own infrastructure. It’s bullshit. Then those same homeowners lobby against densification, low income housing, etc. because they’re afraid it’ll lower property values that they’re not even paying taxes on. The result is a massive housing shortage (3 million units) and a growing homelessness problem, which we address by increasing funding for police to keep the homeless out of view.

And this is most prominent in the most liberal city in the US. Throw enough land value at granola Bernie grandparents and they’ll fuck over poor people as effectively as any republican.

To qualify for low income housing in SF (if you can find any) you need to earn less than $88K a year, as a single person – that’s how unaffordable housing has gotten. Even the tech companies are struggling to pay engineers enough to live there. And its because people are hoarding wealth in their property.

Mitch McConnell would cream his pants if he ever got a tax law as regressive as Prop 13.

Geminid

@Another Scott: I’m against gerrymandering in principle, and as a practical matter it enabled the Virginia GOP to do stupid stuff that hurt Virginians. The republicans also hurt themselves; the stupid stuff they proposed and passed in Virginia helped the Democrats gain a majority in the lower house on a map the Republicans drew. But I’ll vote against the non-partisan redistricting amendment, hoping it fails and the Democratic legislative majorities come up with reasonable maps, and maybe then come up with a less cumbersome non-partisan mechanism for redistricting. I wouldn’t mind seeing a system based solely on principles of geographical compactness and jurisdictional integrity, letting the votes fall where they may.

way2blue

WaterGirl,

The last couple elections I’ve filled out my ‘vote-by-mail’ ballot at home, then dropped it off in-person at a local voting center. Rather than mail it. I like using paper and I like knowing it’s in the system. This election, I’ve signed up for ballot tracking, so I should be able to follow its journey to the county election office. I also asked what happens if the county (San Mateo County, CA) decides my ballot signature ‘doesn’t match’ my driver’s license signature. And was told that I’d be contacted. Which was reassuring.

Martin

@Omnes Omnibus: They faxed the affidavit instead of delivering it in person. The rules are that it needs to be delivered in person.

I’m sorry but this is bullshit legal nitpicking. They had the signatures and the paperwork was done, just not in the precise way that some clerk is supposed to receive it, with no material impact on whether the Green candidate was deserving of being on the ballot.

Limiting voter choice is bad no matter what. If Dems want to be the party of fair and open elections, then they need to fully embrace that, not when it’s convenient for them.

the pollyanna from hell

@Carol: I have been refusing to sign any initiative petitions in Denver for some decades. Legislatures should do their jobs, and voters should not have to research ballot issues unless they are paid minimum to do so.

randy

Yutsano

@CaseyL:

Amazingly enough, we only have two. One repeals the earlier initiative re: sex education in schools, and the other to allow the state to invest the money for paid family leave. Definite no for me on the first and on the second I’m iffy leaning towards no.

Source

Omnes Omnibus

@Martin: Fair elections require parties to follow the rules. Do you know why a faxed affidavit isn’t allowed? Original signatures in ink? Raised seal from the notary? I don’t think the Green Party’s failure to comply is necessarily as minor as you seem to.

Brachiator

@WaterGirl:

I am in California, but right there with you about ballot propositions. I don’t know if there might be some judges to vote for locally as well. I recently downloaded the CA Voter Guide, and it is massive and confusing.

I used to go to a number of online California newspapers to read the editorials about the ballot initiatives. But now with more paywalls up at these papers, this is harder to do. Ironically, I would pay for a single copy or brief online access, but I don’t want to have to subscribe to all these papers.

Politico has a pretty good California Ballot Initiative Tracker.

I will post more aids as I find them.

PST

Like many people here, I dislike ballot initiatives as a general rule. Town meeting government doesn’t work well with populations in the millions. Ballot initiatives present yes/no decisions on complex questions and are inevitably influenced by manipulation of the way they are framed. They produce confusing and exaggerated claims that blanket the airwaves. When they become frequent, it is unreasonable to expect that many people will study them all. The Illinois Fair Tax initiative can’t be avoided, however. The constitution forbids a graduated income tax, and amendments to the constitution have to be submitted to the people. If we want to let the legislature do its job and determine what taxes are needed, we have to pass this amendment. It is very simple, striking two sentences from the constitution:

We have no guarantees what the legislature will pass, although there is a proposal out there. Any website purporting to show what one’s tax will be after passage is speculative. It is possible to imagine a situation in which rates are increased enough to hurt the state, but if that happens you throw the bastards out. Hardwiring rates in the constitution is clumsy and hard to fix.

Roger Moore

@The Moar You Know:

There’s an even more subtle evil to Prop 13 that you allude to with your complaint about being unable to pay your property taxes after you retire without it. That’s true in the sense that if Prop 13 were repealed tomorrow you’d be in trouble. But if Prop 13 had never passed, we would have had to deal with that problem by allowing enough new home construction to meet demand. Instead, by insulating existing home owners from the downside of rising home prices, Prop 13 has allowed, and even encouraged, California to restrict new home construction in the name of ever higher home prices. That’s right, our current housing crisis is an indirect result of Prop 13.

japa21

I like to see how the two sides go after the initiative. In Illinois the opposition is lying like mad. First they are calling it the Tax Hike Amendment and they are saying it will give the state legislature the right to raise taxes without the public being involved, which is what happens now. If someone feels the only way to get someone to agree with you is by lying, then forget them.

WaterGirl

@Jon Marcus: Other than what are the potential risks or downsides, any ways this could be abused by politicians in the future, no.

edit: I hope you’ll come back and let us now if you learn anything from your zoom!

Brachiator

@The Moar You Know:

This sometimes seems the way to go, but I remember a couple of years when a NO vote on a ballot proposition really meant YES. The slimy weasels who come up with some of these propositions know all the angles.

That said, I am trying to read up on these things. I am inclined to want to vote against most of them because I want the legislature to re-think priorities in light of the pandemic. Some of these ballot propositions were drafted before the pandemic and assumed a normal economy. That is not where we are.

This is a common reaction among some citizens, but I wish that you would re-think your position here. Bonds are often a good answer for long-term projects and do not add as much of a burden as people think. This kind of thinking is a frequent response of the reflexive anti-tax crowd.

Jon Marcus

@prostratedragon: Thanks. I’m gonna listen to what Harmon has to say, but I’m inclined to vote yes too.

And agree re the the governors Walker. I believe that was someone else who confused them?

WaterGirl

@dnfree: Are you suggesting that pensions should be able to be reduced? After people have made lifetime decisions based on those pensions?

That it’s just unions that don’t want that changed? Not the people that have made all those long-term decisions about their lives based on the pensions that they earned, and paid into?

Something like 15 or 20 years ago, University of Illinois employees WERE all given a choice between the current one or moving their money to a 401k type arrangement.

WaterGirl

@dnfree:

Part of the picture that is missing from what you said is that the employees funded those 3% increases by paying more into the fund to cover those increases.

WaterGirl

@dnfree:

It’s my understanding that the State raided the pension funds for years and that is why the pensions are an issue. Not because not enough money was put into it by the employees, but because the state used those funds for other things for decades.

WaterGirl

@Jon Marcus: Mike Madigan is no angel, but for the entire terms of the Republican governors we have had, I felt like he was the only thing standing between slash-and-burn republicans and life as we knew it.

In my experience the people that HATE HATE HATE Madigan are always republicans. Or libertarians, who are really mostly republicans in sheep’s clothing.

PaulWartenberg

Oooooh thanks for the reminder I need to blog about the Florida Referendums this election cycle!

WaterGirl

@The Moar You Know:

That’s generally my concern about this one in Illinois. Seems like a no-brainer but I worry that it’s being sold one way, but the ultimate goal may be something else.

That it’s the democrats and the unions that are for it is reassuring, but all the hidden agendas of the past several years have left me gun shy.

Brachiator

@Roger Moore:

Sorry, it is much more complicated than that. Also, even increase home construction would not have helped people who might have been priced out of their homes because of increased property taxes caused by increased assessments. The median price for a home in San Francisco is currently around $1.3 million. Had Prop 13 not been in effect, the impact on home owners would be horrible.

Prop 13 was also a way for lazy and cowardly state legislators to avoid raising taxes outright. They just let inflation do the dirty work for them.

A similar problem existed for a while with the federal alternative minimum tax. Because it was not indexed for inflation, over time, some taxpayers found that they had to pay it simply because their incomes rose. And this started to hit middle income taxpayers even though the tax was originally designed to prevent the ultra rich from getting off without paying some tax. Indexing finally fixed the problem.

Anyway, I huge part of the problem are the local zoning laws and other weird practices that are used to prevent the construction of more homes and affordable housing.

And hyper locally, I am finding it interesting to see how “historic preservation” regulations in Pasadena are used as a weapon to prevent construction of affordable housing. It’s pretty damn disgusting, and sometimes even activists are suckered into working against their own interests.

dnfree

@WaterGirl: Oh, I hate Madigan, and I’m a liberal. I think there are a lot of liberals who feel that way. He’s like Trump in that everything he has done is for his own advantage. He’s profited greatly while kicking the pension can down the road so far we can’t even see it from here.

WaterGirl

@Jon Marcus: Excellent question!

Ruckus

@CaseyL:

This is always what happens. Everyone screams about taxes. Hell the first caveman was screaming about the bear tax, which paid bears to only eat your neighbors.

As we all know everything costs something. Time, effort, money. Sometimes all 3. But money is the commodity that we use to enable us to have lives besides working 18 hrs a day, 7 days a week. To be able to eat without having to grow/raise all our own food. To be able to see a dentist or a doctor, to have those dentists/doctors be trained and have some control over the shitty ones harming patients, without having to hire a lawyer every time we need one of them and which requires money. Government is no different, it of course requires money to pay police, the library, the fire dept, fix the roads. Our biggest point is to find a way to tax AS REASONABLY AS POSSIBLE. Of course the wealthy, those making what 2-3 times or more of the average income have the money to scream the loudest and those making 50% of that average don’t really have enough money for rent and food. And that average varies a lot. Average US median household income is just over $59,000. Average CA median household income is just over $71,000. A lot more of us make less than those numbers. A non progressive income tax is horrible for median and below. No income tax can effectively be a flat tax because other taxes, like sales tax are flat rate.

WaterGirl

@Another Scott: Redistricting in VA is a big deal. I wonder if that could/should be a separate post to call attention to that?

Ken

“But the money was just sitting there!” A lesson they learned from the Federal government and the Social Security Trust Fund.

Another Scott

@dnfree: I really, really, really don’t like arguments that “the state’s unfunded liabilities are XXX.X bazillion dollars therefore we obviously have to cut benefits!!”

Those XXX.X bazillion dollars are not due all at once. They’re due over decades. (People don’t go bankrupt because they take out a 30 year mortgage to buy a house that costs many multiples of their annual income.) School budgets are an annual thing. Comparing annual school budgets to annual pension payments are apples and oranges (we know that schools are underfunded as well).

“Unfunded” is a similarly misleading word. We’ve seen the damage that making the USPS pre-pay for its benefits causes.

There may be good reasons for adjusting pensions. These aren’t examples of them.

Grr…

Cheers,

Scott.

Ruckus

@Tom Levenson:

Doesn’t the security depend on each end of the wire, as well as all the places inbetween? So really it can be as good, or as bad as possible but if not enough time and money is spent to insure that security is reasonable, it won’t be. And reasonable takes time. And money. So if the implantation is rushed the security is very likely to be rushed as well. But – the car dealers are either secure or not now, so how would the same system not be the same level of secure?

WaterGirl

@Martin: It seems to me that it would help Dems if they win, and would have handicapped Dems if they had lost.

They rolled the dice, and won.

dnfree

@WaterGirl: Generally the proposals are that pensions would be reduced for NEW employees, so they would know what they would be receiving. There are no proposals that suggest changing what current employees are receiving. But should some public employees get full pensions after 20 or 25 years? With the rate of increase set at 3% a year (promised probably when interest rates were higher)?

Here’s an example I found from just one smaller Illinois city. I’m looking for something more general but haven’t found it yet. The pensions are killing local governments across Illinois. The legislature votes on them, and in many cases localities have to pay them. And to top it off, the state has crippled local government in the ability to raise property taxes, and in fact says it’s going to cut the ability of local governments to raise taxes. And by the way, a bunch of the local government pension funds were consolidated by the state last year, which will help a little but does not solve the problem. You might check with local governments in your area.

http://cms5.revize.com/revize/streatorillinois/THE%20UGLY%20TRUTH,%20Short%20Version%20Final.pdf

THE UGLY TRUTH ABOUT ILLINOIS’ LOCAL GOVERNMENT PENSIONS

“The State of Illinois apparently believes that ignoring its massive unfunded pension crisis will make it go away. But it gets worse by the week, and soon it may be impossible to dig out. Every Illinois citizen will be impacted. The amount of Illinois’ unfunded pension obligations nears $200 billion. Not only is Illinois in the deepest pension hole of any state; but Illinois’ state and local unfunded pension debt is 15% of the entire country’s unfunded debt. The implications are difficult to comprehend. One-fourth of Illinois’ unfunded pension debt is local. This $50 billion share could explode Illinois’ property taxes. Cities like Streator can no longer wait on the State to do something. So Streator has decided to start its own reform movement. We’re just a small town in central Illinois; but we’ve decided it’s time to stop complaining, and start doing something. This detailed position paper lists reform strategies, not just for Streator, but for municipalities across Illinois, and for the State itself. Illinois’ property taxes are among the highest in the nation. Most cities want to limit property tax increases, but City Council’s everywhere are losing control of their tax levies to pensions. Pensions comprise 55% of Streator’s annual tax levy—mostly police and fire pensions. Some Illinois cities spend their entire property tax levy on pensions. Mandated pension contributions are not set by cities—so limiting property tax increases gets harder and harder. Local fire and police pension benefits are set by the State, though Illinois contributes nothing toward local pension costs. The Illinois General Assembly is happy to mandate higher police and fire pension benefits, because they do not pay for ANY of them.

JaneE

Tax rates at the federal level have always been progressive, which is what the ballot initiative would allow for your state income tax as well. I didn’t know any state actually used a flat rate.

I am still in favor of bringing back the fed tax rates from Eisenhower, so I do have a slight bias.

Rich people benefit from lower tax rates, and a flat tax rate cannot be very high if poor people are not supposed to starve.

WaterGirl

@prostratedragon:

They should have had you do the writeup in support of this ballot initiative!

ciotogist

As an Illinois resident and state employee, I’m voting yes on the graduated income tax. And you can take my pension away over my dead body. We are not eligible for Social Security in Illinois and I’ve paid 8.5% in to it faithfully while the politicians have shirked their responsibility for the other 8.5%.

WaterGirl

@Carol: No good deed goes unpunished! Would you be up for writing something up for the 11 CO initiatives this year? As a jumping off point for a CO discussion post?

edit: We have one person lined up for CA. Would love to line up some more for states where it would be useful.

dnfree

@WaterGirl: Teachers pay more into their pensions than members of some other unions do.

The simple version of how this works is that the state legislature votes an increase in benefits for police, firefighters, whoever. But in many cases the local government has to pick up the increased cost, usually through property taxes. But the state also limits how much property taxes can be increased. These days they’re even promising to cap property taxes. That’s how you wind up with local governments being mandated to spend a certain amount on pensions, and having no way to raise that money, and thereby having to spend less on the actual services the public expects.

Both my husband and I served on local government boards (me on the school board, him on the county board) at different times during the past uh….30 years. We saw the stranglehold the state causes for local governments. Many people aren’t aware of it, they just wonder why their streets don’t get repaired as they should, or why the city doesn’t hire more firefighters or police officers.

WaterGirl

@way2blue: That is good. What tipped me in the direction of in -person voting is that in IL, they can’t start counting the mail-in or drop-off ballots until 7pm on election day, after the polls close.

I would like IL to be able to be called that day. The more blue states that can be called on election day, the less vulnerable we are to cheating/stealing on the part of Republicans.

WaterGirl

@Martin: I’m with Omnes. As long as the rules are stated clearly, you have to follow them. Anything else is a slippery slope.

To me, this is one more defense against last-minute ratfucking.

Roger Moore

@TEL:

You need to be careful about that. One of the quirks of the system is that a referendum, i.e. a voter challenge to a law passed by the legislature, places the original law on the ballot rather than a question about overturning it. This year, for instance, Prop 25 is an attempt by the bail industry to overturn a new law that eliminates cash bail in most cases. Because of the way the system works, a yes vote is a vote to uphold the law the legislature passed and a no is a vote to overturn it. I’m definitely voting yes on that one; getting rid of cash bail is a big improvement in justice.

dnfree

@Another Scott:

Do you live in Illinois? We have one of the worst problems with unfunded pensions in the country. Interest rates have been low for years now, and yet increases in pensions are locked in at 3% for many pension funds, people live longer so collect their pensions longer, and overly optimistic projections that funds were going to be making 7% or 10% turned out to be inaccurate. (The Illinois Policy Institute cited here is a right-wing think tank, but the problem exists at the local and state level.)

Link to article

WaterGirl

@Brachiator: Thanks!

Yes, we do have judges. Most of the ones I get to vote for are clear. One is R, one is D. But there are two where we’re voting for whether to keep them in place.

They mark judges here as no particular party, but we learned in 2000 that even some of the fucking supreme court justices are just party hacks, so everyone has a party.

I don’t know how to vote for those, but the judge choices are all different depending on where you live in IL, so it’s not anything to even open up for input. I am the most political person I know, so there’s not even anyone “in the know” that I can ask People are much more likely to ask me!

Ruckus

@meander:

Not saying I don’t agree with your general point but only raising property taxes on corporate owned properties is going to end up with the corps raising the prices of everything that corp sells, which effectively hurts a lot of people. I don’t think there is any easy answer because a lot of the world is too expensive for a rather large segment of the population with the way we run things now. The biggest help would be a progressive income tax for both state and federal that actually has the wealthy paying a larger share of their total income. Warren Buffet pays less tax on his extreme income than his secretary, by his own admission. Give him credit, he wants this changed, even as he takes advantage of it.

Roger Moore

@MattF:

Having only at-large seats is a terrible idea. It lets a small majority completely dominate the process. Here in California, a lot of cities have had at large seats successfully challenged on racial discrimination grounds; they let a slim white majority- or in many cases a minority that had higher voting rates- completely dominate the city government.

phein61

@WaterGirl:

Pensions are already earned, paid for with years of labor. They aren’t a freebie given to undeserving public employees out of the goodness of the taxpayers’ hearts. Pensions and other benefits, including pay, are negotiated between employer and employee. The employee’s have done their part.

That’s why they can’t — or at least, shouldn’t — be reduced. In Illinois, the Constitution recognizes that.

People who want to reduce already-earned pension benefits are thieves, pure and simple. Once that principle is recognized, we can move on to more interesting questions, like: Why steal from public employees? Why not consider other sources of revenue? Why should we pay bondholders the interest rates promised? Why not reduce those payments? Heck, why not reduce payments to landlords for facilities leased by the state, just cut them in half? Better yet, why not just confiscate properties owned by Republicans and auction them off to pay off the state debt?

If we’re going to steal from our fellow Illinoisans as a matter of policy, let’s be upfront about it and consider all the options.

WaterGirl

@japa21: Excellent point.

Perhaps I need another heading up top:

Is Either Side Verifiably Lying

WaterGirl

@PaulWartenberg: I take it that you are in Florida.

Perhaps we could cross-post your FL writeup here?

Annie

In California we always have initiatives on the ballot. If I’m not sure about one, I look at who writes the arguments. We have some libertarian cranks who are always wrong so if they are in favor, I vote against. And in San Francisco we’ve got one guy who always seems to be opposed to any public tax or expenditure*(I’m looking at you, Quentin Kopp).

*and that’s the polite way to say it

WaterGirl

@dnfree: For me, he was the protecting wall that the Rs couldn’t break through. That is enough for me. Definite downsides, but on balance, I’m really glad he has been there.

I have always wondered why his daughter decided not to run for Governor. You don’t happen to have the scoop on that, do you?

JaneE

Living in CA, ballot initiatives are a way of life. If there are less than 6 propositions on the ballot it is probably a primary election. (only slightly snarky). We have initiatives and legislative propositions, for both statutory laws and constitutional amendments and many elections have had multiples of each. More than a few times we have had competing propositions where both are changing the same thing in different ways – higher vote total wins if both pass. Any form of bonds needs public approval – that may be the result of an initiative half a century ago.

Some things I can look at and say I agree or disagree with what the prop would do. Most of the time I have to read the objective analysis which details what the law is now, and how it would change, and if they can calculate costs and benefits the estimates will be given as well. I always see who is for and against, because there are some people and groups that I know do not have the best interests of the state and people at heart. More often than not the for and against positions contradict each other, calling the opponents positions untrue. Since it is difficult for both to be true, I resort to reading the text of the law as proposed. Every so often I will find an argument that blatantly ignores the text and claims the law would do something it would not or vice versa. The people making that argument go on my do not trust list. I tend to be extra suspicious of propositions that are on the same issue we voted on a few years back. It could be the original was a bad law, or the legislature has changed the proposition, or the new proposition is the bad version, or the original proposition was circumvented by the legislature, or …. whatever the reason, they need to be looked at.

Governing is hard. Do-it-yourself governing by initiative is even harder.

WaterGirl

@ciotogist: Me, too. At the University, I probably made nearly double what my BIL made in the private sector. He gets 3,000 a month from SS. In addition to working at the University, I paid into SS for many, many years, and I will get something like $250 a month from SS because of the stupid “no double dipping” law.

It’s ridiculous. For the people making millions, sure. But the little guys? The whole thing is just wrong.

Brachiator

@Roger Moore:

This issue should not be a ballot initiative at all. The legislature should rethink the issue.

The ACLU opposed the bail system, but see that the law signed by Jerry Brown eliminating cash bail still allows pre-trial detention and gives judges the power to keep people in jail. The fear is that this power will be abused, especially with respect to poor and nonwhite persons.

WaterGirl

@dnfree: I added a link for your article rather than the raw URL because a really long line with no spaces or a really long URL will break the formatting for folks on phones.

Hope you don’t mind.

WaterGirl

@phein61: That almost reads to me like you think we are on opposite sides of this issue, but I agree with every word you wrote.

It is theft. And it’s wrong.

Ruckus

@JaneE:

The wealthy also benefit from the type of income they can arrange and the tax rates on that. Capital gains are taxed at a lower rate (or used to be, I’d bet that hasn’t changed!) than salary income, far lower for the upper levels. And the wealthy have the money to pay accountants and lawyers to help them avoid/challenge taxes. Take the RWNJ Mercers, who supposedly owe 7 BILLION in taxes. They just don’t pay and fight every attempt to collect tooth and nail. Add up your lifetime income and see if it comes close to that. Yeah I didn’t think so…. I’ve worked nearly my entire life and owned businesses, for over a third of that life. One in a skilled trade with employees making pretty decent salaries, the other I was the sole person as it was still a start up when the recession hit. And my lifetime income doesn’t come close to being in the upper half. Now life is not fair and I’ve had it better than many but it should be much closer than someone gets to make/steal so much that they can laugh about paying $500 for a bottle of wine, and having three in one evening or paying for 11 or 16 yachts and less taxes than you or me and then getting a job fucking up schools so that they don’t have to even pay what they have been paying, all the while making an education cost even more.

Do I sound bitter? I can’t imagine why…….

phein61

@WaterGirl: No, I’m sure we are on the same side. It just never gets stated that the goal of Republicans is to steal from teachers.

MattF

@Roger Moore: The County Council is presently a mix of local and at-large seats, about 50/50, I think. The problem is that the current at-large representatives are mostly drawn from a small group of like-minded individuals from the same community, which is entirely contrary to the concept of at-large representation.

Brachiator

@JaneE:

Great breakdown.

Of course, ballot initiatives have become a racket, with proponents crafting deliberately confusing propositions and lying about them.

And it is difficult even for “experts” to understand some of these propositions. I recall a bond measure backed by the education establishment. A group backing the proposition was questioned about it by the Los Angeles Times editorial board, who was assured that the proposition included oversight by community citizen panels. When the thing passed, there was no citizen oversight and the backers claimed that their promises were “misunderstood.” The LA Times editors ended up looking like a bunch of fools, and of course the Times had endorsed the proposition.

However, I note that one of the reasons we have ballot propositions is because in the past, the California state legislature, in thrall to business interests, often refused to consider legislation that the citizens clearly and loudly asked for. So, this became one of the few ways that the people could fight back. An imperfect system, but sometimes democracy needs these kinds of skirmishes.

dnfree

@WaterGirl: one interesting aspect of Madigan’s daughter is that she wasn’t his daughter in the way one would think. She was adopted as an adult. So I have to think there’s a story there, or maybe more than one.

Madigan was born Lisa Murray. She changed her name when she was 18 and was formally adopted in her 20s by Michael Madigan.[1

phein61

@dnfree: Lisa is Madigan’s wife’s daughter from a previous marriage.

Some story.

dnfree

@phein61: proposals for reform do not suggest changing benefits for either current retirees or current employees. They would be in effect only for future employees. The promises made in different economic times are unsustainable with the low interest rates we have now and apparently will continue to have. Any sensible pension plan would have tied annual increases to some real-world measure. And a responsible legislature (looking at Madigan) would have funded the promises.

Brachiator

@Ruckus:

People often think that the rich hire fancy ass accountants who find all the magical loopholes to save them money.

Part of this is true. But more often, the ultra-wealthy hire lobbyists who write laws that save them money. And when I teach tax classes I sometimes joke about the big bags of money dropped on politicians to get them to provide tax favors.

Under Trump’s new tax law, investment income continues to get favorable treatment, business income rates have been lowered and favorable deductions retained and this means — no surprise — that wage income ultimately gets no favorable treatment at all. BTW, this also means that a wealthy person who makes mainly wages gets hurt more than an investor. So it is not just the poor getting screwed as usual.

But we need Democrats who are smart enough to reverse engineer all the crap put in by the Republicans. You cannot solve the problem simply by fiddling with tax rates and taxing the rich more. The Republicans have tailored the entire system, individual, corporate, estates and trusts, to give maximum benefits to a strata of the ultra-wealthy. And for some weird reason, in the past, the Democrats did not seem to hire staffers with good tax policy knowledge or to put the best Democratic Congress people on tax related committees.

Also, for what it’s worth, in the past Al Franken and Barney Frank seemed to be good on tax policy. But Franken is gone and Frank is enjoying retirement.

ETA: And yeah, as you noted, taxes comes with civilization.

Ruckus

OK, for the first time in a while, I can actually see blue(ish) sky. AQI is down to 110, unhealthy for sensitive individuals. The fire close to me (and closer to others here) is being mostly contained on the south end, which is the largest populated area but has grown to the north, crossed highway 2 and is starting to encroach on the cities in the upper desert, Antelope Vally is being affected.

dnfree