The Department of Health and Human Services published their summary data for the 2021 Open Enrollment Period. Table 2 is interesting to me as it shows the impact of Silverloading on preiums. Silverloading is the response insurers and states used to compensate for the shut-off of direct federal reimbursement of Cost-Sharing Reduction (CSR) subsidies in Octoiber 2017. We expected to see Silver premiums to go up way more (highly technical term there) than Bronze and Gold premiums. We see that. We also see a difference in Bronze and Gold premium growth. This is interesting!

I think there are a few mechanical things to consider here that could be driving this growth rate differences (BTW, 11% or 5% growth over 5 years is great cost control for premiums). **

For the 2017 plan year, Bronze plans were allowed to have an actuarial value between 58% to 62%. In 2017, Gold plans were allowed to have an actuarial value between 78% to 82%. Gold faced no pragmatic limitation to using the entire allowable range of design space. Bronze plans faced a pragmatic lower edge limit. It was impossible to design a Bronze plan with less than 58.8% AV because that maximum out of pocket limit constrained the bottom of the design space.

In the Spring of 2017, the Trump Administration promogulated the “Market Stabilization Rule.” One of the big chunks of change in that rule was changing the allowable de-minimas variation for metal bands.

- Bronze was now 56% to 65% AV

- Silver (base) was now 66% to 72% AV

- Gold was now 76% to 82% AV

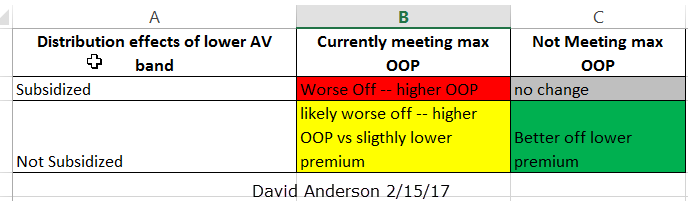

All else being equal, dropping AV means lower premiums with interesting distributional consequences:

Both Gold and Bronze see a drop in the allowable bottom of the range of AV. We should, naively, expect similar behaviors. However, pragmatically, Bronze’s de minimas value floor is not a regulatory floor but an actuarial value calculator floor. In 2017, it was impossible to design a Bronze plan with an AV below 58.8%. In 2021, it is impossible to design a Bronze plan with an AV below 61.35%.

Bronze plan deductibles and MOOPs are increasing but given that healthcare costs increase faster, the actuarial value of a minimum Bronze plan is increasing. In 2021, Bronze plans ranged from 61.35% AV to 64.99% AV. Higher Bronze AV means higher Bronze premiums. If we assume that each point of AV cost the same as any other point of AV, then the difference in minimum pragmatic allowable AV for Bronze plans would lead to a 4.3% premium increase just for benefit richness.

Gold does not face the binding MOOP constraint. In 2017, per the Plan Attribute PUF, Gold plan AV varied from 78.00% to 81.96%. In 2021, Gold plan AV varied from 76.00% AV to 81.96% AV. Insurers are using the entire design space. If insurers want to attract people to Gold plans and they may as they can gain some risk adjustment advantages for certain populations, and if they assume that most marginal buyers are mostly price sensitive, then dropping Gold AV to go as low as possible to reduce premium makes a lot of sense. Making the same assumption, a 2.5% reduction in minimum allowable Gold benefit richness would lead to a 2.5% reduction in premium in 2021 compared to 2017.

These actuarial value band changes, both pragmatic and regulatory, would, on first pass explain a 6.8% difference in premium growth between Bronze and Gold plans from 2017 to 2021. Given that HHS is reporting a 6% difference in premium growth, I think this is a likely explanation. The tendrils of the 2017 market stabilization rule is driving 37% of the difference while the limits of MOOP and the AV calculator are driving 63% of the difference.

** This assumes, on first pass, that Bronze AV points are equal to Gold AV points (they’re not, but close enough for a first pass).

There go two miscreants

No specific comment, just a note of appreciation for these posts; I’m an older person on Medicare so I’m not directly affected, but it is useful to understand this stuff.

JAFD

Dear Mr. Anderson,

Two requests:

First, how’s Claire doing ? Please wish her and her family a Happy Thanksgiving, and many many more.

Second, might you compile, sometime, a ‘Health Insurance Policy Lexicon’ ? When I get into discussion with my friends who’ve never heard of ‘silver loading’ or ‘MOOPs’ (didn’t they invade Spain ? ;-) ), I want to point them at authoritative source, at point where they can start learning, not toss them into ‘deep end’ of esoteric vocabulary.

Regardless – Thank you, very much, for your efforts keeping us hoi polloi informed. You’re someone to be grateful for. Please keep it up.

Gabe

I am currently experiencing the highest health care utilization of my life but looking at the claim info I am profitable for my insurance company not just on an annual basis but actually month to month

I recently had a 20 minute procedure under sedation and the anesthesiologist charged $3500 only he didn’t cause my insurance company paid him $250 and he was perfectly fine. But if I hadn’t been insured or he had been out of network he would have come after me for that full amount.

The idea that there

can be any sort of market under these kinds of price disclosure rules is nuts

David Anderson

@JAFD: Claire is doing well enough — her numbers are good and she is in the start of Phase 4 which is blasting out the cancerous hold-outs for the next 40+ days.

StringOnAStick

@David Anderson: Excellent!