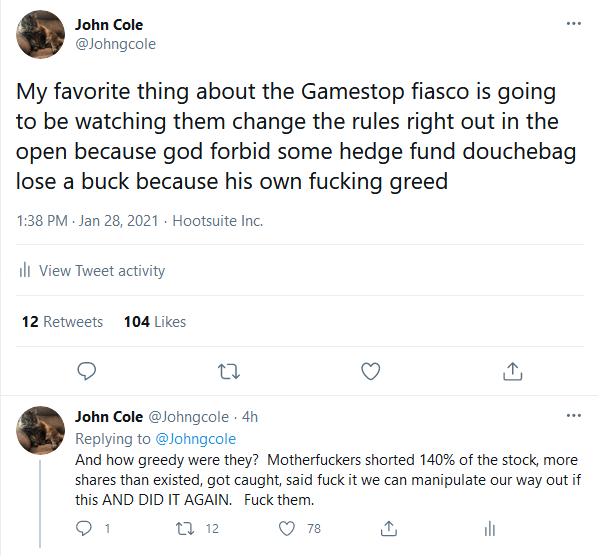

To add to Mistermix, it was not hard to predict what would happen with this. There are rules for you and me, and there are rules for everyone else:

And that’s precisely what they did. When Robinhood and others froze trades on Gamestop, what they did was lock EVERYONE who had purchased through them into their trade, and not allow them to make any action. So if you are a trader bought at certain price and wanted to sell at a certain price, you’re just fucked. You own that stock and Say you bought at 180, and wanted to sell at 100. Tough shit. You eat the loss as it rides to zero as the big money boys manipulate the price down. ** APPARENTLY THIS IS WRONG AND I AM UNINFORMED BOOB WHO HATES HEDGE FUNDS AND WALL STREET SO MUCH HE IS SOMETIMES HASTY, NEITHER OF WHICH SHOULD SURPRISE LONGTIME READERS.***

It’s class warfare Calvinball, and you know what? They’ll fucking get away with it. Because as George Carlin noted, it’s a big fucking club, and you ain’t in it. Robinhood is legit now stealing from the poor to give to the rich.

Spanky

Figgered it’d be Cole. I’m going back downstairs to read up. Back later.

RobertB

I thought I read somewhere that Robinhood was a free brokerage. I’d be terrified of that.

Baud

I would like to hear from an expert of that’s in fact how it works.

schrodingers_cat

India is sliding headlong into fascism this is small fingerling potatoes in comparison.

Major Major Major Major

I’m sorry Cole but the take that this is a shadowy cabal of hedge funds protecting themselves hasn’t made any sense all day. Why can you trade GameStop on most retail brokerages? What about all the hedge funds (probably way more than last week’s short holders) who are having a field day? Why is nobody mentioning the frontrunners, the people who RH sells your transaction info to before the trades are executed?

Part of this, too, is just straight up misfiring regulations.

schrodingers_cat

@Baud: Rose Twitter is apopletic so it is probably a nothing burger.

Baud

@schrodingers_cat:

What happened?

Mary G

Oh, I love a good righteous John Cole rant, which I read here in the Disneyland parking lot tent waiting out the 15 minutes after I got my #1 Moderna covid vaccine shot. They just called for people who haven’t had their shot yet and want one because there are a few extra.doses. There were several as this is the handicapped tent.

It was supposed to pour rain this afternoon, but the skies are blue with a few wispy white clouds and the temperature is a balmy 65 degrees.

Major Major Major Major

Also, to this:

Robinhood restricted buying, not selling.

Poe Larity

You don’t own that stock, you own an option. RH is a margin lending options trader.

Just because the loanshark loaned you money doesn’t mean it’s your money. There are rules, man.

schrodingers_cat

@Baud: Modi is brutally trying to suppress the ongoing farmers protests just like he did with the Citizenship act protests.

A Muslim comedian is in jail for a month for jokes he did not tell because he might hurt sentiments. And he has been unable to get bail.

A 38 year old activist died while awaiting trial for 6 years in jail. The list is endless.

Mary G

@Major Major Major Major: Buut if no one can buy how can anyone sell?

Sanjeevs

I tend to think the bigger villains are the funds on the other side who suckered a bunch of retail investors into following their trade.

Anyone who knows the history of short squeezes knows the victims will pull every lever to get out

Baud

@schrodingers_cat: I read about the farmers protest. Aren’t farmers Modi’s base? If they’re like our Patriot Farmers, they’ll still vote BJP.

trollhattan

How has Biden failed us today?

How Lewandowski still gets jerbs instead of a prison sentence is a thing of wonder unto itself.

Baud

@Mary G:

I think institutional funds can still buy.

Major Major Major Major

@Mary G: most stock transactions don’t take place on Robinhood.

schrodingers_cat

@Baud: No Modi’s base are the wealthy and/or upper caste.

debbie

What is this doing to GameStop? Is the company itself in any danger?

Baud

@debbie:

It’s been in danger for months. It’s a failing business model.

?BillinGlendaleCA

OT: Madame just sent me a text saying that her cat Mabel’s dental surgery was successful and she’s going to pick her up in about a 1/2 hour. She wanted me to tell the jackals that helped out, a big thank you.

Baud

@schrodingers_cat:

How large is that group? Here, the wealthy GOP need the deplorables.

?BillinGlendaleCA

@Mary G: Gives a whole new meaning to “Happiest Place on Earth”.

Major Major Major Major

Good thread via our Tom L

schrodingers_cat

@Baud: Small in number but gigantic in influence.

Ohio Mom

@schrodingers_cat: Every time you update us about India, I feel sad and helpless (truth be told, I feel that way about a lot of things in this country too).

But I would rather know than not, and I don’t see reports other than yours in my usual routes around the internet and my other news reading. So thank you for allowing me to be a witness. It’s not much I know, just a token of solidarity.

Josie

@Mary G:

So glad you were able to get your shot. Now you can go home and rest with a smile.

MomSense

Class warfare Calvinball. Genius.

MomSense

@Mary G:

Yay!!! So glad you got the shot. My mom got hers last night. I’m holding my breath until four to six weeks after the second.

Scout211

@Mary G:

Yay for you! I love hearing all the jackals getting their vaccinations. Awesome

Just Some Fuckhead

@Major Major Major Major: The intent of the GME stunt was to save GME. My question is, can GME do anything with their newfound valuation to save themselves?

PJ

@Major Major Major Major: And the upshot of that was to force the price down, which benefits the short holders, while blocking the strategy of the Redditors, which was to force the price up by buying so that the short holders would have to pay them even higher prices to cover. If that isn’t manipulation by RobinHood, what is?

Major Major Major Major

@PJ: If that isn’t manipulation by the Reddit people, what is?

jnfr

@Mary G:

Yay shots! Congratulations!

Suzanne

@Mary G: I drove SuzMom to a RiteAid in a random rural town in the next county to get her first Moderna vaccine today, too! The second dose is scheduled four weeks from today. Such a load off.

While I was driving there, though, I got a call from Mr. Suzanne. His best friend (best man in our wedding) lost his mom earlier in the week to Covid. Fuck this plague. And fuck Trump.

Ken

@trollhattan: If they can’t unearth the Trump loyalists from these advisory boards, can they at least assign them office space in Point Barrow? (Just the Trump loyalists; everyone else can zoom from home.)

PJ

@Major Major Major Major: I mean manipulation in the sense of being a violation of the ’34 Act. People have been arguing that what the Redditors have been doing is illegal, but I don’t think that would fly in any court today. A broker forcing customers to either hold or sell while the price drops, on the other hand . . .

Jim, Foolish Literalist

my hot take: day trading is a poor investment strategy, and I suspect in a couple weeks will have been abandoned as a social justice tool

Central Planning

@Just Some Fuckhead: unless GME wants to issue some more stock at these new prices, it doesn’t really do anything for them except get them media coverage. Like others have said, they are a dying brick and mortar business. My brother in law works for them as some sort of manager and doesn’t even own any of their stock.

Also, too, I just got my first Moderna shot. Whoohoo!

Roger Moore

@Mary G:

People who aren’t working through Robinhood can buy. As I understand it, Robinhood has blocked purchases because their market maker is charging them an arm and a leg for any purchases and they can’t afford it.

WhatMyNym

Folks are always trying to take out the shorts. This time they were wildly successful. The downside was the hedge funds couldn’t cover their now worthless shorts without selling other stock. The hedge funds are more of a problem.

Baud

I think there’s still some mystery as to how the redditors learned about the short position in Gamestop. I think that info is usually confidential.

Just Some Fuckhead

@Roger Moore: Wasn’t just RobinHood.

Roger Moore

@trollhattan:

It’s cronyism at its finest.

WaterGirl

I haven’t really been following this, except to know that it’s a thing, but I’d kind of like to have at least a kindergarterer’s understanding of what’s going on, and who are the good guys and who are the bad.

Anyone up for describing this in one paragraph, like I’m 5 -10 years old?

VeniceRiley

@Mary G: Glad you got in before the waterworks start!

Congrats on all the shots today everybody who got jabbed or got a loved one in for a jab.

Now I’m going to rush home to get my garbage cans in.

Le Comte de Monte Cristo, fka Edmund Dantes

Pitchforks, torches and guillotines. Turns out that oldest daughter had picked up 34 shares via Robinhood back in November.

Execute Hedge Fund Assholes sounds like a GREAT punk band name to me.

bluehill

@Baud: That’s why Melvin Capital was shorting the stock. GME is a mall-based retailer selling video games in 2020. On the surface that doesn’t seem like a winning strategy, but supposedly the Chewy founder bought a big stake before the recent craziness and was pushing for GME management to make changes.

Now should Melvin have been short 140% of outstanding shares? Doesn’t seem like good risk management to me. I’m sure they had some risk manager calculate the odds of 6000% move against your position and found some infinitesimal chance that would happen. I’m sure they know that returns aren’t normally distributed.

Roger Moore

@Just Some Fuckhead:

No. First of all, their basic business plan of selling games in person is largely obsolete. Most people now buy their games online directly from the game company, so retailers like Game Stop don’t really have a chance. Even their lucrative second hand game sales are going away because you can’t resell a digital download. Second of all, their new valuation is transitory, and anyone they might try to do business with to take advantage of their valuation is likely to know this.

Ken

Certainly not me. All I’m getting from this is a vague feeling of “the shocking thing is what’s legal”.

Just Some Fuckhead

@WaterGirl: My own feeling is there aren’t any good guys in this story so I’m going with realpolitik and siding with the dangerous rebels over the entrenched tyrant.

NYCMT

The r/stockbets scheme is a classic pump-and-dump. It’s usually prosecuted as fraud.

bluehill

@WaterGirl: Well, do you consider greed to be good or bad, because there were, IMO, small-time and big-time speculators that let their greed override their judgement and they made some risky bets. Unfortunately, the difference is that the head of Melvin Capital won’t struggle to pay his mortgage while some of the Robinhood investors are trying to make rent.

germy

John Revolta

@WaterGirl: As far as I can tell there aren’t really any good guys. Basically it’s some assholes on Reddit fucking around with some asshole investors who like to bet that companies are going to fail (“short sellers”) for fun and maybe some quick bucks. And as usual, the big money guys are gonna be the only ones who really make out in the end. (I should add that the Reddit assholes are as close to being the “good guys” as anybody is, because the concept of short selling is basically predatory and pisses me off.) Basically I’m rooting for injuries here.

stinger

I don’t care if you got the deets wrong, John Cole, you are spot on in regards to the overall evil and greed.

Ben Cisco (onboard the Defiant)

RIP Cicely Tyson.

Baud

@WaterGirl:

I might get this wrong but:

Just Some Fuckhead

@NYCMT: Except there doesn’t appear to be a “dump” here.

bluehill

@Le Comte de Monte Cristo, fka Edmund Dantes: If she sells tomorrow, she probably will have gotten a 1000% return on her investment in about 3 months. She should work for a hedge fund!

Patricia Kayden

Manxome Bromide

@WaterGirl: It takes a screen or so of text, but https://arstechnica.com/gaming/2021/01/the-complete-morons-guide-to-gamestops-stock-roller-coaster/ does a pretty good job of explaining both the “short squeeze” effect and also why GameStop might have been worth more than their stock value implied.

Major Major Major Major

@Baud: Don’t forget 6: Lots of other hedge funds made even more money picking up the pieces.

Brachiator

@schrodingers_cat:

What is happening now?

And what’s the deal with farmers riding tractors into the Red Fort?

germy

Just Some Fuckhead

@germy: Wow. Ron Paul is still alive?

debbie

@Ben Cisco (onboard the Defiant):

She was interviewed on NPR just last weekend! ?

Baud

@Just Some Fuckhead:

He had a stroke on TV a little while ago.

WhatMyNym

@Baud: Except for 3 &4 that’s about right. Retail traders and others keep track of stocks that are being shorted heavily, it’s open info. Folks have many boards that they talk about it on, sometimes they are just late to the party and the buying has already started. Reddit and Facebook are just the more well known ones.

The short plays on GME were ridiculously high.

Fair Economist

@Roger Moore:

I don’t think it’s purely coincidence that Citadel LLC, one of the major owners of Melvin capital, had to help put 2.75 BILLION into it just a few days ago and is also the owner of Robinhood.

And, yes, I know they’re claiming that “had no influence in their decision”. If you believe that, I have a bridge to sell you.

germy

Yes, and still barking out those rightwing talking points like “Fauci is the highest paid gubmint employee in the history of the universe!”

trollhattan

@Just Some Fuckhead:

And, is he still a “doctor”? Love the idea of a medical doctor questioning whether masks have any benefits. By “love” I mean “fuck you, you ancient fraud.”

beef

@bluehill:

Melvin wasn’t short 140% of outstanding shares! The total number of shorted shares was 140%. That’s the sum of all the short positions (retail players, short selling funds, speculators, long-short mutual funds, hedgers who sold Gamestop to hedge out some risk).

zhena gogolia

@Ben Cisco (onboard the Defiant):

Oh, damn.

Just Some Fuckhead

@trollhattan: Well the good news is surgeons don’t have to wear those pesky masks any more.

Baud

@Major Major Major Major:

The question is, how much does the economy need to collapse to create infinite profit?

Ken

@Patricia Kayden: Darn, at first I thought they were going to dynamite the traitors off Stone Mountain, and re-sculpt it with Lewis. Keep it in reserve for future improvements, I suppose.

NYCMT

@Just Some Fuckhead: You don’t need an actual completed dump. The touting of a worthless security to drive its stock price up is enough, if the touts had a plan to profit from the stock price, which, btw, includes causing damages to another party.

trollhattan

So we learn that just today Marjorie Taylor Greene is removing embarrassing Facebook posts and not, say, before she filed to run for congress? Evil and thick as a brick go together like cats and catnip.

Just Some Fuckhead

@NYCMT: So pump and dump without the dump. Got it.

germy

trollhattan

@Just Some Fuckhead:

No more steamy glasses in the OR!

Did not realize until winter arrived that glasses and facemasks are a sucky combination. When it’s 105 one does not notice.

Le Comte de Monte Cristo, fka Edmund Dantes

@bluehill:

I was surprised. The kid is a sweetheart, but never really sophisticated about money.

COVID has definitely improved her knowledge base.

cain

India is a very complex country with all kinds of different lines – religion, culture, language, and history. It’s very easy to transgress those lines – and I don’t think Modi has the subtlety to hold on to power – part of Hindutva if I recall is trying to cram Hindi down everyone’s throat. I will tell you now, (and they’ve already tried once) you pull that shit – there will be blood.

I can see it getting bad enough to break up into nation states IMHO.

bluehill

@beef: You’re right. It sounds like Melvin a large position of short stock and puts, but not that large!

Major Major Major Major

@Fair Economist: I’ve heard a lot of people say “citadel owns robinhood” but the closest i can come is that the citadel guy owns another company that is also called citadel, which holds *a* stake in robinhood, as i assume do many other investors. do you have a link?

also citadel bought all those non-controlling shares of melvin because it was a fucking great deal at the time.

beef

@Fair Economist:

Since when does Citadel own RobinHood? RH is a Silicon Valley company. They’re primarily owned by the usual venture capital firms out there: Andreson Horowitz, Kleiner Perkins, etc. I don’t see Citadel entities on their investor list.

Citadel Securities (their market maker) has a business relationship with Robin Hood. They are customers. They pay RH to direct them order flow. Then they make markets against that order flow. (In theory, RH could do this themselves, but it’s a lot more profitable for them to outsource it.)

Major Major Major Major

@beef: as far as i can tell somebody said it on CNBC today and the internet just ran with it without anybody googling “who owns robinhood”

WhatMyNym

@NYCMT: No, the plan was to force the shorts to buy stock to cover their short positions, which would push the price up temporarily. You sell to them at a higher price than you paid.

ETA: I deal with small cap stocks all the time and there always folks trying to short them because the daily sales volume is low.

Martin

@Major Major Major Major: Almost all of it is misfiring regulations. Reddit is just shining a spotlight on it too bright to ignore. Why didn’t the SEC prohibit Melvin Capital from re-shorting the stock rather than let the exchanges continue to halt trading and cut off retail investors? That would have had the same calming effect – it’s just a question of who gets to repair their position, and who has to eat it.

There’s a real chance that Melvin will turn a profit at the end of all of this.

Baud

@Martin:

And it’s a certainty that someone is going to be left holding the bag when the stock crashes.

MomSense

@WaterGirl:

It’s not one paragraph, but it’s the best explainer I’ve found.

http://isthesqueezesquoze.com

Baud

@Martin:

The brokers did that, no? Not the exchanges.

Yutsano

Okay so text does work.

Honestly, if the big effect out of this is exposing that hedge fund managers and the capital behind them are just rich play money not being used to help anyone but themselves that’s probably enough in this climate for some real changes to come about. Maybe like giving the SEC some teeth.

beef

@Major Major Major Major:

The level of misinformation swirling around the Gamestop short squeeze/pump & dump/whatever it is has been absolutely incredible to watch. People are letting their emotions and prejudices run way ahead of their actual understanding.

Case in point: These redditors are engaging at the least in massive market manipulation, and quite possibly in a pump & dump scheme. (It’s hard for me to see how what they’re doing is distinct from a Ponzi scheme.) They’re celebrating their own greed very publically. But they’ve said they’re against the greedy manipulators, so they must be heroes!

Markets are complicated evolved systems. We owe it to ourselves to respect that fact and make an effort to understand what’s really happening before we get out the pitchforks. (I mean, get them out and wave them around if you want, but at least try reading Matt Levine before you stab anyone.)

Martin

@beef: True, but Melvin and the other large naked shorts had to know the potential danger here. I mean, the covered shorts are fine, but Melvin is the big boy at this table. They’re the ones who are supposed to see all and make the responsible actions – that’s why they exist in such an unregulated space. Surely they knew they were part of that 40% that had no net, and surely their economists are smart enough to know what an inelastic market looks like, and surely they have folks that are following social media and see this Reddit group conspiring to take them down. It was all done out in the open. They have NO excuse here.

Reddit was just playing the game by the rules that the hedge funds thought were reserved just for them. I’ve watched hedge funds gamma squeeze fortune 50 companies. I’ve even seen them admit to it. The difference was that Reddit told everyone what they were planning to do, and Melvin didn’t close their position before the shit hit the fan.

Major Major Major Major

@beef:

Even more remarkable, people’s random-ass findings of “fact” miraculously mirror their existing opinions, cough this post and two posts ago cough

Ksmiami

@schrodingers_cat: Shit does this mean a Sino-Indian war is up next? Fucking rhyming history

Martin

@Baud: The exchanges halted trading. The brokers cut off buying. I mean, I understand why the exchanges needed to do that. I don’t disagree with it.

All I’m saying is Melvin can influence the market faster with shorting than the markets can respond. The SEC is putting the regulatory burden on the wrong players. A retail investor should have a greater right to buy stock with actual earth dollars than a hedge fund has to sell a share they don’t own. Yes, slam the brakes on a market spiraling out of control, but do it on the hedge fund side, not the retail side when those are your choices.

Ksmiami

@Baud: GameStop should just cash out and go private. Fuck em all

mrmoshpotato

@germy: Hahaha. Many new fans of men in tights?

trollhattan

@germy:

I keep thinking RobinHood is Pied Piper from “Silicon Valley.”

Searcher

@Just Some Fuckhead: I would wager that at least some of the people pumping are also covertly dumping while telling their audience of fellow-posters to keep up the good work pumping up that stock price.

In any large-scale scam you usually have a mix of frauds & true believers, and one of the more interesting jobs for the arm chair detective is trying to sort out one from the other.

Insomuch as anyone is (correctly) prosecuted for this, I would expect 2-3 of the frauds who pumped the stock and exited today (ahead of the purported squeeze tomorrow) to end up getting banned from future trading, while the true believers just end up holding some fraction of the bag, depending on when they got in.

Yutsano

@Ksmiami: I think they need a shit ton of money for that. I’m not convinced the founders of Chewy.com would be too fond of losing their shirts to support that.

Le Comte de Monte Cristo, fka Edmund Dantes

@beef:

Who are you again? I haven’t really noticed you in these parts, and you’ve got a seemingly large amount of finance arcana in your database.

Fair Economist

@Major Major Major Major:

Buying over a billion in shares makes them a major owner, full stop.

beef

@Martin:

That’s another example. It’s not clear to me that anyone was actually naked. (And if they were some brokers are going to have big problems.) What I’ve read is that the actual short interest is only 58% of the float, not 140%.

https://www.shortsight.com/gamestop-shorts-down-5-billion-in-2021/

So what’s the difference? You have to include the ‘synthetic longs’ in the calculation. When someone shorts, they sell the share to someone else, who’s now long. That person will sometimes lend out their share again, to another shorter, who then sells it to someone… This is particularly prone to happening in stocks like Gamestop, where interest rate for borrowed shares is currently 0.8% A DAY.

Point is, it’s not clear to me that the 140% number guarantees that a lot of shorts won’t be able to cover. A lot of them can cancel against synthetic longs. Which would mean that the redditors have been sold a fiction; there’s no guarantee the shorters are going to be forced to buy to cover their positions. Which would mean the redditors have started a massive game of tug of war, which they’re going to lose in the end because the damned company isn’t worth $25 billion dollars.

frosty

@germy: AOC is really on fire with this stuff today. And Cruz too.

Randolf Hurts

@Major Major Major Major: How can you sell if no one can buy?

grumbles

I’m sorry, the DTC/we can’t afford to carry the volatility argument is just a bit convenient.

I admit ignorance; I certainly know nothing about the mechanics of stock clearance. Perhaps it is exactly this innocent. I do intend to read up on this, it is interesting.

But the result is just very convenient, and shaped exactly right to save Citadel. Who, by the way, gets Robinhoods order book, and would know exactly the right way to save themselves.

The master’s tools will never dismantle the master’s house.

WaterGirl

@Baud: I actually understood this, thank you!

Major Major Major Major

@Randolf Hurts: Most stock transactions are not executed via the Robinhood phone app.

@Fair Economist: You made it sound like their owning a bunch of non-voting shares and their having spent a few bil were distinct phenomena instead of the same thing, is all. Also, I will again note that this company doesn’t own Robinhood, which is rather central to your thesis.

Randolf Hurts

@Major Major Major Major: wut? they are playing the game just like everyone else. you don’t get to change the rules when you start losing because the other team is cheating the same way as you.

Martin

@beef: I take issue with this. My gut reaction is this is punching down, which I dislike.

This is not market manipulation for two reasons:

This is not pump and dump because Reddit was not lying about their intentions. Further, they have no position of authority for the pump part. When Jim Cramer goes on CNBC and talks up Apple while he’s selling on the backside, that’s pump and dump. Reddit was saying ‘hey, these guys are way, way overleveraged, let’s jump on them’. That was true! The hedge funds have always relied on people not noticing that. Rather than Reddit calling it out, they both called it out, and then put their money in the exact direction they were stating. Jim Cramer relies on people putting money behind his lies, but Reddit was relying on people putting money behind the true fundamentals of the market.

It would be nice to understand what’s really happening, but we know exactly what Reddit was attempting to do. That’s not the problem. We don’t know what Melvin was attempting to do and we often don’t know what the hedge funds and high speed traders and all of the other large money entities are doing and are allowed to do.

stacib

@Ben Cisco (onboard the Defiant): I was hoping somebody here would acknowledge her passing. My goodness was Ms. Tyson a fantastic actress who engendered so much pride in this young, black child in the early 70s when my class went to see Sounder that I followed her career like some folks do for rock stars. Imagine, she was still acting in her 90s.

Randolf Hurts

@Major Major Major Major: and?

Ksmiami

@Yutsano: when the price goes down just raise a ton of cheap debt and go private

Felanius Kootea

@Ben Cisco (onboard the Defiant): Oh no! I know she was 96 but I was hoping she would still be around for a while. Dignity, beauty, and class – I love what she represented in film.

Major Major Major Major

@Randolf Hurts:

You asked “how can you sell if no-one can buy”? I told you.

Jay

@WaterGirl:

Hedge funds shorted the stock, ( “bet” that the share prices would fall), in excess of what existed for shares.

Redditor’s learned of the short, and basically crowdsourced driving the share price up, sometimes by just one person of many, buying a share at a higher price.

The Hedge funds can’t even come close to either buying enough shares to fill their short position or for even close to the dollar amount, so they are out billions.

frosty

@frosty: Oops I meant she’s on fire with her comments about Cruz.

beef

@Le Comte de Monte Cristo, fka Edmund Dantes:

I’ve been reading Cole since the early Bush years. Found him via either Digby or Billmon. I’ve commented here and there over the years, somewhat more frequently since Covid began.

I know some finance arcana because I work in finance, although thankfully not on anything involved in today’s mess.

I have to confess that I chose this pseudonym in the hopes that someone would someday ask “Who’s the beef?”. Close enough, I guess.

MomSense

@stacib:

We’re watching Because of Winn Dixie.

Martin

@beef: They HAD to be naked. If they were covered, they wouldn’t have had to go buy up shares to cover and incur those losses (further driving up the price, making the remaining shorts even more busted). If you are covered, you can’t lose money. You lose the opportunity to make more money, you might lose some unrealized gains, but you never need to run to the bank for some more cash – worst case you hand over the share, which is already paid for. It can only happen when you are naked. Even if you’re shorting the same share multiple times with different expiries, only one of those shorts is covered – the other is naked at least until the other one is reconciled because there is always a risk that your position will be forced closed on both at the same time.

Look, I’ve been on the other side of that. I’ve paid $0.25 for the right to buy a share that went up $100 over strike. If the seller of that call wasn’t covered, they had earned $0.25 but had to pay $100 to get that share to me or buy back the contract. If they were covered, they sell the stock, lose out on the $100 premium, but keep whatever gains they realized to the strike. Odds are the covered sellers made a lot of money + $0.25. They could have made $100 more, but they didn’t take a loss. If they were naked, they lost hundreds of thousands just on little old me.

Major Major Major Major

@beef: glad to have ya! Now and then. Or whenever!

Baud

@beef:

Where are you?

Benw

FFS these asshole billionaires can commit whatever crime they want and still walk away with billions and for the rest of us it’s like you’re under arrest again for public nudity in the Stop & Shop produce aisle I swear it’s two Americas out there

?BillinGlendaleCA

@Martin:

Who do they think they are, Baud?

bluehill

@beef: I think this makes things worse for short sellers if the price starts to get away from them as it did here. 1 share being lent a few times is a form of leverage. Add in the OTM calls that robinhooders were buying and offsetting hedging by option market markers, that seems like a combination for a melt up.

Baud

@?BillinGlendaleCA:

I hate when people sell me short.

Jim, Foolish Literalist

COngreswoman Gun Bunny throws in with QANON against the adolescent with PTSD

beef

@Martin:

You seem to be assuming that Melvin was using options to short. I’m not sure about that. I would have assumed that they were short stock rather than using derivatives. I could be wrong on that though.

As for punching down: I’m honestly not that sure I want to root for anyone involved in this. The short selling funds have a purpose in the ecosystem, but their owners tend to be jerks. The investors in those hedge funds are some mix of rich people and pension funds. I feel bad for the pension investors, and assume the rich folks can take care of themselves. The redditors, well, some of them are spending milk money, and some of them are dropping $50k on short options. The latter aren’t little guys by any definition I use.

trollhattan

@Felanius Kootea:

At least she saw Trump make his very dignified exit, an experience I wish Carl Reiner had had. Carl and Mel at breakfast would have been lit on inauguration day.

NotMax

Missed this from earlier in the week – R.I.P. Sonny Fox, at 95.

WaterGirl

@Jim, Foolish Literalist: I know this is politically incorrect, but what a fucking bitch she is, so condescending. I am enraged. The crazies are out of control.

beef

@Baud:

Thank you, Mr. President.

beef

@bluehill:

I’m not sure that the re-lending makes it worse. But 100+% short interest isn’t necessary for a short squeeze. Buying 50+% of a public company isn’t a trivial undertaking either.

I am curious what was the primary driver of the melt-up. Specifically, I wish I knew to what degree it was caused by the WallStreetBets crew, to what degree more generic retail flow, and to what degree it was standard Wall St players piling in.

Brachiator

@Just Some Fuckhead:

Nor do they have to wash their hands.

Major Major Major Major

Here are still more explanations from people who probably understand these things better than most of us. Spoiler alert: this still isn’t a shadowy cabal of hedge funds protecting themselves from the rabble.

Just Some Fuckhead

@beef: Calling this GME stunt a “pump and dump” is quite literally the worst take ever. It’s anything but. This is literally a bunch of gamers banding to save a gaming company while sticking it to Gordon Gekko.

Pretending it is a pump and dump scheme shows you aren’t operating in good faith.

Le Comte de Monte Cristo, fka Edmund Dantes

@Major Major Major Major:

You’re on a hot streak at the craps table at the Cosmopolitan in Las Vegas, and have parlayed $100 in chips to making $5000. All of a sudden, the Cosmopolitan, Paris, New York, Bellagio and Balley’s say you can’t play at their casinos while the dude in the chip cage at the Cosmo says you can’t cash in there.

beef

@Just Some Fuckhead:

They’re also trying a short squeeze in Palantir Techologies. Funny how those gamers love Peter Thiel. And in Bed, Bath, & Beyond. Funny how those gamers love towels. And in Blackberry. Funny how those gamers love antique mobile platforms. And in AMC, but I’ll give you that. Everyone loves watching loud commercials while waiting for the movie to start.

Just Some Fuckhead

@beef: Yes, there’s been a lot of reporting on how these folks are interested in saving the businesses they grew up with. How are you missing this?

Le Comte de Monte Cristo, fka Edmund Dantes

@beef:

So when did you last post here on something unrelated to the GME thing?

schrodingers_cat

Jim McGovern tweeted in support of the protesting farmers in India

Check out the hateful responses of the BJP IT cell minions and assorted supporters

ETA:150 farmers have died in the last two months of the protests.

Ruckus

@Suzanne:

If there is a serious concept here maybe we should take suggestions…….

I’m think the best way to do that would be Freightliner, fully up at 80,000 lbs, doing 60 mph.

Now I understand this would be after a trial and conviction for murder of some hundreds of thousands of people, I just think this would be more humane than lethal injection.

More humane for the rest of us…..

beef

@Le Comte de Monte Cristo, fka Edmund Dantes:

I feel like someone with your pseudonym should be a little less casual about starting an Inquisition.

More seriously: The most recent post I could find with google is here: https://balloon-juice.com/2020/11/19/open-thread-biden-and-harris-live/#comment-7967953

Thanks to the recipe posts, it’s hard to search for ‘beef’ directly, so it’s not easy to identify all my comments. But if you search for ‘@beef’, you’ll at least find places where someone has responded to me.

Edit: Not all of us are frequent commenters. Probably not even a majority. I tend to speak up more when I can bring some knowledge to a discussion. Otherwise I silently agree. (This may well be a variety of the Gell-Mann Amnesia Effect.)

Eolirin

@Just Some Fuckhead: Well, since this will do absolutely nothing to help GameStop survive, I guess the Redditors are also really ignorant of how stocks work then? ?

Literally the only thing that’s made any difference to GameStop’s chances is MS throwing them a lifeline, through Xbox All Access, granting them a precentage of all digital sales on consoles they sell through that program.

Martin

@WaterGirl: I mean, to be honest, they’re kind of all bad. But some are more deserving than others of that. Here’s the unofficial BJ explanation everyone can understand.

Instead of Gamestop shares, we’re going to trade Balloon Juice Pet Calendars. And our market is going to be the members of this board. Rather than pre-order, we’re going to do this as a market. You decide to print 100 calendars. And I’m going to guess that demand is higher than 100. So you tell us there are 100 calendars, and you set an initial price: $20 because you think that 100 people are willing to pay $20. If you thought more than 100 people were willing to pay, you’d set your initial price (this is what an IPO is) higher.

So you set it for $20, and all of the front pagers are allowed to buy at that price. Let’s say 10 FPers each buy 10 calendars at $20 each. Then the rest of us come in and say, ‘hey, I really want a calendar, I’ll pay $22 for one’ and one of the front pagers says ‘yeah, okay, I’ll sell you one for $22’. And now the market price for the calendar is $22 because someone decided it was worth enough to pay $22 for it. Maybe Adam believes the calendar is worth $40, so he refuses to sell his 10 until the price gets up that high, but M4 is like ‘this is full of cats and people hate cats, so I’m going to offload these for anything over $15, because I now believe they aren’t even worth $20’. So people here buy and sell the calendars and the price of the calendar bounces around until it hits a certain equilibrium – the price that 100 people believe the calendars are worth. Let’s say that settles to $40.

But Martin shows up, and Martin gets a tip that one of the dogs on the calendar was involved in some terrible scandal, and that will likely cause people to not want to use their calendar, making them likely to sell it for below $40. And that news will come out in a week. So Martin hatches a plan. I’ll give someone $1 per calendar to borrow 10 of them for 2 weeks. I can then sell them today for $40 each, and then in 2 weeks, buy them back for less, after the news has broken, and return those instead. If the market price of the calendars falls to $30, I sell 10 today and gain $400, less the $10 in rental fees so $390, and in two weeks I buy 10 for $300, hand them back, and I’ve made $90. This is a short sale. Specifically it’s a naked short – I don’t actually have 10 calendars until I buy them off the market.

Alternatively, I could do a covered short. I own 10 calendars, but I want to hold onto them for some reason. I still borrow 10, sell those, get my $390 and then in two weeks I can either buy 10 for $300 and return them, still making $90, or I can just turn over my 10. I could have sold all of them for $400 at the outset, but I bought myself the option for delaying that decision until after the news broke for $10. If I had purchased my 10 at the outset for $20 each, I might be okay with just a $190 profit instead of the $200 profit if it buys me two extra weeks to see what happens. Maybe the value goes up. Maybe we’re into the scandal.

This is what the hedge funds did – they borrowed, sold the calendars and then promised to return them at a later date. But what were to happen if I borrowed 70 calendars at $1 each, sold them at $40 each ($2800-$70 = $2730) and promised to return them in two weeks, but Yutsy did the exact same thing, also promising to return 70 in 2 weeks. Between us we’ve now committed to returning 140 calendars (we currently own 0) to people in 2 weeks. There are still only 100 calendars. This could be a problem. In 2 weeks, Yutsy and I will be able to buy some of the calendars we need for $30 as before, but others we’re going to need to buy for more than $30, because we’re going to have to immediately turn around and rebuy a calendar we just bought for $30 and returned, and we’re probably going to have to pay a bit more for those. But so long as nobody is paying attention, it’ll probably work out fine.

Reddit was paying attention. So let’s say Baud (playing the role of Reddit here) comes along and because my and Yutsys borrowing had to be reported to the government realizes that we’re in a vulnerable position. So Baud realizes that if he starts buying calendars and refuses to sell them, Yutsy and I are going to be pretty fucked. So he does that. The bad news breaks and the calendars don’t fall to $30, instead they go to $45 because Baud is buying. Yutsy and I have a real ‘oh shit’ moment. We own no calendars, only earned $39 a calendar in our short sale, and now need to spend $45 to get calendars to return to people. So Yutsy and I start buying calendars, which starts to drive the price up more, because Baud is still buying – he sees that we’re cornered. The price goes up to $50, $60, $100. Every calendar Baud buys is one that Yutsy and I can’t buy and return, so we’re getting squeezed into a smaller and smaller market of calendars to buy, and they’re getting more and more expensive. (This is the definition of an inelastic market, one where buyers have less capacity not buy, than sellers have capacity to sell, Normally you’d solve this by printing more calendars, by the way, but that takes too long to actually solve the problem.) And the harder Yutsy and I work to get out of our situation, the more expensive it gets. And we can’t wait him out because we’re contractually obligated to return them on a given day. Up to that day, we’re getting squeezed tighter and tighter, and we’re losing money like crazy because theoretically there’s no limit to how high the price of calendars can go. (In the case of Gamestop, those $40 calendars rose to $3500)

Now, absent all other market players, Baud has a growing problem – when does he sell? Because after the calendars are returned the price should go back to $40 or less, and Baud paid more than that. So he’s got to decide where in this situation he has no more calendars than we need and sells them to us, which starts to lower the price, but still means a lot of money for him. But there are other players. Other people here see the price going up, think theres way more demand for these calendars than there actually are and start buying as well. That’s likely to keep the price of the calendars artificially high, making it easy for Baud to get out at a high price.

So, we fast forward a month later, and calendars are worth $40 again, exactly what they were before this all started. The capital value of those was $4000 ($40×100) and still is $4000. Baud has made thousands of dollars for his effort – he just needed enough capital to risk in buying these. He might make more than the $4000 value of the calendars. Me and Yutsy have lost thousands, a transferral of wealth to Baud. What was a cheap capital outlay (just $70 – $1 for each of 70 calendars) turned into a huge loss. For everyone else in the community, some made money and some lost depending on when they bought and sold calendars. We had this huge flurry of activity that was short lived and things reverted to normal.

Now, the question here is, who’s the bad guy? Is it Yutsy and me trying to invest minimal money to turn a big profit by acting as though we had an asset we actually didn’t have? I would say yes. Is Baud the bad guy for recognizing the situation and taking advantage of us? Maybe. He merely took advantage of my scheme which was plain to see. But if you were one of the rest of the community who got caught up in this not realizing what it really was, then you might think he was if you lost money. You might think he’s a hero if you made money.

So, outside of this scenario, I argue the original sin was the naked short, particularly once we had committed to returning more calendars than existed, and that everything that followed was a natural market reaction to correct or take advantage of that sin. I argue that should never be allowed to happen in the first place, which automatically prevents everything that followed from happening.

Naked shorting has unlimited downside risk. In our example above, my investment was $70. Losing the $70 would be bad enough, but I lost thousands of dollars beyond that – money that I might not even have. Baud was in a much better situation. He might lose the money he invested locking down calendars, but he couldn’t lose more than that, so he could better control how much he might lose, and he at least still had the calendar to show for it.

Does this help?

What I object to in the end is the remedy. Robinhood cut off Bauds ability to buy calendars, but not my ability simply pay another dollar to reborrow them, sell them at the higher price, and then rebuy them some more weeks down the line and recover all of my money. And this time, you can’t stop me. The losers in all of this will be folks on the sidelines. Yutsy and I, if we can simply do another short sale while Baud is unable to buy calendars, will probably make all of our money back. Baud will be able to as well. Which means everyone else gets fucked, when really it should be Yutsy and I taking the hit.

Martin

@Eolirin: I think it makes Gamestop harder to recover. Their savior probably bailed out at the high prices. He may buy back in again, or he may move on. But whatever plan might have been in place a month ago is now gutted. But that’s on the short sellers, not on the Redditors. The short sellers were trying to get Gamestop to fail all along.

But I wouldn’t lose sleep over that. Let Gamestop fail if they can’t figure out their new market. That creates space for new businesses. It’s hard for the employees, but there shouldn’t be any nostalgia for Gamestops business – it was going away no matter what.

Just Some Fuckhead

@Martin: Baud makes me want to side with the short sellers. Can me make it Steve In ATL instead?

Martin

@Major Major Major Major: I still object to Melvin Capital being able to open new short positions while other investors are prevented from opening new equity positions. I know those are enforced by different agencies, but it’s a terrible remedy. Equity positions should be the foundation on which the rest of the investment system is built. Everything else should be turned off before they are.

The Lodger

@Martin: I should have bought cannabis stock before you posted that.

catclub

haha. the intent of the redditors was to have fun. Maybe save GME, maybe not, maybe make the shorts really unhappy, maybe not.

Just Some Fuckhead

@catclub: Another wrong opinion stated boldly. They’ve interviewed the folks that participated in the GME stock buy. Educate yourself.

catclub

@Martin:

The real lesson of all this is that BJ should have had some instant Calendar printing available to take advantage of crazy people.

For GME that is an open At The Market (ATM) stock offering, in which they can sell more shares – at the market price – whenever that looks like a good idea. I think this will be the major effect of all this. EVERY company will make sure to have an ATM stock offering open.

beef

@Martin

I have one complaint about your writeup: In stocks, naked shorting refers to selling stocks that you haven’t borrowed. What you’re calling naked shorting is just shorting. You’ve already borrowed the calenders. What you’re calling ‘covered shorting’ isn’t shorting at all. It’s just being flat. You’re short 10 and long 10 and your positions cancel out.

I think you may be conflating the stock and options terminology a little. I’m speaking up about this because what is normally called naked shorting is illegal and I don’t like to see the names of crimes repurposed to describe normal legal actions.

catclub

@Just Some Fuckhead:

All of them?

And people getting interviewed never lie about their motivations.

cokane

Daytraders with the knowledge to be ahead of the curve on reddit are not “little guys”. Many of them are guys with experience in the finance industry, who are either retired or simply didn’t want to work for someone else. This is not little guys vs big guys. This is a pump and dump scheme crafted in online forums, so it’s interesting. But it’s not anything different than what happened before.

One hedgefund has shit the bed over this. But other hedgefunds have gained because of this. This is not “the big guys” losing. At the end of the day, the people who are going to be most screwed are the late-buyers of Gamestop. All of whom now own grossly inflated investments.

cokane

Also, man, I really think the push from the left to get mad at Robinhood for blocking purchases is wrongheaded. Look Robinhood is not a company looking out for the little guy generally — it’s basically a Facebook business model of selling data to big finance firms in exchange for letting people day trade for zero commission. But blocking the stock purchase now *is* actually saving regular people from getting shafted. If nothing else Robinhood doesn’t want a flood of new users to have a bad experience with their app — for perfectly selfish reasons.

And I don’t understand why people on the left and in freaking Congress want to push for regular people to be able to buy shit stocks right now. To me, it’s as if people on the left are all of a sudden arguing for greater access to payday loans. It’s ridiculous. We do not want to encourage people who know little about stocks to become part-time day traders! That’s just setting up regular folks to get fleeced by the pros.