The Affordable Care Act’s individual market is likely to have significant legislative policy changes this year. However, if there is not a fundamental restructuring of how the subsidy system works, weird things are likely to happen that are counter-intuitive. We need to understand how price-linked subsidies work and who those subsidies apply to.

The ACA subsidy system is based on filling a gap. The gap is the difference between the benchmark gross premium and an individual household’s applicable percentage of income. The federal premium tax credit (PTC) serves as a gap filler. The PTC is designed so that two households that are identical in all aspects (age composition, number of household members, and family income as a function of countable federal poverty level (FPL)) pay the same amount out of pocket for their benchmark plan even if there are massive differences in the gross premium of the benchmark plan.

For instance, if a household has an applicable percentage of 5% of income, they are expected to pay 5% of their income for the benchmark plan. This is true if the benchmark plan has a premium of 5.1% of their income (.1% household income PTC) and it is true if the benchmark plan is 15% of income (10% household income PTC). It is not true if the benchmark plan is 4.9% of the household income as there are no negative PTCs.

Furthermore, the ACA subsidy system is set up so that the net premium that a household pays is flexible. If the household chooses a plan that is priced below benchmark, the household pockets the difference between the benchmark premium and their chosen plan’s premium in the form of a reduced out of pocket net premium. Households are frequently exposed to zero premium plans. Conversely, a household that chooses a plan priced above the benchmark pays the entire extra incremental premium for the more expensive plan.

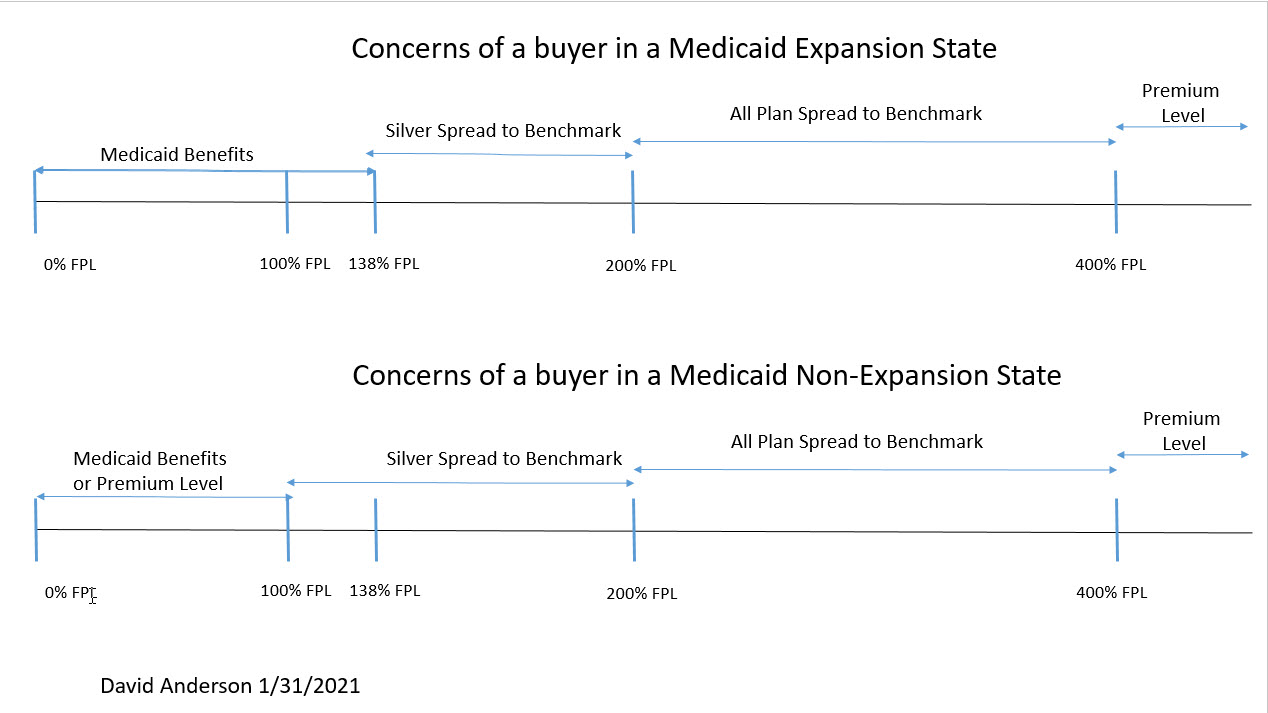

Finally, under current law, not everyone gets a PTC subsidy. Only households who earn between 100% to 400% FPL and who meet several other criteria are eligible for PTC subsidies. Most other people are able to buy plans but not get any financial assistance from the PTC.

So what does this mean?

It means that there are two general classes of buyers in the ACA individual market as it is currently constituted. The first class is the subsidized buyers. They are fundamentally indifferent to premium levels. The federal government eats the premium level risk. Instead buyers who earn between 100% and 400% FPL are sensitive to premium spreads. How far away is their chosen plan from the benchmark is what determines what they pay. A subsidized buyer whose preferred plan costs $1400 a month could be seeing a great deal if the local benchmark is $1900 while they could be seeing an extraordinarily expensive deal if the local benchmark is $900. As a further subnote, individuals who earn under 200% FPL (for a single individual ~$25,500) these folks are hyper sensitive to the spread between the cheapest silver plan and the benchmark (what I’ve called the Silver Gap before). Spread sensitive folks get no direct benefit from premium reductions as those benefits are collected by the Federal Treasury in the form of lower PTCs.

However, folks who are not subsidy eligible don’t care at all about premium spreads. They don’t care about the difference and distance in pricing between the plan that they want and any other plan.

Folks who earn over 400% FPL (~$51,000+ year for a single individual) only care about the premium level. They take on the full burden of premium increases. They get the full benefit of premium decreases.

Why does this all matter?

There are going to be a lot of proposals designed or at least proclaimed to be targeting affordability. As long as we have price linked subsidies that apply to a large proportion of the ACA’s covered populations, we will need to analyze almost all policies through the lens of Spread buyers and Level buyers. Using this lens, the introduction of a premium reducing public option is mostly beneficial to buyers who only care about premium levels and could be slightly to significantly detrimental to price-sensitive spread buyers. Program design would matter a lot.

The ACA is complicated and incomplete in its promise. There are ways to get closer to its core promise that everyone can get affordable health insurance (with significant fights over the meaning of “affordable” and “health” and “insurance” and “health insurance”) but in this legislative window of potential policy change, we will need to grapple with the complexities and oddities that the price linked subsidy system that is at the base of the current affordability mechanism imposes on current program design. That could mean trimming sails, it could mean making explicit trade-offs, it could mean systemic reformation of the affordability mechanism. But whatever path that is chosen, it must be grappled with.

Ohio Mom

Totally off topic but I vaguely remember you are affiliated one way or another with the covidactnow.org site. Is anyone going to fix it, it’s been down for days.

I check it every day for my local numbers (and Anne Laurie for the rest of the world). I miss it!

Ohio Mom

As for the topic of the post, I take my hope in knowing Biden is deeply committed to the ACA.

I am also aware that the ACA always going to fall short of my dream of true universal coverage.

David Anderson

@Ohio Mom: I’m not on the COVID Act Now team; CAN took on the responsibility of the COVID Exit Strategy group that I was a part of as CAN had/has paid staffers and bandwidth.

I’m not sure what is happening with CAN.

Ohio Mom

Thanks.

taumaturgo

Folks as we should plainly see, the system is broken, is costing untold numbers of lives, and our politicians beholden as they are to political

contributionscorruption will only tinker around the edges forcing us to take the pick of our wealth or our lives. When will we say enough?Uncle Cosmo

@traumaturdo: Don’t “folks” us, you miserable turd. Most Jackals have next to nothing in common with petty neo-Stalinists like you.

StringOnAStick

The ACA as currently composed is why we were able to retire at age 62, even with pre existing conditions. Without the pre existing conditions coverage, I would have likely had Covid by now given my old job and my husband would be miserable in a job he couldn’t wait to be done with. We are forever grateful to all the politicians who put their careers on the line to pass it, especially the ones who lost their offices because of that vote.

Long term I want universal coverage but we’ll need at least 60 D senators to do that; big things get done incrementally no matter what the “anyone who didn’t vote for universal coverage sold us out and should lose in favour of an R who will make life bad enough to awaken the proletariat” morons think.

David Anderson

@taumaturgo: are you sure you are not McLaren from ages ago?

Another Scott

@Ohio Mom: The site works fine for me. E.g. COVIDActNow.org – Ohio.

HTH.

Cheers,

Scott.

guachi

I got in an argument with a co-worker last week about health insurance costs and when I dropped the information presented here about subsidized/unsubsidized buyers he looked at me with glazed eyes.

Does anyone else find it difficult to discuss healthcare with others because you know way too much about the Obamacare health insurance market?

taumaturgo

@ David Anderson: I’m sure since I’m not familiar with McLaren.

Freemark

I currently work for Target. My insurance through them is both more expensive and much higher out of pocket cost than what I was getting through ACA with subsidies and cost sharing. It sucks that I can’t choose a subsidized ACA plan because my employer offers me something.

Mudbrush

I absolutely can’t discuss healthcare with anyone I know. My first question, “so can you tell me something.about Obama Care?” is met with either 1) blank stare 2) “it’s a government takeover of healthcare!” or 3) socialism!!

And they won’t read any links I send them or articles I recommended (forget actual books, that ain’t ever gonna happen).

David Anderson

@taumaturgo: just a troll from years back making structurally similar arguments that you make

taumaturgo

See comment #12. To me is a sorry indication of a broken system. We can try to pretend otherwise and go with the idea that’s the best we can do until the moment comes to face either unaffordable care or bankruptcy.

Another Scott

Probably dead thread, but thinking about ACA changes got me thinking about all the battles over the “Cadillac Health Plan” and “Medical Equipment” taxes. I’m of two minds about this:

But, on the other hand:

I think both of these are moot taxes now because there was so much screaming about them by lobbyists that they were (at least effectively) eliminated.

My questions:

While I recognize this is a bit outside your usual area here, I’d be interested in your thoughts on this.

Thanks.

Cheers,

Scott.