Right now, it seems very likely that there is a Democratic Party consensus to significantly increase eligibility for premium subsidies in the ACA market. This consensus is likely able to get 218 votes in the House and 51 votes in the Senate. It will get a signature in the White House and the Supreme Court won’t care one way or the other. This is a 218-51-1-5 policy. Details will likely remain unclear until legislative text is written and the votes are counted.

The goal of this policy would be to remove the 400% FPL cliff where plans can suddenly go from painfully affordable to OMG NO WAY IN HELL CAN I PAY THAT for upper middle class families who are able to effectively organize their screams of pain into political and policy action. States have several policy options to address this group’s real pain.

- State sponsored subsidies for the over 400% FPL group (California)

- Encouraging parallel underwritten insurance markets like Short Term Limited Duration Plans and Farm Bureau “not insurance” insurance-like plans

- Indirect subsidies through the 1332 reinsurance mechanism.

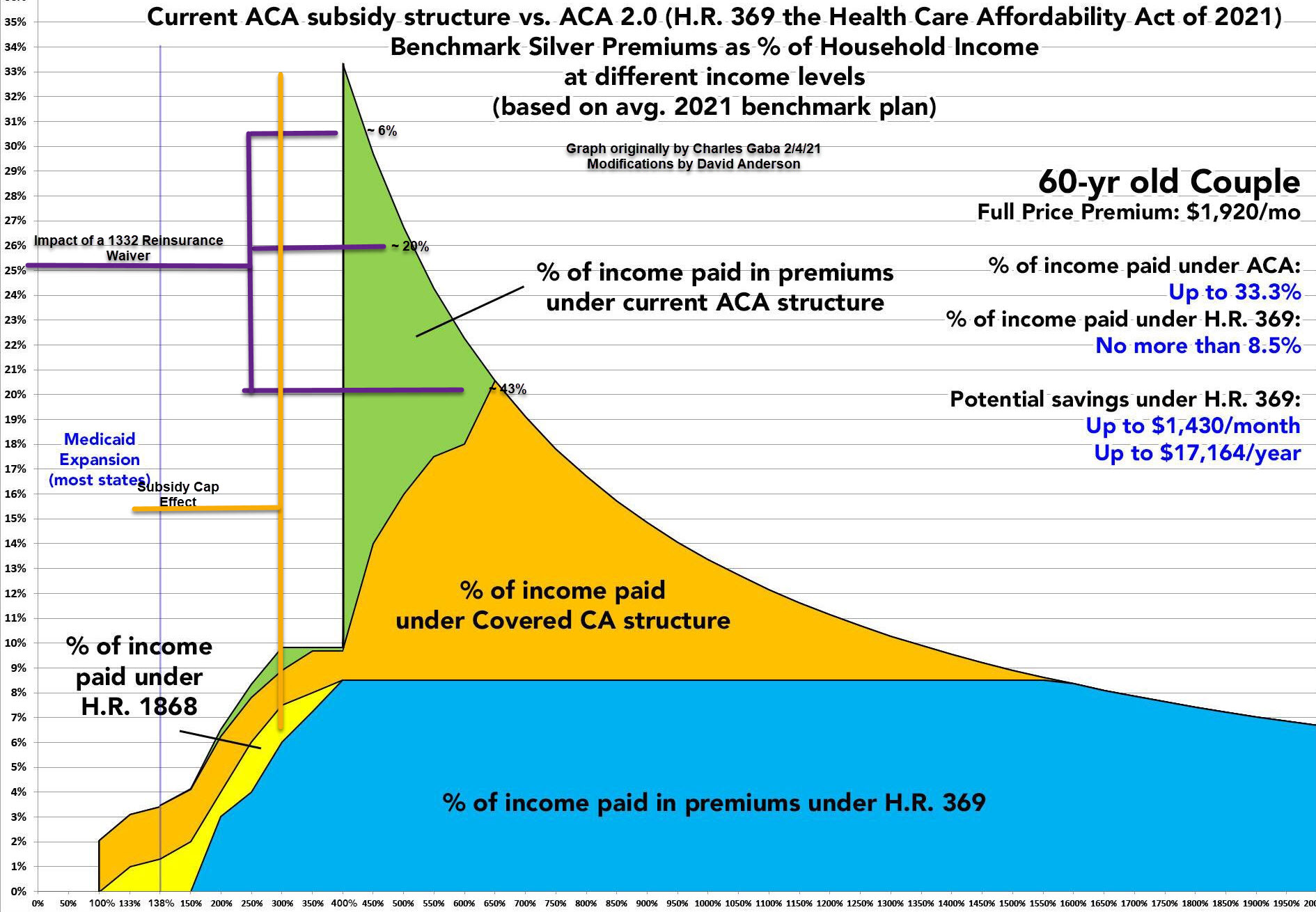

Section 1332 in the ACA allows states to modify their individual health insurance markets to address local needs through local means. Almost all approved 1332 waivers are designed to lower gross premiums for non-subsidized buyers. States add in some amount of state funding to the pool of funds that are used to pay premiums. Previously that pool of funds was composed only of premiums and federal tax credits. The new state money means premiums go down and the federal government does not pay as much in subsidies. The reduced federal subsidies are recycled to help pay claims. This results in slightly higher premiums for people who are subsidized and buy below benchmark plans but notably lower premiums for non-subsidized buyers. In 2019, Avalere estimated that 1332 waivers reduced gross premiums by about 20% compared to a no-waiver world with a broad range of 6% to 43% gross premium reductions.

Charles Gaba has been producing some awesome graphs on the impact of different subsidy schemes for older Americans. I’ve taken his graph for a 60 year old couple at average national benchmark premium who earns 401% FPL and therefore does not qualify for subsidy and marked it up to reflect the impact of reinsurance.

The very short version of this first visual attempt at sketching out what happens to affordability for currently non-subsidized households is that reinsurance is utterly dominated in terms of affordability for people who earn over 400% FPL by changes to the subsidy scheme. The biggest reinsurance premium reduction is producing only the same relative ballpark in gross premium reductions as the current California state funded subsidy scheme that goes to 600% FPL and caps payment at a large fraction of income.

Reinsurance can have multiple goals such as improving the competitiveness of a market by reducing actuarial uncertainty in a market by having a common pool cover truly catastrophic and rare events but currently reinsurance in the state funded 1332 context for the ACA has primarily been a way of reducing some gross premium shock to middle and upper middle class families.

If we move to a world where everyone is eligible for subsidies, I’m scratching my head at what a state 1332 reinsurance waiver is supposed to be doing? A lot more imagination and possibility space will be open for a creative state 1332 that meets Obama and presumably Biden administration guardrails.

Mart

Would you get better coverage at lower cost by lowering the Medicare age to 60?, or is that too big of a legislative lift – big med not like it?

David Anderson

@Mart: It is a flip a coin analysis — a big question would be on take-up rates — do we think 60 years would sign up for Medicare like 65 years currently do…

StringOnAStick

@Mart: Lowering the Medicare enrolment age would sure help people in the 60-65 age group who either want to retire (and thus open up a job slot for a younger worker) or pursue individual employment full or part time (again, leaving their old position open to others) The cost of insurance is the block to that. It makes sense in terms of public policy for those reasons alone, and there’s plenty more reasons too. I would love to see your proposal happen.

Fair Economist

Always thought the 400% cliff was bad policy both economically and politically but I didn’t realize it was *that* bad!

Mart

@StringOnAStick: I was fired at 61. COBRA was crazy expensive. ACA was great if I kept our 1040 income low enough for subsidies. Eye opening for me was how shitty we were treated when asked what coverage we had. Extremely rude when I told them our ACA plan, snearing we don’t accept that here. When you did get in a lot of the offices were run down. Wait times could run three hours to see the Dr. And they always made us pay upfront for estimated out of pocket. Never had to do this before or since with company coverage. Once they realized we had money they had all sorts of tests and follow-up visits which I soon determined were BS. Anyway back to working for the man with a great healthcare plan. And back to us being treated like regular upper middle class old folks. A very small non painful glimpse into how the poor are treated in this country.

StringOnAStick

@Mart: We’re 63 and have retired, making zero income this year (we’ve been lucky and saved aggressively in order to do this), and when we got an ACA plan we bought the best one we could since it was subsidized, we pay an additional $500/month for it out of pocket. I’ve had to see a doctor and PT for an arm injury and so far everyone has treated us well, but that could be a function of the very friendly smaller city we moved to late last year.

It is such utter bullshit that the medical profession treats patients differently based on how well their insurance pays the doctor. There is so much that is wrong with the US medical system but that alone is high on the list of wrongs.

A good friend with his own business pointed out that having no way for middle aged or any aged people to take the risk of starting their own business because of the costs/risks of health insurance is a sure fire way to tamp down on innovation and small business creation. He was saying this as the 2009 recession ultimately forced him to close the engineering firm his father had started and that he had taken over a decade before.

Gus

I have not noticed a change in the quality of care when going from employer’s plan -> COBRA -> ACA in 2017-2018. Same doctors, same labs, same tests. I moved from Huntsville, AL to rural Illinois a year ago, no noticeable change in the quality of care. But neither area is what I’d call a booming economy and center of cultural excellence. Which helps explain how I can live comfortably on less than 400% of FPL. There’s nothing to do here, what with COVID, and my retirement plans are all on pause until maybe 2022?

It seems a no-brainer to limit my retirement income so that I qualify for the ACA subsidy during this pandemic. I’m single/divorced, 63 years old and retired. Last year’s income was 394.61% of FPL. My current premium is $540/mo on a $1290/mo plan ($750/mo subsidy). I’m still volunteering and contributing to my local animal shelter and meals on wheels program, and caring for my 88 year old mother. Meanwhile the 401(k) keeps growing.

Bob Hertz

1. Lowering the Medicare age to 60 is very attractive, but also very expensive. Medicare costs about $12,000 per person. The total number of individuals between ages 60 and 65 is about 21 million. Thus expansion would cost over $240 billion a year.

This could be paid for with a 3% increase in the Medicare payroll tax, paid by all ages. I do not think that would ever pass.

2. Gaba’s excellent work shows a savings of $17,000 for an older couple by wiping out the subsidy cliff. I am all in favor of that, though I do wonder how many couples like this will be impacted. Are there 500,000 such couples? That would be a budget cost of about $8.5 billion. I personally have no problem with that, but would Congress go along?