Last night, Congressman Neal (D-MA) released the chairman’s draft of the House Ways and Means Committee version of the reconciliation bill for COVID. It is about 200 pages. There are less than ten pages that requires my professional attention. The meat of the health policy is on p.84 of Subtitle G.

The short version of the bill is that for 2021 and 2022, almost everyone earning over 100% FPL will be eligible for an ACA subsidy and those subsidies will get notably bigger.

The long version is that this is an aggressive affordability attempt. It will make the 2022 market an almost entirely price-spread sensitive market. There are significant challenges on automatic re-newals as a lot of people could conceivably be placed in strictly dominated plans because in 2020 when they bought their 2021 plans, they purchased a lower premium but higher actuarial value plan from an insurer offering lower cost-sharing but higher premium options on the same network/plan type. They made those choices under a different subsidy system. However, it is likely that at least some higher premium plans with lower AV but on the same basic platform will now be zero premium plans. Actively aware individuals can make changes during the upcoming open-enrollment period. Not everyone is actively aware and involved. There will be people who are eligible for 87% or 94% Silver CSR plans with zero premium buying either zero premium Bronze or Gold plans in 2022. Fixing the automatic renewal process so that people are placed into plans with the highest actuarial value on the same fundamental platform of network, plan and plan type for a given premium will be an urgently needed update.

The second big question I have is if this passes in anything like its current form, what is the purpose of state subsidies like in California or 1332 reinsurance waivers for at least the 2022 plan year? Both of those are attempts to lower premiums for people who earn over 400% FPL. An 8.5% benchmark cap makes both state subsidies and 1332 reinsurance waivers irrelevant. So what happens to those funds. Thirdly, states that run a Section 1331 Basic Health Program where the state gets 95% of the federal subsidy that enrollees who earn under 200% FPL would other receive in order to provide a state funded and designed program that is effectively Medicaid Plus will see a huge cash windfall. The value of the APTC pass-through will skyrocket for two years.

There are a lot more things happening but these are things that stick out to me in this draft.

rumpole

Can you put this sentence a little more into layman’s terms? It sounds important but I can’t quite follow it:

There are significant challenges on automatic re-newals as a lot of people could conceivably be placed in strictly dominated plans because in 2020 when they bought their 2021 plans, they purchased a lower premium but higher actuarial value plan from an insurer offering lower cost-sharing but higher premium options on the same network/plan type.

CindyH

Just dropping in to thank you for all of your invaluable analyses of ACA. Now off to parse.

Xantar

Why is this only for 2021 and 2022? Is there any reason why they can’t make this permanent?

Brad F

The value of the APTC pass-through will skyrocket for two years

Why two years? NY and MN have arrangements with the feds that reset in 2023 and cant be touched at present?

Baud

@Xantar:

Probably reconciliation rules.

Another Scott

@rumpole: Someone bought a Yugo on credit because that was all they could afford. Suddenly, there’s a deal where a Corolla is the same monthly payment. Do they stick with the Yugo, or go through the hassle of the paperwork, etc, to get the Corolla?

I think it is something like that.

Cheers,

Scott.

dnfree

@Xantar: read the portion copied in the post that says it shall apply to fiscal years beginning after December 31, 2020. Doesn’t specify any end date.

David Anderson

Basically what @Another_Scott said

The ACA defaults people into the same plan that they had in Year 1 for Year 2. It takes an active choice to change the choice.

And that usually is good enough but when there is a big price or policy shock, strange shit happens. We had a big shock in 2018 with Silverloading, and this bill would be similar to Silverloading in that a lot of relative prices will move around.

So a system that puts people who are in a cheap Bronze plan in 2021 into the same cheap Bronze plan for 2022 will see those people eligible for a Silver or Gold plan (or even a better Bronze plan) for the same exact premium. That is bad. Our system defaults should place people into not horrendous dominated choices.

that is what I am worried about.

David Anderson

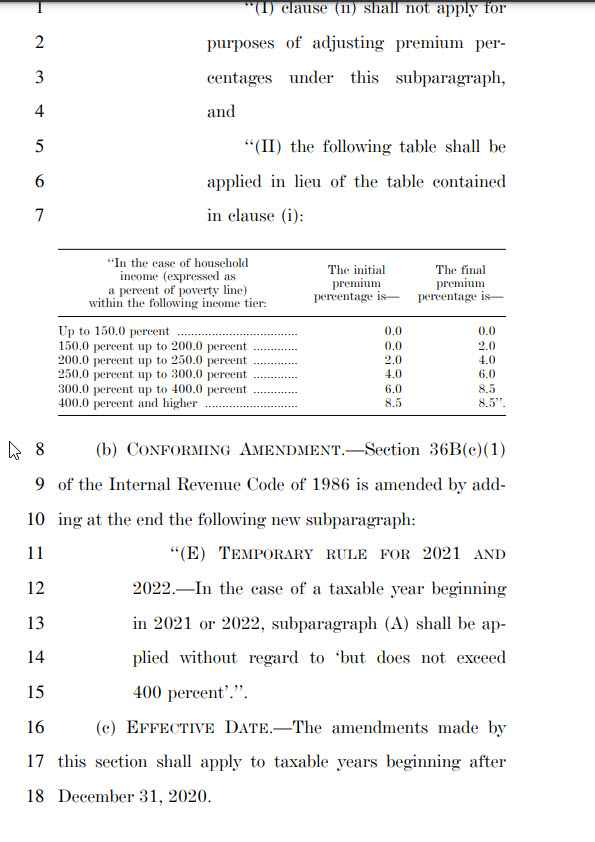

@dnfree: P. 83 is the time limiter

(iii) TEMPORARY PERCENTAGES FOR

2021 AND 2022.—In the case of a taxable

year beginning in 2021 or 2022—

The big thing on the 2 year window is to keep the number down to a $1.9 T total.

Jaysails

Wondering how they’re calculating either income or premiums where household members don’t share a plan: e.g. one spouse on the Marketplace, one spouse on Medicare. Is “income” just the Marketplace participant’s income? Or is it both incomes? And in that case, do they also include the Medicare premiums in figuring out 8.5% total allowable premium? This is our position, and we are in a (weird, I think) position where it would make a difference).

David Anderson

@Jaysails: go talk to a Navigator!

Adam Lang

“…they purchased a lower premium but higher actuarial value plan…”

If the plan is high AV and low premium, how is that ever dominated? Unless you are saying that there is now a plan that is (also) zero premium (under the new regime) and even higher AV, which you don’t state clearly.

laura

I’m paying $1,743 per month covering me 61 and spouse 63 next month for our Kaiser plan off the exchange. It’s a bronze plan and we choose it to keep our doctor who is an excellent partner in health. It’s more than our mortgage. We had 100% employer paid coverage through a multi-employer plan that we could have stayed with when I retired in September, but the cost per month would have been over 2,400 per month for plan year 2021. Our annual utilization is very low – maybe we see the doctor 2 or 3 times each per year. Huge income drop at retirement, but not enough to qualify for any subsidy yet. We are hoping that there will be a lowered age for Medicare buy in or qualifying for a subsidy for plan year 2022. The burn rate on savings is sobering.

WaterGirl

@laura: Holy shit that’s a lot of money.

CaseyL

@laura:

Holy shit. I remember pricing insurance policies before the ACA existed, during a lull in employment. Allowing for inflation, the premiums I was seeing were comparable to what you’re paying.

My point being, what you’ve gotten from the ACA is comparable to prices I saw in the bad old days before there was an ACA.

Jeez.

sab

@CaseyL: And her insurance will work, unlike individual market pre-ACA, where they took your premiums for years and then cancelled for newly discovered pre-existing conditions when you finally had a health issue

ETA: I was paying $1800 a month for a silver plan under ACA before I aged into Medicare.

laura

Thank you all for the feedback. My comment wasn’t intended to garner sympathy but instead to show the cost of carrying the full freight of coverage absent an employer group plan. I knew I was taking a risk in retiring if Biden hadn’t been elected that we’d become uninsurable if the ACA was eliminated – and that we’d heave our asses back into the workforce if work would have us. We scrimped and saved enough to pay for healthcare until Medicare eligibility – but we’d sure rather use it for other economic activity.

I am convinced that there is a huge number of workers that would retire yesterday if they could afford health coverage – saw it first hand with public works workers who are desperately trying to avoid loss of employment due to physical condition and employers with aging, broken workers. If they can leave the workforce with slightly more than a shoe box, curtain rod and sparrow it would create a demand for labor in younger cohorts and, well I’m heading into Veblen territory.

CaseyL

@sab: That was notoriously true in many places, but not in my state, where we have a very strong Insurance Commission office that doesn’t hesitate to levy sanctions against non-compliant insurers.

JaySinWA

@laura: Does Kaiser not offer an ACA plan in your state or is the bronze plan cheaper for your income?

I haven’t looked at WA Kaiser ACA rates since we are Medicare age so I don’t know what the price points are.

Bob Hertz

Thanks for sharing your story.

You would seem to be a good candidate for short term health insurance – assume no pre-existing conditions — and that would cut your insurance costs by more than half.

However this product is not available in California.

Still, to have retired at a relatively young age and still have an income too large for subsidies — in most states, people would be jealous.