At the Journal of Health Care Finance, Jean Abraham, Sih-Ting Cai and myself have a short policy focused blog to pay for quality on the Affordable Care Act’s individual health insurance marketplace. Some of our previous research, with an additional co-author in Coleman Drake, had found that Medicaid Managed Care organizations had lower than average effectiveness of care ratings and behavioral health ratings. We were curious about the quality of some of the most commonly bought plans on Healthcare.gov.

The ACA used a price-linked subsidy system to make insurance available and at least theoretically affordable for individuals who report between 100% and 400% of the Federal Poverty Level. This price linked system is based on filling the gap between an individual’s contribution which is defined as a percentage of the household’s income (lower income = lower percentage) and the gross premium of the second least expensive silver plan that serves as a local benchmark.

Most people, most of the time are not actively involved with the US healthcare system. This means that the marginal buyer is buying on monthly premium. The lower the monthly premium that an individual will be paying, the more likely a plan will be purchased by someone who is flipping the coin as to whether or not they will buy any plan. Few other characteristics are highly valued.

So the combination strong price sensitivity among marginal buyers and relative indifference to most other characteristics interacts with the price linked subsidy system to create a strong incentive for insurers to offer plans at as low of a price as possible for a metal band. The dominant motivation of an insurer that is seeking to sell to price sensitive buyers is to drive the price down as much as possible while ignoring most other characteristics.

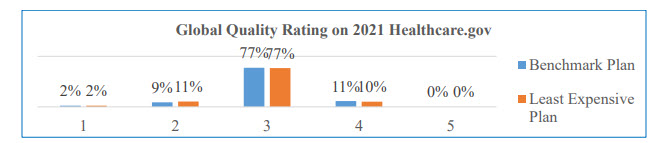

The Center for Medicare and Medicaid Services uses the QRS system to survey health plans over a several year period to assess health insurer quality.  The Global Rating ranges from 1 to 5. 5 is the best. We matched the 2021 QRS Global Rating score to insurers and then linked this data to the insurer offering the least expensive plan and the benchmark silver plan on Healthcare.gov in 2021. We looked at the distribution of quality.

The Global Rating ranges from 1 to 5. 5 is the best. We matched the 2021 QRS Global Rating score to insurers and then linked this data to the insurer offering the least expensive plan and the benchmark silver plan on Healthcare.gov in 2021. We looked at the distribution of quality.

About 90% of counties that had data for both the cheapest and the benchmark plan sold on Healthcare.gov in 2021 had the plans offered in these positions have a rating no greater than 3. This is mediocre quality.

And at the same time, this makes sense if we assume that investing in quality may not lead to short term pay-offs in the form of either longer enrollment or lower claims costs. The ACA market has a significant amount of churn and disenrollment. People get in and people jump out. There is some inertia as people who buy in one year need a bit of a kick in the pants to change insurers in the following year if they stay within the ACA market. But insurers are seeing short horizons where any investment in quality or anything else has to pay out quickly. That is a tough hurdle. And then the incentive is to offer low premium plans.

This could be problematic if we think that plan quality matters. There is emerging evidence that there are notable mortality effects between high and low performing Medicare Advantage plans. If we think that this generalizes to the ACA (and other insurance programs like Medicaid) we should care that the most commonly offered plans have modest quality ratings at best.** But under current law, the business case for an insurer to spend money on improving quality and hopefully quality ratings is a hard case to make. A low quality insurer that spends nothing on quality can usually get to a lower price point and get the enrollment of people who are unlikely to touch the medical system compared to a high quality insurer spending money that does not attract incremental enrollment. Risk adjustment will shift some money from low cost and low morbidity insurers to high morbidity and likely high cost insurers, but we should never assume that risk adjustment will be perfect.

We propose that the price linked subsidy system that defines the ACA borrow a page from Medicare Advantage. We could modify subsidies so that the price linkage is held constant for any plan that is a 3 or less while plans that have a global score of 4 or 5 would see buyers get a subsidy booster. Doing this would change the business case for insurers to invest in quality on the ACA exchanges as there are situations where higher quality plans could be less expensive to buyers than low quality plans or more frequently. the premium differential would notably shrink and become far less of a barrier to purchase.

** Yes, this assumes that the quality ratings actually are mostly reflective of something that we can all agree is actual quality versus check the box or drunks by lampposts data mining

Another Scott

Sounds like a great idea. Robert Pirsig would be proud.

Thanks very much.

Cheers,

Scott.

Butch

Doesn’t the fact that the business case for quality is hard to make say everything you need to know about the private insurance industry?

dr. bloor

I’m a little confused–are they rating their health insurance plans or the access to and quality of the health care they received with the plan?

David Anderson

@dr. bloor: The global rating is a composite rating of clinicial care (mainly HEDIS measures), customer experience, and care management attributes.

5 is high

1 is low

Mart

When we were on an ACA plan there was a real bias against us. Many networks refused our business, pay up front, etc. Don’t know if that impacts quality, the general treatment just missed us off.

Ken

If it’s data mining, the algorithm did a good job of forcing the data into a (discrete) bell curve with mean 3 and standard deviation about 0.9.

dr. bloor

@Mart: That’s probably a reflection of the insurance company you went with rather than getting a plan through the ACA exchange per se (if you had a choice of insurers). In Rhode Island, your choices are Blue Cross or Neighborhood Health. BC is far better than NH, but that’s equally as true for their non-exchange plans.

Mart

@dr. bloor: It was a Cigna plan at first, but when you told them the plan code letter, that is when we got the cold shoulder.

dr. bloor

@Mart:

The code letter might have tipped them off to the benefits–maybe a large deductible that requires prepayment?–but no one makes a distinction between ACA and non-ACA. As far as the doc’s office is concerned, there are only benefits (or lack thereof).

Mart

@dr. bloor: All the tut tuts, sniff sniffs, lack of access to long term providers, and prepayments dissapeared as soon as I went back to a higher deductible plan from my new job. Maybe I am missing something.

laura

I’m hoping that one day – sooner than later, healthcare coverage eats less than 50% of my income. Currently, we could buy another home with the premium. Sadly, we need coverage and do not need a second home.

dr. bloor

@Mart:

Weird. Never heard of an experience like that before.

Although maybe it was the “Cigna” thing specifically. You never hear healthcare folk refer to Cigna without prefacing it with “Fucking.”

David Anderson

@laura: expect April to be that case

dnfree

I enjoy these posts so much, partly for thought-provoking content, and partly just because it’s fun to watch someone who really enjoys their job. I am retired, but I really enjoyed my job also–not every single day, but the big picture. You’re having a chance to do interesting research and also have an impact on the real world for real people.

laura

@David Anderson: ? David, I cannot tell you just exactly how grateful I am for your ‘splainers over the last few years so that when it was time to select a plan off the ACA when I retired, I was able to make a choice that was meaningful in the forest of options. Spouse and I share a young PCP and she’s been a true partner in health. Keeping our Kaiser doctor was the sole concern and we could sort plans by which one’s she was available in. Many Gracias.

David Anderson

@dnfree: Today was definitely one of those potentially high impact days… I can’t say much but several conversations I was in today that built on my research and interests have a chance of making the lives of a good number of people a bit better.

dnfree

@David Anderson: Well, then, this is the kind of reply that I wish I had a “Like” button for!

l3000

This was interesting info. And makes me hopeful for future improvements. One thing never taken into account (because it’s out of fed control) is the problem of red states. Currently unemployed, so no health insurance for me. Because KS limits medicaid: no single adult under 65 without disability gets medicaid. So I’m out of luck until someone hires me or I turn 65 (3.5 yrs and counting). Just would like to point out that this never gets mentioned in any article anywhere ever. It’s a state problem but it’s still a problem for national health insurance coverage.