The Affordable Care Act’s subsidy system only applies to benefits that are categorized as part of the Essential Health Benefits (EHB). EHBs are determined by each state and they vary. Typically the EHB package is benchmarked against the benefit set of a commonly sold commercial plan in the state. Insurers have the option of adding benefits to any policy that they sell. These are called non-EHB benefits and the buyer, even if subsidized, has to pay the full incremental price. Some states require non-EHB benefits. The most common state-mandated non-EHB benefit is elective abortion coverage. However there are other non-EHB benefits and these can prevent individuals from being exposed to zero premium plans.

Zero premium plans have notable length of coverage effects due to lower administrative burden. Zero premium plans for individuals earning under 150% FPL have always been available but mostly have been Bronze plans. The under 150% FPL cohort has been buying Silver CSR plans overwhelmingly so these plans are not particularly relevant. However, under the new House Ways and Means committee reconciliation draft, a household earning under 150% FPL would be expected to pay nothing for the EHB component of the benchmark CSR eligible silver plan. Zero premium plans would proliferate.

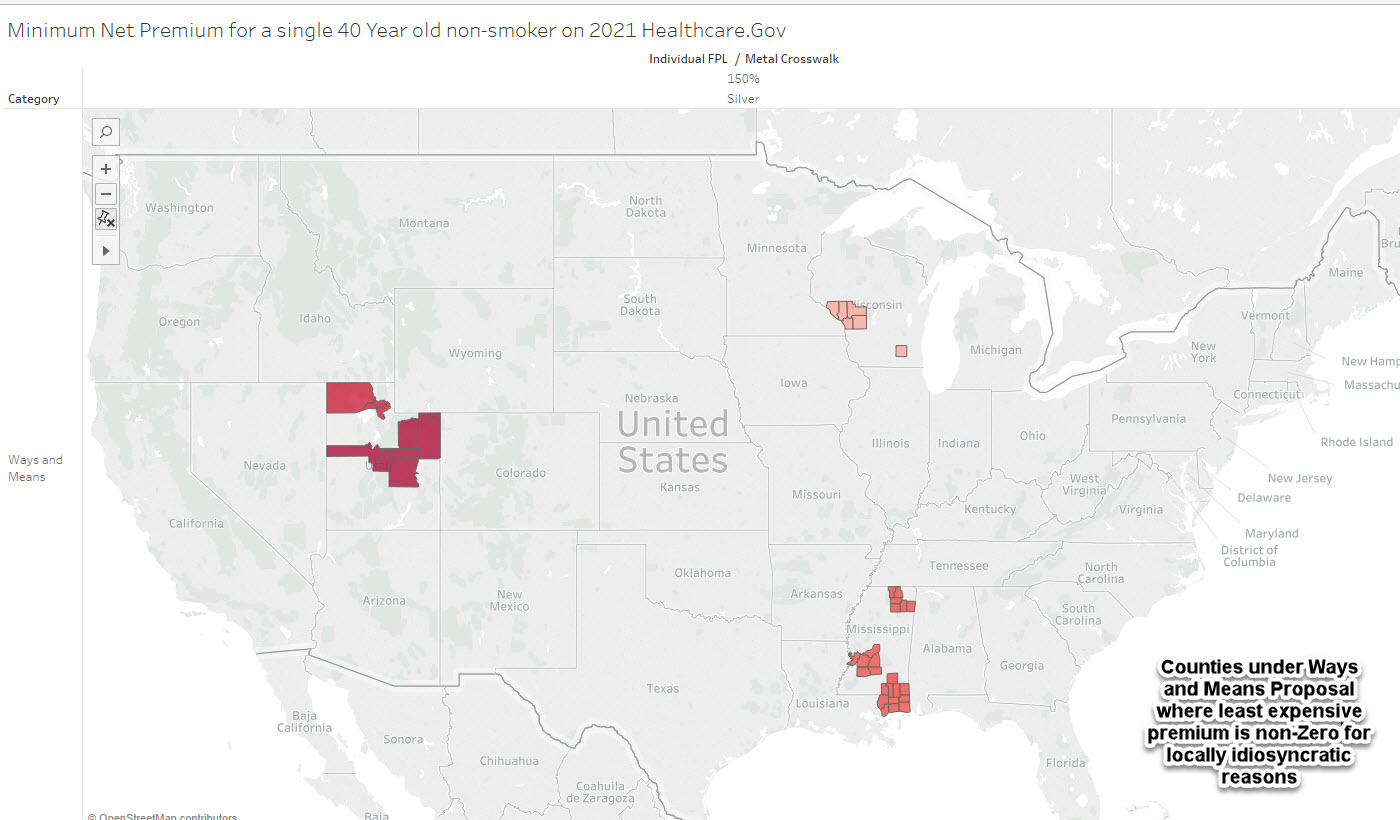

But there are pockets across the country where zero-premium plans are not occurring. Some states require elective abortion coverage. The cheapest plan will be a dollar per month to cover these benefits. However, other states, like Utah does not require elective abortion coverage. Insurers are allowed to design their plans to be all-EHB or add in non-EHB plans.

We see this in Box Elder County Utah and La Crosse County Wisconsin where insurers offer the benchmark and least expensive silver plans (EHB component only) but have very small added non-EHB benefit categories. In Box Elder County, these benefits add $1.36 per month in premium for a single 40 year old non-smoker. In La Crosse County, these added benefits add $0.16 in premium. Other insurers in each of these counties offer 100% EHB only plans. These are tiny benefits. However they are benefits that impose comparatively massive transaction costs.

We know that new buyers are mostly price sensitive. New buyers will buy the cheapest thing available. In most of the country, the cheapest thing available to families earning 150% of less with the Ways and Means proposal will be a choice of two zero premium silver plans. However this will not be universally true. It is not true in states where insurers must offer coverage of elective abortions due to the politics of Hyde/Stupak. There states are trading off administrative burden and access to a needed but politically fraught medical service. It is not true in chunks of Wisconsin, Mississippi, and Utah on Healthcare.gov where insurers that offer the least expensive or benchmark EHB component silver add on non-EHB services. This is problematic as there is little policy trade-off for a $0.16 per month benefit and several orders of magnitude greater administrative burden.

If I was the insurance dictator for a day in these states, I would require insurers to offer EHB only plans for their cheapest offering in each market. If they see a significant business case to add a minor benefit that is not subsidy eligible, then they could add it as the 2nd or 44th price ranked option (actually I would have something to say about offering 44 plans too).

Choosing insurance is tough. Imposing disproprortionate burdens for no gains makes it even tougher.

Brad F

David

This is an interesting insight.

How folks respond, even to a 16 cent bump in premium, is contingent on choice architecture and any state-based tweaks the regulators in their DOIs make to their sites (if they are allowed)?

It’s one thing to be 44th on the list of similar plans, but another with bold font, a star, and larger font expressing what the small additional charge buys you. That strikes me as way more important the added cost that interested parties might be willing to pay if only they saw the option clearly.

Brad

Jaysails

Agree that this is a stupid design. I seriously disagree with calling abortion coverage a minor benefit, however. If you need one, it’s not minor.

PenAndKey

As a born and raised resident of La Crosse county I can safely say that, as much as it pains me to say it, I’m not surprised to see my home area called out here. Right now the county is more concerned with the fact that our regional airport has apparently been leaching flame retardant chemicals (PFAS, specifically) from the runway into the local water supply for decades and contaminated a large chunk of the private well serviced French Island area. And for those not familiar with the area, French Island is an island in the Mississippi waterway so their water supply? It sits underneath the river. I haven’t seen any reports about it yet, but I can’t see how it got into their water supply without also getting into the river and downstream areas. That’d they’d also screw this up? Sounds about right.

David Anderson

@Jaysails: I am seperating non-Hyde abortion coverage from the other non-EHB services being offered for precisely the reason that you raise.

David Anderson

@Brad F: Under current law, most of the counties highlighted with a non-abortion related non-EHB charge on either the benchmark or cheapest silver plan would already have a non-zero premium so the current presentation is that someone earning just below 150% FPL would be paying a $50.16 premium instead of $50.00 EHB only premium. In that case 16 cents only matters so much as it might marginally deter one person in a very large number from buying insurance. It does not impose new transaction costs.

Under the House Ways and Means proposal, the individual would be facing a $0 premium with no payment system set-up transaction costs OR a $0.16 premium with significant payment system transaction costs….

Another Scott

I’m not seeing why the administrative burden is higher for non-EHB supplements. Is there something about the PPACA that mandates different and more expensive administrative and payment paths in such cases? If so, could the Congress fix that by changing the law? Or could they set up a payment system to automatically cover those costs (even via some slight-of-hand the way abortion coverage is done (as I understand it))?

I’m not a fan of making systems more complex to solve problems caused by complexity, but I understand the “5” in 218-51(60)-5-1. Grrr….

tl;dr – more words please.

Thanks very much.

Cheers,

Scott.

David Anderson

@Another Scott: Really easy.

We assume that a zero-premium plan reduces administrative burden as there is no need to set up a payment mechanism.

Insurers have to offer all EHB and can choose to offer or not offer non-EHB benefits in addition to EHBs. Gross, headline, premiums are the sum of the cost of providing EHB and non-EHB. Federal premium subsidies only apply to EHBs.

A plan that is only EHB benefits has a chance of being a zero-premium plan. Under current law, the cheapest silver that is 100% EHB only might be a zero-premium plan given the right combination of age, household size, income and plan offerings in a county. Under Ways and Means, a 100% EHB silver plan that is either cheapest or 2nd cheapest (benchmark) will be zero premium.

Adding even a penny of non-EHB benefits to both the cheapest and benchmark silver plan guarantees that a zero premium silver plan under the Ways and Means subsidy table can not exist. And that increases administrative burden under this proposal.

This is not a Supreme Court problem — it is original legislative text to keep the government from paying for abortion services and peoples’ gym memberships (among other things)

Kent

So this weekend I started the process of trying to get my 55 year old brother onto his first ACA plan. Some questions and confusion and I welcome any advice.

First he lives in Alaska and which is a medicaid expansion state that uses the federal exchange. I went on the exchange on his behalf and it turns out he is right at the borderline of 138% of poverty level so can go either way, an ACA plan or Medicaid. His 2020 income put him below the 138% but he is also a tile and stone contractor with an aggressive accountant and so they managed to take probably $45,000 of income and push it down to about $18,000 with aggressive business deductions. He could easily be slightly less aggressive in 2021 to qualify for an ACA plan. So…questions.

First, given a choice between ACA and Medicaid, is it the obvious choice to go with a Blue Cross ACA plan? I’m not really sure which way to advise him here. He has the ability to manipulate his income to go either way.

Second, the exchange threw up two Blue Cross Silver plans that were about $300 deductible and $700 annual out of pocket for about $70/mo. vs a gold plan for $10/mo. with much higher deductibles and out of pocket annual expenses. My inclination is to push him to a silver plan. I was surprised to see that the gold plans were less generous and less costly.

These are the three plans that the ACA marketplace threw up when I entered an annual income of $22,300 which is just about the 138% limit for Alaska and slightly more than he declared for 2020. I copied the healthcare.gov results to flikr to post them here:

Gold 1500 plan: https://live.staticflickr.com/65535/50970038746_d7fa6a61e3_b.jpg

Silver 3000 plan: https://live.staticflickr.com/65535/50969338608_0a723678de_b.jpg

Silver 4500 plan: https://live.staticflickr.com/65535/50970146312_7e68f2d6f0_b.jpg![]()

Which plan would you guys advise I steer him towards? He has no chronic health issues, just needs some decent insurance.

David Anderson

@Kent: Honestly, I would check the networks in Alaska Medicaid and see if his preferred doctors/hospitals are in the Medicaid network. Recent research on folks who were just over/under the Medicaid to ACA line in Colorado found similar health outcomes, but Medicaid had far less out of pocket spending. Medicaid might be better.

Another Scott

@David Anderson: Thanks, but I’m still missing something.

Guttmacher (from 2015):

Ok, I understand and agree that this non-EHB benefit (imposed because of RWNJs in Congress) has been in the PPACA from the beginning and increases costs. And that states requiring abortion coverage or not introduces complexity (and real hardships for those who need the coverage and cannot get it!).

But isn’t this a special case? Why are other non-EHB benefits as burdensome? Insurance companies are used to collecting money from several pots – premiums from policy holders, payments from companies, payments from other insurance companies (e.g. fighting over who pays in traffic accidents with “medical payments” coverage), payments from governments, etc. Isn’t getting money from another payor these days ultimately just a matter of clicking some box on a form and waiting? (And then fighting with them to actually get the money, but that’s a given with any payor isn’t it?).

I understand the friction for people deciding to buy a policy, and the issues in getting people to pay for the policy at the right time to get coverage (as you outlined immediately previously). So I see the issues for the real-world person trying to pick a policy. I just don’t see why it’s a huge burden for the system for non-abortion non-EHBs.

Maybe it’s a matter of emphasis. Or the contrast between the best case (no friction at least for the policy holder) vs any friction at all?

And it is an unalloyed good, is it not, that Democrats are expanding the universe of coverage even if there are still friction points?

Thanks again. I appreciate it.

Cheers,

Scott.

Kent

He doesn’t have any doctor period, much less any “preferred” doctor. He lives in Juneau which has the one regional hospital for all of Southeast Alaska and I’m sure is in-network for both Blue Cross and Medicaid. Anything beyond that and he is doing medivac to Harborview in Seattle.

I’m just trying to get him some sort of catastrophic coverage in the event he has some major medical issue in his late 50s like cancer or heart surgery or such. He is very much the opposite of a frequent user.

David Anderson

@Kent: Get him to apply for Medicaid; and if Medicaid says no, sign up for the CSR Silver plan (the CSR benefits bump up the silver benefits so that they are better than Gold, and the Silverloading stuff I talk about all the time is why Gold is cheaper than silver…. don’t explain it, just accept it and avoid the cross-eyed headaches.)

David Anderson

@Another Scott: Right now under current law, the friction is the same for the 2nd least expensive silver plan that is 100% EHB and one that is only 99% EHB and 1% non-EHB. In both cases, the buyer needs to set up a payment system.

Under the COVID relief bill that is going through reconciliation, there will be a difference in friction. One will be easy and the other will be challenging.