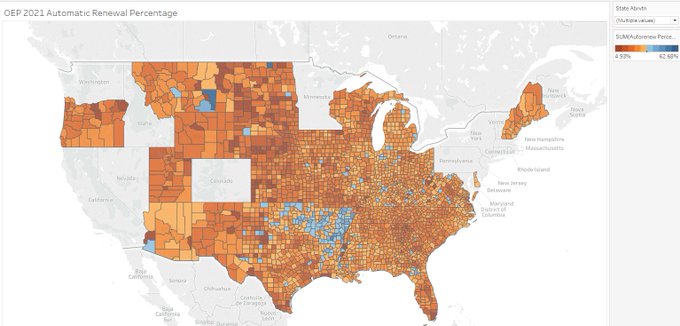

Last night, CMS released the 2021 Healthcare.gov Open Enrollment Public Use Files. One of the things that immediately stood out to me was the wide variance in the importance of automatic re-enrollment for Healthcare.gov. We have found that it has a massive association with increased enrollment. Automatic re-enrollment significantly reduces administrative burden by allowing people to not have to do anything to keep their current plan for the next year.

There is tremendous variation though. Nationally, about 21% of enrollment was through the automatic re-enrollment channel. Sargent County, North Dakota has less than 5% of the county enrollment coming through the automatic renewal channel. Rosebud County, Montana and Rolette County, North Dakota each have more than 60% of their enrollment coming through the automatic re-enrollment channel.

Why does this matter?

Automatic re-enrollment significantly lowers the cost to maintain coverage. However, it also likely to significantly increase the risk of an objectively poor choice for the future year plan. This is true in all insurance markets. It is especially true in the ACA markets as the combination of a price linked benchmark that is dependent on both own-insurer strategy, own-insurer pricing changes and other insurers’ choices, people can yo-yo from low cost to high cost insurance if they do nothing.

This will be especially true for the 2022 plan year as there will be a massive price shock of the new ARP subsidies that will both rejigger relative prices (a lot more people will see zero premium plans) and change insurer strategy as to what they offer and at what relative and absolute price point.

Automatic re-enrollment is a powerful tool but it comes with trade-offs on the quality of choice. I think that there are behind the scene tweaks and technocratic tinkering opportunities that can amerliorate some of those trade-offs and that these tweaks can be implemented fairly quickly.

rmjohnston

Take the baseline silver plan and all silver plans with premiums no more than 10% higher than baseline and re-enroll people automatically in one of those plans at random. The insurers will now have incentive to compete to set the baseline or be shut out of a huge segment of the market, and no one gets stuck with an awful plan.

Does that work, or is there something I’ve missed?

Spartan green

Off topic question I’ve been meaning to ask. Can you talk about the difference between Medicare advantage and Medicare supplemental? I have advantage for my husband. I think I like it ok. Now I have to make the choice for myself and I’m wondering what the best option would be. I’m 3 months out from 65 and I’m getting bombarded with phone calls.

David Anderson

@Spartan green: Really good question.

Medicare is effectively 2.5 programs now.

Traditional Medicare pays for hospitals and doctors on a fee for service basis. It has cost-sharing and no limit to total exposure. A Medicare SUPPLEMENTAL plan is an add-on, voluntary insurance contract that covers some of that cost-sharing and may have a limit to personal costs if you get hit by a meteor/run over by a dinosaur.

Medicare Advantage is a private company offering an insurance contract that replaces Traditional Medicare. It will often have a more limited network and a different cost-sharing arrangement than Traditional Medicare.

If you have Medicare Advantage you don’t need a supplement.

If you have a supplement, you can’t be on Medicare Advantage.

More later this week.

David Anderson

@rmjohnston: people value networks and relationships with their docs.

And we have some automatic re-enrollers who are making an active choice to be automatically re-enrolled because they are happy enough with their situation.

sab

@David Anderson: My husband has back problems, so his most serious medical costs involve surgery scheduled in advance. So he can easily stay in network with a Medicare advantage plan.

I have a heart defect that causes occassional arrythmia problems, so my serious medical costs tend to be sudden onset.

We hope to travel in retirement. I don’t want to be across the country and out of network when my heart acts up. So I have a supplemental with a national network. Spouse figures his back problems will all be dealt with through scheduled physical therapy or surgery back home.

Does our reasoning make sense in the real world?

Frank Wilhoit

David,

Quasi-OT, but someday will you do a longform on subrogation?

Thanks in advance,

FW

.

Spartan green

If I pick an advantage plan, do I have the option of changing to supplemental? Also, I don’t understand the letter system

Four Seasons Total Landscaping mistermix

When I see counties near where I grew up included in statistics that involve percentages, I like to look into the details, because there are a lot of small counties, and a lot of counties that are basically reservations, out there:

Sargent County ND population 3,872. A couple of families move out and your stats skew all over the place.

Rosebud County, MT, pop. 9,152, big part of it on the Northern Cheyenne Reservation which means a lot of poverty. It also raises the question of how Indian Health Service-eligible patients are counted relative to Obamacare (if you’re an enrolled tribal member, you get IHS services). If everyone who is IHS eligible is counted as a re-enrollment, that would skew the stats.

Rolette County, ND pop 13,937 – Turtle Mountain Reservation is a big part of the county, same question as Rosebud.

David Anderson

@sab: That is reasonable logic.

My parents went Traditional Medicare + Supplemental as they travel enough (non-pandemic times) up and down the East Coast that they wanted national access.

David Anderson

@Frank Wilhoit: Going to try to avoid subrogation as I don’t understand it well enough to explain it.

David Anderson

@Four Seasons Total Landscaping mistermix: Agreed that small numbers do weird things as percentages — each of these counties have a couple hundred enrollees, and the reservations have a different set of benefits and choice parameters than most of us, so that could explain the outlier status.

Ken

Language!

Barbara

@Spartan green: If you are basically healthy and not taking expensive medications, one thing to remember is that your choices will likely be less consequential in the short run. Having said that, when people ask me about Medicare Advantage, I direct them to the Medicare.gov plan finder tool, as a place to start, first, by seeing if hospitals or doctors you know you want to have access to are in the network. You can also obtain information about any medications you might be taking, which is recommended if you are using a branded drug product.

Medigap (the shorthand for Medicare supplemental plans) gives you more flexibility, but it does mean you have to sign up for a standalone Part D plan. Otherwise, you will face late enrollment penalties if you try to get a drug plan later. The “all in” costs for the various options depends a lot on local plans, but it’s worth comparing.Some things to consider:

1. You can join an MA plan during open enrollment periods every year. There is no penalty for enrolling in MA later rather than sooner.

2. Rules for Medigap have been changing, but your right to sign up without underwriting (as in, health scoring) could be limited to the first year in which you become eligible and under a few other circumstances. This might vary by state and feds might adopt new rules as well, so definitely get specific advice regarding your state. This difference means that if you are on the fence and really don’t know what you want, you are probably better off going the Medigap plus Part D rout initially, unless there is a difference in cost that is material to you.

3. Ask yourself some questions about your lifestyle, which might make a big difference — for instance, do you spend a lot of time at a second home or in a distant location with your adult children? If you do, then your “in-network” MA choices might not be sufficient for your circumstances.

4. On the other hand, if you have complex medical needs and don’t travel and you really value coordination, some MA plans are likely to do a better job than the fragmented game of hopscotch that fee for service beneficiaries frequently encounter.

Mudbrush

Keep in mind that medicare advantage plans cost the government 2-5 % more than traditional medicare, because, you know, it’s private health insurance, so they need their pound of flesh. Also, it being private insurance, if you like all the hassles of dealing with insurance companies, you’ll love medicare advantage! I can Tell you horror stories from dealing with my mom’s medicare advantage provider…

Frank Wilhoit

@David Anderson: Merciful Heavens! If you don’t understand it, then (as one had suspected) nobody does. Quite briefly, for the benefit (? ??) of anyone who has not heard the term, it refers to insurers shifting blame — and, with it, responsibility for payment. That is obviously only the tip of a very dirty iceberg. What a shame; I was looking forward to the definitive discussion, in your inimitable style.

Barbara

@Frank Wilhoit: Subrogation in what context? Medicare? Medicaid? Or something else?

Kelly

@David Anderson: Looking forward to this. I’ll be 65 in June. Your Obamacare writing has been useful evaluating Medicare choices. I’ve been on Kaiser for the last several years. It’s been fine but I’m healthy, only needed vaccinations. Initially joined because Kaiser was significantly cheaper than the other Obamacare choices. I’ve grown to like that all my medical folks work for the same organization. Wish it was nationwide.

Barbara

@Mudbrush: No, don’t keep that in mind. The federal government does what it does. Individual beneficiaries should consult their own needs. Beginning in 2010, the feds began shaving the excess that had been granted to MA beginning in 2006, and by 2017 per capita revenue for most plans is based on fee for service spend, but it’s actually a complex undertaking to understand the fiscal impact of MA plans on overall Medicare spend.

David Anderson

@Frank Wilhoit: There are plenty of people who know it really well. I never spent much time hanging out with the third party liability teams — maybe 3-4 cups of coffee over 6 years at UPMC — as their work never bumped into my universe of concerns.

Steeplejack (phone)

I have a Medicare Advantage plan with Kaiser Permanente, and I like it a lot. They have their own doctors and medical facilities, so the experience may be different from a plan put together by a “pure” insurance company.

They also cover you for emergency and urgent treatment when you travel. Fairly detailed FAQ here. And I believe they have an add-on plan for regular care if you spend a lot of time at a second location.

I would not rule out Kaiser simply because you “travel a lot” or “it’s not nationwide.”

Brachiator

@Barbara:

I really did not understand this as a key difference in types of plans. The potential impact of travel. Makes sense.

I am not sure that this is spelled out clearly in deluge of Medicare info that is sent out.

Thank you, and a thanks to others who commented on this.

Mudbrush

All those phone calls and mailers you get when you are about to turn 65 urging you to get their MA plan, and the endless tv commercials you see around enrollment open season (lookin good Joe Namath!) ? All that is money the private insurance companies are not spending on health care for seniors. Why people are gung ho to support private insurance companies when they retire while bitching about them when they are at the mercy of them via employee provided health care is beyond me. MA is the insurance industry’s bid to privatise all of medicare. Me, I still want a national health insurance system that dies not subsidise the insurance industry (unless you want extra). I guess that makes me a commie these days.

Barbara

@Steeplejack (phone): No, but if you spend six months in Florida and six months somewhere else, Kaiser would likely not be optimal. That’s what I mean. You might want to get routine care in multiple locations.