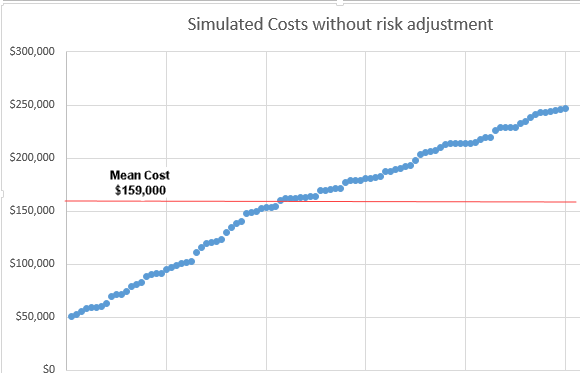

I’ve been reading risk adjustment papers this week. Some of them are technical reports while most of them are analysis of population health programs that show that there is significant selection occurring in voluntary programs because the business case incentives lean towards game playing instead of taking care of people. I want to do some writing to think through the issue. All numbers are completely made up. The graph below is for a hypothetical disease where costs vary between $50,000 and $250,000 with a uniform probability of any one individuals’ costs being anywhere in that range. All of these assumptions are pragmatically problematic, but they allow for simple toy thought models to be constructed.

Let’s assume that there is a population health model in place for these 100 people. The model is voluntary and it pays average costs (~$159,000).

Let’s assume that there is a population health model in place for these 100 people. The model is voluntary and it pays average costs (~$159,000).

Let us also assume that the potential risk bearers (individual doctors, physician groups, hospital systems, insurers etc) have some ability to fairly cheaply and reasonably accurately and fully legally guess whether or not the person that they could voluntarily treat will be in one of two categories: CHEAP or EXPENSIVE.

The screening protocol is not perfect as someone who is expected to be CHEAP could be wicked EXPENSIVE but it is pretty good.

So what happens?

The model is cream-skimmed to death.

The business case here is really straightforward — the only people who are treated in the model that pays ~$159,000 are people who are expected to be CHEAP. This leads to very profitable patient selection as the average payment is way above average actual costs within the model. People who are expected to be EXPENSIVE are only going to have a positive business case for treatment within the model when the preliminary screening program wrongly classifies them as CHEAP instead of their actual state of EXPENSIVE. These individuals will get their care either outside of the model or not get care at all.

Why does this matter?

We’re moving towards more population health bundles even in the context of significant individual level variation of health status and expected costs even after group risk stratification. If we’re not risk adjusting bundles to appropriately align payment with roughly expected average costs for an individual then we’re creating strong incentives for risk bearing clinical groups to figure out ways to identify CHEAP vs EXPENSIVE individuals and target only CHEAP individuals within the bundle payment mechanism.

Big R

I may not be following the game perfectly, are you saying that setting payment rates based on the mean patient cost incentivizes providers to…what? What does the provider do if the screening tags the patient as EXPENSIVE? How do we get from a machine blinking EXPENSIVE to the patient walking out untreated? And is this an issue that can be fixed through cultural processes (i.e., better management of professionalization rather than through profit incentives)?

WeimarGerman

This is currently being done by nearly anyone who can afford to build risk/stratification algorithms using artificial intelligence/machine learning approaches to classify people into these buckets. See, https://www.wsj.com/articles/mayo-clinic-others-use-ai-factories-to-speed-ai-development-11621330202 and https://science.sciencemag.org/content/366/6464/447

WeimarGerman

@Big R: A friend was receiving robo-calls that started with “how are you feeling today?” If he said anything negative, the call hung-up. When he said he felt fine, the call continued to invite him to sign up for a Medicare Advantage program.

Another Scott

Simple models are good. Krugman is a big fan, and you know where that got him… ;-)

What happens when you add Reinsurance (for “catastrophic” cases) to this model? I assume it gets even worse unless there are strong guard rails in place. After all, if they can unload even a small fraction of the EXPENSIVE folks onto someone/something else, it helps their bottom line even more, no?

To be clear, I understand that life isn’t simple and forcing insurance companies to go out of business by paying for the $1M/month case when that isn’t built into the premiums isn’t helping anyone. But clever people earn their pay by finding ways to make money off of corner cases…

Thanks as always.

Cheers,

Scott.

Matt

@Another Scott:

Counterpoint: letting them stay in business and collecting premiums while refusing services to paying customers only helps insurer’s stock prices.

They’re an INSURANCE company. If they don’t know how to price tail risk, they should go out of business – it’s literally their JOB.