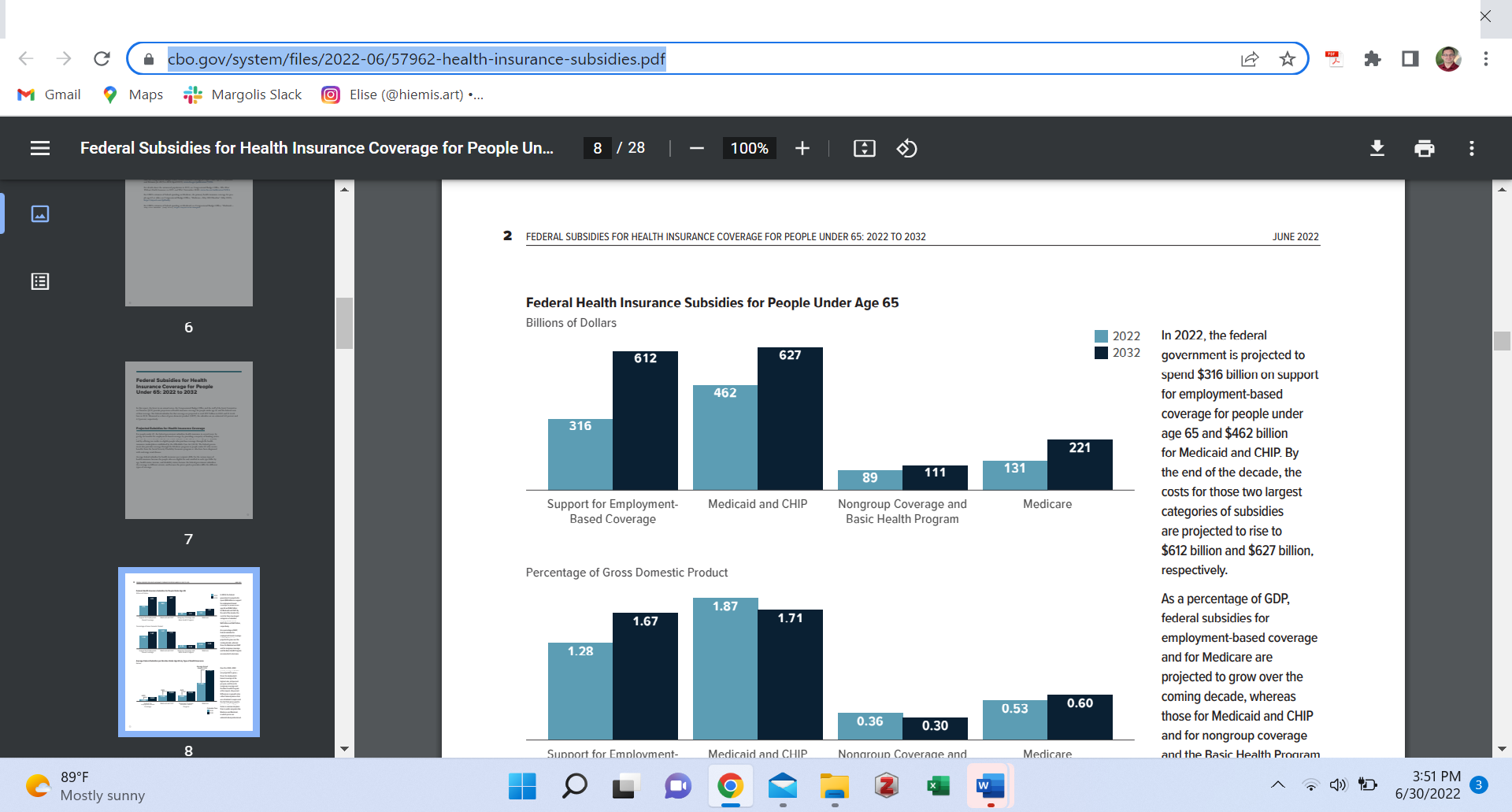

The federal government spends almost a trillion dollars per year on non-elderly healthcare. The Congressional Budget Office released a new report that breaks this spending down for 2022 and projects what it will look like in 2032.

The big story is that the tax exclusion for employer sponsored health insurance is big and growing as a percentage of GDP. These tax expenditures are regressive as higher income folks get bigger tax breaks and likely contributes to increasing medical cost spend growth as this segment of the US healthcare ecosystem has the worst ability to actually negotiate prices.

It is also a nasty political problem to control or reduce. The ACA attempted to slow the growth of this tax expenditure by the Cadillac tax. The Cadillac tax was an excise tax on the increment of premiums that were above a fairly high threshold. The objective was to shift people out of super broad network plans that had no incentive or means to say no, into plans that would at least occassionally say no. The target plans were often the $40,000 per year Goldman Sachs paid for senior executive health insurance in 2009. It also would have hit union plans pretty hard.

It failed. No one, besides a few health and tax economists, loved the policy. Congress kept on voting to extend the start date before finally killing it.

The GOP has the idea of ICHRA, individual contribution health savings accounts, that will sort of chip away at the value of this exclusion by the creation of an annual defined contribution lump sum payment that will encourage people to buy cheaper plans instead of what is offered by their Human Resources Department. The CBO thinks ICHRA will be a small sliver of US health coverage with 2 million people covered in 2032.

The ESI tax exclusion is a huge subsidy to middle and upper class families that no one recognizes that they are getting right now. It distorts our labor and healthcare markets at a significant direct and likely larger indirect costs. And it is only going to get bigger over time.

TGIFriday Morning Open Thread: Still Busy

TGIFriday Morning Open Thread: Still Busy

Ohio Mom

Now I am trying to imagine what’s included in a $40,000 a year plan. Obviously, it’s all free, must certainly include plastic surgery and all sorts of skin treatments that typical plans exclude. Gotta keep those trophy wives worthy of trophies.

Ironic that something could exist — the proposal for the Cadillac tax — that could unite unions and the fattest of the fat cats. Well maybe there are also trade policie they agree on.

Jake Gibson

My only consolation is that AGW will break down systems enough that immediate survival will take precedence over such mundane concerns.

Shorter: We’re fucked and getting more fucked.

Ohio Mom

@Jake Gibson: And maybe World War III will break out in earnest, instead of just this Ukraine-Russia proxy tussle, and we’ll be nuclear-bombed back into cave people times. Geesh.

catotheodg

catothedog

The politics of this applies not just to healthcare. The mix of taxation & means testing has produces an inhospitable political milieu for public policy. The top 20% pays a most of the taxes but get nothing in return for it.

E.g. They pay full price for college, get no deductions for tuition, and so on.

In terms of progressive policy, this is right. The well off should pay more. But in terms of politics this is absolutely bad. There is a sizable bock of people who get taxed a decent chunk and then full pay “full price” for everything. This is a politically active block, and it is easy to sell them the idea that ” taxation is theft” .

The idea that your employer sponsored medical insurance premium is taxable income is in the same class. They end up paying tax on this, and at the same time, pay full price for the premium, while the less well-off gets a subsidy for medical insurance.

Means tested benefits and subsidies is just politically terrible for progressive policy. It is poison to the idea of solidarity and public good. It creates “makers and takers” and similar kinds of bad narratives for selling good public policy

Just raise the damn income tax rates and make stuff free/same price for everyone. This will increase the political base for progressive public policy.

The top 1-2% will never line up for good public policy. But there is no need to piss of the winnable chunk of the 20% by bad implementation of policy

catothedog

The politics of this applies not just to healthcare. The mix of taxation & means testing has produced an inhospitable political milieu for public policy. The top 20% pays most of the taxes but get nothing in return for it (as they see it)

E.g. They pay full price for college, get no deductions for tuition, and so on.

In terms of progressive policy, this is right. The well off should pay more. But in terms of politics this is absolutely bad. There is a sizable bock of people who get taxed a decent chunk and then full pay “full price” for everything. This is a politically active block, and it is easy to sell them the idea that ” taxation is theft” .

The idea that your employer sponsored medical insurance premium is taxable income is in the same class. They end up paying tax on this, and also paying full price for the premium, while the less well-off get a subsidy for medical insurance.

Means tested benefits and subsidies is just politically terrible for progressive policy. It is poison to the idea of solidarity and public good. It creates “makers and takers” and similar kinds of bad narratives against good public policy

Just raise the damn income tax rates and make stuff free/same price for everyone. This will increase the political base for progressive public policy.

The top 1-2% will never line up for good public policy. But there is no need to piss of the winnable chunk of the 20% by bad implementation of policy

gene108

@Ohio Mom:

I can’t picture what’s included that would actually be enough to influence overall healthcare costs.

Most relatively healthy people don’t use the healthcare system much, from my anecdotal experience.

Even using healthcare services for something like skin treatments at a dermatologists office can’t be that expensive versus immunosuppressive drugs for people with organ transplants.