In a new paper at Medical Care, Linde and Egede look at the price differences for common procedures at over 1,500 US hospitals. They then try to figure out what is happening:

Ninetieth -to-10th-percentile price markups factors (ratios) range between 3.2 and 11.5 for chargemaster; 6.1 and 19.7 for cash; and 6.6 and 30.0 for negotiated prices. Adjusted regression results indicate that hospitals’ cash prices are on average 60% (P<0.01) higher, and list prices are on average 164% (P<0.01) higher, than negotiated prices. Systematic pricing differences across hospitals were noted, with urban hospitals having 14% (P<0.01) lower prices than rural hospitals, teaching hospitals having 3% (P<0.01) higher prices than nonteaching hospitals, and nonprofit hospitals pricing 9% (P<0.01), and for-profit hospitals 39% (P<0.01), higher than government owned hospitals. In addition, hospitals that contract with more insurance plans have higher prices, hospitals in more competitive markets have lower prices, and higher quality hospitals have on average 5% (P<0.01) lower prices than lower quality hospitals.

Chargemaster is the list of fantasy prices that hospitals have and release to the public. This is often the starting point for cash price charges before discounts and write-offs.

There are a few things that are interesting to me here.

The big thing is that all else being equal, hospitals that face competition are likely to charge and receive lower prices. This suggests that we need to make sure that there is sufficient competition in as many areas as possible. Secondly, the rural hospitals are getting a double whammy of low competition and likely higher price levels from a poorer base. There are a few working papers that I’ve seen discussed in the past six months that strongly suggests that this is a very bad thing from a macro-economic perspective.

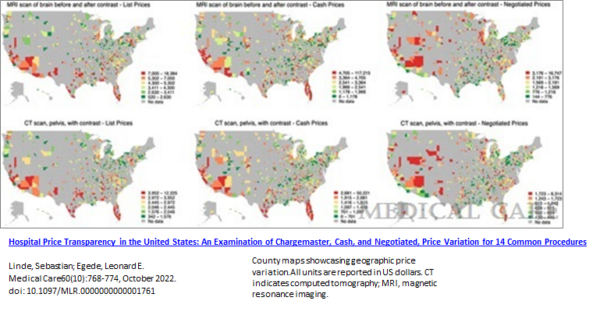

Finally, there is a lot of price variation for common services that is somewhat idiosyncratic as I grab their Figure 1:

From a policy point of view, this is tough. When there is price variation for services that are both deferrable and with huge baseline prices, there may be a case for allowing inter-state transfers and centers of excellence. Some large employers already do that where they fly all of their potential back surgery patients to a few national centers of excellence. That strategy pays off if the expense is higher enough. Transportation and transaction costs eat up any plausible savings wedge moving someone from a high cost region to a median or low cost region for standard imaging services. We need to think about what networks mean and how we value them if we think that there are significant chunks of local rents being collected.

daveNYC

I didn’t scope out the report since it seems to be not-free, but did they compare the impact that competition has on different procedures? Specifically those that a patient could actually do some comparative shopping for vs. those where it’s go to the nearest place or your dead so price doesn’t enter into it.

StringOnAStick

We live in the city that has the largest hospital for all of Oregon east of the Cascades. My understanding is they lost so much $ during Covid that now they are in a financial world of hurt, shedding staff that some suggests is an indication they are trying to get a larger player to purchase them. This city is like an Aspen, CO (joking, almost) as far as housing costs go and has plenty of doctors but is very short on the staff below that level , some of whom struck for better wages and conditions earlier this year; the remainder of their service area is poor to very poor rural areas. I wonder how this impacts prices here, and hospital profitability; I suspect the rural areas are where the loss of profitability are coming from, especially since so much of it is MAGA-land and unvaccinated so plenty of desperate cases ended up here.