A valued commenter sent me the open enrollment packet for the University of Georgia System that I think highlight a couple of interesting things about the decisions companies make when offering insurance plans to their employees. One slide in particular stood out to me, and that is the total cost splits for coverage.

This is interesting for four reasons. First, the university is showing both the cost to the employee and the total premium cost. This is unusual but becoming more common. PPACA requires employers to tell employees the cost of health coverage in box 12DD on the annual W-2. They are not required to show it in the open enrollment period. None of these plans are Cadillac plans. The goal is to get people more aware of where their pay raises went.

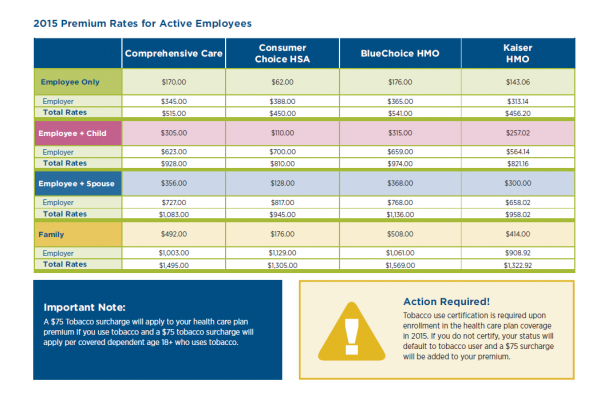

Secondly, the subsidization rate varied by plan. Comprehensive Care was the least subsidized at all tier levels as the employee picked up 33% of the premiums. BlueChoice HMO and Kaiser HMO each had the employee pick up between 31% and 32% of the cost while the Consumer Choice HSA has the employee picking up 14% of the costs. UGB is pushing people hard to the HSA model while nudging peoplem away from Comprehensive Care and BlueChoice. Choice is being maintained, but the structure of the premiums for employees means there will be an ingroup adverse selection issue as healthy people will migrate to the Consumer Choice HSA, and unhealthy people will go to the more expensive plans. This is a little odd as Kaiser’s total cost of premiums for much better coverage is no more than the cost of a good burrito per person covered per month than the HSA coverage. If UGB is interested in pushing people to buy cheaper coverage, it would make more sense to roughly equalize the employee costs for Consumer Choice HSA and Kaiser and then give a second, much higher tier for Blue Choice and Comprehensive Care.

Secondly, the subsidization rate varied by plan. Comprehensive Care was the least subsidized at all tier levels as the employee picked up 33% of the premiums. BlueChoice HMO and Kaiser HMO each had the employee pick up between 31% and 32% of the cost while the Consumer Choice HSA has the employee picking up 14% of the costs. UGB is pushing people hard to the HSA model while nudging peoplem away from Comprehensive Care and BlueChoice. Choice is being maintained, but the structure of the premiums for employees means there will be an ingroup adverse selection issue as healthy people will migrate to the Consumer Choice HSA, and unhealthy people will go to the more expensive plans. This is a little odd as Kaiser’s total cost of premiums for much better coverage is no more than the cost of a good burrito per person covered per month than the HSA coverage. If UGB is interested in pushing people to buy cheaper coverage, it would make more sense to roughly equalize the employee costs for Consumer Choice HSA and Kaiser and then give a second, much higher tier for Blue Choice and Comprehensive Care.

The third thing I noticed is the structure of the employer provided subsidy for health insurance. It is a flat percentage modified by plan choice. This is becoming more unusual. UGB could probably have a more predictable budget if they said that they would kick in $357 per employee per month for employee only coverage. That would give UGB a predictable health insurance budget where the only variables in play would be the number of employees electing coverage and what tier of coverage they are electing. It would remove the variable subsidy by plan.

The final interesting thing, is UGB subsidizes larger families over single or childless employees. A family of two married adults and two kids (mine) is charged the same rate as a family of two married adults, and twelve kids (several reality shows). Costs flatline after three people are covered. This subsidy structure produces some odd incentives for hiring/firing decisions.

A pair of health policy researchers with the same hire date, the same hourly rate, the same boss, the same grant funding source and the same title could have wildly different total compensation packages and costs of employment for UGS. A single person or a person taking employee only coverage is $500 or more a month cheaper than family coverage from the point of view of UGS. This cost structure means there is a strong incentive to hire the person covered by someone’s insurance, a strong incentive to hire single person over the married or domestic partnered person, a strong incentive to hire either the childless adult, or the adult with only adult children over the worker with minor children, and a minor incentive to hire the shacking up but not married over the married. That is a strange incentive structure we’ve put in place to run an invisible social welfare that is massively government subsidized but it is not an actual check from the government.

One of the things that I think most large employers will change over the next couple of years is to a more defined contribution model. They will tell employees that they will have four or five or twenty seven choices to make. The employer will kick in a flat amount of money sufficient to buy “adequate” coverage but anything over that minimal adequate coverage is coming 100% out of the employees’ pockets. That flat fee may or may not vary based on family situations, but the defined contribution model would lead to more predictability from the employer point of view, and slowly continue the disentanglement of healthcare from employment. Privately run exchanges as well as the public SHOP exchanges will take on the burden of the open enrollment period.

Keith

The presentation of total plan cost is also made at my place of work. From which I can tell that UGA is not as generous with their subsidies as my employer (lucky me).

Another thing I infer is that UGA prefers a stick approach rather than a carrot for “improved behavior” adjustments to plan cost / subsidies. UGA will default you to Tobacco Certified (+$75) if you fail to check that box telling them you are free of nicotine.

My employer assumes you are moving along the golden path to wellness and healthy living – chipping in extra money from the get-go. Demonstrate that you are tobacco-free and you keep that. Engage in other healthy-living pursuits and the employer chip-in becomes yet more generous.

A regular (annual) check-up counts as such demonstrated engagement.

esc

I know this isn’t the point, but my eyes popped a little at those premiums. The best part of my spouse working for the university system in California was the benefits. We paid $28 a month for Kaiser.

raven

@esc: And your mortgage?

RSA

@esc: My eyes popped at those premiums, too, for a different reason. I’m on the NC state health plan, married with no kids; here are the charges for the traditional plan:

Employee: $0.00.

Employee + Children: $205.12.

Employee + Spouse: $528.52.

Employee + Family: $562.94.

The jump from Employee + Children to Employee + Spouse has always surprised me.

boatboy_srq

It also offers some odd conditions for salary negotiations and merit increases. Single employees, or married employees with separate employers, should be in a better position to negotiate higher starting pay and higher raises. Conversely, the employer is discouraged from paying a married employee with children more given that said employee is benefiting from the greater coverage.

@Keith: It’s a regional thing. Southern employers aren’t all that different from the public sector when it comes to benefits: there’s a strong “be happy you have a job” push from management. See: Work, Right To. And in UGA’s case that may not be entirely unjustified: GA is one of the states that has strongly resisted funding education in general and higher ed in particular, so every budget line item has been squeezed and trustees are hard pressed to keep the lights on.

@esc: Here in NoVa, Kaiser costs me as an individual $85/mo on a 20/80 split with my employer. That’ll change when the SO arrives and gets added to the coverage, but not by an obscene amount. I can remember working for Wells Fargo in SFO and getting Kaiser coverage gratis: those were the days.

boatboy_srq

@RSA: I take that as a positive for single parents and shaming for two-person single-income households: single parents have a tough time of things, and the break there is useful, but conversely if your spouse is on your policy s/he is either working for Scrooge & Marley or unemployed and that’s his/her fault (and thereby yours) in either case.

raven

@boatboy_srq: #2 . . . .you got that right

Richard Mayhew

@RSA: Employee + Kids tends to be way cheaper than Employee +Spouse or Employee+Family for a couple of different reasons. The biggest is that kids, once they get past their first birthday are cheap as hell to cover. But let’s look at two scenarios with adults.

Scenario 1: Both people are young and the woman in this scenario is in prime child bearing age (21-40) — decent chance that a married couple will have kids in the next couple of years.

Scenario 2: The woman is out of prime child bearing age but now there are two people in middle age and middle age is a pre-exisiting condition.

Now as a side note, same sex marriage messes up some of these asusmptions (two sero-negative guys getting married are a mass cross-subsidy to the breeders, and two women marrying makes the pregnancy assumption a bit dicier as either the employee or the spouse could get pregnant, but the odds of an oopsie goes down dramatically) but SSM is still rare enough on a practical matter that the actuaries aren’t stressed.

Lee

The company I work for has included their portion of the cost for several years now.

I’ll see if I can find the PDF with the costs involved.

raven

Is it legal for someone to look at the family size of a prospective employee during the hiring process?

SP

I’ve never seen a place that charges more per kid once you reach family- given what you said about kids > 1 being incredibly cheap, why even bother?

RSA

@Richard Mayhew: Thanks, Richard. You’ve answered a few questions about costs that I’ve been wondering about for several years.

Richard Mayhew

@SP: $100/$150 per kid per month is not nothing (compared to a 40 year, they are dirt cheap) so 2 kids versus 10 kids as an extreme example is a significant cost differential.

Lee

@Richard Mayhew:

We joke at work, you hit 40 and it is like a switch is thrown and things just start hurting.

japa21

I work for an insurance company and just went through the open enrollment period. Our company has its own private exchange.

There were 6 different plans available with differing levels of deductible and out of pocket. They also showed not just what I would pay, but what the company also picked up, which was new for this year.

Also new this year is that the premium went up depending on level of pay. This is also a first. So they subsidize the lower paid employees a lot more than the higher paid employees. At the upper levels of income, almost the entire premium is employee paid.

Capri

Just got my enrollment packet at Purdue University and it is very similar to UGA’s – a huge price difference between the HSA plan and the other options. Currently, a same sex partner can get covered but a live-in partner of the different sex can not. I’m guessing that as soon as same-sex marriage is official and past any appeal, they will get rid of this difference and any spouse can be covered but a non-married adult living in the same household can not.

I very much doubt that a person’s status in regards how much they will cost for health care guides any hiring decisions. Departments hire people, while health benefits are some centralized, invisible other place on campus.

Also, this year is the first time EVER that my premium did not go up. Perhaps there’s something to the ACA after all.

Morat20

My company, a very large one (tens of thousands of employees, minimum) switched to 80/20 plans several years ago (which I hate, because I can NEVER tell when I’m going to get more bills because sometimes the co-pay covers labs, sometimes it doesn’t, so it’s just ‘wait and see if I’m billed). A few years ago it started pushing high-deductible plans, but kept it’s 80/20 plan as an option.

This year? ALL high-deductible plans with HSA’s.(And, of course, when ‘calculating costs’ they strangely did NOT add in my HSA to my costs, which make it look like I was saving thousands as I no longer used my FSA and the premiums were cheaper. Factoring IN the money I needed to put into my HSA, my paycheck deductions have risen even more).

This trend started well before the ACA.

I’m curious what’s so freakin’ attractive about a high-deductible plan to companies the size of Boeing and Lockheed (my company is, indeed, that size) that they’ll force employees onto the plan despite them being fairly unpopular? (Admittedly, most of my coworkers are late middle aged at best, all with families. It’s a grey workforce, especially in the area I work).

SP

Harvard just switched from fairly generous benefits to pretty awful relative to other higher ed- dropped premiums 2.5% but added a $250/$750 individual/family deductible, with 10% coinsurance after that, and out of pocket max of $1500/$4500. The coinsurance is what’s pissing people off since it exposes them to the ridiculous world of medical billing and who wants to deal with that shit?

qwerty42

@Keith: …Another thing I infer is that UGA prefers a stick approach rather than a carrot for “improved behavior” adjustments to plan cost / subsidies. UGA will default you to Tobacco Certified (+$75) if you fail to check that box telling them you are free of nicotine.

That was started a year ago. Under the old system you had to ‘fess up. Unsurprisingly the number of smokers was significantly under reported.

Lee

EmpMonthly Total Monthly

Employee only $102.21 $511.04

Employee + one $255.52 $1,022.08

Employee + two or more $383.28 $1,533.12

cat

@Morat20: “I’m curious what’s so freakin’ attractive about a high-deductible plan to companies the size of Boeing and Lockheed (my company is, indeed, that size) that they’ll force employees onto the plan despite them being fairly unpopular? ”

They self insure so all the “insurer responsibility” part of your bill goes to them and not the insurance company named on your card.

So its a rather large savings for them for you to pay the first 3k/6k/12k of your medical bills and they pick up only the catastrophic bills.

Gretchen

I get my insurance from my husband so my employer gets a free ride. I wish they had to give me the $300 they save on my insurance compared to other employees.

Gretchen

@raven they can’t ask, but if you let them know you can’t prove that’s not why they didn’t hire you. And when layoffs happen, it seems that the sickly are more likely to get chosen. One of my husband’s coworkers was fired a couple of days ago. Guy is recovering from colon cancer and has $160,000 in medical bills. Something about his going on disability so employer insurance wouldn’ t pay.

Mnemosyne

@Morat20:

The Giant Evil Corporation I work for (in entertainment) is also trying to push people into the high-deductible plan, but they sweeten the pot by putting about half of the annual deductible directly into your HSA, so the employee only has to come up with the other half. I can’t do that plan, though, because the prescription coverage sucks and I have to take daily medication for my asthma and ADHD. Fortunately, they continue to offer a PPO and HMO plan in addition to the high-deductible plan.

Mnemosyne

@cat:

The GEC is also self-insured, but we don’t all get stuck with high-deductible plans. I suspect it’s because many of us are union employees, so there may be contractual reasons that they can’t reset everything to high-deductible plans.

sarah

When I worked for the regional BCBS out here, they HEAVILY pushed the HSA plan and it was the plan they incentivized the most. Premiums were of course next to nothing, but the plan was a joke if you weren’t a single healthy adult <40. But of course there was no Kaiser-like HMO alternative. In this example, I find it beyond odd that UGA almost punishes people who want to choose Kaiser. It feels very ideological. Why wouldn't you encourage folks to choose a plan that is more cost-effective, other than if you ideologically feel that HSA's are the way to go? Obviously the HSA is the least expensive for the company, but for what they offer and the comprehensiveness of care that is typically available, the Kaiser plan is incredibly cost-effective. Weird that UGA wouldn't do more to encourage their employees to pick that one.