Charles Gaba is doing his usual exceptional work of tracking rate increase requests from insurers that want to sell plans on Exchange. He recently highlighted Oregon’s initial requests. As I was reading through the actuarial summaries, the different insurers modeled sabotage risk differently. Two carriers effectively discounted it. The rest are extremely concerned. I will highlight a few key elements to show how an actuarial shows significant concern about sabotage.

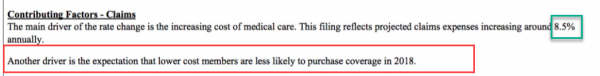

First is Bridgespan. They are projecting a rate increase of 17.2%. There are two lines of interest in their summary.

The first line is they projected an 8.5% increase in medical trend. This is the cost of services. 8.5% is a bit high but not unusually so. In the alternative counterfactual universe of a Hillary Clinton presidency, 8.5% would be the vast majority of the requested rate hike. But that is not the universe we’re in. Trend makes up less than half of the increase.

The second line explains the thinking Bridgespan has in their rate increase. They think that the non-enforcement of the mandate or at least the perception that the individual mandate is gone will lead to a sicker covered population. Individuals with cancer will still sign up, individuals who are in good health and see a doctor once every couple of years won’t sign up in the same numbers.

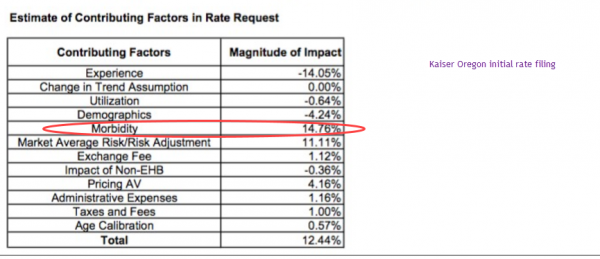

Kaiser in Oregon wants a 12.5% increase. They break down the components that drive premium changes in the following handy table:

The key assumption here is morbidity. They are assuming that their covered population will be significantly sicker in 2018 than it is in 2016 and early 2017 claims. Mechanically, the pathway is again simple. They are projecting that the perceived lack of an individual mandate will more frequently discourage relatively healthy and low cost individuals from signing up in 2018.

All of the insurers in Oregon that filed and broke out their pricing assumptions had a morbidity increase of various sizes. Everyone is expecting a sicker population on the 2018 guarantee issued, community rated plans. The typical drivers of change in rates are changes in the prices paid (trend) and morbidity. One-off adjustments such as the health insurance tax are pretty much a uniform requirement and administrative expenses. Trend is easy to prove. Regulators can ask to see provider contracts, networks and utilization patterns. Morbidity is fuzzier. Morbidity is where insurers will put their policy uncertainty risk in their rate filings.

Finally, there is a side note on optimism. Optimism on the behavioral impacts of perceived mandate non-enforcement is a big bet for actuaries to make. The most optimistic projection of low morbidity increases will lead to higher enrollment. If there is no behavioral change from the perception of a lack of mandate enforcement, the optimistic company will do very well although it would be leaving money on the table if it is too optimistic. If there is significant behavioral response to perceived or actual non-enforcement of the mandate, the most optimistic company will lose a massive amount of money as it will have attracted a significant proportion of the somewhat expensive and expensive without the counterweight of the very healthy to balance and fund their care.

Fair Economist

So assuming Trump screws up the exchanges by screwing up the mandate, how possible is it for a hypothetical Dem trifecta to fix things in 2021? Could they just resume the mandate and possibly pass some laws to make goofing off less possible in the future, or would they be forced to a different system?

Thru the Looking Glass...

So I’m scrolling thru your article and the line in the chart circled in red, Morbidity – 14.76%, catches my eye and the immediate thought is, “Oh, another comment on Ailes’ death…”

What’s the magnitude of impact rating for ‘Politically-induced stress’?

So Kaiser in Oregon wants an 12.5% increase for 2018?

I’m guessing Kaiser in CA will ask for something similar, which would push my monthly premium up to nearly $800/mo for something I rarely use… I guess it would be in Kaiser’s best interests to a) keep me as a client and b) keep me healthy because right now, I’m a nice little profit center for them…

I suppose that’s still better than the GOP’s plan which would either strip me of coverage or increase the monthly substantially more… of course, living in CA, I am in a very different situation than many, many other people in regards to possible outcomes…

David Anderson

@Fair Economist: That is a damn good question and I don’t know… I need to think hard about it.

Charles Gaba

@David Anderson: This is the REAL elephant in the room, so to speak.

Unless there’s some earth-shattering turn of events re TrumpRussia which somehow ends up with Nancy Pelosi going from Speaker in January 2019 to becoming the 46th POTUS (or 47th, assuming Pence takes office for 5 minutes before being immediately impeached himself as well), the odds are that it’ll be January 2021 before the Dems have the opportunity to fix this mess for real. Whether they go for full-bore single payer, a beefed up ACA or whatever, that’s the likely start date.

So…what happens in the meantime? Chemotherapy can’t be put on hold for 3-4 years waiting for this disaster to sort itself out. Lots of people are going to suffer and die unnecessarily between now and then. That’s the reality.