The theory of change for a health savings account based insurance system is that people are far more sensitive to spending their own money for needless care than spending someone else’s money for low value care. And from there, we should expect to see a massive compression of healthcare spending without negative health impacts as low value care is driven out of the system and consumers can harness the power of markets to get better value. That is the theory of change.

The biggest problem is that people are absolutely horrendous at discerning low value and high value care. There is incredible information asymmetry between the doctor or other medical professional and most consumers of medical care who are quaintly known as patients. We don’t know. Secondly, we’re just not rational beings with infinite time horizons and the ability to rapidly shift consumption from the future to the present or from the past into the future. Not everyone has savings or easy credit that can absorb a one time $5,000 or more shock much less an annual expenditure of $5,000 or more.Let’s

More subtly, we need to figure out who would be under the first dollar discipline of increased deductibles and how much money they could save working with the assumption that everyone is perfectly rational. We’re not, but it is a simplifying assumption. And here we run into a problem. The population of people who have incremental medical costs between a low deductible regime and a high deductible regime is limited. That population is even smaller once we knock out the people with these types of medical costs who are already covered by high deductible insurance.

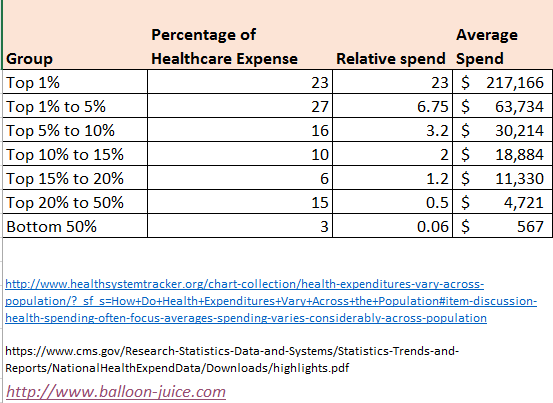

I used the 2014 data assembled by KFF at the Health System Tracker but broke it out a little differently. I also used the CMS National Health Expenditure to estimate average spending per group from the KFF HST with an estimate per capita 2014 Health expenditure of $9,442.

Let’s define low deductible as a deductible under $1,000. Let’s also define as high deductible a deductible of at least $1,001 and no more than $7,000. The maximum deductible is approximately equal to a 58% AV plan that is proposed by the Senate.

Who is hit by moving regimes and therefore who have changes to the incentives that they face?

Let’s start with the easiest two cases. People in the bottom 50% of the spending distribution either don’t touch the medical system in a year or are barely connected to it. I am one of those people (as I knock on wood and throw salt over my shoulder). In 2016, I had a $600 deductible. I used a single PCP visit that did not have cost sharing apply to it. Moving my plan from a low deductible to a maximum deductible plan won’t change my behavior, assuming I stay lucky and healthy.

The other extreme is easy too. An individual with hemophilia or cystic fibrosis or any other long term, chronic condition that puts them into the top 1% of spending is going to blow through their deductible at some point in the first month of care. Catastrophic events like a cancer diagnosis or a gun shot wound will also lead to $100,000 claims very quickly. It won’t change their incentives either.

Now we get to more complicated cases. People between the top 1.01% and 5% are also going to blow through their deductibles in the first quarter of the year under the highest deductible regime. People in the top 5.01% to 10% of spending will hit their deductible mid-way through the course of their treatment.

Now the group between the top 10.01% and the median American is where incentives could in a change from a regime shift from low deductibles to high deductibles. People with medical expenditures in the 20th to 50th percentile would see almost all of their expenses apply to their deductible. The amount would vary. The person who is the incrementally more expensive than the median American will see a few more dollars at risk while the person on the 80th percentile of spending would see several thousand dollars at risk.

People in the 80th to 90th percentiles will have significant elements of their healthcare spending over the high deductible limit but there could be incentives for them to shop in order to get their care costs underneath the deductible. This is, I think, more likely to occur with people whose costs are near the deductible maximum than people whose costs are currently three times the high deductible limit.

We’re looking at a maximum population of 40% of the country with 31% of the healthcare spending whose incentives could meaningfully change in a shift from a low deductible to a high deductible regime.

I think that is an overestimate as we are already part way through that shift. There are numerous people whose incentives could have plausibly changed that have already been moved to high deductible/low actuarial value plans. We see this on Exchange with Bronze, no CSR Silver and Gold plans. We see this in Medicare Advantage with $0 premium plans. We see this in Employer Sponsored Insurance. 29% of ESI covered lives in 2016 are in a HDHP.

So the people who have not converted from low deductible to high deductible plans with medical expenses that are amenable to being influenced by the regime shift is a small proportion of the total population. They are being asked to make heroic efforts for the theory of change for high deductible plans to really play out en masse.

Barbara

High deductibles are underwriting by a different metric. People who are healthy barely notice and people who are really sick pay more, every year. Don’t get me wrong, I would prefer high deductibles to ex ante choice by insurers over who can have coverage, but let’s be honest about the purpose and impact of these plans, and it is not to make us better consumers. One refinement I would like to see is for certain classes of medications to be deemed preventive care, so as not to disincentivize or penalize people who take medications for the specific chronic conditions of asthma, diabetes and high blood pressure.

David Anderson

@Barbara:

A couple of points in reverse. It looks like there is an EO that will allow for chronic care management services and Rx to be pre-deductible spending on HDHP

http://vbidcenter.org/press-release-president-signs-executive-order-making-the-high-value-health-plan-a-reality/

Secondly, it is unusual underwriting. For people with known high cost conditions, HDHPs do nothing to change their incentives. It is a decision between Premiums + OOP-Max between the traditional and HDHPs. For people with a high probability of having low expenses, it is minimal underwriting again. The people who get hit by HDHPs are those with the uncertainty of intermediate expense profiles.

Kelly

I only see a couple advantages to a middle income family for high deductible HSA plan. The main one is we can move our deductible money out of our MAGI keeping us from falling off the subsidy cliff. This is valuable. Secondly the HSA money can be spent on dental and vision care, those expenses have been higher than our other medical the last couple years. We did that last year. Administering the account was surprisingly annoying.

Hunter Gathers

I remember when we had the meeting about the changes to our health insurance.

The rep claimed, with a straight face mind you, that a $8000 deductible wasn’t very high.

He was laughed at. Someone in accounting muttered, ‘it takes me 3 months to gross that, shithead’.

Drove a Bently, by the way.

Evidently, removing self-awareness is a requirement to actually making money in our society.

MAGA, bitches. MAGA.

Another Scott

Isn’t it clear to everyone that the world doesn’t work that way when it comes to health care? HSA aren’t intended to solve a health care spending or incentives problem, they’re intended to give the wealthy tax breaks. There might be 0.0000001% of the population that loves going to the doctor (there are, after all, a few people out there who want to have their perfectly functional limbs amputated) and spending as much time and resources as possible, but the rest of us try to avoid any interaction with the health care system.

:-/

Your numbers about who costs how much and how that fits into deductibles is interesting and important, but I don’t think any advocate for HSAs will be the least bit swayed by them. They want their tax breaks.

Thanks.

Cheers,

Scott.

gene108

Beyond know what’s wrong with us, one of the most opaque things on the planet is what medical care actually costs.

Providers accept a contracted rate with insurance companies, which has no real bearing on what they declare as their cash price.

A patient in a high-deductible plan, and I’ve been on these for many years now, has no clue what the charge is going to cost until they get the bill from the provider, after the provider bills the insurance.

You can’t comparison shop on price, if Provide A has a cash price for a visit of $200 dollars, but will has a contracted rate with the insurance of $70 versus Provider B, who has a cash price of $250 and a contracted rate with the insurer of $50 per visit.

The providers billing departments are not customer facing. You don’t get to know what you are on the hook for until you get the bill. And there’s no way to know that Provider B is a better deal, if you only see Provider A, because these prices are buried somewhere out of sight of the consumer.

Just the basic idea of comparison shopping based on price is next to impossible.

The whole idea of high deductible plans as being a vehicle to unleash the power of the free market to reduce health care costs just breaks down on the basic issue of comparison shopping based on price, because no one knows what the fucking prices are you will end up paying.

Another Scott

@gene108: Yup. Well said.

Cheers,

Scott.

Barbara

@David Anderson: It’s cruder than underwriting but it shifts costs to those who use a lot of services, and in that respect, people who are sick end up paying much more than people who are healthy. If you have a one bad event year, you could be basically healthy and still pay a lot more than you otherwise would have, it’s true, but people with chronic conditions are guaranteed to pay the maximum out of pocket year after year. HDHPs were never a first choice for employers or insurers. They tried narrow networks, high touch utilization management, etc., all of which are extremely unpopular. HDHP is crude but low touch.

Kelly

@gene108: Oh yes a thousand times yes. My wife just left for a physical therapy appointment. Third weekly appointment and we still don’t know what our 30% of the bill will be.

? Martin

Quite simply the problem is that the bottom 50% who are attracted to a high deductible plan to save money aren’t paying in should they turn into the top 1% due to some accident, byproduct of genetic lottery, or just happen to live to be 115.

There are two failures of the free market taking place here. The first is that insurers are fine with the high deductible plans for the bottom 50% because in all likelihood they won’t be around when the big costs come – those will probably hit Medicare/Medicaid instead, so they have a certain incentive for short-term thinking. The second is that policyholders are making the same calculation – they’ll just shift to a low deductible plan when their costs start climbing, and we allow that to happen.

If instead of picking a plan once a year, you had to pick it once every 10 years, or for life, you’d approach it differently. Now, we wouldn’t necessarily make the right decision because we’re idiots at anticipating the future, but we’d at least recognize that it’s a different choice with different outcomes.

Morally, we feel that everyone needs to be given healthcare their entire life, so we’ve taken this moral position that all this care must be provided and paid for, but we’ve erected systems that allow both insurers and policyholders to avoid paying for it. Somehow those need to be squared up – either by the GOP stating clearly that they’re fine if you die on the side of the road because you made the wrong policy choice, or by a de facto or simulation of a single payer system. There’s just no middle ground.

randy khan

Let me add that at a certain income level, a high deductible is essentially the same thing as not having insurance at all (well, actually worse), in that you will not seek treatment except for something that appears to you to be life-threatening, and when you do you likely will have to spend money you don’t have.

Meanwhile, while I love having an HSA, its benefits to largely are independent of the deductible for my insurance policy. My wife and I use it, for instance, to pay for our long term care policies, which effectively gives us a hefty discount on the price, since we are now paying with pre-tax dollars. As mentioned by others, it’s a great tax shelter, not a real option for most people.

I actually could imagine a high-deductible/HSA approach that would work for most people, but it would require the HSA to be funded by the employer or whoever procured the insurance policy, at least to some significant extent. Then spending below the deductible would be possible for lower income households without making them choose among food, rent, and medical care. But I can’t imagine a universe in which that kind of policy would be enacted.

Ohio Mom

I just love these discussions on comparing medical costs, as if your comfort level with your doctor, and your doctor’s skill sets are not important parts of anyone’s calculus.

Okay, you need a doctor in your plan but after that, even if I could figure out who charges what for this and that, well, it’s not my priority.

To use my disabled kid as an example, we’ve dropped doctors for being more interested in him as a research subject than a patient (one of the drawbacks of our children’s hospital having a very strong research focus), and for just plain not “getting” autism.

On the other hand, his PCP is nothing special but she has her own kid on the spectrum and as a result, sometimes can be helpful in ways another doctor wouldn’t be.

I like to humor myself and say I’ve been very careful in choosing only doctors with deserved good reputations for me and my family but who knows? Maybe our doctors have made lucky guesses, maybe our conditions are relatively easy to treat.

So far none of them have made any major errors, that is all I can know for certain. The minute I discover any of them have made things worse is the moment they are fired, no matter what their fee schedule might be.

Sab

@gene108: Yep. That’s been my experience. The doctors and their billing people don’t know what it costs until the insurers send their statement.

sherparick

At Lawyers, Guns, and Money, commentator LosGatosCA, posted the following guide on how the intelligent health care consumer (formerly patronizingly called “patients” could use his or her “freedom” to obtain the best price for “health” care under the Bret Stephens, Avrik Roy, Ted Cruz, Paul Ryan, and Scott McConnell plan of Tax Freedom for Rich People: (Please note that this is snark.)

“…I think I’m starting to see the brilliance of the conservative Republican market driven, outsourced delivery model. For example, consider a massive heart attack strikes a 55 year old man without a health insurance policy but a HSA with 6 month’s of contributions.

Step 1 – call Uber, not 911. Pay the peak pricing gladly – it still beats a fully loaded EMT response . Plus, if they don’t show up you get a $5 credit, should you survive

Step 2 – remember to not go comatose. Such lack of discipline at this critical pricing decision point could adversely impact your ability to make a rational decision on the services you may be willing to pay for and which supplier in your particular market you may want to utilize. You can ignore this if you live in a rural market and the nearest regional hospital with an ICU is 25 miles away.

Step 3 – direct the Uber driver to the nearest accredited hospital while you use your iPhone to solicit quotes from alternative medical retail establishments (hospitals, clinics, etc) don’t forget to read the reviews. At these times it’s also especially helpful to bring up your pre-defined Excel template that you cribbed from Consumer Reports to plug in the quotes as you are making your way to the first medical retail establishment in your itinerary for this medical emergency. Be glad you aren’t a rape victim so you can be sure that whatever fully informed facility and treatment path you decide on, the hospital won’t refuse to treat you according to your wishes. OTOH, the medical retail establishment might not treat you unless you can produce a current liquid net worth and credit score that meets their patient treatment scoring index. Subprime can lead to restricted options.

Step 4 – If your are alive and still conscious when you reach the first medical retail establishment remember ‘you don’t get what you deserve, you get what you negotiate.’ Just think of the ER staff and attending physicians as Turkish rug merchants. They need your business, keep in mind that you may need to just walk away if they refuse to bargain in good faith. Beware of hardball negotiation and scare tactics like:

You should have called 911 instead of Uber, now it’s going to cost you an extra week in ICU.

If you had been getting regular checkups and lowered your cholesterol from 525 you wouldn’t need the bypass and the stent.

You should take our offer because you won’t make it to the next medical retail establishment.

Don’t let these medical financial predators stampede you in to making rash split second decisions that they claim are life or death. Take your time, gather all the data, read all the reviews and make a carefully considered, rational decision. Don’t treat this like that impulse buy when you bought that overpriced, red convertible that had that incredibly hot model in the magazine ad.

Good luck, with a solid plan and the patience to not panic under pressure you’ll be able to get a great deal. Should you die, it’s not your problem anyway. If you have severe brain damage, you might still have gotten a bargain by not paying for services you didn’t get. Plus using Uber is a major savings opportunity. Not everybody needs trained medical technicians administering CPR, oxygen, or other stabilizing procedures.

Next week: how to determine if you really even need Uber to reach your local medical retail establishment.

Previous articles: How to have physicians bid for your business when your appendix has burst

Thinking of selling your blood, plasma, organs – read this first!” http://www.lawyersgunsmoneyblog.com/2017/07/medical-care-bargain-hunting-bret-stephens

Sab

@? Martin: Martin: this is all BS. There is no free market that everyone is rationally computing about, because nobody knows what the fuck anything costs. Medical stuff in the US is not any sort of market. Quit blathering your nonsense and get in the real world with the rest of us.

Sab

@? Martin: Sorry about the previous tirade, but I have been on the phone with insurance all morning. Still agree with what I said, just want to retract the anti-Martin personal attack part.

Sister Rail Gun of Warm Humanitarianism

@randy khan:

I once worked for a company who did that.

ruckus

@Ohio Mom:

I’ve had docs who are smart, knowledgeable, caring and “always” right, just ask them. They have never made a mistake, never seen a patient with outside the normal reactions to a common med, and don’t believe the patient, who of course doesn’t know anything. Some people are so full of themselves, they just refuse to acknowledge that they don’t know everything.

ruckus

@Sab:

Martin is not saying what you think he is. He’s pointing out that for a small segment of the market , the type of insurance they purchase will have little effect on their healthcare, because they don’t use it. So they might as well pay the least,or nothing at all. Everyone else is screwed.

Sab

@ruckus: So I should reinstate my personal attack on Martin?

randy khan

@Sister Rail Gun of Warm Humanitarianism:

Your comment jogged my memory – I know of a non-profit that doesn’t do this, but does something similar. It went with high deductible policies for its entire staff and then agreed to pay the deductibles. It turned out it was cheaper than purchasing the low-deductible policy it had before.

Barbara

@ruckus: It’s not even that small of a segment. It’s a sizable number of people. Because health care is so fragmented or atomized, a significant percentage of the working population does not routinely obtain health care services. Most people are healthy until they are not, but once they are not, they are also more likely to be funneled into a different stream or pool for purposes of obtaining health care, either for demographic reasons (elderly — Medicare) or because they are really sick (disability — Medicaid, then Medicare). There is a lot of variation, of course, but a surprisingly small percentage of people use the vast majority of health care services. I had a client once who told me that something like five percent of their membership accounted for nearly half of all emergency room visits, and asthma was the most likely condition to generate an ER visit. They threw a lot of resources at helping asthmatics manage their condition.

gene108

@? Martin:

What insurers really look at is who is spending the first dollar on any healthcare transaction.

In other words, are you paying out of pocket or will the insurer by on the hook for the payment. Even if you have a small co-pay, the insurer is footing most of the bill, so they see that as them paying the first dollar.

At the end of the day the insurer is looking to not pay out, wherever possible.

So they view high deductible plans as a way to avoid paying out anything, while collecting premiums because the bottom 50% will never hit their deductible, so nothing gets billed to the insurer.

OGLiberal

My son has Crohn’s. That doesn’t go away – unless medical science figures something, it sticks with you until you die, which could be in 70-80 years.. And his 7-year old ass when he was first diagnosed (now 11) didn’t result from poor decisions and responsibility. He was born with this shit. His GI says he needs Remicade because the lower level stuff we tried didn’t work – and it didn’t…this wasn’t test results, it was physical diagnosis of him being in pain saying it didn’t work. For over 4-years now, he’s been on Remicade and it has worked – not Crohn’s symptoms since…knock wood. Each infusion costs between 8K and 12k, mostly for the drug and then for the 3-4 hours of outpatient care. I believe they recently came out with a Remicade alternative (it’s a relatively new drug so patent stuff was in effect) but these are the kind of drugs you don’t fool around with…if the immuno-suppressent you are using works, you don’t switch. Given that, how am I supposed to shop around and decide what care we need or don’t need? He’s basically the only person in our household right now who needs regular care? (our daugther has NF-1 but not symptomatic so far…knock wook very hard) The only other show in town is to stop, let him get painful flare ups, and treat with massive steroids, which might be cheaper but not good for his health at all..or quality of life.

All these mother fuckers think this shit will never happen to them and when it happens to others they think it’s their – the ill peoples’ – fault. Fuck them because none of this is my kid’s fault and if you are OK with him suffering in pain then you are a fucking monster. I struggle to pay bills even with my quite good employee plan because a bunch of fuckers at my company decided via survey that they wanted 50 bucks more per paycheck v. lower deductibles because they think it will never happen to their lily white privileged asses. I can only imagine what I’d be facing if I was tossed onto the individual market. I’d be better off being poor and on Medicaid – but, of course, they want to get rid of that as well – although I’m a white person so those fuckers might give me some sort of pass because my skin color matches their tribe. (although my Chinese adopted daughter might be SOL)

DHD

@gene108: One of the “whataboutist” criticisms that I’ve heard about universal health care systems is something along the lines of “Canadians/Brits/Cheese-eating-surrender-monkeys pay job-killing taxes for public insurance but then they end up paying out of pocket in the private system to get things done quicker, so single-payer is fake news, whatddyathinkaboutthat?”

Except that… while I think there are big ethical issues with two-tier systems, when you go to get a blood test or an elective surgery or whatever done privately in Canada, the UK, France, or wherever, the price is stated up front and there is no back-door special rate that somebody else is getting by virtue of their particular insurance company. And since if your condition were really life-threatening (you know, as opposed to just painful and debilitating), you’d already be in the public hospital getting treated, there’s some plausible argument that you have that magical “freedom of choice” that Paul Ryan and company are always blathering on about down stateside…

I really can’t figure out why supposed advocates of the free market in the US don’t understand this. It’s like they hate our freedom, or something.

Eric

@gene108:

Its not easy for doctors either. I don’t control the prices (the hospital practice does) and its difficult to get a sense of how much it is charged for cash vs medicare vs anyone else. The best that I can do sometimes is compare RVUs to see that perhaps this treatment may be less expensive than another treatment; however even that varies greatly depending on where the treatment is provided (other costs for the patients from anesthesia, labs, etc.)

So its opaque to the doctors and opaque to the patients.

dr. bloor

@gene108:

What providers take as the contracted rate with insurance companies is the “actual cost.” Their “cash price” is irrelevant if you have insurance, because every provider (with some exceptions) is going to charge some number over the insurance company allowable, and take the contract amount. “Shopping” to minimize an HSA/deductible hit is pointless because if you’re only responsible for the contract amount, not retail.

I’ve said this in response to similar posts in the past (forgive me if I’ve said it to you and I’m being repetitive), but if you want to know what a particular procedure costs with a particular provider, don’t waste your time asking the doctor’s office. Ask your insurance company. It’s the only number that counts.

ruckus

@Barbara:

That was exactly my point.

We are healthy til we aren’t. Most of the people I know who complained about the ACA before it was live didn’t need health insurance, as far as they were concerned. They now had to pay for something they didn’t think they needed. Of course they probably could have had subsidies and not paid a thing, but that may have been over their heads.

ruckus

@OGLiberal:

Sorry about your kid.

On your employer want wanting that extra money, it could be like a place I worked, the company wanted to keep their great insurance but no one would sell it to us. They demanded that the employees have deductibles and copays. To help control costs.

Bradley Flansbaum

David

I see one flaw in your logic. The movement in and out of the cost bands years to year is so dynamic, that one cannot predict when an expensive illness will occur. Cancer might occur in Jan, Mar, or Sept. When do you become an “unprudent” shopper. Very few folks stay in one tier for more than 3 or so years. You can play the odds, but eventually one year you will be a heavy spender. That unknown may make folks watch their wallet more frequently than you think.

Brad