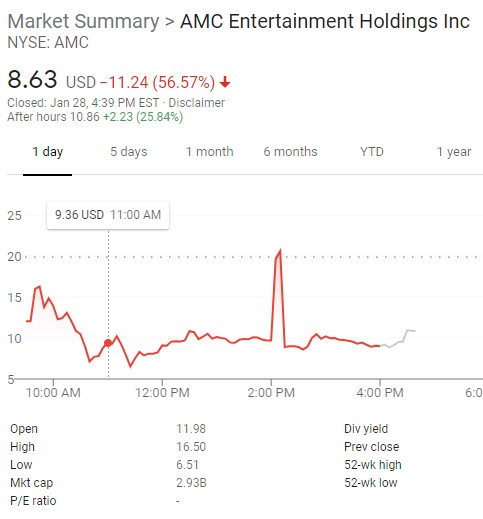

The market closed with GameStop (GME) at $263, down from its close of $346 yesterday. The other stocks that have a lot of short interest (AMC, Blackberry, Nokia) also took hits. Trading was all over the place. Example: AMC. I believe this graph is called the “defibrillation” trading pattern.

Anyway, other developments included Robinhood, the “free” trading app, halting trading on GME, AMC, BB and others, then, unbelievably, liquidating GME positions of Robinhood investors.

It now appears @RobinhoodApp is selling customers’ shares of Reddit stocks “to mitigate the risk” to their portfolios.

This is unbelievable. pic.twitter.com/QjpJLlm1jw

— Sawyer Hackett (@SawyerHackett) January 28, 2021

Robinhood’s major source of revenue is Citadel Capitol, which bailed out Melvin Capital Management, the firm that was shorting GME bigly. There’s a rumor that Citadel reloaded their short sales after Robinhood halted trading.

The whole thing is a fucking stinking shitty mess that makes it pretty obvious that the market manipulators who shorted GME to 130% of float (how the fuck did that happen, btw) don’t like it when someone else tries to use the same tricks. AOC and other squad members, Maxine Waters, Ted Cruz (fuck him) and Don Trump Jr (fuck him double) are all complaining about it on Twitter. This caused AOC to murder Cruz with words on Twitter, which is one of the sweetest parts of this whole debacle. AOC is going on Twitch tonight to discuss the situation.

In conclusion, insanely poor timing on the part of hedge funders to do this when Democrats are in power, so perhaps they’ll get a stronger than usual slap on the wrist.

Am I The ONLY One Who Remembers Wil Wheaton Commented Here??

Am I The ONLY One Who Remembers Wil Wheaton Commented Here??

cain

I think you can expect a class action lawsuit. I don’t think they are allowed to sell share that people ahve paid for without authorization or prior notice.

Some serious shit is going to come out of this. If they are mitigating this disaster by fucking over investors on the street – there is going to be bad blood.

ETA: dammit.. so close.. should have waited a little longer to post.

Yutsano

Test…

Okay so I’m not banned and Firefox is just being weird on mobile?

On topic: I found this analysis rather interesting in the “okay I get it now” sense.

Patricia Kayden

TaMara (HFG)

I have been trying to wrap my brain around all of this and …. well, I’ve just given up. But it does sound like there needs to be some un-fucking to correct things.

debbie

Huh, guess only the big guys get to manipulate the market.

Baud

A tax on transactions might calm the waters a bit. And get Cruz out of our lane to boot.

Another Scott

Something, something end stage Capitalism something, something.

It’s long past time that these gambling activities that are explicitly rewarded by the tax code (unearned vs earned income, capital gains, etc., etc.) be examined much more carefully.

We have the economy and investment system we do because it was designed that way over time. It’s not a law of nature. It can be changed and made better for society. Something, something, transaction tax, something, something…

Cheers,

Scott.

sab

Who cares. Idiots piss away their money.

Baud

@cain:

Four Seasons Total Landscaping mistermix

@cain: At least one class action has been filed.

Baud

@sab:

Innocent investors can be harmed by volatility caused by market manipulation. Manipulation also discourages new investments by good faith investors.

Served

In the end, all the usual players made all the moves that ended up highlighting the issues that the situation was bringing to light. All to make sure the house always wins. I think the hedges are in a much worse political position than before today. This is a bipartisan, populist message, which several well-known Democrats have been blaring for years, especially the primaries. I’m sure people like Griffin think they can buy their way out of it, though, and time will tell if they can.

There are a lot of people still pissed about 08, which is underrated as a foundational event for many millennials who are just now coming into their political power.

Jim, Foolish Literalist

I’ll check back in two weeks and see if there’s any reasons for me to be interested in this.

I’m more concerned about what sure as hell looks to this dumb guy like a housing bubble, paired with an eviction and possible foreclosure process if Manchin and Sinema let Susan Collins’ furrowed brow and Mitt Romney’s born-again (by which I mean bad faith, in case anyone misses the sarcasm) debt-hawkery fuck up Covid relief plans

Ken

@debbie: Can’t find it now, but one of my favorite Twitter responses was something like:

Rich people: Poor people should invest their money.

Poor people: OK.

Rich people: … Wait, stop

zzyzx

I’d be a lot more amused by the Reddit thing if it were just a few people in it for the LOLz. However, there’s also some aspects to a pyramid scheme going on where I’m seeing a lot of people who don’t know what they’re doing kind of going along for the ride and some of them might be left holding the bag

dlwchico

https://twitter.com/IsicaLynn/status/1354894529208348673

Ken

Why would you want him out of our lane?

Oh, wait, you meant metaphorically, not “centered between the headlights”.

Baud

@zzyzx:

Yep. Someone’s getting screwed when the price crashes.

Baud

@dlwchico:

We’re not doing Wall Street speeches again.

aliasofwestgate

@dlwchico: Not that shit again. Do they have any new lines?

catclub

@cain:

I bet neither you nor I have read the RobinHood terms of use. But I am willing to guess that RobinHood CAN do this based on the terms of use that each ‘customer’ has agreed to.

TS (the original)

@debbie: But of course. I have never understood how hedge funds and the like are a valid part of share trading. Their aim is to ruin companies.

They make money out of failure – so much for private enterprise & the business community.

sanjeevs

To me this looks like a professionally run pump and dump where the protagonists used troll farm techniques (memes, ‘the elites’) to run the pump.

Roger Moore

My understanding is that the halt to trading was triggered by the market makers charging the brokers incredibly high fees if they didn’t stop their clients from selling. Since the retail investment companies like Robinhood aren’t set up to deal in stocks directly, only through market makers, they didn’t have any choice.

For those who don’t know, market makers are intermediaries who are involved in most stock trades these days. They hold a position in the stocks they make markets for, which lets them sell directly to anyone who wants to buy and buy from anyone who wants to sell without having to match up each individual buyer with an individual seller. This provides liquidity to the market and makes everything function smoothly.

Under normal conditions, that works fine. The market maker’s holding goes up and down a little over the course of a trading day, which is why they actually need a position, but they can match buyers and sellers well enough that everything evens out. Retail investors never have to worry about what’s going on behind the scenes and probably don’t even know market makers exist. When things go severely wonky, as they have during the current market, the market maker may no longer be able to keep up. If there are many more people wanting to buy than willing to sell, then the market maker may run out of shares and no longer be able to sell them. When that happens, the broker can’t process buy orders no matter how much the customers want to buy.

Steve in the ATL

@Yutsano: you’re not banned, but WaterGirl said that about 90% of the posters here have you pied!

catclub

@Served:

Who exactly is ‘the house’

I think the hedge fund community is highly varied. There are hedge funds betting just the way the little guy redditors are, and hedge funds betting against them, and others that have no dog in this fight.

I have also mentioned that RobinHood’s actual source of money is NOT from those little guy redditors, but from hedge funds who pay for retail order flow. And any ‘intelligent’ investor knows this. RobinHood doing what the people who actually pay them prefer, is not surprising. And I bet it is not illegal, either.

Matt McIrvin

I cannot bring myself to care about the stonks aspect but the “AOC whaling away at Ted Cruz” part is gold.

catclub

@Baud:

Good luck with that lawsuit. I bet all this is allowed in terms of service.

Or better yet, no class actions allowed and binding arbitration (RobinHood hires the arbitrator!) required.

Patricia Kayden

Jim, Foolish Literalist

@dlwchico: is the theory about speaking fees as a scandal that there’s a clause in the appearance agreement that the paid speaker will have to refund the money later for… reasons?

bluehill

@catclub: If they bought on margin (i.e. borrowed money from Robinhood), then the broker can sell enough shares to meet the margin call, which is having enough cash in your account to cover potential losses.

I think there are more factors here than just Citadel or Wall Street protecting its own and bailing some hedge funds. Maybe it is just that, but I think the scale of this in terms of volume of shares traded and leverage through options was unprecedented and could have possibly broken some things in other parts of the market and financial system.

zzyzx

@Patricia Kayden:

So boycotting MyPillow is bad but boycotting the boycotters is good?

Baud

@zzyzx: We need to boycott the boycotters of the boycotters. We can’t let them have the last boycott.

beef

That ‘defibrillation chart’ is amusing, but I think it’s just a data error. Google doesn’t clean the data they show you.

I agree with Sanjeev that this seems like a pump & dump scheme. And FWIW, I suspect the retail brokers are saving their clients a lot of pain. The same people suing for losses now would be suing in a day because the brokers didn’t prevent them from taking losses.

Chyron HR

@Patricia Kayden:

Seems reasonable, if he can’t be impeached for anything he did after election day then none of his appointments after election day should count, either.

fuckwit

Yes, GME and r/wallstreetbets is a Ponzi scheme.

But then, the entire economy is a Ponzi scheme! The stock market, the real estate market, the bond market, and yes even crypto. As is our fiat currency as well, and any kind of “hard money” is also a Ponzi scheme, and whiteness in general. It is all predicated on the privilege of being “first” to get in, and convincing (or forcing) other people to want what you have. It is a shared hallucination.

And if you were planning to make noises at me about “fundamentals”, please take firm grasp of such concerns and stuff them securely and deeply up your ass. Fundamentals are a solipsistic fantasy just like the economy: they are in the eyes of the beholder and purely psychological. Not everyone even agrees on what they are, they are not scientific, and not every investor cares about them or even knows what they are, rendering them moot.

debbie

@Ken:

Exactly.

Mom Says I*m Handsome

I’ve been a supply chain manager for 30 years. When I learn that a supplier is owned by a hedge fund, that’s the kiss of death — the fundies make all their investment choices based on what their balance sheet looks like for the next acquisition, and none of those choices benefit me, the customer: they won’t invest in capital for factory expansions, headcount to provide better service, R&D to design the next generation of products, or inventory to get me parts faster. They buy the company, they fuck around with real-world conditions (like staffing & benefits for said staff) to make their fake-world numbers look good, then they sell the company and pocket millions. Literally everyone loses except them.

(The best kind of company, in case you’re wondering, is run by a passionate tinkerer who loves making great products, treats his employees like family, wants to buy cool new equipment, has a capable finance guy gently reining him in but otherwise can say Yes or No without needless scrutiny.)

Patricia Kayden

@zzyzx: Rightwing “logic”, my dear. Doesn’t make a lick of sense in the real world.

Conservatives call for boycotts all the dang time but act offended when others do the same. Hypocrites.

Steve in the ATL

@fuckwit: whiteness is a Ponzi scheme? You’re going to need to show your work on that one.

Patricia Kayden

@sab: Especially when you consider all of the poor Americans who have lost their jobs and have nothing to invest.

debbie

@Served:

Why not? They certainly have before.

Poe Larity

From the response out there, I think the Venn diagram of QAnon, Brogamers and RobinHood ragers is the same set.

We need more of this, maybe we can rage them into limbo.

debbie

@Baud:

Two words: Bear Stearn.

cain

@Baud: MisterMix Excellent. They’ve opened themselves up to some serious liability. I assume they rather plead guilty and pay the money hoping that the settlement is less than what they are going to lose in the market.

debbie

@Steve in the ATL:

Question: If I wanted to get the FOP or PBA banned, how would I word that? Is it decertifying? Asking for a friend.

beef

It’s pretty amusing to see people who’ve tried to implement a short squeeze whinging about market manipulation.

Ken

@Baud:

We must not allow a boycott gap!

rikyrah

@dlwchico:

Kapow.

Thank you.

opiejeanne

@Baud: Correct.

I inherited some stocks when my dad died, and usually just ignore what they’re doing for weeks on end, because they’re mostly blue chips. This week I’ve watched two stocks, Clorox and Disney* play seesaw against each other for no discernible reason. I wasn’t sure what was causing them to overreact so violently at first, and 3-5% swings are violent swings when they happen daily, IMHO.

Since I tend to be patient with

*Disney’s not what I consider a blue chip but it’s been solid for 8 years.

debbie

@Patricia Kayden:

This is almost as ludicrous as Glenn Beck comparing himself to MLK.

different-church-lady

A time traveler from just three years ago would have no idea what the hell you just said.

Gravenstone

@Baud: They have a very limited repertoire of “bad things” to accuse Democrats of. While Republicans laugh and cash their checks for the same actions.

Major Major Major Major

I don’t think it’s so simple as RH trying to help a nebulous shadowy cabal of hedge funds, especially since plenty of them are no doubt having a field day. This thread for instance says that SEC requirements played a role. https://twitter.com/vladtenev/status/1354900958942175233?s=21

But, we will learn more during the lawsuits and investigations and congressional hearings where every one can make an idiot of themselves.

Martin

I can’t express what bullshit this is.

Robinhood really should be torn apart over the irresponsible escalation of trading privileges that they’ve done. I’m very much in favor of extending investing opportunities to people that have been excluded from the market. But the ‘safest’ part of investing is buying and selling equities. It’s not safe in the mutual fund sense that you are (normally) guaranteed to lose capital, but it’s safe in the sense that you can’t lose money you don’t have. The whole pitch for Robinhood is that you can buy very small quantities of equities. $100, etc. If people want to blow their $600 simulus check to buy 2 shares of Gamestop, that’ll probably be worth $10 by the end of Feb, I don’t have a problem with that. I would prefer that they gate it to relatively small portfolios, so people can’t toss their life savings at it, and have them pass a different set of requirements to get that kind of access.

My concern here is that the hedge funds are being protected here at the expense of retail investors. That’s bullshit. The whole point of a hedge fund is the guardrails are removed for the class of investor that shouldn’t need it – they shouldn’t get to replace those guardrails by manipulating the markets.

What people might be missing here is that the tool that the Redditors have to hold the naked short sellers to account is their ability to buy the underlying shares. The only thing the short sellers need is for investors other than them to be unable to buy those shares, but be allowed to sell them. In that scenario, the short sale pretty much can’t lose and they’ll make a killing off of investors who can’t fight back.

schrodingers_cat

Why are posts on politics so few and far between. I thought this was a political blog.

Ken

Ooo, neat! Can we get a list in the right-hand sidebar showing “top 10 pied posters”?

WaterGirl

@Yutsano: Nothing from you in spam, trash or pending.

What’s going on?

debbie

@Patricia Kayden:

All this started back in the 1990s when conservatives insisted there was a War on Christmas. I remember there being a website where peoples’ grievances could be aired. They were all stupid, but the most memorable one I read was from a woman who insisted she would boycott Target because they did not have baby Jesus gift wrap.

different-church-lady

@Martin:

…THEN THEY SHOULDN’T HAVE GOTTEN THE $600 IN THE FIRST PLACE HAVE YOU ALL GONE MAD?

dlwchico

@Jim, Foolish Literalist: I do now know what theory you mean. I just saw that pop up on twitter and thought it was relevant.

Yutsano

@dlwchico: Listen, m’lad: posting Rose Twitter around here isn’t going to do wonders for you credibility.

WaterGirl

@dlwchico: She shut that right down. Though not in those exact words.

MomSense

If the Reddit mob wants to fuck with the hedge funds, I’m all for it.

Yutsano

@WaterGirl: It’s a Firefox issue. I’m going to try a delete and reload here soon.

Ken

Well in my case, when I hit “reply”, intermittently I get a blank textbox that isn’t editable. I have to switch from the Visual to the Text tab to see the <a href> link and enter a response. This started about forty minutes ago.

EDIT: Same thing happens when I edit a response. Firefox, BTW.

Major Major Major Major

This thread from a college friend offers another theory that also doesn’t require a shadowy cabal, and involves RH’s actual business model, selling your trade information before it executes.

Steve in the ATL

@debbie: unions can decertify, but the members have to do that themselves. The alternative would be to legislate them out of existence.

But are those actually unions, or just fundraising scam organizations?

different-church-lady

Before this is over we’re definitely going to find out the founder of Robinhood is buying rare Wu Tan Clan albums.

debbie

@Steve in the ATL:

I guess I was assuming they were unions. They stand up for criminal cops, acting as if they were union reps for their members.

But yeah, definitely scam fundraisers.

Steve in the ATL

@Ken: 8 of the 10 are Omnes

Tom Levenson

@schrodingers_cat: Can’t speak for everyone else, but I’m on a politics detox for a little while.

I’ll be foaming at the mouth again soon enough.

Jim, Foolish Literalist

@dlwchico: I didn’t necessarily mean you, but I’ve seen this a bit, the idea that having accepted speaking fees creates some kind of corrupt hold over the speaker.

It may even have come up before Chuck Todd gave Bernie! the idea that there was something inherently nefarious in WALL STREET SPEECHES!, but I can’t remember any examples

Steve in the ATL

@different-church-lady: I’ve done the math, and your all caps posts are 87% better than your non-all caps posts!

sanjeevs

@Major Major Major Major: Free trades are financed by the High Frequency trading shops who then frontrun the orders.

different-church-lady

Y’all feel like me thinking how refreshing it is to get back to discussing how ordinary run-of-the-mill idiots are fucking up society instead of how the president is doing it?

Just Some Fuckhead

@Tom Levenson: We ain’t even doing politics in this country any more. It’s a full on hot war now with a Twitter soundtrack.

different-church-lady

@Steve in the ATL: Yeah, but you gotta throw some lower-case plays in there, or the all-caps are easier to defend.

zhena gogolia

@different-church-lady:

hahaha

Jim, Foolish Literalist

@schrodingers_cat: FWIW I’m with you. Way, way too many restricted threads these days

we could always go back to the old “every thread is an open thread” days

zhena gogolia

@different-church-lady:

oh yes

Major Major Major Major

@sanjeevs: yep. The fact that these entities are completely missing from everybody’s hot takes suggests a problem with the hot takes to me.

Roger Moore

@TS (the original):

This isn’t even close to true. Hedge funds are basically investment groups that solicit money from very rich people and invest in relatively exotic investments in the hopes of getting greater than market rate returns. There is a species of private equity firm that specializes in buying companies, looting them, and trying to sell off the remains to a greater fool but:

debbie

@Jim, Foolish Literalist:

Leave the respite threads alone!!!

VeniceRiley

Novavax passes phase 3 in UK. https://www.dailymail.co.uk/news/article-9199125/Another-shot-arm-Britain-60million-jabs-set-UK.html

Martin

@Major Major Major Major: The SEC needs to get their shit together. This is untenable. If you’re not going to restrict naked shorts and calls, then you can’t restrict retail investors opportunities to protect against those.

You could do the math on the short interest in GME and see that it would need to go well above $300 in order for the shorts to get out of their positions. Buying at $300 expecting a fairly implemented market was pretty reasonable, provided you understood you’d need to be out by Friday. Those people are now fucked, not because they misunderstood the market, but because they misunderstood who would be allowed to protect their investment.

Robinhood may have a problem here because they can’t clear the cash as fast as the trades are being made, but the SEC needs to jump all over what the hedge funds were doing here. It’s not unusual, but it’s a wild abuse of the markets. It serves no larger economic purpose. Selling covered calls and covered shorts are different – they can work as a hedge for the holders of those equities, and their potential risk is very low.

elm

@Jim, Foolish Literalist: I believe the theory is that she is openly A Woman so ick.

Just Some Fuckhead

@Roger Moore: This sounds like one of those “the Nazis had a few good ideas” arguments.

zhena gogolia

I’m hoping that I can just wait for this RobinHood thing to go away so I don’t have to learn about it. Kind of like bitcoin.

Ken

@Major Major Major Major: OK, I am neither a lawyer nor a trader, but aren’t there laws forbidding brokers from using customer trade orders that way? That is, broker X gets an order to sell a customer’s ten million shares in company Y, so first sells his own shares in Y since he knows the customer sale will drive the price down? (EDIT: sanjeevs has the term: “frontrunning”.)

Do Robin Hood and Citadel et al get a pass because the entity making the customer trade isn’t the same as the one frontrunning? If so, are there any insider trading implications?

Steve in the ATL

@different-church-lady: on a related note, I’m not drinking tonight, so I’m having a bottle of Amarone Della Valpolicella

schrodingers_cat

@Tom Levenson: I will also take Tikka and mini-Tikka posts!

Roger Moore

@WaterGirl:

I don’t know what’s going on with Yutsano, but I’ve been having problems posting. I’ll click the “reply” button and the “Leave a Comment” dialog will pop up, but I can’t type in the comment box. It usually fixes itself if I refresh a few times, but it’s frustrating.

Spanky

@Jim, Foolish Literalist:

Wait. Was there a memo I didn’t get?

different-church-lady

@Steve in the ATL: That’s how you’re not drinking?

Major Major Major Major

@Ken: no clue! Sorry! I am but a humble tweet reader.

Martin

@zhena gogolia: Robinhood is just a regular brokerage. They’re really no different from eTrade or Schwab – they just have lower minimums, and are designed for ease of use. The one thing they do differently is the ability to buy fractional shares. Don’t want to put up $1850 to buy one share of Google? They’ll let you buy 0.1 share, by pooling you up with other investors wanting to buy the other 0.9 shares. So it kind of fuses a mutual fund (which does exactly that but where you don’t get to specify which specific equities) with a brokerage. It’s a good concept – devil is in the details on that.

My main objection to Robinhood is that they give elevated trading privileges to people that really don’t seem to know what they’re doing. That’s a different problem, though.

But I was part of the eTrade generation, which brought a ton of new investors to the market. RobinHood is no different – they’re just making the tent bigger.

Mom Says I*m Handsome

Re: Roger Moore @ 83, I would like to clarify my previous position that the assholes who cause me professional grief are indeed private equity douchebags, and not hedge funds.

Back to other topix.

Nutmeg again

Is it time yet for the, “Jump you Fuckers!” sign?

Tom Levenson

@schrodingers_cat: THAT I can do…

tom

@dlwchico: Since we are trading twitter quotes:

https://twitter.com/ModeledBehavior/status/1354904481494872068

Just Some Fuckhead

@zhena gogolia: Ima refuse to learn it AND opine about it loudly.

schrodingers_cat

@Jim, Foolish Literalist: Thanks good to know that I am not the only one who misses the old Balloon Juice rather than this polite parlor talk genteel Balloon Juice

schrodingers_cat

@Tom Levenson: Splendid!

zhena gogolia

@Just Some Fuckhead:

The best of both worlds.

zhena gogolia

@schrodingers_cat:

Wha?

Sanjeevs

@Ken: You’ve literally described the business model of High Frequency Traders. Illegal or not it’s been going on for at least 10 years ( and before that was done by the ‘specialists’ on the NYSE floor

dlwchico

@Yutsano: Sorry, I don’t know what that means.

Roger Moore

@Just Some Fuckhead:

This isn’t a “the Nazis had a few good ideas”, this is people assuming the worst of the worst are representative of the whole group. There are some very bad actors in private equity, and we hear about them all the time. There are also far more private equity firms that buy companies, run them like ordinary businesses, and never make the news.

Major Major Major Major

@Roger Moore: my mom works for a PE firm that’s in the latter category. Sometimes the companies can’t be saved, which is unfortunate, but most of the time the companies, and their jobs and assets, *are* saved, and everybody makes money and is happy.

debbie

@Major Major Major Major:

I went through five separate M&As back in the 1980s and 1990s (book publishing). Not a one of them gave a fuck about the company they were trying to acquire.

Just Some Fuckhead

@Roger Moore: Yeah, like all the “good cops” who never speak up about the bad cops.

Cameron

@Another Scott: You mean, a Tobin Tax to address market manipulation? (Not to be confused with the Toobin Tax, which addresses manipulation of…another sort.)

PJ

@Roger Moore: Trading wasn’t halted – only buying was halted. You could sell all you wanted, and that’s what RobinHood was trying to get their customers to do, because that would free up shares for the short holders to buy and would also drive down the price.

MomSense

This is a good article explaining this mess.

http://isthesqueezesquoze.com

The Squeeze Has Not Been Squoze

Dan B

@Steve in the ATL: A non-alcoholic Amarone, I’m impressed!

It’s been a long time since I’ve had Amarone but there are some very good deals. I’m on the hunt for good deals from relatively unknown eastern Washington AVA’s like Wahluke Slope, and southern Oregon AVA’s.

By my clock you should be aerating or decanting already.

beef

@Sanjeevs:

You’re completely mistaken about how HFT traders make their money. They are not front-running, whatever Michael Lewis says. Their business model is placing limit orders and then collecting the spread by matching market orders. They’re paid for this because they warehouse risk during the day. They are, contra rumor, not paid all that much in the scheme of Wall St. They make a steady income, but the magnitude isn’t all that large and the margins have been steadily shrinking for 15 years.

dlwchico

@tom: I’m not trading twitter quotes.

This Gamestop thing is driven by anger. It’s anger that goes all the way back to that Carlin quote that John referenced in his latest post above.

There is a big club and we ain’t in it. But for a few days, some dumbasses on reddit seemed to strike back a little. Some rich folks got a little less rich and some poor people seemed to be getting some back.

And then Robinhood shuts down trades and apparently even sells off some people’s stock without permission and then it turns out that the Secretary of the Treasury was paid nearly a million dollars by the same company that is screwing these people over. For a speech.

People are getting paid $7.50 an hour and she gets paid nearly a million bucks for a speech. It doesn’t matter if she could have joined some Wall Street corp and made a ton more.

To the vast majority of people watching it looks really fucking bad. It does nothing to quench that anger, that’s for sure.

I don’t usually go too deep into the comments here on BJ so I’m sorry if this “Getting paid by Wall Street to make speeches” thing is old hat for the rest of you and you don’t want to talk about it anymore but if you think the rest of this country is done with it I am pretty sure you are wrong.

Yellen needs to do something to show she is not in Wall Street’s pocket in this case. Something that proves that that $800k for a speech wasn’t actually buying influence.

Major Major Major Major

@debbie: I mean I don’t think anybody’s trying to say that doesn’t happen.

PJ

@catclub: It might be allowed in the terms of service, but market manipulation (which refusing to allow customers to buy while allowing them to sell definitely seems to be) is a no-no under the ’34 Act.

Major Major Major Major

@dlwchico:

lmao good lord dude

Miss Bianca

@dlwchico: God damn, you know…regardless of whether or not anyone deserves speaking fees of that magnitude (and why is it always when *women* make those speaking fees that the Twitterati go apeshit?), it’s refreshing to see Democrats just say, “so what, suck it up” to bad-faith trolling instead of scurrying around apologizing.

Dan B

@Roger Moore: I was getting dialogue boxes as well. When I did ‘go back /undo’ a couple times and then return to ‘comments it would work normally.

debbie

@Major Major Major Major:

I know. I just have a negative gut reaction to them. Kind of like Frau Blucher. ?

beef

Regarding Yellen:

Our public discourse would be vastly improved if people could get it through their heads that famous people can charge really high fees for their time. If you want to set the scale, think about this: Neil Gaiman, who’s a pretty well known author but not in the same league as King or Rowling, charges six figures for his non-charity appearances.

Yellen was the chair of the Federal Reserve. She’s one of the most prominent economists of modern times. Likewise, Hillary Clinton was the most prominent female politician of her generation. They aren’t taking bribes. They’re just charging the going rate.

Jim, Foolish Literalist

@dlwchico:

So she has to prove she’s innocent of…. an unspecified crime? So this is just like Hillary Clinton and Goldman Sachs (and Benghazi, but I will give you BernieBrats this much, you never waded into that particular muck).

You really think people around the country are thinking, “I voted for Biden, but Matt Stoller just tweeted this thing about Janet Yellen’s speaking fees, so now maybe I should’ve voted for trump?”

PJ

@Martin: So many people posting here (and elsewhere on the internet) seem to have no idea what happened today with RobinHood (or what has been going on generally with GME) and also seem to be completely fine with hedge funds ripping off retail investors.

Baud

@Jim, Foolish Literalist:

Agreed. Yellen owes nothing to anyone.

PJ

@Ken: @WaterGirl: Yeah, I have Firefox 84.0.2 for Mac OS and have to refresh before being able to comment.

Major Major Major Major

@beef: also like, I’m sure she has an agent or some sort of representation doing the actual bookings. She could barely even know who she’s talking to when she takes the stage (not saying she does, but I’ve worked for lesser folks who basically did that).

Roger Moore

@Major Major Major Major:

I’m thinking about my brother-in-law’s company. He’s spent about a decade building it from nothing to profitability and what looks like rapid growth. Now he’d like to cash out and retire. I think it would make sense for him to sell the company to a big consumer products conglomerate that would like to get into the product space his company represents, but it’s probably too small to attract their attention. Instead, he thinks the best chance is to sell to a private equity company. They would either continue running it as is or manage it until it’s finally big enough to be bought up by one of the big companies. Doing that kind of thing- taking over functioning companies whose owners don’t want to run them anymore- is a valuable function, and companies capable of doing it deserve to make a reasonable profit for it.

Just Some Fuckhead

@Cameron: I blushed.

Steve in the ATL

@Roger Moore: sell out! Why do you hate Bernie and America?

Roger Moore

@Steve in the ATL:

Sorry, I’m an evil capitalist; I own a small stake (less than 1%) of BIL’s company.

WaterGirl

@Jim, Foolish Literalist: Fun fact: 6 out of 10 threads so far today had open threads listed as at least one of the categories.

WaterGirl

@zhena gogolia:

Perfect.

WaterGirl

@Roger Moore: If you close the box and hit reply again, then @someone shows up in the popup reply box, correct?

Roger Moore

@WaterGirl:

No. I can close the box and hit reply as many times as I like, and it stays the same. I either have to enter text or refresh the page.

Jim, Foolish Literalist

@WaterGirl: and I’m sure if I had the time and energy, I could find several instances of two or three “respite” or otherwise restricted threads stacked up one on top of the other. And they tend to linger. On Sunday the gardening thread, which I try to respect and sometimes enjoy, was the only thread for, if memory serves, nine hours (longtime complaint about this blog for me: There’s lots of political news on Sunday mornings, rarely an open thread to discuss them).

WaterGirl

@Jim, Foolish Literalist: Yeah, the 9 hours last Sunday was bad.

catclub

Me too. switching over to text mode in the comment box works.

WaterGirl

@Roger Moore: @catclub:

Try clicking the blue link just above the comment box and let me know if that resolves it.

catclub

@WaterGirl:

Nope. I still have to switch to text mode.