On September 4th, the Centers for Medicare & Medicaid Services (CMS) released a new policy statement for the ACA individual marketplaces.

The U.S. Department of Health and Human Services (HHS) announced today it is implementing important measures to expand access to more affordable catastrophic health coverage through HHS’ new hardship exemption guidance. This guidance streamlines access to more affordable catastrophic coverage for consumers who are ineligible for advance payments of the premium tax credit (APTC) or cost-sharing reductions (CSRs).

Through these efforts, more Americans will be able to qualify for catastrophic health coverage based on need, beginning November 1st with the start of open enrollment. Catastrophic plans generally have lower monthly premiums, are designed to protect consumers from very high medical costs in the event of serious illness or injury, and are required to cover three primary care visits pre-deductible. Consumers under the age of 30 have always been eligible for catastrophic plans through HealthCare.gov.

Coleman Drake, Dylan Nagy and I were curious. Would this policy have bite? Would it impact many people and would its impact vary by income and subsidy system in place?

We wrote a rapid research letter published at Health Affairs Scholar attempting to answer these questions. But first let’s lay out some background.

Catastrophic plans have a simple benefit design — they have the legally allowable maximum out of pocket limit and the deductible is equal to the maximum out of pocket limit. Preventive care services and three primary care visits are provided without cost-sharing. Structurally they are equal to some of the lowest actuarial value Bronze plans in benefits and networks.

There are two massive differences between Catastrophic and Bronze plans. First, Catastrophic plans are NOT eligible for premium tax credits. Buyers pay full price no matter their income. Bronze plan buyers can receive premium tax credits that may reduce premiums down to zero.

Secondly, Catastrophic plans are risk adjusted only against themselves. Catastrophic plans are very high cost sharing plans bought by highly likely to be healthy and young enrollees with decent to high incomes right now. Money flows between Catastrophic plans to equalize risk but no money goes from Catastrophic to the Metal Level Pool. Bronze plans have a substantial portion of the total premium going out the door to cover some claims in Silver, Gold and Platinum plans. This risk adjustment quirk means that the Catastrophic plan offered by the same insurer on the same network as their lowest cost Bronze plan is typically cheaper in gross premium than a similar benefit structured Bronze plan.

So does this matter?

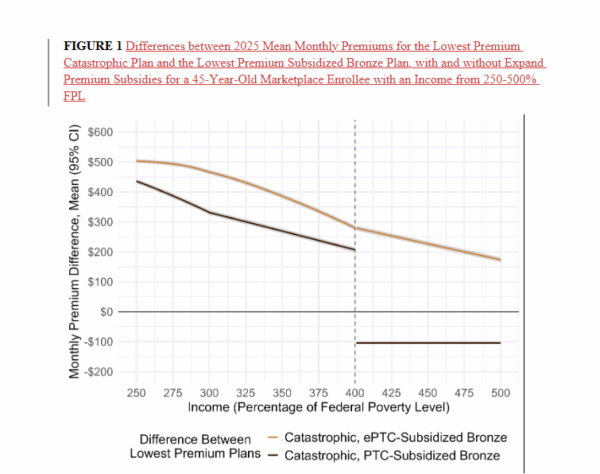

Well — it depends. We estimated net premium paid by enrollees in 2025 for the lowest cost Bronze and lowest cost Catastrophic plan in a given county-year on Healthcare.gov in the approximately 1500 counties where both are offered. We simulated 2026 subsidies under both a current law (2026 subsidies are back to the standard schedule) and current policy (enhanced subsidies continue) scenario.

What did we find?

Under an enhanced subsidy scenario, this policy does not offer any enhanced affordability through at least 500% Federal Poverty Level (FPL) for a single 45 year old. Bronze plans, due to premium tax credits cost less for a similar benefit.

Under the current law, return to standard subsidies scenario, Catastrophic plans are modestly cheaper by about $100/month in premium than Bronze plans at and above 400% FPL.

However this is only a modest amount of help as someone at 401% FPL who had a low cost Bronze plan could plausibly experience an $800/month premium shock while the Catastrophic plan replacement might “only” be a $700/month premium shock. Sure it helps on the margin, but it is marginal.

The current CMS leadership is prioritizing affordability for the non-subsidized portion of the market. This is a legitimate policy choice. Expanding Catastrophic eligibility will modestly benefit the 400% or higher group.

Now pulling this back out to the intersection of actuarial projections, policy and federal budgets. Actuaries were terrified of this proposal as it came in late and it came in unexpected. There is likely some movement between Bronze to Catastrophic next year, but no one knows who, how many and how sick. We can think that the most likely movers are likely healthier than average Bronze enrollees, and we can also sort of expect that these movers are more expensive than the marginal current Catastrophic buyer so the actuaries don’t know how to predict the risk pools of both the Catastrophic pool and the Metal Level pools. If there is a lot of movement, both pools are likely underpriced. If there is no movement, both pools are appropriately priced given current projections. There is a lot of uncertainty. Some insurers have pulled their catastrophic plans from the market as they don’t want to eat surprise risk.

From a policy perspective, if there is a lot of movement from Bronze to Catastrophic, the Metal Level market is highly destabilized as risk adjustment is going to be, using a technical term, bonkers. There won’t be enough low risk folks kicking into the pool to cover higher risk folks. Assuming a decent amount of movement, insurers in 2027 will jack up their rates, which means any federal cost savings in 2026 likely will be consumed by increased subsidies in 2027.

WTFGhost

I have just enough actuarial training that I really do appreciate the work you do, and I really like how you mix the politics and the personal, so we can see that the personal really is the political, and vice versa.

Seriously: I would hate Republicans much less, without you around showing me why I should be really ticked off at them, and ticked off at them with a *mathematical* basis, i.e., one objective and real.

Anyway: thanks.