As part of a very interesting discussion on the underlying ethics of the American health insurance direction, there was an interesting set of tweets that I want to explore some more here:

@MDaware @ddiamond @uereinhardt and the same payer

— Richard Mayhew (@bjdickmayhew) July 23, 2016

From a provider point of view, the fragmented payer market is an excellent opportunity for providers to segment the market. I was speaking with a friend of mine whose a neurologist and she said that her office manager routinely juggles a dozen different insurers. She did not pay attention to what the individual insurers paid per product, she just saw the patients who her scheduler put on her schedule.

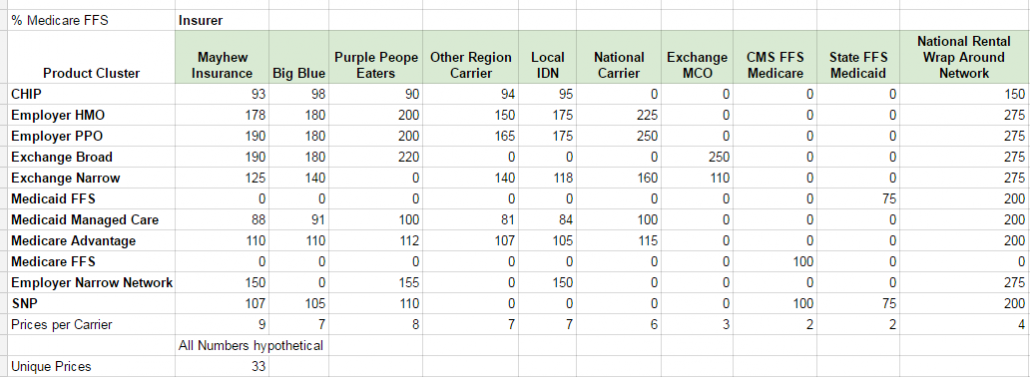

Below is a hypothetical pricing chart by insurer and product line that a typical doctor could see in the course of day. The numbers are hypothetical but close enough.

Yes, this is confusing as hell for the patient as they have no idea what they are getting. It is confusing as hell for the doctor’s back office. It is confusing as hell for the insurance company.

It is also an attempt to segment the market. We talked about provider account receivable preferences before where docs want to fill their schedule first with high paying, no questions asked commercially covered people, then Medicare as they pay fast, then Exchange plans, then CHIP and then finally Medicaid. That was a general statement. Providers or their schedulers will often give the marginal appointment slot to one or two particular commercial payers instead of any and all commercial payers.

The more segmented the market the theoretically ‘efficient’ it is but all of these pricing decisions are amazingly non-transparent so I have no idea how to math out an efficiency argument here.

MattF

Simulation? You need to get a feeling for what the ‘solution space’ looks like. Also, btw, this may well be a classical problem that every expert in optimization learned about in kindergarten.

Also, even if there is a ‘best’ solution, if it’s computationally hard to find, you’ve got a hard problem. OTOH, the situation where there are a lot of ‘good enough’ and ‘easy to find’ solutions near the ‘best’ solution is what usually happens IRL.

spartan green

I’m delurking to ask a question about my situation. The girls who work for my doctor have prevented my husband and myself from seeing the doctor anymore. The office does not take my particular plan. They have used the words “illegal”, “fraud”, and criminal to explain to me that the doctor can not see me if I pay cash, but I have insurance. Do you know anything about this? A friend of mine tried to explain it to me as a function of Obamacare. (The doctor has never said that he won’t see us – in fact quite the opposite.)

Richard Mayhew

@MattF: satificing is my favorite decision rule.

I can micro model this in linear algebra no problem for any single provider as a straightforward optimization problem but throw in reality and interaction effects the simple optimization does not reflect actual experience well

orogeny

What is the difference between “commercial” plans and plans purchased on the Exchanges? Aren’t the Exchange plans the same individual market plans that they sell off the Exchange?

Richard Mayhew

@orogeny: Commercial in my terminology is group/employer sponsored plans. Exchange is individual commercial market.

Depending on the insurer, the plans might be the same or they might be different. We’re in a period of consolidating the individual market configuration profile into something distinctly different than group insurance as the pricing points are very different.

amygdala

Yeah, the almighty payer mix. This was a major focus of attention where I used to work. It’s why, in my state, Medicaid patients had very few options in my specialty. Reimbursement was so poor that each patient seen was money lost. At least one of the state-supported teaching hospitals wouldn’t take these patients either, outside of the ED.

Hoping the ACA eventually fixes this.

Lawrence

@spartan green: The only thing I can think of is that your plan may not allow billing balance to patient for non covered services. Because otherwise you would get treatment, your insurance would deny the claim, and you would get the bill. Paying upfront would save your provider the hassle of all that. Always remember to try to get whatever Blue or UHC pays instead of the fee schedule. Sounds like the business office manager has instructed these people not to schedule you and they have very poor communication skills.

Ultraviolet Thunder

No, I was just resting my eyes.

Market Segmentation you say…

ETA: I worked for health care insurers for 13 years and actually find these posts interesting and informative.

spartan green

@Lawrence: I have been paying in cash upfront all along. And my insurance co (BCBS) laughed when I asked them if they had any objection to me not using my insurance for office visits. Those girls are still are telling me that I’m breaking the law. :(

gene108

I think this is one of the underlying problems of our heatlhcare system. How exactly are we supposed to control costs, when the same service, by the same provider, at the same facility, can vary widely.

I just can’t wrap my head around how insurance companies and providers set prices. It seems like they are just pulling numbers out of thin air.

Villago Delenda Est

Do you suppose the pricing decisions are simply pulled out of the ass of the person making the decision?

jl

“The more segmented the market the theoretically ‘efficient’ it is”

I don’t think that is true if the differential rates reflect segmented risk classes of insurer enrollees, and feed through to insurance premiums. That is how cherry picking destroys the insurance market.

I think the robot’s breakfast of metal plans has potential to damage efficiency of insurance market.

A uniform mandatory plan on a very highly regulated market, with the various metallic flavors moved to less regulated supplemental market might be a good idea (Go Swiss! -except that might be a bad example soon, since their regulated mandatory policy market seems to be good enough to drive out the supplemental market policies.)

Stella B.

@spartan green: That’s weird. My former employer used to discount for cash. I had a couple of patients who paid cash and submitted the bill to their insurance company, but the insurance companies prefer electronic billing from doctors’ offices because it’s cheaper to process. My guess is also that the office manager is confused about balance billing.

I have a Republican aunt who is a little dim. She inherited a bunch of money from an elderly husband and finds Fox News too left wing for her taste. She enjoys screwing the government by paying cash, which she can well afford, for her medical care rather than accepting socialist Medicare. She is convinced that she is doing something quite illegal. It could also be the case that the office manager is an Alex Jones fan.

Richard Mayhew

@gene108: some of the pricing is pulled out of somewhere the air is quite rank

Timmeh

@spartan green: Is it a Medicaid policy? There’s a lot of confusion and state-to-state variances in whether you’re allowed to charge medicaid patients for non-covered services, or as said above, for balance billing. In my clinic, we come across situations where a patient needs an injection or IV infusion, but the insurance won’t pay for the cost of the drug (e.g the drug costs us $79 but the insurance pays $60) and it’d be fraudulent to try and arrange a balance billing for that situation, so either they pay out of pocket and we don’t bill insurance, or we have to refuse treatment. But we don’t give medicaid patients that option. They get treatment at another facility or choose a different treatment.

It’s, uh, also possible your doctor doesn’t want to see you anymore. Sometimes they take a passive approach to patient dismissal.