Every year, all of the health wonks scream from the rooftops that it is critical that people who bought their insurance on the Exchange go and actively shop. The Exchanges would eventually automatically renew people into the same or similar coverage but that mechanism could produce significant cost shocks as the relationship of the same plan to the subsidy Benchmark could change. Actively shopping removes the surprise.

This year it is even more critical. The threat that Cost Sharing Reduction Subsidies may or may not be paid has led to insurers and states adopting three basic strategies. Some are ignoring the threat and pricing their premiums in the normal fashion. Other states may be allowing insurers to spread their CSR costs across all plans. Finally, quite a few states that Charles Gaba is tracking will allow insurers to put all of the CSR costs onto the Silver plans.

As I explained last week, this produces weird stuff:

Bronze, Gold, and Platinum plans saw their premiums increase by the normal trend of increasing price per unit of medical care, the number of units bought and other normal factors. Silver plans were different. They also had the normal price increases but then the insurer added a twenty five to thirty percent charge on top of the normal premium to calculate the actual premium.

This produces a pricing order from least expensive to most expensive of Bronze, Gold, Silver, Platinum.

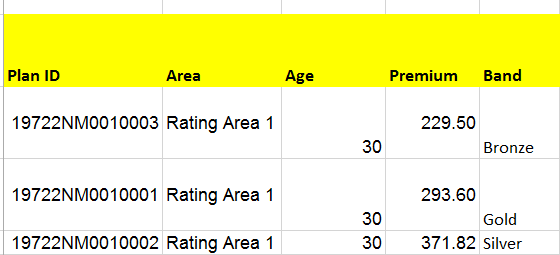

Gold plans are better deals than Silver plans for anyone who makes between 200% and 400% Federal Poverty Line as the out of pocket expenses and post-subsidy premiums are lower. Below is the pricing example of a single insurer in part of New Mexico:

Gold is way cheaper than Silver and dominate Silver on cost sharing for this group of people. However, the auto-renewal logic is set by rule. The 2017 rule is still the operational guidance. The rules try very hard to keep the person in the same metal band that they bought the previous year for the next year. Eventually there is wiggle room for odd-cases but most Silver buyers will be auto-renewed into Silver even if Silver is now a dominated plan.

The system change effort for this problem is to notify the exchange regulators so that they tweak their assignment systems so that if an individual makes more than 200% and less than 400% FPL and if that individual had a 2017 Silver Plan and if they live in a Silver Load state where Silver is more expensive than Gold, to move the person to Gold as the first option. This is CMS for 38 states and the state based marketplaces for 12 states.

The individual level effort is to actively shop for your own plan. You are going to get a much better deal by going to Gold if you live in a Silver Load state. Take 20 minutes and make sure that you are not buying a dominated plan.

Punchy

Not to threadjack, but Christ, put up a post on the Vegas massacre. Its horrific and unreal.

David Anderson

@Punchy: My apologies, this was a piece I wrote on Friday and pre-scheduled it for this time. Betty has the open thread.

Matt McIrvin

In more related news, I heard that they let CHIP expire–what’s the potential fallout there?

proudgradofcatladyacademy

Heartily second this Dave. Personal story time:

In 2016 I assisted a younger millennial friend in finding coverage for himself on the OR exchange. Keep in mind that my friend never had to shop for insurance and was new to how benefits/deductibles/Out of Pocket expenditures would work with his monthly budget. This friend has an ongoing monthly behavioral health issue that requires a monthly psychiatric med check visit. We found him a plan with a relatively low deductible for his visit, and a really low co-pay. I crunched the numbers for him and found it would be cheaper to go with the higher month premium in order to have a smaller deductible and copay situation due to his known monthly medical costs.

2017 enrollment time comes around and I ask him if he wants to shop on the exchange as he received the notice his plan would not be available next year. He advises me it’s all covered and the Exchange advised him they are putting him in a similar plan for 2017. I didn’t think any more of it, assuming he would check on things like deductibles and benefits on his own.

In May I receive a call from him, apparently his doctor wouldn’t see him due to claims being denied by his insurance company. After calling his insurance company, getting the benefits for his plan, we find the exchange auto enrolled him in a 3k deductible with an HSA plan, which is not anywhere close to his benefits for 2016. We worked it all out, but now my friend has huge medical bills and on his income an HSA he really can’t fund.

This year as soon as OR releases their plans and premiums he and I are doing a comprehensive review. I also offered in the worst case to marry him so he can have my ER coverage, which is only a 50/50 percent joke.

Please encourage your friends and family to shop the Exchange for 2018!

Raoul

@David Anderson: Your tireless work and willingness to post these deep dives are valuable.

Yeah, ok, today’s auto-post timing is off, but keep going. We need to know.

And thank you, David.