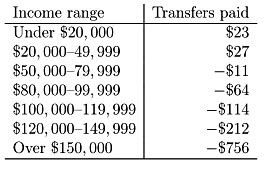

This is kind of shocking, but then again it isn’t:

Isn’t that peachy? This is the result of allowing an effective monopoly in the card business, thus giving network providers the power to force merchants to keep interchange fees hidden instead of charging them directly to card users. Vast masses of poor and middle income families end up paying a few dollars into the system every year while a small number of upper income families reap the benefits.

This is why I don’t like hidden fees: there’s rarely much point in keeping something hidden if it’s fair and equitable. You only do that if someone is getting screwed. And guess who gets the shaft more often than not?

Basically, people too poor to even own a credit card are subsidizing the super rich. I’m sure that the glibertarian argument for those consumers using cash and spending with in their limits but getting shafted anyway is quite compelling.

sven

I guess the libertarian solution to this is….?

I’ve got it, we start our own credit card, I’ve got like $50 lying around, if we all chip in we’ll be golden!

Big business looooves the free market; I’m sure Visa and Mastercard would sit up and cheer for some competition!

Glibbie the Glibertarian

Pssshh. People who don’t like credit card fees can rationally choose to live in a world where credit cards were never invented, and everybody pays with gold and chickens. Why do you hate freedom?

PeakVT

The numbers surprised me. ATM fees and even the $.50 fee that you get charged at the grocery store are also a scam, but at least with those you know when you’re getting screwed.

El Cid

You libruls are always trying to stir up class warfare instead of letting all those geese keep laying their golden eggs which you have to break to make that omelet we keep hearing about.

beltane

The glibertarian argument would be that the poor are paying for the privilege of using cash. If they were as productive as rich people, they too would be entitled to the same inalienable rights. One can do very well with a minimum wage job provided one has a proper work ethic and is prepared to work 36 hours a day.

harokin

As Ben Folds sings, “When I was broke I needed it more, but now that I’m rich they give me coffee.”

El Cid

My local liquor store fights for revolutionary equality of the proletarian classes by giving a lower price for cash or debit. Unfortunately my bank charges me fees for debit which usually outrank the savings.

Bill Rutherford, Princeton Admissions

@El Cid:

Really? One bank has tried to charge me for PIN debit transactions, and I closed my account there 4 years ago.

Roger Moore

No, that would be too hard. Instead they’ll fall back on the other libertarian dodge and come up with some bizarre way of blaming the hidden fees on government intervention in the market. Then they’ll be able to claim that in the hypothetical Libertarian Paradise™ the Invisible Hand™ would do away with hidden fees, making it better than the horrible world of government interference.

randiego

My gas station charges 5c less a gallon for cash and debit.

I’m not sure why it all isn’t this way.

El Cid

@Bill Rutherford, Princeton Admissions: If yours doesn’t now, it will soon.

El Cid

I think we should ask Megan McArdle. She’ll know why this is good, and also why these data are completely meaningless, because, you know.

Daddy-O

First thing I thought of when I saw this post was that George Carlin video.

Then I remember I saw it here…

ant

my grocery store wont take cc’s, for this very reason. Cash,check, or debit only.

Best prices in town.

Calvin Jones and the 13th Apostle

Maybe someone mentioned this in an earlier thread, but Jack Tatum passed away earlier today.

R.I.P. “The Assassin”

anonymous

Russell Simmons needs to DIAF.

Violet

A store I go to on a semi-regular basis lists all of its products with a ca sh price and a cre dit card price. The ca sh price is lower. I thought that kind of thing wasn’t allowed by cre dit card companies, but I think if the store is willing to double price every item, then they can do it. Most don’t because it’s a pain.

(I posted this once already, but the post vanished. I’m seeing if it’ll post by editing potentially unacceptable words.)

PurpleGirl

Time was when my bank didn’t charge you if you got cash back when you used your debit card to buy groceries. Now they charge $1.50 as if you were using another bank’s ATM or one of those independent ATM machines. Also, they used to allow you 4 non-their-bank ATM withdrawals a month without charge. Now they don’t. All my ATM withdrawals are at the bank now. (At least I’ve found enough branch locations close by that I can easily get cash.)

malraux

What really pisses me off about that is how the CC companies are bribing the rich in helping to gouge the poor.

SpotWeld

I just have to wonder if this is creeping into other places as well.

Cable fees?

Cell phone fees?

Rommie

And if someone tells the BigWigs to stop doing it, the BigWigs will just shake their heads sadly, and let everyone know that they would be forced into doing some Mean Things, and may even head to Galt’s Gulch and deprive folks of their services altogether. So back off, Jack! It could be worse if you push us too far!

I’ve been keeping a close eye on my BoA checking account, because I know they are likely to Alter the Bargain sooner or later.

malraux

@Violet: The wording on most merchant agreements is something along the lines of the regular price needs to be the one payable with the credit card, ie no surcharges for credit. But there can be a discount for cash.

El Tiburon

As someone in one of those categories who is being subsidized, please let me say thanks. Suckas!

I remember WAY back in the day, pre-Valdez spill, I had an Exxon credit card. Those ass-hats charged .04 cents extra per gallon when using the Exxon credit card.

I never understood that.

Does using a debit card = paying cash? I know some of my favorite vendors (Wiggies Liquor, I’m talking to you) prefer my debit card over the credit card. I guess they don’t have to pay that 1-2% transfer fee.

PeakVT

For those who enjoy a nice conspiracy, here’s an article on how all these fees are part of the plot.

DarrenG

I’ve worked on both the banking and merchant side of dealing with credit card processors and contracts, and trust me — everyone in the industry knows the interchange fee system is screwed up.

The problem is that it’s like the old joke about democracy and capitalism. It’s the second-worst system in the world, but all the others are tied for first.

The original article also missed another huge inequity in the current system: The interchange rate is not a fixed amount, but is negotiated separately with each merchant, meaning Walmart pays much, much less per transaction than your local mom ‘n pop store.

I’d love to see a better way of funding the massive electronic payments infrastructure, but unfortunately I haven’t see one proposed yet.

cmorenc

My week long stay in high-tax Denmark was accompanied by a strange contradiction: sales or value-added taxes are seamlessly built into the retail “sticker” price of everything, and so they’re strangely invisible except as reflected in the relatively high cost of living in Scandinavia. Doubtless, residents much more directly feel the bite of progressive income taxes – but their society is much less intensely stratified economically than ours is. Yet, Denmark is a remarkably prosperous, happy society for the prototypical European social democratic state laissez-faire right-wing fundamentalists in the US consider a nightmare only mildly short of Soviet Russia in the 1950s. Oh, and they like soccer and a high portion of their urban workforce commutes to work on bicycles, traveling in bicycle-specific lanes on every urban street from the biggest and busiest to the smallest lane. OOOh, any gooper-winger who visits Denmark is going to need intensive psychotherapy to get over the shock of cognitive dissonance at a people so massively successful and content in a place where it should be impossible according to winger logic. Else, more likely they’re going to lie completely to themselves about what they’re seeing, which is more likely.

DarrenG

@El Tiburon:

Most debit card transactions cost a relatively high fixed fee, whereas credit transactions charge a percentage.

For low-cost transactions credit cards are cheaper, but for expensive purchases debit cards are. Exactly the opposite of what most consumers would want and expect, of course.

Zifnab

There’s a chain of liquor stores called Specs, down in Texas, and they offer a discount for paying in cash or with a debit card rather than using credit.

Freak’n commies.

El Tiburon

@DarrenG:

I’m assuming you mean they charge the retailer this fee. If so, I find it curious that few small stores I’m talking about prefer I use my debit card. It seems they would prefer I use my credit card as usually these purchases are less than $50.00

kdaug

@Zifnab: I’m a regular at Spec’s. Also Central Market.

SpotWeld

@DarrenG: You mean

— Winston Churchill, In a speech in the House of Commons on 11 November 1947,

ruemara

bloody hell. I double and triple hate everybody. Well, not my kitty. But everyone else, I am selling to the aliens for fast ship, good maps and 20 million galactic credits. Maybe the rich will enjoy being turned in earth burgers.

edited because stuff is weird. Why is my comment attributed to SpotWeld? Not that s/he is not a fine person and all.

geg6

Fuck credit cards. They’re for suckas.

I haven’t had a single one since 2001 and haven’t missed them a bit. I can use my debit for reserving hotel rooms or rental cars and I can’t remember the last time I paid a service fee (my bank only charges a fee if I use a non-network ATM). I don’t buy anything I can’t pay cash for or do a 12-month no-interest payment plan (furniture, tv, etc.).

Best financial plan I ever made. Get rid of yours and see how much money you save and how little hassle it creates in your life to not have them. You’ll never go back.

Davis X. Machina

My credit union requested that for pay-at-the-pump, we use the credit option, for security purposes. (Shoulder-surfing PINS off of security camera footage? I don’ t know….)

El Tiburon

@Zifnab:

I am familiar – got a Specs a mile from the house in Austin, although I prefer to trade at my locally-owned establishments. The cheapest method is a gun, of course, although this is the least favored method by the liquor stores.

El Tiburon

@geg6:

My understanding is credit cards offer certain consumer protection services that debit cards do not offer.

Also you have to keep your bank account loaded up if you plan on dropping a lot of money, say on a vacation or something.

I tend to use my debit card for day-to-day stuff; credit card for bigger ticket items, including plane tickets, etc. This way if I have to cancel or something, the cash is not deducted from my bank account.

DarrenG

@El Tiburon:

Yes, interchange fees are paid by the merchant, and are negotiated merchant-by-merchant, so maybe your liquor store just managed to get a sweet deal on credit card transactions but gets gigged on debit cards.

Or maybe their management or clerks are just innumerate. I’m surprised how many businesses don’t have a clue which types of cards are cheapest for them to accept for a given purchase.

sven

JCole, DougJ, ALaurie, etc. do we have a tag for when the right loudly and passionately makes an argument we all know is in bad faith?

Here is an example:

http://www.tnr.com/blog/jonathan-cohn/76596/breaking-gop-blocks-disclosure-bill

Liberals would like limits on how much corporations can spend on issue advertising. Conservatives oppose any limits but often argue that as long as the public knows who is paying for advertising how much won’t be an issue.

The Supreme Court recently made it much easier for corporations to fill the airwaves with political ads but at least Republicans will make certain we know who is paying for them, right?

Of course not:

So what do we call this?

Irony Abounds

@El Tiburon:

Call me a capitalist pig, but I use my credit card for virtually everything. Reason: I get cash back on every penny I spend. Most of it is only a 1% rebate, but with my AMEX I get 3% back on all restaurant charges and 4% if I get my gas at Costco (3% otherwise). This saves me upwards of $700-$800 per year. I am fortunate enough to be able to pay off all the balances every month so I don’t pay any interest charges, so I don’t see the downside – other than perhaps I am more willing to buy since nothing immediately comes out of my pocket.

Corner Stone

@Zifnab:

And for some unknown damn reason, they raised their prices across the board over the weekend.

Bastards.

Corner Stone

I disagree with anyone who says credit cards are for suckers.

They serve a very valuable purpose and if you’re accountable to yourself there’s no way they can harm you, only help you.

Anton Sirius

It’s a nice chart, but it’s based on faulty logic:

(2) just isn’t true. A 1-2% charge on some transactions does not get built into a store’s markup, and if those charges disappeared tomorrow prices would not come down.

It’s just too insignificant an amount, relative to other factors like competition and rent and payroll, to matter.

sven

@Anton Sirius: Is that your supposition or do you have any evidence to support your claim?

DarrenG

@Anton Sirius:

/disagree

You’re over-generalizing there. All large merchants most certainly do factor payment processing costs into the overhead figures which are used to calculate markups. As do smaller, large-ticket retailers (a 3% interchange charge on a $2000 big-screen TV or computer isn’t chump change…)

The original article linked by Drum has some very good research by the Boston Fed showing exactly how interchange fees affect retail pricing. Check it out.

malraux

@Anton Sirius: But it’s constant and predictable, the easiest thing out there to build into the price.

Morbo

Boy are you reading that chart wrong. See, what that chart tells me is that Elizabeth Warren is the wrong person to head the Consumer Protection Bureau.

le sans culottes

it seems like we are getting ripped off…. but at the end of the day, everyone is paying these higher prices, whether they use a credit card or not. the only real winner here is the credit card companies.

DonkeyKong

Like Reagan said, “a rising tide lifts then fucks you in the ass and dumps you by the side of the road.”

HyperIon

@PeakVT:

No.

ATM (and grocery store) fees can be avoided by paying cash.

In fact some would say that only a moron pays a fee to access one’s own funds.

In this case, however, paying cash has no effect on the screwing one is getting. The existence of credit cards means that prices are higher in places that take them.

Ruckus

Most have hit it right.

Debt cards have a set fee when processed as a debt card. (Pin used) Otherwise the fee is the same as cc.

Credit cards fees are priced per whatever the merchant bank can get from the merchant, so you have to knowledgeably shop around to get good rates. Knowledgeably because the terms are not stated in common language, you have to learn the system to get the best deal as a merchant, and even then you can get screwed.

On top of the % there is a monthly fee based on volume and size of each charge. As well as a statement fee. And so on.

Total card charges I pay are just under 5% of sales, even though the % charged per transaction is much less.

Everyone I know charges a little for credit and hopes people pay cash.

BTW those premium cards? The rewards are paid by the merchant in a higher % fee. Or all of that merchants fees are higher. And AE and Discover require a set monthly fee in addition to all the rest of the fees. And AE % is much higher. So everyone else pays higher costs due to the premium cards even if you don’t have one.

You don’t think banks, cc companies pay for this do you? They don’t pay those big bonuses and build those big buildings out of the goodness of their hearts. The people with their pockets open are the ones paying, and it adds up to a whole lot of money.

geg6

@El Tiburon:

I don’t buy a big ticket item if I don’t have the cash, no vacations, no nothing. Simple as that. Hell, I paid cash for my car.

I rarely use my debit card for anything other than getting cash or gas (when I use the credit option so they don’t freeze my entire checking account for a $15 top off), so I’m not much worried about needing protection.

From my early 20s until my mid-40s, I was a slave to credit cards. Almost ten years after giving them up completely, I have yet to discover a scenario or reason for which I’d need one. I’ve bought furniture, electronics, plane tickets, hotel rooms, everything you could imagine and never once needed a credit card. I spend less on shit I don’t need and I haven’t paid interest or a finance charge in almost a decade. Credit cards are for suckers. I completely stand by that.

geg6

@Corner Stone:

Credit cards actually serve no useful purpose at all. You can do the same with cash and a debit card with no need to risk the shitstorm you risk when you use a credit card. If you are paying your balance in full every month, what’s the point? Why pay the service fees or make the merchant pay the fees? Almost no one NEEDS a credit card and almost everyone is better off without them. They are an extremely, extremely risky item to have and 90% of the people that use them shouldn’t because only a very small percentage of cc holders can actually afford them. Anyone who carries a balance on a credit card is throwing their money away and that vast, vast majority of cc holders carry a balance.

Anton Sirius

@sven:

Just my own experience working for and with retailers of pretty much every size, from single-owner stores to small regional chains to big national and international chains.

That’s anecdotal though. It should be possible to trace pricing trends around the time electronic processing machines replaced the old carbon sliders, and see if prices actually went up to account for those processing fees. The Boston Fed paper that originally generated the discussion lists previous papers that discuss the issue of markup subsidies but doesn’t footnote them, so I don’t know if that research has ever been done or if it’s just an assumed fact.

jake the snake

@beltane:

.

And are able to get from each of their 12 jobs to the other in 15 seconds,

malraux

@geg6:

Well, doubling warranty length, cashback rewards, max of 50 dollar liability, more portable, delayed payment, easier budgeting. I’m not seeing the downside.

JBerardi

@Daddy-O:

First thing I thought of was this Louis CK’s “being broke” bit… his social commentary might actually be better than Carlin’s, if only because it’s somewhat less explicit.

Corner Stone

@geg6: Why would I pay cash for a car when I can get that car at 1.99% apr, take the cash and invest it in something I can return 5, 6, 7 or 8%?

And the reason people get low credit offers? Because of good credit scores, which are almost entirely based on your interactions with companies that lend money. Either banks that loan or banks that loan you cc’s.

Credit cards serve their purpose for people who are able to effectively evaluate risk.

Xanthippas

On a related topic (well, credit anyway) here’s Fred Clark on the one-sided credit scoring system employed against us little people:

I guess it’s too much to ask that we just pay these credit scoring agencies to give us the ratings we need to get whatever credit we want from banks. That’s only for the important people on Wall Street.

malraux

@Corner Stone: Hell yeah. I just bought a new car with 0.9% financing. My bank account pays 3.5%. Sure I could pay cash (actually, I would have put it on the credit card for the extra cash back), but this way I’m making my money work for me.

The game is clearly rigged, but that doesn’t mean it isn’t worth it too play.

daryljfontaine

@Corner Stone:

For those who’ve been burned, whether due to selective blindness or predatory marketing, credit cards are a burden — and those people with the ability to dig themselves out from under their accumulated debts tend to have a negative backlash against continued use of credit cards.

These people are not the ones receiving 1.99% APR offers to finance a car, ever.

D

Corner Stone

@daryljfontaine: I agree. It’s not surprising that a lot of people don’t really understand risk. Those who got in a tight spot, or let their eyeballs get bigger than their stomach are a big part of that.

I’ve seen people save cash to pay for a car they could have qualified for 0% apr on back when dealers were desperate.

Who would give away the upfront nominal return, plus the end result of depreciated dollars to use as repayment?

Obviously, some among us.

Mark

I’m surprised that so many people dislike credit cards. Just a few advantages:

1) They give me a complete accounting of my monthly spending

2) They allow me to dispute charges where the merchant has misbehaved

3) If I lose my card, my liability is extremely limited

4) I never have to set foot in a bank or even go to an ATM

5) I get some portion of the discount rate returned to me

6) Returns are so much easier – the days of being screwed because you lost your receipt are over

Yeah, people get into trouble with credit cards, but the people I know who’ve ruined their lives with alcohol and drugs have done a way better job of it.

Tim

@Corner Stone: I’m with you and Malraux. If you don’t use credit cards available to you, you are giving up quite a bit merely to protect yourself from yourself. Ideally that shouldn’t be necessary. I don’t want to fight with a merchant over *my* money that he already has (the debit card scenario), plus float, etc. as was mentioned.

I will concede that an optimal credit card scenario may not be available to relatively less well-off people, and that will have some effect in perpetuating unequal distribution of wealth. I think that even though this result is dictated by the market, one could rationally regard it as unfair.