The New England Journal of Medicine has a great piece on the arguments of the Partners Effect in the Eastern Massachusetts healthcare and hospital market. It is framed as an explainer as to why Lahey Clinic and Beth-Isreal-Deaconess would want to merge as a matter of public interest instead of internal gains seeking:

The system CEOs have indeed been painting their merger as a value proposition for Massachusetts. In an interview in late March with the Boston Globe, Grant and Tabb suggested that for every 1% of market share their combined entities are able to wrestle from Partners, medical spending in Massachusetts would be reduced by $18 million.

This argument is effectively an HHI minimization argument. It goes like this. Partners’ is a very powerful entity with both excellent branding (Mass General Hospital and Brigham and Womens are the flagships) and significant market power. This market power in community hospitals leads to a very profitable feeder pattern into the flagship hospitals. This allows for the collection of significant economic rents through much higher prices. Insurers don’t believe they can say no to Partners so they pay the very high prices. A competing 500 pound gorilla won’t displace the current 800 pound gorilla but it can give some ability to insurers to say no again. Therefore the merger is good.

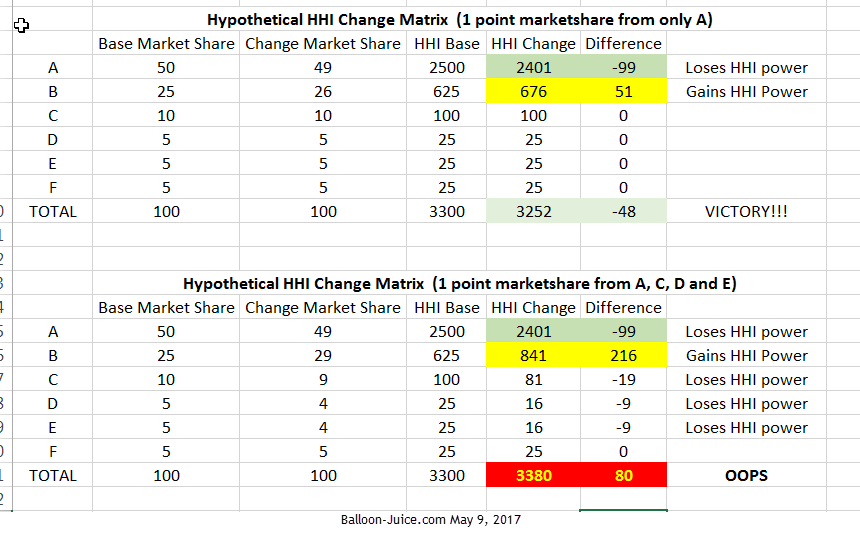

There are a couple of problems with the countervailing gorilla theory of competition. First the FTC will not approve mergers solely on the need to create new negotiating leverage in an already distorted market. Secondly, it assumes that the new entity will only take market share from Partners. If it only takes market share from Partners, the argument makes mechanical sense. If it takes market share from other competitors, the market concentration mechanically gets worse. The chart below shows two hypothetical scenarios:

If the newly merged entity has local market power and can impose increase frictional costs on patients who need the tertiary care in the new entity but receive care outside of the new entity and Partners, patients will flow into the new entity to minimize the hassle costs. If that is the case, and in my mind it is a plausible case as my parents are a good use example of this story, market share will shift from non-Partners, non-new entity hospitals to the new entity.

Weaselone

It may be my cynical nature, but I’m fairly certain that Public Interest as the driving force in a merger of two entities, even nominally non profit entities probably occurs with the frequency of pole reversals.

David Anderson

@Weaselone: There are many talented dancers who can do a pole reversal on cue —

Ohh, that other pole reversal

Cynics Anonymous meet at the Applebees near the Raleigh Airport every Tuesday night

Sab

OT, but praying for green not Green.

chopper

what does HHI stand for?

Achrachno

HHI? Remind me what that means. I get lost easily I guess, but this makes no sense if one doesn’t know.

Another Scott

Herfindahl-Hirschman Index – HHI is my guess:

Is that what you meant, David?

Thanks.

Cheers,

Scott.

David Anderson

@Another Scott: Yes… too much jargon and I got caught up in it. HHI is a measure of concentration. 10,000 points is a monopoly, 0 points is pure competition. 2,500 points is where the FTC gets worried

FlyingToaster

As a sideline sitter* in this, I’m hoping the merger goes through. Partners is working its way into becoming the Comcast of Hub healthcare.

* All of ChezToaster PCPs and specialists are Mount Auburn affiliates; Mount Auburn generally feeds into Partners or Childrens’ for issues outside of their scope. WarriorGirl’s pediatric practice has doctors with privileges at MAH, Partners, Lahey, BD/I, BMC, Childrens’, Tufts/NEMed. The only ones missing are Steward (the former Catholic Hospitals: St E’s, Carney, etc.) and Lawrence Memorial.

laura

@Sab: Praying for or thinking about or wishing good stuff for greennotGreen is always on topic.