Earlier this week, Iowa asked for a “rescue” plan for their individual exchange market for 2018. There is an inherently contradictory counterfactual that underlies any waiver that can be granted. This means there will be a lot of lawyers.

Iowa basically wants to turn its 2018 ACA market into a the bastard child of the 2019 and 2020 AHCA markets. The major elements are below:

- Single plan (Silver-like) will be offered by each insurer

- Continuous enrollment requirements for special enrollment periods

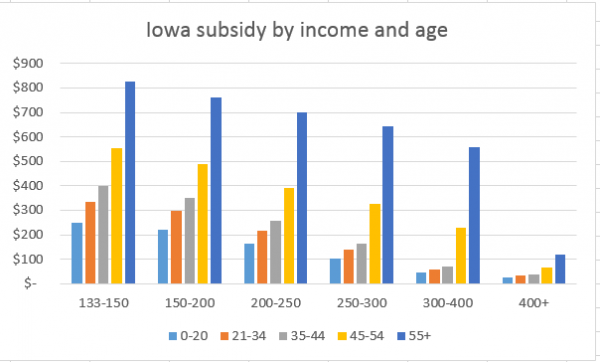

- Flat age and income based credits including small credits for people earning above 400% FPL

- $80 million dollars for catastrophic claim reinsurance.

- Insurer’s exposure is capped at $535,000 for any single individual

- Healthcare.gov becomes irrelevant and everything is sold through brokers and income is verified by the state

- No Cost Sharing Reduction subsidies

Iowa is asking for additional federal funding and a massive waiver. Tim Jost at Health Affairs has a critical summary:

Iowa essentially says that it has a crisis, and the only way to meet it is to establish a different program than that established by the ACA, which it wants the federal government to fund. Iowa has a real problem but so do a number of other states (although notably California and other states that have embraced the ACA and tried to make it work have often fared better). However, rewriting the ACA without congressional authority and giving federal money to a state without a congressional appropriation raises serious concerns, as does a program that would help middle-income enrollees at the cost of those with lower incomes.

It is also hard to believe that Iowa could possibly stand up what is essentially a state exchange, determining eligibility, calculating premium tax credits, and paying insurers, in less than five months. States that had far more preparation time failed to do so in 2013 and 2014.

There are two major issues with the 1332 criteria. There are four major guide posts for a 1332 waiver. The waiver must provide at coverage at least as comprehensive as the baseline ACA, with cost sharing protections at least as good as the ACA to at least the same number of people at no more net federal costs than the ACA.

Iowa’s argument is one of choosing a favorable counterfactual. Their counterfactual will be that their plan will meet the coverage requirements of at least as good for as many people as the ACA if one assumes that the ACA will cover no one on the Exchange because there will be no insurers on the Exchange. That is a plausible counter-factual. It is one that can be defended with a straight face.

However, let’s think about the implication of that counterfactual. In this scenario, the ACA will cover no one. Covering no one means the federal government spends no money.

Yet Iowa wants to be funded as if they have normal enrollment at normal premium growth rates. This might be a problem.

Oops.

The second major issue is the disappearance of Cost Sharing Reduction subsidies. These subsidies bump up the actuarial value of policies for people who earn between 100% and 250% Federal Poverty Line (FPL) so that a Silver plan has a bump in actuarial value from a maximum of 72% to anywhere from 73% to 94% actuarial value depending on income. The single Silver plan has a lower actuarial value than the weakest CSR Silver plan. This is most notable for people earning under 150% FPL as they would transition from plans with $500 deductibles to plans with $3,500 deductibles. This is a major violation of the 1332 guidelines. It is not rational regulatory wiggle room. There are plenty of people who would have standing to sue as they will be harmed.

There is a good argument that reinsurance will help stabilize the market. The Iowa market has the case example for the benefit of a high cost risk pool or invisible risk sharing or reinsurance or whatever else you want to call it where a small cluster of people are carved out of the general pool and their care is paid for by a much larger pool including external to premiums funding. But between a contradictory counterfactual and the elimination of the CSR assistance, I don’t know how this potential waiver survives a lawsuit.

janelle

Didn’t know where else to put this, but U.S. Rep. Steve Scalise (R-LA) was just shot at a baseball field in Virginia where he was playing baseball with several other Congressman. Gunman fired 50-60 shots, sounds like others were hit (but no other members of Congress).

Fuck.

John

Look at that Reichtag burn…

stinger

David, as an Iowa resident, I’ve been wondering about the patient with a million in claims per month, every month. Granted that the patient has a very rare condition, Iowa has a low population. Wouldn’t other, more populous states have more such high-cost patients? How do those states handle it? Why don’t we hear about those cases?

I don’t know much about health insurance but am trying to learn!

David Anderson

@stinger: Really good question. It is not “unusual” for people with the condition that this individual has to have one-off million dollar claims that spike and then disappear after several months. The unusual thing about this individual is not the single $12 million dollar claim year. That is high but it could have been handled by traditional reinsurance through either the federal government or bought on the private reinsurance market. The unusual thing is the repeated $12 million + claim years and the ongoing nature of the crisis.

Really extreme outlier cases have to happen somewhere, and this guy happens to live in Iowa. If he lived in California, the dynamics of his care would be muted by the much larger risk pool ($1 per member per month) but in county or rating area level markets, this type of case would still be the rating nightmare from Heck.

tobie

This likely belongs down thread in the post “Call the Senate” but I wanted to say that I was able to reach the Senate Finance Committee chaired by Orrin Hatch (202-224-4515) and told the nice woman who answered the phone that I expected the committee to hold numerous public hearings on the Senate healthcare proposal, as healthcare has significant economic and budget implications.

Any other committees I should be calling? I’ve already reached out to my Democratic senators (and my mother’s Republican senator).

NotMax

If ever there was an argument in favor of universal single payer as opposed the to the oldest established, permanent floating crap* game** of fizzbin now in place, this may be it.

*in the most excretory sense

**(Apologies to the creators behind Guys and Dolls.)

Raven Onthill

And, of course, that inconveniently expensive patient would conveniently die when money for his treatment ran out.

ruckus

@NotMax:

Would be great if there were people who could properly explain to the people that make the laws might listen to that with a 300+ million person market, people on the very outside of the cost curve would be a blip on the bottom line.

But the very idea is highly likely to be the ability of the right people to understand it.