Within the ACA, plans are grouped into metal bands. Those bands have a target actuarial value with a band of allowed variance around that target. After a plan shows that it meets the allowed actuarial value without going the maximum out of pocket limit nor violating the non-cost sharing preventative services restriction, insurers are allowed to design their plans however they want.

There is wide variation in plan design. There are three cost sharing components. Deductibles are what the patient pays before the insurer will do more. Deductibles may apply to all services or only some services. Co-pays are fixed amounts that the patient pays for a given service. Co-insurance is a percentage that the patient pays. Once the total out of pocket spend meets the plan’s maximum out of pocket, the insurance company is on the hook for all claims above that limit.

Insurers can choose their plan designs and those choices have significant distributional impacts:

Deductible plans favor the sickest people as the low utilizers pay for almost all of their care via deductible cash. That means the proportion of the pool’s individual responsibility amount is borne by healthy people.

Co-pay only plans favor people who use highly concentrated cost services. A co-pay does not differentiate between a specialist visit with a contract expense of $200 and a specialist visit with a contract expense of $600. It is the same fee. So people who use very costly services but only rarely are best off. People who use a lot of fairly low costs services on a regular basis pay more proportionally.

Co-insurance only plans favor low cost utilizers. They are not paying full price via their deductible, and unlike co-pays, the individual cost per unit matters.

I was talking with a colleague about insurance in North Carolina earlier this week. There are 33 plans being sold on the Exchange. Twenty-seven of the plans have a maximum out of pocket expense (Max OOP) of $7,350. I expected to see that type of Max OOP for Catastrophic and Bronze plans. I would not have been surprised to see that Max OOP for Silver plans but I was surprised to see a $7,350 Max OOP for a Gold Plan. The lowest Max OOP was $6,650 for a Bronze plan where the entire cost sharing was the deductible.

We looked into the plans and saw that the deductible got lower as the AV increased as well as co-pays and co-insurance. The max-OOP translated to different levels of spending. The Bronze Plan Max-OOP was $6,650 before the insurer paid everything the Gold plan only paid some of the claims to just over $40,000 before the insurer had to pay everything. It is mainly a risk distribution bet on actuarial value as people who have a $10,000 claim are much better off in Gold than Bronze.

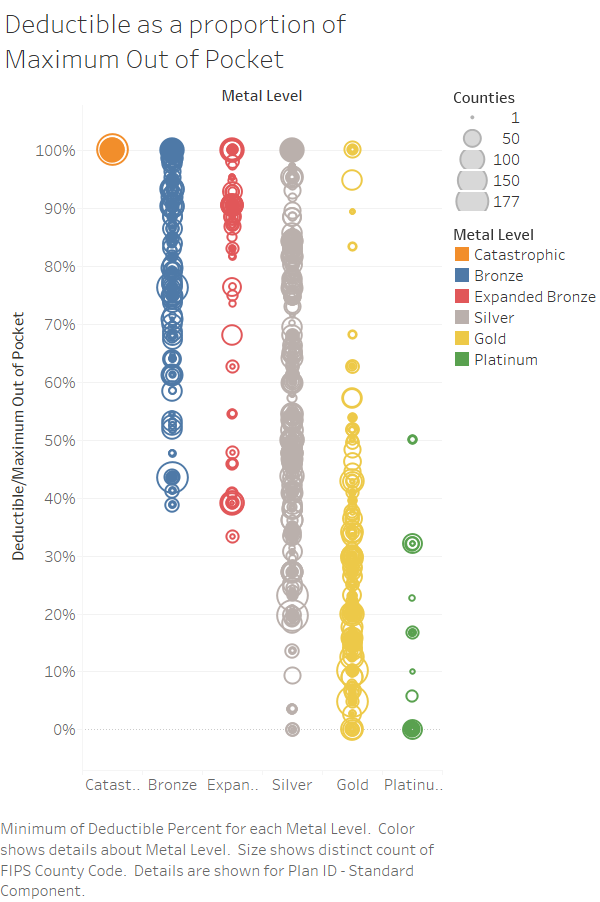

But as part of that discussion, I got curious about how much weight the deductible bears in cost sharing across the country. I used the Landscape PUF to calculate a rough metric: Individual Medical Deductible/Individual Medical Maximum Out of Pocket. If the quotient is 1, the deductible does all of the cost sharing. If the quotient is 0 there is no deductible. The Gold plan I mentioned above has a quotient of .17.

I’m seeing a few things. There is wild variance in plan design. Silver is all over the place. Zero dollar deductible plans are possible with Silver, Gold and Platinum. Low deductible plans are fairly common for those metal plans. They make up their cost sharing by co-pays and co-insurance. I need to go back over time and calculate this quotient in previous years before I can make strong statements. Right now it looks like plans of Silver/Gold/Platinum are being designed more often than not to look or actually be more attractive to healthier individuals.

Butch

David, since it looks likely I’m about to join the “gig” economy, I was talking yesterday with an insurance agent about health insurance and she mentioned some policies that cover accidents and hospitalization only, which are really my main concerns at this point. Are you familiar at all? They’re much cheaper but I’m afraid it could be a false economy.

Ridnik Chrome

You can have the Black Sabbath plan, the Judas Priest plan, or the Def Leppard plan. But if you live in a Tea Party state, you get the Cannibal Corpse plan.

(ETA: Sorry, I couldn’t resist.)

father pusbucket

Thanks, David! Please add the usual tag to this great article (maybe start an “open enrollment 2017” one?).

David Anderson

@Butch: By extremely careful. Read through the fine print 3x as they don’t cover much and the coverage might be ($500/night in the hospital) or something like that.

Butch

Thanks, David. Last year’s income puts us above the threshold for any support, and we’re probably looking at around $1,400 a month for some really minimal coverage (I’m in a rural area); that’ll be tough on uncertain income, so I was looking for alternatives, but I don’t think this accident-only policy is it.

Amir Khalid

@Ridnik Chrome:

Is the Motley Crue plan any good?

Butch

@Amir Khalid: Not since about 1995.

Brad Flansbaum

David

First, great work. Two questions:

1) A well functioning RA system would ameliorate the exercise of gaming the payment design of plans. We are not there. But if we were, the games MCOs play would be minimal and you would not need to post on above, correct?

2) “Co-pay only plans favor people who use highly concentrated cost services.” Be more specific if you could. Highly concentrated can mean an NP visit every week versus a high ticket specialist and associated service requiring more copays. Its the copay cost ($10 vs $75), not the copay itself.

THanks

Brad

David Anderson

@Brad Flansbaum:

1)Assuming perfect Risk Adjustment, there would still be plan design variations but I would be writing far less. And these games are not just MCO games, they are being structured by every type of insurer.

2) Let’s imagine that Person X with two claims scenarios.

Scenario A: Single claim for the year. It is a $500 specialist visit.

Plan 1 has a $800 deductible — Person X pays $500

Plan 2 has a 50% Coinsurance — Person X pays $250

Plan 3 has a $100 co-pay — person X pays $200

Now Scenario B has two claims for the year. Both are $250 specialist visits for total spend of $500

Plan 1 has a $800 deductible — Person X pays $500

Plan 2 has a 50% Coinsurance — Person X pays $250

Plan 3 has a $100 co-pay, Person X pays $100 each time for a total of $200

There will always be edge cases but in general co-pay only cost-sharing is best for people who don’t use much but use very expensive services as the percentage of total personal costs covered by the co-pay is lower compared to someone who has frequent claims of less expensive services as this second individual gets dinged every visit and the total percentage of costs covered by the insurer goes down.