We should expect significant Medical Loss Ratio (MLR) checks to be written this summer for the ACA individual market. This is independent of whatever the courts decide on Cost Sharing Reduction (CSR) litigation. If the current decisions that there has been a broken contract with no mitigation through Silverloading stands, MLR checks will be bigger and could come in two waves.

This is not surprising. In June 2018, it was evident that insurers were overpricing 2018.

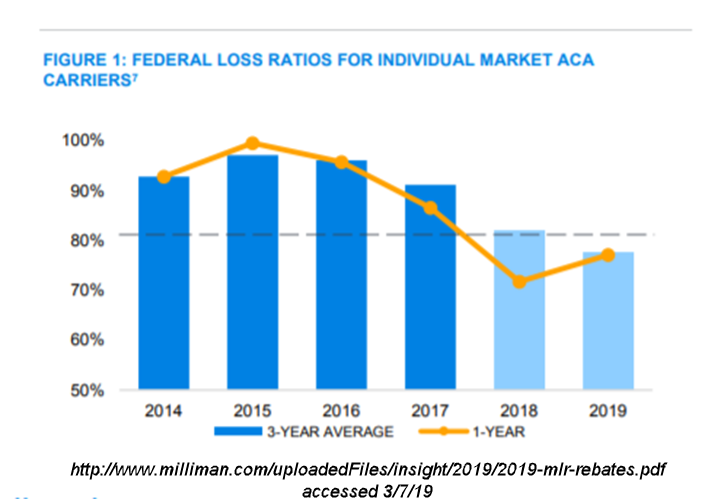

Over the past couple of years, there have not been large checks cut as insurers weren’t making large profits anywhere in the individual market. That is changing. 2017 looks to have been a very profitable year for insurers. 2018 looks to be even more profitable. There is a good chance that the 2016-2017-2018 time period will produce several states with an average MLR well below 80% as the first quarter results plus initial 2019 rate filings strongly suggest that insurers in many states overpriced their premiums for 2018.

States that have mostly monopolistic insurers and large Silver loads are more likely to have significant MLR checks.

The actuaries are starting to confirm my inkling.

New @millimanhealth paper discusses issue many insurers haven't yet faced since marketplace implementation: "Could 2019 be the year of MLR rebates for ACA issuers in the individual market?" https://t.co/czBDXztFzf

— Paul Houchens (@PaulHouchens) March 6, 2019

2018 was massively overpriced. It is some combination of monopoly markets, uncertainty over the behavior of CSR eligible individuals shifting to other plans, Silverloading bringing in healthier than expected individuals and continued policy/political uncertainty. Any insurer that is competently run should be Scrooge McDucking it. Milliman shows this.

MLR rebates are normally calculated in mid-summer with the checks being sent out in early fall.

It looks like the three year rolling average will have much smaller MLR checks landing in voters’ mailboxes a few weeks before the presidential election than this year. I had a moment of severe cynicism in 2017 when I figured out how to game the system so that insurance commissioners could make themselves look real good right before an election:

in the fall of 2020, ambitious state insurance commissioners will be handing out rebate checks in late September as they are running for Governor or the Senate. Or if they are a bit less ambitious, they are supporting the incumbent party by handing out checks and injecting new federal money into the state and making the fundamental background economic picture a bit better than it otherwise would have been.

I might be getting too cynical today.

There are games that can and will be played with MLR rebates, but this nakedly cynical one looks to be either isolated or non-existent.

Luthe

These can replace all those income tax rebate checks the “tax cut” screwed people out of.

Sab

So will they be issuing 1099s which we then get to figure out how to report on our taxes?

dr. bloor

@Luthe: Not for very many, it won’t. The self-insured market is a sliver of the market as a whole, and any MLR refunds going to companies with group plans sure ain’t going to find their way into employees’ pocketses.

David Anderson

@dr. bloor: Most of the pricing shock will be in the individual market only.