The ACA health insurance markets are individual choice markets. There is some differentiation between insurers as some insurers are bottom feeders who try to cover people who are likely to never use services while other insurers want to take on risk and win on risk adjustment. This reflects things such as prescription drug formularies, networks and likely customer service ratings (study to be done once I have free time!) But there are substantial differences within insurers. The easiest one is the different metal levels of different actuarial values.

Sometimes people make bad choices. Petra Rasmussen and I looked at dominated choices in California where people earning over 200% FPL routinely were buying silver plans that had both higher premiums and more cost sharing than gold plans from the same insurer with the same network and plan type. This was an expensive oopsie in both premium and plausible cost-sharing. In that scenario we studied, we only looked at a binary choice.

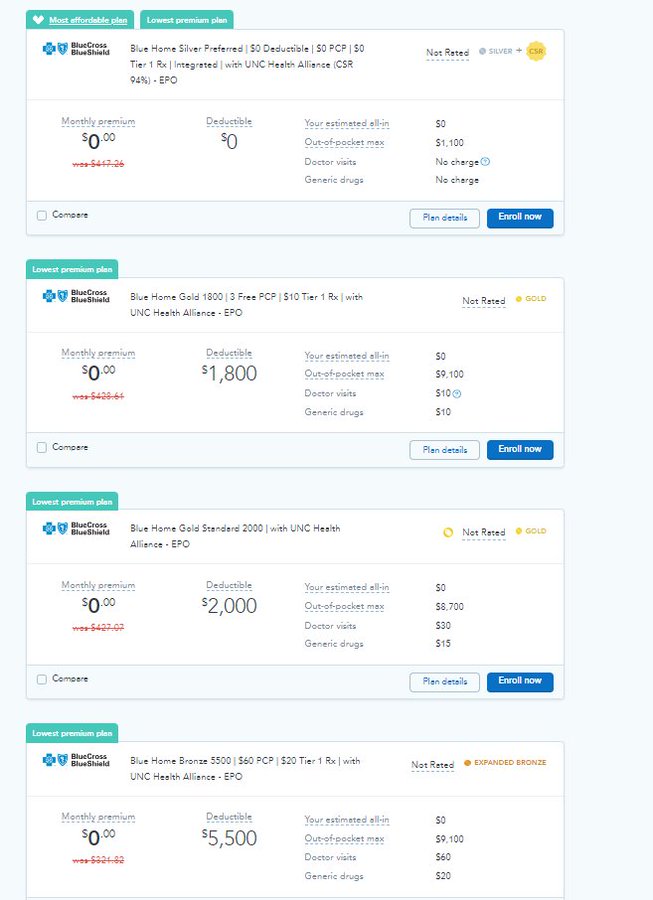

One of the questions I want to poke at in the future is stacked domination. Below is a screenshot from HealthSherpa.com for a single 28 year old in Orange County, North Carolina earning $19,000/year for 2023. This individual is probably a typical-ish University of North Carolina PhD student. I selected only BCBS-North Carolina plans.

The first thing to note is that they qualify for a lot of zero premium plans. There are eight BCBS-NC zero premium plans. One is a Silver CSR-94 plan with no deductible and an $1100 out of pocket maximum. The rest have between $1800 to $9100 dollars in deductibles and at least $7000 out of pocket maxes. The Silver CSR plan dominates everything else.

But if we assume people don’t always choose silver for whatever reason even when we control for the observables, how do people make their choices when the premium is a constant for the same network and plan type? Do they make massive errors such as choosing the bare bones Bronze $9100 deductible/MOOP plan at as if random rates relative to the $0 premium Gold plan with “only” an $1800 deductible, or do most people who are making errors choosing the less bad errors while avoiding the hideous?

I don’t know.

I want to find out.

Mr. Smith Goes to Washington – No One Is Above The Law Means Something Again

Mr. Smith Goes to Washington – No One Is Above The Law Means Something Again

Fair Economist

One question is, easy as Health Sherpa et al. are, how many people even see the comparisons? Another issue would be people picking plans to keep their doctor.

Jerry

Why would folks not choose the first option in your screenshot?

Old School

@Jerry: Why choose silver when you can have gold?

Butch

We have a choice of only one company (Blue Cross), which is increasingly starting to act like you’d expect a monopoly to act – you can just about guarantee that whatever claim you file will be rejected. Our recently supposedly “completely covered” yearly physical ended up costing us just over $1,600. Some of these questions just aren’t relevant to some of us in restricted markets. (I did protest; I was told that these costs were discussed with me beforehand, which wasn’t true, and discovered once again that the folks at the state insurance commission regard it as their job to answer the phone and tell you there’s nothing they can do.

David Anderson

@Fair Economist: that is a damn good question… I got to this comparison on 2 clicks

I think the strong default of the BCBS NC CSR Silver plan will get most low attention folks but not all.

David Anderson

@Jerry: They should choose the 1st option. It ties all of the relevant comparisons on Premium, Network, Insurer fixed effects while winning on cost-sharing for any service

But we know that a decent percentage of folks won’t pick the dominant choice. And that is an expensive problem.

Uohn

Stacked domination seems fine, everyone’s preferences are different and valid

David Anderson

@Uohn: Safe, & sane with ongoing, enthusiastic, and obvious consent