In this month’s Health Affairs, I have a new article co-authored with Coleman Drake of Pitt and Ezra Golberstein of the University of Minnesota. We examine the enrollment effects of Georgia’s Section 1332 Reinsurance Waiver on subsidized enrollment using a matched border county design between Georgia (which adopted a waiver) and the five surrounding states that did not adopt a waiver nor have Medicaid Expansion during the study period.

BLUF: Section 1332 Waivers decrease non-subsidized premiums. These waivers ALSO increase the minimum cost of coverage for subsidized enrollees. Enrollment in the 250-400% FPL group DROPPED BY A THIRD!

WHAT?

Weren’t waivers supposed to make health insurance more affordable?

YEAH BUT…..

The key question in the ACA when we think about affordability is: FOR WHOM?

Section 1332 waivers are increasingly common. Sixteen states use these waivers to implement a reinsurance program that uses an injection of non-premium funds to pay some portion of insurers claims. These external funds drive down premiums. Cheaper premiums are good for people who care about the premium level. This group consists of upper income individuals who don’t qualify for premium subsidies AND individuals with complex work and immigration statuses that aren’t legally or programatically eligible for premium subsidies. In 2017 this was a pretty big group, just under half the ACA total individual market enrollment. By 2023 when we conducted the study, the combination of expanded subsidies, removing the income cap for eligibility, premium inflation and removal of the family glitch makes this group tiny. It is about 10% of the total enrolled population now. But here, cheaper premiums are great.

The other group in the ACA are the individuals who receive premium subsidies. This group has always had incomes between 100-400% Federal Poverty Level (FPL). Since the passage of the American Rescue Plan Act in 2021, the 400% FPL cap was removed and the subsidies got substantially richer. The subsidy works as a gap filler between what an individual is expected to pay (as a function of their income level) and the full premium of the 2nd cheapest Silver plan. If a person buys a plan below the benchmark, they pocket the difference in the form of a lower personal premium. Personal premiums decline to zero. We know that going from $0 premium to $1 premium is a much bigger barrier to enrollment than going from $1 to $2 in monthly premiums due to the administrative friction.

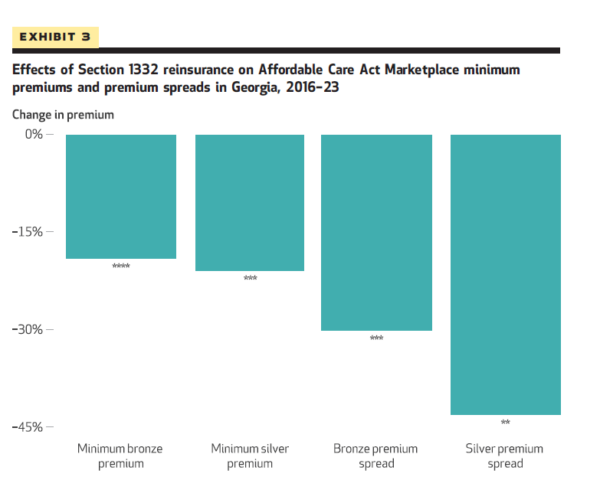

Reinsurance does what it is intended to do. Gross premiums go down!

But at the same time, the premium spreads go down as well. This means that the cheapest plans that subsidize enrollees face become substantially more expensive. This is a huge trade-off! Which way does it go and does it really matter?

That is the policy question.

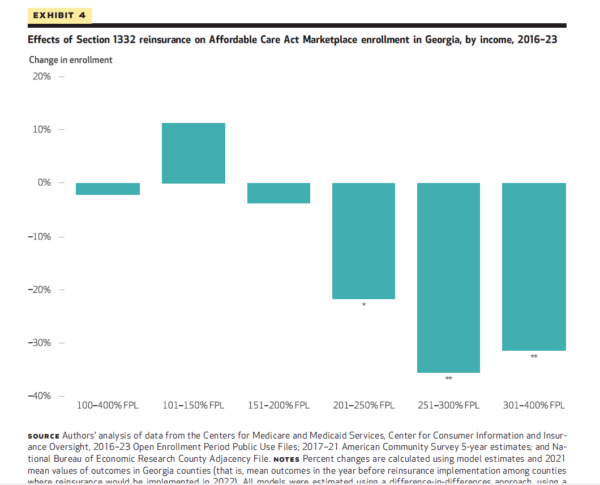

We find massive drops in enrollment for income groups between 250-400% FPL. Approximately a third of enrollment goes POOF!

We are not surprised by this. We know that the ARPA subsidies effectively makes everyone earning under 150% FPL zero premium exposed, and usually exposed to a zero premium Silver CSR plan. The enriched subsidies and Silverloading makes most if not all people earning between 151 to 200% FPL exposed to at least a zero premium Bronze plan. Only as we go up the income scale does the cheapest plan likely transition from zero to not zero. I would bet if we had individual level data we would see a kink in enrollment somewhere around 220% to 230% FPL but we don’t have that fine grained data.

Reinsurance drives down premiums.

Reinsurance makes the spreads smaller.

Reinsurance makes the cheapest plans more expensive for subsidized enrollees above 250% FPL.

We estimate that for every new enrollee that was not receiving a subsidy, Georgia may be trading several enrollees earning between 250-400% FPL.

We also don’t think Georgia is particurly unusual. I tweeted this out from a 2022 Academy Health ARM session as RAND was presenting some of their preliminary reports on three state waivers:

So what?

We think that reinsurance waivers need far more nuanced analysis and distributional trade-offs. Currently, every state reinsurance waiver application just assumes that the under 400% FPL group is indifferent to reinsurance. We don’t think that this is the case and our evidence strongly suggests that the zero premium effect for the minimum cost of coverage is really important.

TLDR The ACA is really complicated!

TBone

I participate in the marketplace through the PA exchange called Pennie. If it weren’t for the completely subsidized premium on my Silver plan, I’d be uninsured out of spite.

Betty

Your final sentence says it all. So if we simplify health insurance in the US, will people like you still have jobs? Just wondering who might be negatively affected besides private insurance companies.

Fake Irishman

And now that the subsidy cap is lifted, the distributional effects for some folks in the 400-600 percent of FPL might get complicated too, at least until next year.

Unintended consequences are always a fun/maddening feature of policy. Remember when Donald Trump tried to destroy the exchanges by cancelling payments for the CSR subsidies? I seem to recall he managed to give zero premium plans to something like a million people instead because most states directed insurance companies to funnel all the premium hikes into Silver plans (thanks to people like Charles GABA, Andrew Sprung and you banging the drum)

David Anderson

@Betty: Always will have a job…. even in a very simple system there are things that we need to figure out — how should we structure care to make sure that the right thing is going to the right person at the right time…. do we need more or less hospitals in region X — or more accurately, what are the trade-offs of adding a hospital there…. How do we finance the system? How do we deal with trade-offs for different groups at different health levels and different abilities to access care.

I have 50 years of job security in health policy.

David Anderson

@Fake Irishman: Urban Institute banged that drum early and often.

the pollyanna from hell

Since I moved to Chattooga County I have often felt as if Georgia is trying to kill me. Your report does not relieve my paranoia.

David Anderson

@the pollyanna from hell: This is not intentional. This is a blind spot among policy makers and very high priced consultants who really don’t understand priced linked subsidies.

Betty

@David Anderson: Good to know! Your knowledge is so valuable.