I know the right wing is all worked up about the lucky duckies and their cell phones, but this seems like a better place to focus some anger:

One Merrill Lynch trader apparently gambled away more than $120 million in the currency markets. Others seemingly lost hundreds of millions on tricky credit derivatives.

But somehow all this red ink did not spill into plain view until after Merrill earmarked billions for bonuses and staggered into the arms of Bank of America.

Inside Bank of America headquarters here, executives are asking why. The bank is investigating how Merrill accounted for wayward trades in the final, frantic months of 2008 — and why at least one big loss was slow to appear on Merrill’s books.

Of particular concern are the activities of a Merrill currency trader in London, Alexis Stenfors, whose trading has come under scrutiny by British regulators, according to people briefed on the investigation. The loss Mr. Stenfors is believed to have incurred so alarmed Bank of America that this week the bank examined the books of other traders who were on vacation.

The simple fact of the matter is that when we finally hit the bottom and start to work our way out of this mess, there need to be long prison sentences handed out to a lot of our John Galts out there. If we do not react appropriately and harshly to this kind of recklessness, we are greenlighting it again in the future.

See also.

joe from Lowell

My inner Leninist says we need to shoot a couple of these rich bastards so the rest will get the idea that we’re serious.

Zoogz

"But Jim Cramer said that it was a good bet!"

CalD

Bet he’s got a camera phone.

Dennis-SGMM

How heartless! Isn’t paying 39% in taxes on income over $250,000 punishment enough?

anonevent

John Galt at least never tried to socialize failure.

Alan

You don’t seem to get it. These are Jim Cramer’s friends. They are really hurting out there. You know nothing NOTHING about what they’re going through. If Obama would just do something…just do something…all this wealth destruction wouldn’t be taking place.

Dork

If by prison sentences, you mean new jobs with different companies doing the same thing for ginormous bonuses all over again, then, yeah….they’ll get the typical treatment for these types of criminal acts.

El Cid

We Americans need to move to a new economy where we don’t mind our own companies moving all their manufacturing to 3rd world labor sources and we’ll somehow become super-successful in high tech (which we’ll also off-shore) and in financial innovation!

It’s a great plan! And anyone who doesn’t agree is a terrible repressive Luddite who hates technology and wants us all working in mills and hates foreigners!

Zifnab

For what crimes? Buying shitting mortgages may be dumb, but it’s not against the law. I guess you could go after Moody’s or S&P for fraud on how they rated bonds. But AIG, for instance, was taking advantage of a legal loophole. At best, you’d be tied up in court for years attempting to prosecute a thousand different Enrons. At worst, you don’t even have a case to work from.

When the entire system implodes like this, you can make a few scapegoats and sacrificial lambs pay the price, but you can never come close to metting out proper punishments.

Ultimately, the best you can do is rework the system. I think Bank Nationalization isn’t just a good idea because it offers stability, but because it sets up a bedrock for future reforms in the financial system. The Corporate Age is looking awfully shaky right now.

Perry Como

I think you are getting the order wrong here. Putting people in prison for this shit will actually help us get out of this mess. There is still too much fraud in the market so people do not trust it. Private capital will return more quickly if we see some really high profile perp walks.

Das Internetkommissariat

What i keep asking myself is …

WHO are the counterparties for these ginormous bets? I mean if one guy loses 120 million in a bet then someone WON 120 million in the same bet.

How long until it turns out that the guy who lost the money knew the guy who won the money?

The Moar You Know

@Zifnab: Sadly, you have a point. What these people did was not against the law.

Brian J

If I can focus on the long-term and be a little bit nice for just a moment, one of the real problems with this mess is that it’s going to scare a lot of people who want to invest but aren’t particularly skilled or knowledgeable from doing so. That’s a shame, because solid, responsible decisions can often reap big gains for people, particularly for those towards the lower end of the income ladder who save and try to make something greater out of something small.

I don’t know if there’s any evidence that people like the ones being discussed really screwed over the little guy. I’d bet that they didn’t, simply because these types of people don’t invest enough to ever really attract their attention. In fact, most of the losses that most people have seen are normal ups and downs. But still, it’s unfortunate that a few assholes are going to frighten a lot of people from doing something that will probably make them more secure later in life.

So yes, perhaps we should shoot a few of them. Or maybe we can just line them up in a public setting, charge $5 to throw eggs at them, and use the money to buy up some mortgage securities to help the housing market or to pay down the deficit.

Zifnab

@Dork: I don’t know if the money is there anymore. You can’t get blood from a stone and the government won’t keep bailing out these bankrupt industries forever.

Right now we’re working towards a soft landing, but if GM and BoA and AIG finally go the way of Lehman Brothers, who’s going to be giving out the big bonuses anymore?

If the government spending works and the bailouts don’t, you’ll be left with the US Government as the primary pillar of the economy. And the US Government isn’t hiring people to the tune of $10 mil+ / year.

A lot of these bonuses are coming from the cannibalism of the company. Eventually, you’re going to run out of shit to eat. Who was getting giant bonuses in 1933?

libarbarian

I’m talking Federal "Pound Me In The Ass" Prison.

HeartlandLiberal

But isn’t that like saying unless we investigate the Bush and Cheney regime for their crimes and punish them we are just asking for the descent into police state tyranny to continue?

Wouldn’t it be better to just hug and make up? I mean, all that was so last year.

libarbarian

Lets enslave them for 10 years to help make up for all the wealth they lost. We’ll call it Indentured Servitude but they will really be our slaves and have to TeaBag any American who asks.

Walker

@Zifnab:

Can we make enough of a case that they defrauded company shareholders, and thus we can seize personal assets from high level executives?

Alan

I like Bill Maher’s solution. Hang a few of them in the exchanges with their balls stuffed in their mouth.

Brian J

@Zinfab:

I don’t think anybody is saying that losses are necessarily criminal. The $120 million loss from the guy in London might not be fraud; it might just a bet turning into something bad.

The problem comes from the fact that the proper procedures for financial markets weren’t followed, so that when Bank of America looked into this, they were shocked at what they found. Maybe it won’t make a difference one way or the other, but when taxpayer money is on the line to insure the transactions, I don’t like the idea of shady tactics. Again, it’s not clear that outright fraud was committed, but the fact that proper book keeping wasn’t taking place is symptomatic of a larger problem: some of these people feel they can do whatever they want, whenever they want it, no matter what the laws or standards say.

Svensker

In that period, many of the titans of commerce and finance were funneling their own money into the economy or their companies to try to keep things afloat. They actually felt some sense of responsibility and honor back in those days. The new breed of Master of the Universe just feels a huge sense of aggrieved entitlement.

J. Michael Neal

My inner

LeninistStalinist sayswe need to shoot a couple ofthese rich bastards need to go the way of the kulaks, so the rest will get the idea that we’re serious.Andrew

I think that financial crimes should be judged relative to the actuarial value of human life, which might be something like $1 million dollars or whatever. Probably a lot lower, on average. If you steal $100 million dollars, you go down for 100 murders.

If some poor person gets 3 months for stealing $80 or a life sentence for a third strike on a minor felony, these fuckers deserve to go to federal-pound-you-in-the-ass prison for life.

This would also serve to mitigate complaints from the prison industrial complex that we’re releasing all of the marijuana users.

Jim Cramer can be the first one brought up, with additional charges of severe douchebaggery.

Josh Hueco

So many traders, so few lamp posts.

Comrade Dread

I will bet you 120 million dollars right now that not a single one of these bastards from Merrill, Countrywide, B of A, AIG, or any other company that employs only the "best financial minds" does any jail time, faces any serious repercussions, or even censure, scorn, or polite disdain.

Unless they pulled a Madoff, and even then I’m not entirely convinced they’ll see the inside of a jail cell.

These people all have powerful friends, and short of a peasant uprising, I don’t expect we’ll see real justice done.

Shinobi

You’re so right. Focusing on all the money that is now mysteriously missing from the economy is focusing on the past. Investigating fraud, and holding people who stole money and lost people’s savings is backward looking, it will only drag us down. We need to look forward, so we can build up the economy, so that a new generation of investors can get screwed by wallstreet insiders with no accountability whatsoever.

/Limbaugh’s Miniion

cleek

odds are good there was no $120M. there was probably just a piece of paper somewhere that said "no fear. i’m good for the $120M, as you can tell by this big pile of mortgage-backed securities i’m sitting on!"

Perry Como

@Das Internetkommissariat: AIG counterparties.

Gus

Neither was what the Ancien Regime did in pre-Revolutionary France. Just sayin’.

Andrew

I think this is right.

As first, it leads me to question why some of the finance types haven’t just been murdered by people who have lost everything, but I immediately realize that the sociopaths are the finance types.

Bring on the 90% marginal tax rates.

John Cole

@Zifnab: I bet you could find a wealth of fraud, misreporting, and other financial crimes. And, as always, it may not have been the gambling itself, but the hiding of the losses and cover-up.

How many people invested in these companies after corporate HQ knew what was goign on? How much taxpayer money? I bet that is pretty fertile ground for investigation. I would even say throw a couple billion in stimulus money towards investigation.

Additionally, the larger point is that we are in a crisis of confidence as well as a number of other crises. Until people feel safe to invest, they won’t.

Alan

@Josh Hueco:

It wasn’t the traders that caused this financial mess. It was the investment bankers. It’s their financial wizardry that made it all possible.

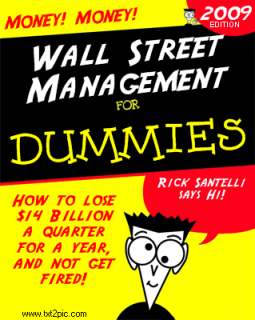

The Other Steve

I created this for you…

http://i41.tinypic.com/27y1gd0.png

Xanthippas

Stories like that make that douchebag Santelli seem even more…well, douchebaggery.

Zifnab

@Brian J: @John Cole: I suppose that’s all true. Ultimately, I’d like to see what the shareholders do at the end of all this, from a civil perspective.

People will feel safe to invest given enough time. I don’t think that’s really a problem. Right now the markets are cratering because everyone’s got a doomsday scenario playing out on their future projections sheets.

The idea is to actually hedge against this sort of thing happening again. Prosecutions will help. I just don’t know how much bang we’ll actually get for our buck.

Olliander

This hit the nail on the head. Those titans of industry of the early 20th century had ownership interest in their businesses for the most part. These rogue traders don’t have significant equity stakes, not enough to make a difference anyway. Look at the CEO’s of the Wall Street banks, even the auto makers who ran their companies into the ground. How much ownership do they have? There is no accountability unless the majority of your net worth is at stake, which my guess is, wasn’t the case here.

Jason

Who opened the vintage Ann Coulter 2003 in here with this "let’s kill a few to get their attention" shit. I mean, kudos to Maher for getting the ball rolling, but I think "going Galt" is probably sophisticated code for "find a country without an extradition treaty." So maybe forward-thinking populists will require human collateral for all this knowledge-work our traders offer on the chance they suddenly withhold it? Should we be rounding up their grandmothers, maybe.

Napoleon

@Zifnab:

I disagree. You have 2 separate problems, the economic environment and the regulatory environment. Time may heal the economic environment, but until the regulatory environment is changed so that people are convinced that the system is "transparent" and the police are on the beat they are not going to invest. The New Deal is a good example of addressing both. The government closed down banks, reviewed the books, allowed solvent ones to reopen with a federal guarantee. With that change in the regulatory environment people put money back in banks.

jenniebee

I know that Death Squads aren’t funny – we’ve established that – but I’m ready and rarin’ to establish some Kneecapping Squads.

May those who love us love us.

And those that don’t love us,

May God turn their hearts.

And if He doesn’t turn their hearts,

May he turn their ankles,

So we’ll know them by their limping.

If the kneecapping is in God’s hands, I’m ok with that. As long as he doesn’t take too long getting around to it, and I get to watch.

Alan

OMG, if anyone is watching CNBC. "Obama speaks and the DOW drops." That’s what Kudlow and Melissa say is a fact. It’s obvious the market hates Obama. Time to que Cramer.

Karmakin

Ummmm…

http://www.dailykos.com/storyonly/2009/3/5/16720/74815/703/705113

If that’s accurate (And I have no reason to doubt it), then it’s going to take a lot more than regulation IMO.

Xanthippas

Ha.

Michael

In a truly just world, Larry Kudlow would fear for the safety of his teeth every time he ventured out in public.

Rick Taylor

I presume everyone here has already seen Krugman‘s most recent article. There’s a counter-argument from JustOneMinute here. It sounds like we’re supposed to play the market to save the market. I’m really hoping Krugman’s wrong this time; not a good position to be in.

Michael

I made a nice little Santelli graphic…

http://img17.imageshack.us/img17/4695/roflbot3lb2.jpg

By the way, anybody catch Hunter’s Kos diary?

http://www.dailykos.com/story/2009/3/6/10302/42404/660/705140

There’s lots more, but as rants go, it neatly disposes of Rand.

And in lot fewer pages.

gwangung

Why would we WANT their knowledge and expertise given where they led us?

If they’re the top 1 percenters, maybe the the next 2 percent might be just as talented, but not be such douchebags…

The Other Steve

Jim Cramer has been manipulating stocks for years.

Joe Max

Word up.

I want to see some goddamn orange jumpsuits, dammit.

When is it going to be pitchforks and torches time?

Lupin

Like Bill Maher said we need to hang a couple of them in Wall Street with their balls in their mouths.

We’re not dealing with John Galts here, the new Mellons or Carnegies, but more like the Sopranos on a grand scale.

cleek

hey now, Tony Soprano was a likable scumbag.

liberal

@Zifnab:

We can speak of "crimes" in a sense beyond that written into statute. Just like we can speak of the "criminal" Bush administration, without need of in-depth demonstration that Bush violated international or domestic laws.

I agree with the sentiment that it really would be nice if some of the most egregious cases were lined up against a wall and executed by a firing squad, but the only way it’s going to happen is general violence, and in that case these rich bastards would probably buy protection, so it’s not going to solve anything. And we can’t do much on the legal route, because of the Constitutional prohibition against laws enacted after the fact.

What we can do, however, is neuter this bastard sector of the economy going forward, make these #$!&ers persona non grata, and tax the living hell out of them.

Of course, that takes coordinated political effort, which is not as emotionally satisfying (no snark intended) as violent fantasies.

gopher2b

Heads, I win. Tails, we tie.

The Grand Panjandrum

It should surprise no one that Merrill Lynch is once again being mentioned in possible underhanded dealings. Somehow it has escaped mentioning by the CNBC crowd that Merrill has been involved–in some way–in almost every major Wall Street scandal since the 70’s. Remember Michael Milken and Junk bonds? Who paid hefty fines after then New York Attorney General Elliot Spitzer investigated Wall Street for shenanigans? Plenty of other examples, but those are the two that come to mind at the moment.

liberal

@Andrew:

AWESOME!!!

I’ve had exactly the same thought myself. It’s turning the usual cynical cost/benefit analysis ("a statistical life is worth only $1 million [or whatever], therefore this regulation is too costly") on its head. (FWIW, I don’t necessarily always disagree with that kind of analysis.)

Though part of the punishment should be of assets, not just a life sentence in prison. That will really add to the incentive not to pull this kind of crap, and furthermore will provide the government with much needed revenue.

Lupin

@ cleek

Personally I thought Tony was scary, not likable.

Seriously, Ayn Rand would barf at the kleptocrats that have been running the show during the last decade. We have more in common with Brezhnev’s utterly corrupt nomenklatura than some kind of Nietzchean utopia of supermen.

Frankly, I don’t think the country is going to make it, in its present form, no more than the USSR made it. Obama is our Gorbachev. He is trying to rescue a system that arguably can’t be rescued, and indeed will fight tooth and nail against reform — just as the old communists did.

I have no idea what our future will be like, no more than the average Muscovite in 1989 knew where they were headed. I think however that the current GOP clowns will go the way of the Communist Old Guard in Russia. I am far more wary of a Petraeus-led movement in eight years, bankrolled by our own oligarchs.

On a personal level, we took steps in 2004 (right after Bush was reelected) to protect ourselves and create a reasonably safe future for us. As far as I’m concerned, Wall Street can meltdown all the way to China, I don’t give a rat’s ass.

Michael

Also, Tony Soprano was a believer in the "win-win", where everybody in a deal enjoyed some benefit.

Lupin

@Michael

Remember the episode of the Sopranos where the manager of a sports equipment store can’t pay his gambling debt and Tony and his cronies take over his store, loot it for everything they can get their hands on, then depart, leaving behind a wrecked business.

We’re the sports store.

joe from Lowell

These, of course, are the "productive" people we supposedly can’t live without.

theturtlemoves

I read some comment thread yesterday on The Atlantic wherein all the latter day John Galts were saying how they’d cut back their work hours, etc, to protest a possible marginal increase in taxes. It was hilarious and sad. One guy owned a "consulting business". I honestly think these douchebags are jonesing for the end of the world so they can live out the stories from the fantasy novels and movies of their youths. Problem is, not much need for "consulting" in Bartertown.

ThymeZoneThePlumber

Once we get over the initial reaction, the long term fix is appropriate and effective regulation.

We are seeing our regulatory agencies and systems falling apart after years of neglect and deliberate sabotage. Food safety, air quality, banking oversight … hell, Congress has even abdicated its responsibility for declaring wars.

A strong, effective government is what we need. Not the dysfunctional and emasculated wreck of government the previous owners left behind.

Cris

Didn’t bother him too much when that train tunnel collapsed.

Cris

Sorry to be a humorless prude, but all the calls for violence — which I totally understand are done in jest, complete with historical references — are starting to bother me. All this "string them up, shoot them" talk looks a lot like the bullshit we used to see at LGF. And I’m sure those guys were just joking too.

garyb50

I don’t know if this has already been pointed out but it’s a fascinating & bizarre article about the Icelandic meltdown – where I doubt anyone is going to prison.

garyb50

Ok… that didn’t work.

garyb50

Crap… just go to Vanity Fair & look for Iceland.

Ryan S.

@theturtlemoves:

You need to read this GMBM post to see just how dump that strategy is.

ThymeZoneThePlumber

@Cris:

Well, anything goes here, which can get a little disturbing at times …. but as long as we are clear that we are, in fact, joking …… does that make it work?

I mean, we can laugh about stringing up the fat cats, but is it it still funny if we start laughing about stringing up the government officials?

I have called Gordon Liddy a domestic terrorist for doing things like that. I have no doubt that the rhetoric egged on some really stupid people like Tim McVeigh.

So where is the Line That Cannot Be Crossed? I think that’s a conversation worth having once in a while.

Perry Como

IANASL, but is knowingly creating a fraudulent contract is illegal? AIG was writing swaps it couldn’t possibly pay out. It knew it couldn’t pay them out. Sounds like fraud to me.

Martin

BTW, the Dow is now positive, so apparently these unemployment numbers are good news.

libarbarian

I don’t care. I’ve never met a Trader who wasn’t a total subhuman piece of shit and I’m up for shooting them all on general principle.

Brian J

@Ryan S.:

The link you provided is very good and restates what even a very basic knowledge of our tax system would show. But you’d be surprised how many intelligent people seem to think otherwise. Back in the fall, one of my conservative college friends told me several times how Obama was going to fuck him. You see, he’s at the top of his law school class and is currently working with one of the biggest firms in the United States. He has, by all accounts, a pretty bright future, and he thinks he’s going to make $250,000 or a little more when he graduates next year. (He’s still a friend, but I’m not the only one in our group of friends who has noticed he can be a huge douche when it comes to building himself up in this way. He’s pissed me off a lot recently because of the shit he’s said to me, which is amusing for a few reasons.) He thought that his taxes would go up by a lot under Obama’s plan. I corrected him several times, sometimes in a very nasty way, and he never said anything back, so either he got the idea or he’s just very dense in this area. But if he doesn’t realize he’s wrong, I’m honestly not sure what to think. I find this stuff very interesting, but I don’t know all that much about it. Yet I still know how the tax system operates, and he didn’t, at least not until a while ago.

I’ve always said it was possible for that to happen, but it didn’t seem likely. What I knew of the legal world made it seem odd for someone in his position, as strong as his potential may be, to offer that high a salary, particularly in this economy. I told some variation of this information on this board before, and several people who were knowledgeable said that the only way he’d make that sort of money right away was to work all day, every day, with breaks to service the partners in between. With what I read this morning about several of the Vault 100 and other big firms laying off not just assistant staff but associates and partners, that seems more accurate than ever.

Xanthippas

Pretty sure it was CME traders who were behind Santelli booing the idea of giving "loser" homeowners a hand.

liberal

@Jason:

It’s also important to look at the money.

If we’re going to reform the financial system, we should do away with this nonsense that allows people to hide their money in Switzerland or the Carribean.

liberal

@Rick Taylor:

Tom MacGuire? LOL!

Alan

Three cheers for Goldman Sachs.

Is my rhetoric hyperbolic when I say these investment banks have corrupted every aspect of our financial system?

Perry Como

No.

ThymeZoneThePlumber

@Alan:

Maybe a little hyperbolic, but more misdirected?

Those banks couldn’t do anything that the regulatory process (or lack thereof) didn’t allow them do , did they?

The Populist

A-Fucking-men!

You know, if you or I did this we’d be arraigned and jailed. Because these people are elites, they get away with more.

Where is this mantra of personal responsibility? I could NOT imagine running a company (mine or anybody elses) and taking bonuses and watching the stock tank due to neverending losses.

If the right want to whine about Obama, fine, but have some credibility and spend as much time scrutinizing these CEOs and their cronies too. You can’t tell me that Obama is bad but these jerkoffs are good?

Les Miserable Fulcanelli

@Michael: Outstanding post.

The Populist

Yes, they were but it wasn’t just "loser" homeowners who created this mess. Who gave these brokers full license to loan this kind of crazy money without due diligence of the borrower? Who created ARM Loans, No money down loans and interest only fixed rate loans?

Sometimes I think we should let the system crash and then maybe these asswipes would truly see the mess they created. Problem is, if we let it crash we may never recover.

Rick Taylor

@liberal: @liberal:

Yeah I know. I said that I hoped that Krugman was wrong in this instance, not that I believed it. It is interesting to see him defending the Obama administration at this point. And the argument makes some sense (well, more than I’m accustomed to when visiting conservative sites). What it boils down to though is because of the crises, no one’s willing to bet on this toxic paper, so the government needs to step in and do so (and over time may profit as a result). As Atrios would say, re-inflate the bubble!

theturtlemoves

@Ryan S.: I enjoyed the comments after that from the folks claiming that an extra couple percent tax on the income above 250k is a huge, HUGE, disincentive to work harder and therefore these captains of industry will not perform to their utmost potential. Good. Let ’em. There are plenty of folks waiting in the wings to take up that slack and that income. Not that I believe that paying a couple hundred extra dollars in tax is going to prevent someone from making an extra few thousand in take home, but if we’re going to assume that lunacy, I say we roll with it. I’ll take that extra income from them. Need to pay off some debt…

The Populist

Hey Rick Santelli:

Read up on poster boy #1 of the mortgage bust, Casey Serin:

http://www.caseypedia.com/wiki/Casey_Serin#The_House-Buying_Spree

Les Miserable Fulcanelli

@Cris:

Serious, meet heart attack.

Rick Taylor

@Alan:

Excellent article. It is absolutely infuriating that we’re spending hundreds of billions of dollars on AIG without knowing where the money is going. Politically I can see why they wouldn’t want to say, but that’s just unacceptable. At a minimum, we should know who we’re giving all this money to.

The Populist

It’s the greed folks like Santelli exude that created the asswipes like Serin and Robert Kiyosaki who sells these books and games to idiots who believe they can do what he does.

It’s greed that right defends as "capitalism" that allows places like Nouveau Riche University in Phoenix to charge crazy sums of money to teach people to be "investors" when in fact they want "advisors" to find more dupes to sell their MLM scheme that portends to be education.

If the status quo was so great, why are we in this mess to begin with?

Alan

@ThymeZoneThePlumber:

I’m of the view the investment bankers lead the government by its hand to economic utopia land. :)

Cris

Well said, and as you imply, the conversation is they key, because a ready answer doesn’t exist. One thing we can do is occasionally try to listen to what we’re saying as it would be heard by an outsider.

I do love the chatter that goes on here. I just don’t like the thought of this comment section being held up as a shining example of the Hateful Left. I guess there’s no stopping that anyway.

ThymeZoneThePlumber

@Alan:

Yes, the influence has been palpable. But to me the remedy is to fix the government, and let IT take care of the greedy fat cats.

As opposed to the McVeigh view, which was to get mad and blow up a government building. I think that kind of thing is what you get when the rhetoric gets out of control.

Thoughts?

ThymeZoneThePlumber

@Cris:

Well, we are hateful. At least, at BJ we are.

But in a totally lovable and nurturing way!

The Populist

But we aren’t hateful. We actually TALK about solutions that right wing blogs have no idea about.

If you are critical of the right, they label you a hateful liberal. Funny, most people here are pretty diverse and it shows in the conversations. There are libbies, moderates, independents and a few righties.

The Populist

If the right think this is hate, maybe they need to step back and READ the nonsense posted on their own sites then check back.

Sorry, but calling somebody an asshat is reasonable compared to the kinds of negativity, hatred and downright rudeness displayed on partisan right boards.

Alan

@ThymeZoneThePlumber:

I with you on that. My only fear is the government won’t fix it. That the Investment bankers along with their RW and media dupes will do a masterful job to poison the effort.

joe from Lowell

Yes. All around the country, there are thousands of community banks and credits unions that have kept their noses clean, and spent the last decade doing business in a responsible manner.

My bank, Enterprise Bank and Trust in Lowell, has never bought, sold, or owned a mortgage-backed security; it has an Outstanding CRA rating; and it was listed as one of the best businesses to work in Massachusetts in a recent study.

These institutions, not the scumbags on Wall Streets, are the backbone of our financial system. I hope they get to pick over the carcasses of Citi and BoA like something out of Wild Kingdom.

joe from Lowell

Oh, btw: it’s also profitable as all hell, and expanding its business.

Alan

@joe from Lowell:

Community banks and credits unions are not investment banks. I agree, I would love to see those institutions pick over the carcasses of Citi and BoA et al.

Rick Taylor

Josh Marshall agrees with you, John:

Rick Taylor

Ohhhh, this is just ducky. At TPM:

and

Alan

@Rick Taylor:

Wow, now that’s interesting.

liberal

@The Populist:

I agree. While it’s hardly the #1 cause of the crisis, I don’t understand what brokers pushing loans without a fiduciary responsibility to their clients adds to the economy.

There was some article about some woman involved at some bank (Countryside?) who worked (IIRC) to vet loan applications. She’d think about whether the stated income was bogus, etc, and this would slow down the pipeline. Apparently the guys selling the loans didn’t like that, and they had a routine where they’d come by the desk of people like her and bang on it with a baseball bat.

Scum…

liberal

@Rick Taylor:

I second Alan. If true, that’s really interesting. Just more fodder for "that bankruptcy bill sucked, and everyone who voted for it sucks." (IIRC Lieberman voted against it, but voted for closure, so he sucks too.)

liberal

@ThymeZoneThePlumber:

Yeah. Like I said before, that’s difficult, because positive political action is difficult. But it’s the necessary course

FIRE sector of course has bought off the important politicians (paging, among others, Barney Frank…).

joe from Lowell

@ Alan

Actually, EBTC can set up investments for you, too. You can probably go into just about any community bank or credit union and set up an IRA or other investment account. These days, you can even get a credit card from them.

Xanthippas

We ARE hateful. We just hate assholes who burn the economy while getting million-dollar bonuses, and their allies in the right-wing nutosphere who defend them. We DON’T hate poor people who manage to afford a cell phone. So that makes us decent, if hate-filled, human beings.

joe from Lowell

Barney Frank?

Barney Frank is one of the foremost advocates of fixing the regulatory system, and has been for years. Before the 2006 elections, Dick Cheney addressed a financial services convention and told them they’d better support Republicans, because if the Democrats won, "Barney Frank would become the Chairman of the House Banking Committee, and you can just imagine the regulations he’d put on you."

FM Watch – an organization that lobbies for reform of Freddie Mac and Fannie Mae – singled out Barney Frank as one of the good guys, who worked to pass important financial regulation.

Rick Taylor

@ThymeZoneThePlumber:

I don’t see why it has to be either/or. Where people took advantage of loopholes, those need to be fixed with effective regulation. Where people got around regulatory limits that did exist and might have mitigated the crises by breaking the law, those people need to go to jail. Even the most brilliant regulatory system needs enforcement mechanisms.

Perry Como

@Rick Taylor: Okay, that’s fucked up. That’s like saying if someone goes bankrupt while gambling, the casino gets first dibs.

Jason

@liberal:

I think the Swiss are probably distracting from a lot of similar activity in the British IoNA. So I’m not hopeful there’ll be much activity in that area of regulation.

TenguPhule

1 dead banker is a statistic.

10 million dead bankers is a party.

Porlock Junior

garyb50 in 65 has the most fascinating advice I’ve seen lately:

"…just go to Vanity Fair & look for Iceland."

Though it might be quicker to go the Mid-Atlantic Ridge and look.