As we discussed yesterday, Bright Health Group is pulling out of the ACA individual marketplace. Bright insures about a million people in 2022. All of those folks will need somewhere to go for January 1, 2023.

The Centers for Medicare and Medicaid Services (CMS) has an automatic renewal process that accounts for the situations where an insurer leaves a market at the end of the year. Automatic renewal is very important to maintain enrollment as Coleman Drake and I showed in 2019.

Losing the option to automatically reenroll was associated with a 30-percentage point decrease in enrollment both with adjusting for household characteristics (95% CI, 9.4%-52.0%; P < .001) and without (95% CI, 14.2%-46.8%; P < .001).

CMS prioritizes placing people in plans that CMS thinks are reasonably similar.

What the hell is “same product network type?”

It is the plan type. CMS wants to prioritize keeping people who chose an HMO in an HMO. They want to prioritize people who chose an EPO in an EPO etc. This basic logic was announced for the 2017 plan year and it only been modestly updated since then. Plan Type is a combination of two characteristics — is there a primary care gate keeper for higher cost services and are there out of network benefits. This creates a 2×2 table which leads to 4 plan types.

| Gatekeeper Required | |||

| Yes | No | ||

| Out of Network Benefit Offered | Yes | POS | PPO |

| No | HMO | EPO | |

It is a reasonable logic. There is an argument that people choose an HMO for a reason or people choose a PPO for a reason so that revealed preference should be highly valued. I see the logic, especially in 2016 when this was being drafted and mooted about. However, I don’t think this is the best schema under current policy and law.

In 2017, zero premium silver plans at any income level were rare. That is not the case in 2023 with the IRA/ARPA subsidies making zero premium plans extremely common for people under 150% FPL and zero premium bronze plans not unusual for people earning up to 300% FPL due to a combination of richer subsidies via the law and larger premium spreads due to Silverloading.

This change in the policy and legal environment means a previously reasonable default might not be reasonable any more. We know that marginal consumers are buying almost entirely on price. We know that zero premium plans notably reduce administrative frictions and increase re-enrollment and enrollment. We know that inattention is extremely expensive. We have looked at within-insurer automatic re-enrollment rules and found likely expensive and potentially dominated choices are being imposed on individuals.

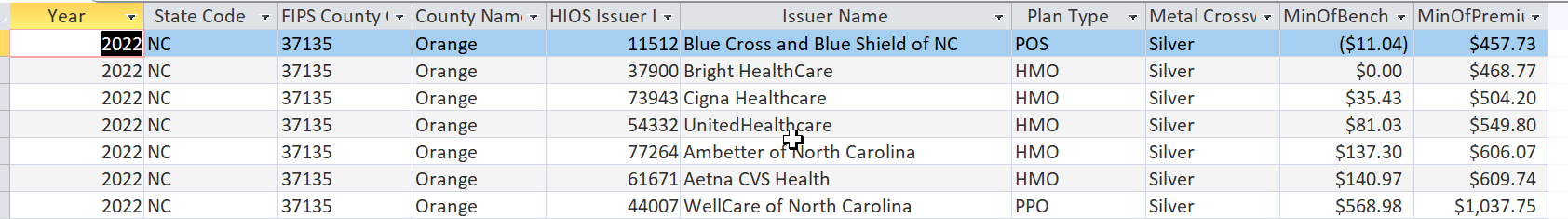

The current rules ignore the value of zero premium plans. Let’s take a look at a my home county, Orange County, North Carolina for a single 40 year old non-smoker enrollee. Let’s think about two classes of Bright enrollees. The first class are those who chose a zero premium plan. The second class is everyone else.

Let’s assume that the plan rank order for 2023 will be the same, so BCBS-NC is the cheapest silver plan again and now another BCBS-NC plan is the benchmark plan. Under the current scheme that will be activated in the next couple of weeks, BCBS-NC as a Point of Service (POS) plan which has an out of network benefit and PCP gatekeeping structure will not receive any Bright Health automatic re-enrollment. Instead, these individuals will go to the HMO plans. All of the surviving HMO plans (Cigna, United, Ambetter and Aetna) are modestly to signifcantly more expensive than the current Bright plans. All Bright enrollees will need to set up a new payment mechanism. Some of these folks are likely to go from zero premium to not zero premium. That might be a big barrier to enrollment.

What if we rethink the rules? What if we say that the fact that an individual chose a zero premium plan provides meaningful information about their preferences? And that this information should be valued in the re-assignment mechanism? From here a new rule could be formulated — move the individuals with current year zero premium plans to the most similar future year zero premium plans and then move everyone else to similar non-zero premium plans with the objective of minimizing premium shocks.

That rule I think minimizes re-enrollment frictions and net premium revelation shocks while incorporating consumers’ revealed preferences.

Let’s see if we can get this rule changed for the 2025 plan year?

Yutsano

I just had this horrific thought that if the Republicans take the House that everything they don’t like gets a zero budget especiallytheACAP. Please talk me off this ledge? The ACA isn’t perfect but it was an actual start.

David Anderson

@Yutsano: Let’s say the GOP gets the House and the Senate…. they can try to replicate Ted Cruz Strategy of October 2013 where they shut the government down over policy arguments. Have fun fucking that chicken.

Sure they can try to zero out everything they hate, but that becomes a political fight over pretty popular programs over ideological extremism.

Brachiator

There must be a way to take both factors into consideration. I chose an HMO from my employer offerings because I liked the provider and the medical offices were near my home.

If I used the ACA I would probably choose an HMO if available and would not want to be switched if the insurer bailed.

Scout211

I saw first-hand a real problem that can occur with automatic renewal, but for Medicare Advantage. In the waiting room with my husband for one of his doctors, an older man and his daughter (who was translating for him) found out from the front desk staff that he now was covered under a new Advantage plan that did not cover this doctor. They were both in shock and extremely upset and confused. The staff person tried to explain to them that there would have been letters that he received. The daughter explained that he may have received them but he would not have understood them. They had no idea what to do next. She gave them phone numbers to call but changing the plan mid-year wasn’t promising.

So many people just don’t understand insurance and all these intricacies. They just want to be able to see their doctors.

David Anderson

@Brachiator: The ideal system is (in descending order of match quality)

A) Everyone makes an active and fully informed choice.

B) Everyone pre-indicates known valuations of a wide variety of characteristics

C) We use a massive data mining revealed preference model using the last 8 years of data to predict where people similar to you make a change

D) We develop a pretty basic dumb set of rules that are broadly applied

E) We do nothing

We’re on D. A means a lot of people pragmatically lose coverage. B runs into challenges that people are really bad at prospectively indicating their hypothetical preferences. C would be nice to run but there is no current interest in doing this.

Brachiator

@David Anderson:

I don’t know. Some stuff seems simple.

Here’s the type of plan you had. HMO or PPO or whatever

Here is what you paid.

Here are similar plans that cost the same or nearly the same.

Or you can make a new choice