OSCAR is a new-ish health insurance company (active since 2014) that overwhelmingly sells policies on the ACA individual marketplace. It has sold a lot of policies and lost even more money. It IPO’ed in March 2021. Since then, the stock price has declined by roughly 90%. Its strategy through 2022 has been to price low and buy membership to hopefully achieve scale. At some point their self-proclaimed awesome special sauce of member engagement leading to member reported intermediate outcomes mixed with regular claims and purchased data blended in a huge vat of logistic regressions would do something and profit would eventually result.

There have been several other insurers with this concept. Bright blew up. Friday pulled out of Texas because the regulators told them to do so. It is a hard bet to play. OSCAR has a better capital cushion than Bright and Friday.

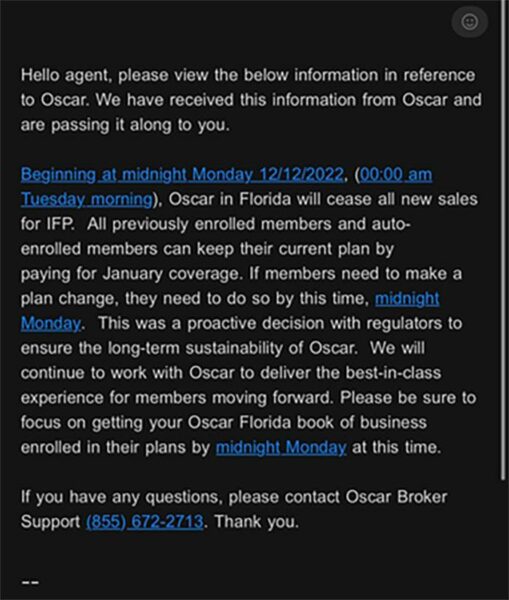

But it also has nervous regulators. Nervous regulators are very cautious regulators. Florida’s regulators have an institutional scar of watching insurers blow up so they get very titchy when there is any doubt about an insurer’s condition. Those regulators in Florida have taken action: (h/t Jenny Chumbley)

What does this mean in Florida?

For consumers who are already OSCAR customers or who are being automatically re-enrolled into OSCAR, it does not mean a lot.

For people who want to buy OSCAR, there is 15 hours to do so.

What does this mean outside of Florida?

Not much except for the nerds and finance folks….

More generally, it means that regulators are looking at the enrollment numbers for OSCAR in Florida and looking at the capital cushion/reserve situation for OSCAR in Florida and are getting worried that if OSCAR is pricing at a loss (and they likely aren’t pricing at a large profit margin) there might not be enough reserves to cover all losses if OSCAR continues to sell in the busiest 3 days of the Open Enrollment Period (REMINDER — CHOOSE YOUR PLAN BY 11:59PM DECEMBER 15 (THURSDAY))

Enrollment in the last several days of the January 1st deadline period (right now) tends to be healthier and younger and cheaper. Usually that would be a good thing. However, it also means that these enrollees generate massive risk adjustment payable obligations. For some insurers, that is fine. However, OSCAR has a strategy that leans heavily into paying out massive risk adjustment, so if they pick up an even healthier cohort than the rest of their book of business, their incremental risk adjustment pay-outs are higher. Now if some of those incrementally really health late enrollees go elsewhere, OSCAR’s risk profile gets a little closer to the state average and their pay-out obligations likely decrease.

Pulling back a step, I wonder if some of this is a second order result of Bright blowing up? If I am estimating the automatic re-enrollment crosswalks correctly, OSCAR is getting a whole lot of the healthier than average membership from Bright in SE Florida (Miami-Dade, Broward, Palm Beach Counties etc).

Fraud Guy

This is reminding me of the crypto chain reaction for some reason.

Ken

Is that mostly homeowners insurance, or have the health insurers also had problems?

Also, do Medicare fraud losses affect private insurers, or is that cost entirely on the state and federal governments?

Dorothy A. Winsor

OT, but I want to sing the praises of Medicare’s ability to negotiate fees. A couple of days ago, I got a bill from the anesthesiologist from my cataract surgery. The price of the service is listed at $1020, but the Medicare contractual adjustment is $904.94. Medicare paid $90.21 of that. I owed $23.01.

Scott

My son (age 25) in Austin, Texas chose Oscar last year (a basic Bronze, $0 monthlies, 8-9 thousand deductible). Reading this, I’m wondering if he should ditch Oscar for a more traditional insurance provider. Hate to have him left high and dry.

He consumed no healthcare last year except COVID vaccines. Doesn’t expect to consume any healthcare this year except a basic physical. So basically he needs a just in case plan. He’s got savings to cover any deductible but he’s saving that money for more school, a car, etc. Plus he’s got the Bank of Dad to back up any really serious healthcare expenses.

Jharp

”Its strategy through 2022 has been to price low and buy membership to hopefully achieve scale.”

Ah, the old we’re going to lose money on every sale but make it up in volume model.

CaseyL

Your analysis seems counterintuitive to me, because I thought a generally younger, healthier population presented lower risk. Or is the thinking that if younger, healthier populations do need medical care, it’s more likely to be for catastrophic events (cancer, serious injuries) and therefore more expensive?

David Anderson

@Scott: For someone in your son’s situation (healthy + assets + credit from either the Bank of Dad or an actual bank) then getting a plan that has a low premium and a plausibly useful network is what he needs. There are a ton of zero premium Bronze plans in Austin from a bunch of insurers. His choice space is large given his requirements.

David Anderson

@CaseyL: Any other market, your intuition is right.

In the ACA, there is zero sum risk adjustment where insurers that are disproprotionally heavy on healthy/low diagnosable folks pay insurers that are heavy on high cost/high diagnosis folks. Sometimes those payments are very large ($500 Million + for a single insurer/state) It is a huge cash flow problem.

More importantly, there are folks who risk adjust as cheap but their actual utilization patterns incur a decent amount of expenses that don’t generate scorable diagnosis codes. I think OSCAR gets a lot of “worried well” folks from some of the data they have released in the past. Finally, OSCAR is likely to get a huge bolus of folks from BRIGHT who OSCAR has no medical history on and thus they are starting the risk adjustment chase from scratch.

Another Scott

@David Anderson:

I know you have told us that that feature has been there from the beginning. Was it invented with the ACA, or is it a “duh, of course you have to have that if you have a subsidized private insurance system or it will collapse” thing that every other subsidized private system has across the planet? It seems like a genius move either way, and the only way to keep the MotUs from wrecking it via their mania to extract monopoly rents in everything they touch…

Thanks.

Cheers,

Scott.

Fake Irishman

@Another Scott:

I believe there are some unique features in the ACA version, but there are some similar parts of in the Medicare space as well, I seem to recall.

CaseyL

@David Anderson: Ah. That explains it.

“You’re covering high-risk populations, directly or indirectly.”

Mike S

My wife had Oscar when she shattered her ankle in 19. Luckily we have world class hospitals within minutes of us but they didn’t like Oscar. They waited to do surgery until we saw the surgeon 2 days later. By then we had to wait for the swelling to go down which was 3 more weeks, the day before Thanksgiving.

All in all Oscar was pretty good. She had a young, gun surgeon who was great who put her ankle back together with 32+ pins and plates. Covid hit, my station made me full time and I took the best Blue Shield coverage they offered. Here we are 3 years later, she is still doing PT but just started looking for work again. Looking forward to being DINCs again.

Barbara

@Dorothy A. Winsor: It doesn’t take much negotiation when you have the power to determine what the fee will be.

Barbara

@Another Scott: I weigh in only to explain that no, risk adjustment isn’t technically necessary, but it is considered to be preferable to the kind of risk adjustment that comes with cherry picking customers, underwriting, or preexisting condition exclusions. It’s a trade off.

Geo Wilcox

Oscar health insurance has the Kushner stink all over it via Josh, the brother of Jared Kushner.

Roger Moore

@Jharp:

There are actually cases where prices come down as volume goes up, so it makes sense to price below the point that’s profitable today in the hope it can be profitable tomorrow. I can definitely see that with insurance, where there’s a huge overhead setting up the network. That doesn’t mean Oscar (and similar insurers) is being smart, but it’s not necessarily as stupid as it sounds at first.

Barbara

@Roger Moore: I don’t know but if I had to speculate, it’s that Oscar’s per person administrative overhead is too high and thus can only be lower if it obtains additional enrollment.

Scott

@David Anderson: Thanks. As I just found out, that is exactly what he did yesterday. No matter how old they get or how capable they are, you just don’t stop worrying about your kids.

twbrandt (formerly tom)

Deleted, moved.