Reinsurance in the ACA context is currently a state waiver program that is enacted at state discretion. Sixteen states have a reinsurance waiver. These waivers introduce state funds to pay some portion of claims. Using non-premium funds to pay some claims means premiums go down. This is important and valuable for individuals who don’t get subsidies (more on folks who get subsidies in a few months once that manuscript is published!)

However, the question stuck in my head is the cost of a new enrollee? I had to look at waiver applications last night for a few slides that I need to build today. The cost per new enrollee is not cheap. Below is New Jersey’s actuarial analysis:

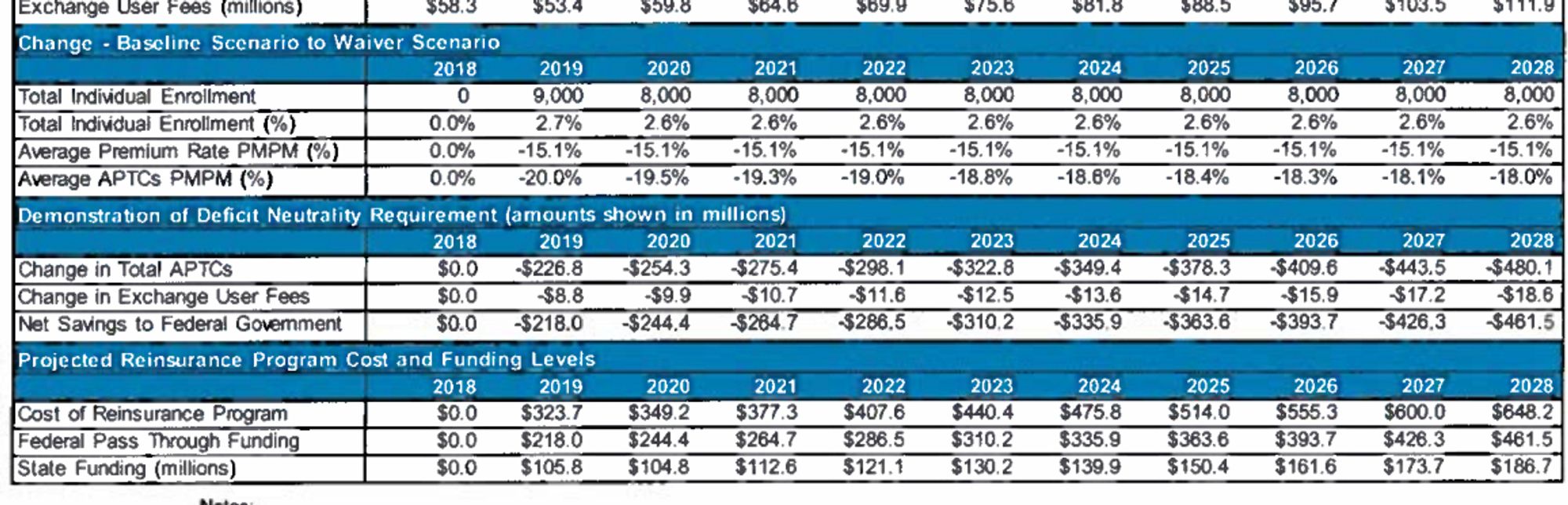

The key thing for today in this summary is the 2020 projection of an 8,000 person enrollment gain at a total cost of $349 million dollars. This works out to be $43,600 dollars in funds per new enrollee. This is not an unusual number. Georgia projects a higher cost per new enrollee. Most of this is because reinsurance in the ACA acts as an inframarginal transfer to people who already would have bought insurance. Each additional dollar of affordability that might increase enrollment of a single person has dozens of dollars going to currently enrolled folks.

Meyerman

I’m sorry professor, but I lost you at the end. Could you rephrase or expand on:

Most of this is because reinsurance in the ACA acts as an inframarginal transfer to people who already would have bought insurance. Each additional dollar of affordability that might increase enrollment of a single person has dozens of dollars going to currently enrolled folks.

I’m familiar with reinsurance in the non-health context where insurers transfer the low frequency high dollar risk to reinsurers for a price, but I’m not sure how the state is acting as a reinsurer here. Thanks for your help!

David Anderson

@Meyerman: In the ACA, “reinsurance” through the waiver programs is not traditioanl reinsurance. It is a covert/submerged subsidy to upper middle class enrollees where the state puts some money into the pot that is used to pay claims instead of having all claims paid for by premiums. This lowers the required premium level and makes some plans more affordable for some people.

Most of the lower premiums benefit people who already would have bought insurance. It does not change incentives (much) for these folks but if we are trying to buy new enrollment with public funds, we need to change decisions from NO BUY to BUY. Dramatically increasing subsidies (overt or covert) means most of that money goes to people who aren’t changing their minds.

BradF

David

But the aggregate effect may impact coverage expansion, yes? Might MCO actuaries greenlight policies that might include incentives for more comorbid (or marginal) folks? These folks might go uncovered and in a counterfactual world incur greater costs via public monies and unmanged care. Its shifting bucks to another payer–ACA plans, but on net, might this be a more cost-effective path?

Brad