Tonight we have a special edition of Medium Cool in honor of Tom Levenson’s new book, released today!

In addition to receiving rave reviews, Money for Nothing has also made the long list (15 books) for the Financial Times-McKinsey best business book of the year prize!

We’re honored to host Tom’s book launch, which comes at an opportune moment. Fraudsters, corrupt politicians, men enriched by speculation and lies. Plus ça change. ~BG

Take it away, Tom!

Money for Nothing: The Scientists, Fraudsters, and Corrupt Politicians Who Reinvented Money, Panicked a Nation, and Made the World Rich

So—yeah: there’s a book out today, by me, about a lot of stuff, centered on what happened on a few hundred yards of a London alley during 1720—an experiment in financial engineering that turned into the first great stock market boom, fraud and bust.

There was a central flaw in the deal, (to be revealed in the book, of course) and it all ended in tears and ruin.

But my goal in telling this story wasn’t to retell an old morality tale of ignorance, folly, and the inevitable consequences of greed.

Rather, I wanted to answer two questions: where did the ideas that sparked the Bubble come from? And what really happened in and after 1720—because the old version of the South Sea story as a morality tale on the evils of money mania always struck me as a way to take those events out of history. Something came out of it, that is. What?

So, about the “where it came from” bit: that would be the scientific revolution. (Also coffee shops.) In the broadest strokes, I argue that Britain’s scientific revolutionaries, William Petty, for example, and his more illustrious successors, Isaac Newton, Edmond Halley and others, inspired, informed, and shaped the nearly simultaneous financial revolution that ran from (roughly) the 1680s to the 1750s. More broadly—the book traces how the ideas and themes and even perhaps the feel of late 17th century notions of reason, empiricism and the power of math affected so much more than the study of the night sky or the flight of cannonballs.

Did I say that I love the 17th and18th centuries? I do. So much of our world was born then, and so many of our problems now can be explored by examining the first occurences of the same pathologies back then. For just one example, the 2008 crash was recognizably a direct descendent of that first Bubble.

As for what we got out of the Bubble? Well—for that, you should read the book, but in its shortest form the answer is…

Financial capitalism, with all the wealth and woe it engenders.

At about eight p.m. on Sunday, June 18th, 1815 — still sunlit on that long midsummer evening— the Duke of Wellington stood in his stirrups over his famously cantankerous chestnut, Copenhagen. He waved his hat above his head. His army, men he had once called, with respect, “the scum of the earth,” poured over the ridge, chasing the remnants of Napoleon’s Imperial Guard back down the slope. At the battle-ruined farmhouse called Le Haye Sainte, three battalions of France’s elite soldiery stiffened to a last stand. Facing a combined charge of infantry and cavalry, they broke, and the rout was on, fleeing French soldiers shouting (in legend) “The Guard retreats! Save yourselves if you can.”

About an hour later, Wellington crossed the battleground to greet Field Marshal Gebhard Leberecht von Blücher, the commander of the Prussian army that had crushed Napoleon’s reserve at a decisive turn in the fight. There would be a few more skirmishes in the coming days, but this was the end: the long century of conflict between Britain and France was done at the moment those two commanders met, victorious, on the field of Waterloo.

To the last hours of that seemingly endless war, nothing about the British triumph was inevitable. Battles are decided by those who do the actual fighting, of course. But it took more than simple courage, or even the mastery of a Wellington, to lift Great Britain past its larger rival. The Napoleonic wars were national conflicts. The forces the two sides deployed were vastly larger than any either had previously deployed. The fleets that met at Trafalgar represented huge capital investments in the most advanced machines of their day. Ships of the line, red coats, muskets, beer and beef, gunpowder, shot and everything else had its price. Somehow King George’s government managed to keep on paying for a war that, at times, pitted Britain alone against the wealth of Napoleon’s conquered Europe.

It’s too simple to say that what happened in the banks and markets of Paris and London after 1720 determined the outcome at Waterloo. But it remains true that Britain and France had pursued two very different responses to very similar financial disasters — and that over the long haul, those choices made material differences to Britain’s ability to punch above its weight class.

So, Waterloo might very well had been lost had Wellington been absent. But it was highly improbable that Britain could have maintained the fight long enough for the Iron Duke’s army to reach that ridge if Britain, like France, had reverted to old habits of public finance after the South Sea crisis. Over the course of the eighteenth century, the raw size of the nations at war came to matter less than the ability to mobilize the resources that each state’s economy could produce….

Put another way: The secret weapon that Napoleon could not counter was the successful implementation of a new financial technology.The institutions and techniques that emerged in the three decades after the Bubble made it possible and then desirable for private actors to put their cash at the state’s disposal, in exchange for a share of taxes yet to be collected from the economic activity of generations yet unborn.There was the market in which such bonds were easy to trade, supported by the Treasury’s demonstration over the years government-issued credit was a safe investment. (This, in contrast to the French experience of defaults at intervals throughout the eighteenth century.)That combination of an exchange and an increasingly plausible official guarantee meant that the ultimate legacy of the Bubble for Britain was the emergence of an elastic, expandable pool of credit available for any national purpose.

This was what Defoe had glimpsed long before. Ready access to debt, Defoe noted, was his country’s decisive advantage in the never-ending struggle for power: “Foreigners had been heard to say,” he wrote, “That there was no getting the better of Englandby Battle.”It was not that the inhabitants of that green and sceptered isle possessed greater bravery or martial skill.Rather, Defoe wrote, potential enemies understood “That while we had thus an inexhaustible Storehouse of Money, no superiority in the Field could be a match for this superiority of Treasure.”

Defoe wrote that at the height of the South Sea spring. This doesn’t mean Defoe understood and anticipated the evolution of Britain’s financial system in the decades to come – he clearly did not.But still, he was an acute enough observer to recognize great change as it unfolded, and what he saw was that Britain’s financial system had experienced a revolution.We can see what Defoe didn’t:that the financial revolution was as transformative as the other upheavals in ideas that convulsed Europe from the late seventeenth century forward. The seventeenth century scientific revolution had not been solely or even mostly a British invention, for all that Isaac Newton has come to symbolize its triumph. The various breakthroughs behind the new forms of money and credit that Britain exploited for its ends weren’t either. But the extent of the cultural changes that flowed from the eruption of natural philosophers’ habits of mind– the way many people came to incorporate the values of empiricism, of experiment and the importance of measurement and calculation – had a profound effect on British civic life. What animated men and events in London more deeply than anywhere else in Europe, that is, was the eagerness, almost the urgency to apply emerging ways of thinking to everyday, human experience.

Specifically, the South Sea scheme itself was no deeply reasoned application of mathematical insight.It was, rather, born of specific historical circumstances, the immediate pressures of governance and the urgency of war, power and strife.But it emerged within an intellectual and political world in which the apparatus of calculation and the willingness to accept abstractions from material reality — replacing jangling coins with the elusive and elastic notion of “credit,” for example — fed a public culture in which a vast experiment in the manipulation of money could seem plausible, even the obvious thing to try.

Yes, that experiment failed. But the longer view captures companion truths:the nation’s debt was indeed transformed, and in place of its prior tangle of unmanageable obligations, Britain gained the ability to conjure up money more or less at will out of nothing more than trust in the future.Though it would be foolish to say that London’s bankers and exchange secured the final victory in the wars of the long eighteenth century, the fact remains: a war against a French Empire that could, at times, command the resources of most of Europe, could not have been fought without them.

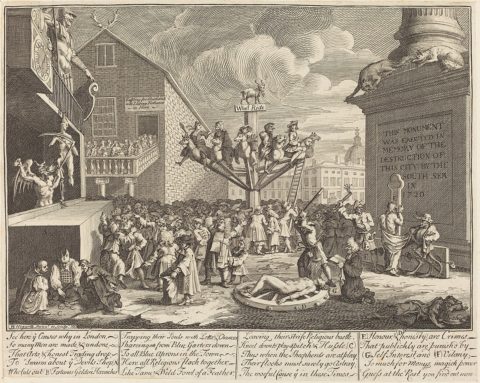

So there’s a taste of the book. There’s lots and lots more between the covers, including plenty of exemplary madness of the sort Hogarth’s cartoon above depicts. It’s easy to enjoy disasters that have the kindness to remain at sufficient historical distance, isn’t it?

I’ll be hanging out in the comments. Ask me about the book, the process of bringing it forth, my experience of the publishing carousel, my preferred gin:vermouth ratio…which is to say, anything.

*****

You can order the book at the links below.

Indiebound–Independent bookstores link

Bookshop link (Another, newer site supporting independent bookstores).

Oh, and it didn’t take long for me to find a gaggle of glowing reviews of Tom’s book.

“Does a stock market crash and a plague sound somehow familiar? Thomas Levenson’s new book is proof—very cleverly told—of how enlightening history can be. There is no excuse not to learn from the past.”—Andrea Wulf, author of The Invention of Nature

“Superb, fascinating, and totally timely, Money for Nothing is a gripping history of the South Sea Bubble by a scholar who makes complicated and subtle matters not just accessible but fun—the story of a world crisis with a flashy cast of grifters, scientists, politicians, and charlatans that Levenson makes utterly relevant to the 2008 financial crisis and 2020 pandemic. . . . Essential reading.”—Simon Sebag Montefiore, author of Jerusalem and The Romanovs

“A brilliant history of the South Sea Bubble, an astounding episode from the early days of financial markets that to this day continues to intrigue and perplex historians. Deeply researched and featuring a colorful cast of characters out of 18th century England—mathematical geniuses, unscrupulous financiers, greedy aristocrats, venal politicians—Money for Nothing is narrative history at its best, lively and fresh with new insights.”—Liaquat Ahamed, Pulitzer Prize-winning author of Lords of Finance

“Levenson is a brilliant synthesizer with a grand view of history. Here is the birth of modern finance amid catastrophe and fraud—a gripping story of scientists and swindlers, all too pertinent to our modern world.”—James Gleick, author of Time Travel: A History

“Inspired by Isaac Newton’s example, clever schemers sought to conquer the chaos of human affairs by abstracting financial value from tangible goods. Their calculations unleashed the notorious South Sea Bubble, which destroyed fortunes and roiled nations. Thoroughly researched and vibrantly written, Money for Nothing captures those heady, heartbreaking times, which still hold lessons for today.”—David Kaiser, author of Quantum Legacies: Dispatches from an Uncertain World

“Mr. Levenson, a professor of science writing at the Massachusetts Institute of Technology, interweaves the story of the rise of mathematics and astronomy with the rise of bankers and actuaries and stock promoters. He traces the evolution of the idea of money to the habits of mind that brought us calculus and the art of surveying and the theories of gravity and optics. And he frames this vivid narrative around the century-long wars between France and Britain that culminated in the Battle of Waterloo in 1815.”—Wall St. Journal

“The story of government debt finance, which sounds boring but definitely isn’t . . . an enthralling account of an economic revolution that emerged from a scandal.”—Kirkus Reviews (starred review)

Medium Cool will return tomorrow (Wednesday, 8/19) at its regular time.

~WaterGirl

SiubhanDuinne

I’ve read only the first couple of chapters, but this is an enthralling read. Tom, you write both beautifully and easily.

I’ll have questions and comments about the substance, but first I want to comment on the cover design, which is inspired! I know that’s the realm of the publisher, not the author, but to what extent — if any — did you have input into the cover art decisions?

Frankensteinbeck

Many congratulations, Tom. Every book release is exciting, a life event.

Another Scott

Added it to the Kindle on my phone. It’s a great topic. I hope it’s a great success for you Tom!

Cheers,

Scott.

BGinCHI

Loving the book so far, Tom. It just came a little while ago.

I’ve been skimming around and got to the first London coffee shops (pages 75-84) section. Really fascinating stuff that echoes the intellectual history of those spaces in Vienna and elsewhere.

It got me wondering about another place, founded earlier: the Royal Exchange, founded by Thomas Gresham in 1571 (its opening year). Gresham is a fascinating figure, but it’s the building space I’m thinking of here, as it reminds me of the way you describe the coffee shops that came later.

The RE building itself was two floors. The bottom was used as a site of trading & finance. Business was done there formally and informally. The top was filled with shops. The idea was that men did business below, and women could shop above (men as well, I presume). It was a visionary and very modern place for commerce of all types.

Here it is in Hollar’s engraving.

I’m curious how the Exchange, or any other spaces from the 16th C. came up in your research. Are there elements of the period from 1550-1620 that had an impact on the context of what happens in the book?

SiubhanDuinne

@SiubhanDuinne: Oh, and congratulations on this:

Baud

Congrats, Tom.

Emma from FL

*sigh* rearrange reading list to put Tom’s book on top. If it’s halfway as good as Newton and the Counterfeiter, I’m going to be up all night.

tom

Should that be empiricism?

Kristine

Congratulations on all those glowing reviews. Here’s hoping that sales blow the doors off.

James E Powell

Congratulations! Ordered it. Can’t wait to read it.

zhena gogolia

Congratulations, Tom! Looks wonderful.

zhena gogolia

@tom:

No, I think it’s a different concept.

zhena gogolia

@tom:

Or maybe you’re right! I should let the author answer. I’m such a busybody.

Omnes Omnibus

I just got home from work and a stop at B&N to pick up the book. They had not put it out on the shelves yet, they went to the back and got a copy for me and brought out five more for display. So, Tom, you are welcome.

Cheryl Rofer

Congrats, Tom! Sounds good!

BGinCHI

@Omnes Omnibus: Super impressed you guys have a B&N.

Tom Levenson

Dear everyone–thanks so much to all of you. It’s always nice to hear good things from happy readers–but at this moment, when there’s really no human interaction around the book launch, I can’t tell you how much it means.

There are plenty of writers on this site, so this won’t be a surprise to many, but publishing a book is this weird combination of joy and excitement and enormous anti-climax. I mean–the book’s out there. It’s been me and it for years and now there’s just it, in the world. And if you don’t get to do readings or talks or what have you, it just goes out there. So this is a the book party–and it’s great to hear from everyone.

One more thing before trying to answer anything specific:

Watergirl and BGinCHI did an amazing amount of work to make this happen. They do that for all this series. I’m deeply grateful, and I hope the jackaltariat is as well.

Omnes Omnibus

@BGinCHI: We got all kinds of civilization and shit up here. But the Sonic closed.

Yutsano

First of all: Congrats and stuff on the release!

Second: No one is far enough in to have me telling jokes yet. I haven’t read the book but I’m a bit familiar with what’s going on here. Just not as much the further back set-up and the ramifications beyond 20 years after. But the meat of the South Sea bubble I’m familiar with.

WaterGirl

@Omnes Omnibus: Nice!

KSinMA

Ordering it tonight. Can’t wait to read it!

Tom Levenson

@SiubhanDuinne: I get to kibbitz as they try out designs, and in fact Random House was great about checking with me repeatedly. But the cover was the designers idea–and I agree, it’s really good.

My major contribution was to change the coins they chose for the Newton’s cradle. They first tried some Stuart coins from the 17th c. that were produced by a different method than the George I sovereigns you see in the image–they look different, and for the purposes of this story, wrong, as they would have been withdrawn from circulation in 1696.

So yeah, I got to nerd out a little. Other than that, I weighed in on the typeface (I liked a slightly lighter option, and that’s the one we went with). My agent said my name should be in bigger letters, and it is…that kind of thing. But the look and the idea is all the work of folks with actual talent, not me.

SiubhanDuinne

@Tom Levenson:

Yup!

Tom Levenson

@BGinCHI: The exchange did come up, and in one draft I had a whole section on it, but because the stock trade was essentially booted from the RE in the 1690s, I just told the tale of that event and left it’s Elizabethan history behind, which is too bad, because, as you say, it was very cool, and Gresham himself a fascinating guy. (There’s a not bad popular biography of him that came out not that long ago. I’ll dig it up and get the title.)

Tom Levenson

@BGinCHI: The exchange did come up, and in one draft I had a whole section on it, but because the stock trade was essentially booted from the RE in the 1690s, I just told the tale of that event and left it’s Elizabethan history behind, which is too bad, because, as you say, it was very cool, and Gresham himself a fascinating guy. (There’s a not bad popular biography of him that came out not that long ago. I’ll dig it up and get the title.)

@tom: Yeah. It should. I got this excerpt from my last word draft; that was, I believe, corrected in galleys. Sorry.

NotMax

Will toss in as a corollary how absolutely vital to shipping was the study of the sky (both day and night), coupled with math. Coincidentally spent an idle half hour this morning while trying to will myself awake refreshing my layman’s knowledge of time balls.

Tom Levenson

@Omnes Omnibus: Thank you!

Elizabelle

Looks fascinating. Goes on my 2020 reading (and purchasing!) list. Although have a few books (Isabel Wilkerson’s Caste) queued up ahead of it.

Have heard the South Sea Bubble mentioned in passing in history classes, but know nothing about it, so Tom’s work will be the introduction.

OT, but learned this week that Hokusai, Japanese woodcut artist famous for The Wave (formally, The Great Wave off Kanagawa) lived during the time of Wellington, Napoleon, George Washington, the French Revolution. (1760 to 1849; the world changed greatly during his lifetime; he just missed Matthew Perry’s arrival by 4 years.)

1720 seems like centuries ago. 1820 — you are getting much closer to modern history. Dog knows we are still clawing our way through the aftermath of the 1850s and 60s.

Tom Levenson

@Kristine: Your lips to Logorrhea’s* ear.

*Patron saint of book sales

J R in WV

@Tom Levenson:

WaterGirl is amazing, working full time, and lifting Balloon Juice up from digital failure to new success. I’ve worked with her on a couple of tiny On the Road pieces about our furry babbies, and I can tell everyone she is focused on making this site a success.

Tom, congratulations on your new book. I have never written anything more complex than a federal grant proposal or a system specification document, but my mom spent many months working from when she put us kids to bed til when dad came home from his AM newspaper job at 2 or 3 am writing her great American novel.

Which no one ever got to read, sadly and unfortunately.

But a nonfiction book about financial evolution in 16th century Europe, that will be amazing. Thanks for all your work on the books and your fascinating posts here on B-J.

TaMara (HFG)

Now on my Kindle. Looking forward to reading it. Congrats!

WaterGirl

@Tom Levenson: It’s not the same thing, of course, but next week we are re-posting the Paris After Dark that went up last night, and we are postponing the rest of those posts until next week – because there’s not a lot of oxygen for much besides the convention this week.

We could easily do the same with this post – or some version of this post – if you want to invite you colleagues (or anyone) to an Ask Me Anything related to your book, in the days or weeks to come.

I think we could promise to be on our best behavior.

Immanentize

Buying for my son. He may be your successor one day.

Omnes Omnibus

Wow, that is one rash promise.

Baud

@J R in WV:

Agreed. Thanks to her, we’re now only a moral failure.

BGinCHI

@Tom Levenson: My pleasure, Tom. Your book deserves all the attention it’s getting.

And just so everyone knows: WaterGirl does all the hard work. I’m just lucky to be able to stand at the end of the bar and glad-hand the regulars.

lashonharangue

Congratulations Tom!

From your research can you comment on what Neil Stephenson got right or wrong in his historical fiction The Baroque Cycle as it relates to finance?

NotMax

@WaterGirl

Please see comment 125 in your programming post thread.

/OT

BGinCHI

@Omnes Omnibus: Wha?

Our Sonic (in Uptown, believe it or not) has been packed all summer.

Best frozen cherry limeade ever.

Elizabelle

Gonna acquire my copy at Chop Suey Books in Richmond. No public contact, so I guess no hanging with the store cat either. Great NY Times article on them from last year.

A Southern Bookstore Serving Up a Little Bit of Everything

For bibliophiles with plenty of time to browse, Richmond’s Chop Suey Books offers a feast of “gently used” books packed into its two-floor store.

But they have mucho brand new books too! Worth a click for the wonderful color photographs (including said cat, name of Won Ton, who gets her own portrait). And the tin roof.

Walked by the store yesterday. They have even cooler tee shirts in the window. But locked up tight, alas. No cat in sight.

Omnes Omnibus

@Baud: I thought we were a moral hazard. When did we graduate to failure?

WaterGirl

@Omnes Omnibus: I did use one weasel word, so there’s that.

WaterGirl

@BGinCHI: But you’re the reason they come to the bar!

Elizabelle

I think we should do another thread on Tom’s book in about 6 weeks. By that time, a lot of us will have read it and can ask questions or share comments.

Baud

@Omnes Omnibus: You know what you did.

narya

Gonna have to detour from my fiction-only diet to read this . . . out of curiosity, what did/do you think of Neal Stephenson and/or Dorothy Dunnett, if you’ve read either? I was fascinated by the (sub)text in that fiction about the “invention” of money, and this sounds like it’s, if not in the neighborhood, in a nearby city.

BGinCHI

@Tom Levenson: I need to read it. I’ve been curious about him for a long time.

If anyone’s interested, there’s a great play from 1605 by Thomas Heywood called If you Know Not Me, You Know Nobody that describes the Exchange and a lot of London sites, and commerce, etc. It’s in two parts. Part 2 is all about the Exchange and its building.

Redshift

Looks awesome. I’m back to reading more actual books than I was a year ago, but I still need to do more.

SiubhanDuinne

@WaterGirl:

I was just thinking it would be nice to revisit Tom’s book in a couple of weeks when some of us have had a chance to read it (or more of it, anyhow). Maybe a good project for Labour Day weekend.

Tom, it was difficult to read about the 1665-66 plague at this time — the numbers of infected and dead, the way the numbers grew from week to week — and not to be acutely aware of very similar numbers in current headlines. History rhymes again.

BGinCHI

@J R in WV: Second your comment on WaterGirl’s efforts.

Prodigious. Soul of the venture. Salt of the earth. Button on the cap of kindness.

BGinCHI

@WaterGirl: You’re too kind.

MMM

Congratulations!

BGinCHI

@SiubhanDuinne: We can do this.

Stay tuned.

WaterGirl

@BGinCHI: Alright, now you’re just mocking me! :-)

Omnes Omnibus

@Tom Levenson: All fucking around aside, I am looking forward to reading this. About ten years ago, I was traveling around in the Netherlands and visited the towns of Enkhuizen and Hoorn. About a month later, the oldest known stock certificate (from 1606) a trading company) was found in Hoorn issued by a company in Enkhuzen. It paid a dividend. Those little historical details can be so fun.

BGinCHI

@WaterGirl: I would never.

BGinCHI

@Omnes Omnibus: I’m dying to go to Antwerp and wish like hell we’d done that when we were in Norway.

Have you been? So many historic firsts there…..

MazeDancer

Huge Congrats, Tom! Well done!

Origuy

Have you ever thought about doing a book about the Darien Scheme, that bankrupted Scotland in the 1690s?

Omnes Omnibus

@SiubhanDuinne: Funny, I bought someone Defoe’s Journal of the Plague Year for as a birthday gift in back in March.

Just One More Canuck

@Omnes Omnibus: to be fair, it’s a pretty low threshold

Tom Levenson

@WaterGirl: That sounds great. I have an idea—to be discussed off line.

Tom Levenson

@Immanentize: ;-)

Omnes Omnibus

@BGinCHI: Antwerp? Yeah, but I was coming down with a flu sort of thing. Maastricht and Bruges were awesome, but the days in Antwerp in between were a bit of a fevered blur.

Tom Levenson

@lashonharangue: long answer. Basically, Neal is a very good researcher, and, while he serves his story, his history is pretty damn good.

WaterGirl

@Tom Levenson: Yay. We like ideas!

WaterGirl

@NotMax: thanks, and done. assuming I understood your directions correctly.

Tom Levenson

John Cole

@Tom Levenson: CONGRATULATIONS AND WHY ARE YOU NOT POSTING ABOUT THE BOOK YOURSELF?

Omnes Omnibus

@John Cole: Some people are modest.

SiubhanDuinne

@Omnes Omnibus:

I should probably reread it. I distinctly remember reading it (for the first and only time) shortly after I graduated from high school. Summer of 1960.

Omnes Omnibus

@SiubhanDuinne: I was born a few summers later. :P

SiubhanDuinne

@Tom Levenson:

Do you never rest?

TaMara (HFG)

@John Cole: Probably because as FP, we try not to abuse the privilege by promoting our own books when we have Bradley and Watergirl to do it for us. ;-)

SiubhanDuinne

@Omnes Omnibus:

I’m well aware :p

soup time

My copy arrived today. It’s next up after I finish reading the current Dept Q book. I’ll have to pick up the pace.

Mike S (Now with a Democratic Congressperson!)

Congratulations Tom! I just bought it and downloaded it to my kindle. I’m really looking forward to reading it. Starting tonight. I hope I don;t stay up to late…

DCA

Congratulations (as any author should get): looks fascinating, and I’ll order it ASAP. The cover is indeed wonderful.

For fraud and bubble geeks, let me also recommend Lying for Money by Dan Davies (aka Dsquared) and the

financial manias page of (full disclosure) somebody I roomed with in college, a mathematician and historian. (Apologies to Tom if I’m being redundant with the book).

WaterGirl

@TaMara (HFG): Thank you. Plus, who wants to say “hey, look at these awesome reviews I got!” and “here are all the places you can buy my book!”.

I went looking for reviews so I could include them, and I will shamelessly encourage buying books that you guys write – which I could never be comfortable doing if I had been the one to write a book.

Tom Levenson

@John Cole: yes sir!

it will be done.

BGinCHI

@TaMara (HFG): They also serve who Medium Cool.

Mary G

I am in awe of the work you put into all this. I preordered the audio book and downloaded it at one minute after midnight last night. It would be nice to have a thread after we’ve had time to read/listen.

I did have one question after rewatching Hamilton on Disney – did any of his ideas feed into this, or were the Brits too snobby to be influenced by a “bastard orphan” revolutionary?

Felanius Kootea

Congratulations Tom!

Miss Bianca

Damn, Tom, no copies available yet through my library system. Too new! Only the academic libraries have it! I am going to request that my local libraries buy copies immediately!

Omnes Omnibus

@Mary G: Not Tom (of course), but Hamilton came after.

Tom Levenson

@Origuy: it’s a great story. I’d be terrified of running afoul of the Scots who know so much more about this than I do.

Tom Levenson

@Omnes Omnibus: that is in part a South Sea allegory.

Tom Levenson

@Miss Bianca: Thanks!

Sab

Note to self: Nook bookstore search couldn’t find Tom Levenson but it did find Thomas Levenson

Mary G

@Omnes Omnibus: Oops, revealing my ignorance – I saw Waterloo and 1815. So nevermind.

John Cole

@Tom Levenson: Stop being so bashful and humble. Go against your natural instincts and self promote. I’m just super glad this post is here to bring attention to your book, but you should also be promoting it!!!

joel hanes

One of my favorite parts of Dorothy Dunnett’s Nicolo series, much of which is set in the low countries and Italy of the mid-fifteenth century, are the description of the Dutch and Italian capitalism of that time.

To be honest, the books are almost entirely composed of favorite parts.

WaterGirl

@Sab: Amazon has the same issue with Tom vs. Thomas – you can only find it with Thomas Levenson.

Citizen_X

@Mary G: I was wondering precisely the opposite: was Hamilton fully aware of these financial innovations, which he incorporated into the Federal Reserve system, while Jefferson and Madison were—uncharacteristically for them—kind of dumbfounded by the whole idea and dazed by Hamilton’s energy and dedication to the project?

Miss Bianca

@Tom Levenson: And done. With myself first on the reserve list. : ) Tho’ I may have to break down and buy a personal copy before it gets thru’ the system – big fans of the history of the period in this household!

Omnes Omnibus

@Citizen_X: Jefferson and Madison weren’t really cutting edge on economics.

Narya

@joel hanes: with you on that. I like that series much more than Lymond.

BGinCHI

@Narya: I hope I get to retire some day so I can reread those….

tom

@Tom Levenson: Just ordered it from my favorite bookstore, Literati in Ann Arbor. Looking forward to reading it!

Narya

@BGinCHI: i always learn something when I reread those. Though I don’t do it as often as I reread Tolkien (rereading that now for maybe the 30th time ).

BGinCHI

@Narya: I love her immersive world-building.

She makes it look so easy!

Narya

@BGinCHI: I know! It makes me feel like I’m there (my favorite kind of fiction).

Gvg

I just ordered a hard copy as I intend to share with my parents and they don’t really do electronic books.

Tom Levenson

@tom: my thanks!

@Gvg: and thanks to you!

Thor Heyerdahl

I really enjoyed “The Hunt for Vulcan”. I need to visit the wonderful Toronto Public Library again – so I’ve put my hold on this new 480 page masterpiece – alas 4 people are already ahead of me (copies are apparently on the way).

J R in WV

@Omnes Omnibus:

She didn’t say we had to do it — be on our best behavior — just promise to stay there for some breif period of time. Whoosh!!! That was fast.

blacque_jacques

I’m really sorry to have missed this in all the convention excitement. I live in Amsterdam and am very familiar with the 1720 Windhandel (Wind trade) and even have a copy of The Great Mirror Of Folly (Het Groote Tafereel Der Dwaasheid) with about 2/3 of the hilariously scabrous cartoons printed for it at the time.The Dutch economy emerged pretty much unscathed from it. The companies that sprang up in various cities had their shares traded in coffeehouses and not on the official bourse. During the bubble and after it burst, Dutch cartoons mainly mocked John Law, who had reorganized French finances at the behest of the Duc d’Orleans, Regent of the future King Louis XV, and the Mississippi Bubble John Law created. Of course you know all of this.

Pity the Rona upended what could have been a raucous “celebration” of the Bubble’s tercentenary. I could swear I’ve already seen your book in a Waterstone’s here. I’ll pick it up ASAP (and add it to the reading pile…sob!) or keep an eye out for it.

Barney

@Tom Levenson: Great to see it’s here at last (well, there – here in the UK, they’re saying Sept 3rd).

And since I can’t use the ‘Look Inside’ feature yet – is my relation, Robert Chester, one of the inner circle of directors who bribed the politicians, mentioned?

TomatoQueen

That faint swish swish you hear is the sound of many alumni Johnnie palms sliding together, for we are devoted to our Isaac and will love another deep dive into his life.

Tom Levenson

@Barney: Chester didn’t make the cut. Others, more venal, took precedence.