Dan Ludwinski, Emory University Department of Economics, and I have a new paper at Medical Care Research and Review. We investigated how frequently is the cheapest silver plan in a county in the first year also the cheapest silver plan the following year. We looked at Healthcare.gov only states from 2014-2021.

Why do we want to know this?

We have very good evidence that individuals act with a high degree of inertia in the ACA markets (actually in most markets). Most people most of the time will make an initial choice and then stick to that choice unless they get hit with a huge attention shock of either an insurer leaving OR wicked high new premiums. We know that automatic re-enrollment is really important and the current algorithm prioritizes plan similarity without premium considerations. We also know that most people in the ACA when they purchase a plan with full attention will buy the least expensive plan in a metal level. Kong et al looked at the chances that a zero premium silver plan would be available to someone earning under 150% in a single year with the enhanced ARPA subsidies. We expanded this concept and tweaked it a little to only look at the cheapest plan at that is what brings in the marginal buyer.

So what did we find?

What does this mean?

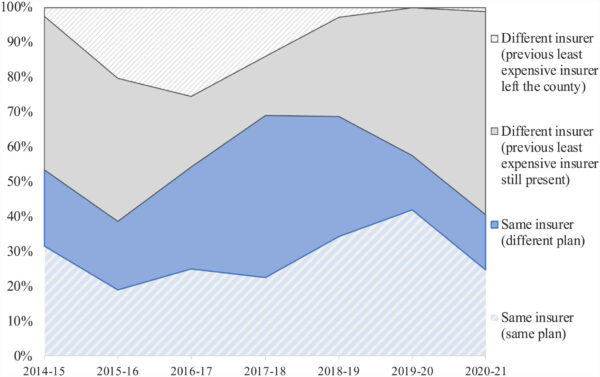

Depending on the year-pair, between 20% to 40% of the population weighed county year-pairs have the same silver plan occupying the #1 price rank position. This means that the cheapest silver plan in 2015 was also the cheapest silver plan in 2016. Conditional on someone preferring silver (especially CSR Silver) doing nothing does not make someone worse off.

The other 60% to 80% of the time requires action on the part of the consumer who wants to pay the lowest possible premium. Sometimes it is a switch within the insurer. Sometimes they would have to change insurers. We are not making judgements as to what plans people should move to. Sometimes the cheapest plan is just BAD from an individual’s point of view and avoiding it is a good thing. Sometimes cheap is all someone values. We just don’t know.

What we found interesting was the solid blue segment. In each year between 20% to ~40% of population weighed county-years the same insurer had the cheapest plan in Year 1 and Year 2 but it is a different plan. Some of this is dynamic price competition. A new insurer could come into a region, credibly threaten to drop the relative price levels and an incumbent matches the price cut. That is effectively what happened in the North Carolina Triangle in ~2018/2019. The prior year cheapest silver was guaranteed to not be the current year cheapest silver. It would just depend if it was from a different company or the incumbent that now was offering a skinny restricted network product.

Not doing anything is expensive:

When the new least expensive plan is offered by the same insurer, not switching plans increases premium cost by $18.75 per month on average ($17.34 SD/interquartile range: $5.75–$25.79, for a single 40-year-old) (Exhibit 5). When the new least expensive silver plan is offered by a different insurer, remaining on the same plan incurs an extra $45.49 per month on average ($44.21 SD/interquartile range: $17.07–$57.07, for a single 40-year-old) (Exhibit 6).

The same insurer, different plan case is interesting to us as it hints at insurer business strategy. We think this hints at an “invest and harvest” strategy where low prices are offered in Year 1 and prices are increased in Year 2. Attentive buyers move but inattentive buyers stay put due to automatic re-enrollment and pay more.

What could be done?

The Centers for Medicare and Medicaid Services recently tweaked the automatic re-enrollment algorithm to move some individuals who are in strictly dominated zero premium Bronze plans to zero premium CSR Silver plans. CMS could plausibly allow for individuals to indicate their automatic re-enrollment priorities. Do people want to hold onto their actual plan? Sure, keep the same assignment plinko board. Do people want to stay in the same network and insurer but want the cheapest plan in a metal level, sure, move them so the market does not segment on attention. Do people just want the cheapest plan in a metal level without regard to which insurer — this I need to think about as I think we already have too many strong incentives for underpricing the cheapest silver plan. But tweaks to at least the within insurer automatic assignment may lead to consumer benefits.

Adam Lang

“What can be done?”

Well, this doesn’t work very well in California…

dnfree

When it comes to Medicare Part D drug plans, there’s an option on Medicare to enter the drugs I take and then rank plans by total cost to me, including premiums. My preferred pharmacy can also be a factor if desired. It seems there should be some way for insurance purchasers to do something similar, including saying if they want to focus on premium, or low deductible, or high deductible, or copay, or wider network, or whatever. But even understanding all those choices is probably difficult for many consumers.