We’ve talked about the failure of Friday Health Plan in the ACA market several times over the past year. It was a VC funded expansion play that expanded too quickly by underpricing its products to buy market share. This worked until it did not.

One of my big worries has been contagion. Friday Health Plan and another ACA insurer that went bust, Bright Health, have large risk adjustment obligations. Risk adjustment in the ACA is intended to balance premiums to risk in a given state. Insurers whose populations code as having lower than state average predictable expenses send money to insurers whose populations code as having higher than state average predictable expenses. It is neither a good nor a bad thing to be pay or receive risk adjustment. These are reasonable business decisions an insurer may make.

The Centers for Medicare and Medicaid Services (CMS) runs the ACA risk adjustment program on a concurrent basis with a data lag. All risk adjustment is settled for each contract year the following summer. Insurers that owe money pay in the summer the following year. Insurers with higher than average risk scores get that cash in August which means they convert a high quality receivable on their balance sheet to actual cash assets.

Most of the time a federal receivable is great. It can be treated as if it is almost cash for an insurer. They can use it to readily borrow money for operating expenses and it counts as a good asset for regulatory purposes.

BUT….. that counts on the insurers that owe the money paying up.

FIERCE Healthcare ran a story that interviews health strategist Ari Gottlieb who did some digging into the Texas liquidation of Friday:

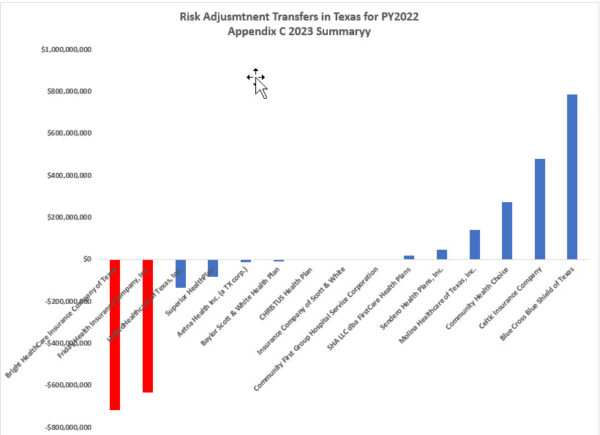

Gottlieb cites a recent filing (PDF) in Texas courts by Friday saying that the insurtech will not pay any of its approximately $640 million risk adjustment payable to that state this month. Bright said in its most recent Securities and Exchange Commission earnings report that it also does not plan to pay its entire risk adjustment liability.

Here is the relevant chunk of the Friday filing:

Risk Adjustment Transfer (“RAT”) Liability: The RAT program is a component of the ACA that transfers premiums from insurers that enroll members with relatively lower health risks to insurers that enroll members with relatively higher health risks. CMS issued its 2022 Summary Report on June 30, 2023. It recites that FHIC owes $633,696,895 in RAT liability for the 2022 plan year. RAT payments are calculated annually, and payment for the 2022 assessment is due in August 2023. The RAT obligation arises under federal law, and it is the SDR’s position that it has a Class 3 priority under Section 443.301 of the Insurance Code. The SDR will not make any payments on the RAT liability outside of the POC process.

I AM NOT A LAWYER, but reading the relevant law, I think this means risk adjustment falls below ongoing operational expenses of winding down the firm as well as below paying outstanding claims. Again IANAL but it is hard to get an order that will actually recover anything when there is almost nothing available to be recovered for a given class of claims.

This is problematic. The 2022 Texas Individual health insurance market had roughly $1.5 billion dollars in risk adjustment payables. FRIDAY is responsible for just about 40% of that. Bright is on the hook for another 45% or so.

If these two firms can’t or won’t pay the risk adjustment payables that they owe, the federal government is not back-stopping the payments. Risk adjustment is intended to be a zero sum game with only a miniscule per member per month payment to CMS to run the system. Instead, the other insurers that were expecting to get paid in full will get a proportional hair cut. That haircut could be up to 85% of what they expected.

That is a lot of money.

I would not be worried about insurers like Christus which is owed just over $700K. An 85% haircut for them is a small enough sum that their business model should be able to absorb the hit like it was an unexpected car crash with multiple people having multiple 3rd degree burns. I would not worry about Centene/Ambetter or Blue Cross of Texas. They both have reserves that make Smaug look like a miser.

I would worry about community and provider-owned firms whose pricing and reserve model relied on getting paid their risk adjustment payables on a timely basis and in full. They could have done everything right in 2022 and 2023 but are facing substantial operational risk due to other companies screwing up royally.

Another Scott

Oops.

:-(

Are you keeping track? If so, what number is this of reasons why having a (quasi-single) national health insurance system is a good idea?

[sigh]

Thanks.

Cheers,

Scott.

There go two miscreants

@Another Scott: I think it’s reason #1. Insurance always works better when more risks are pooled rather than segregated. You don’t need these Rube Goldberg mechanisms to equalize things.

iAnonymous at Work

Aside from Texas government helping the little guy out, the actual little guy, not the cousin of a commissioner who also got a major family loan. THAT ASIDE, would a state level bailout involve admitting errors by the state government or Lege?

I can see ego as the primary obstacle.

Anonymous at Work

Aside from Texas government helping the little guy out, the actual little guy, not the cousin of a commissioner who also got a major family loan. THAT ASIDE, would a state level bailout involve admitting errors by the state government or Lege?

I can see ego as the primary obstacle.

KrackenJack

Making or receiving transfer payments may be neutral in a business sense, but are there metrics like operating ratios that would indicate that it is a dangerous strategy or a systemic risk?

trollhattan

Maybe this is the place to share Blue Shield’s move re. pharmacy partnerships.

That’s roughly 1/8 of California’s population who are affected by this effort. Half a billion saved per year isn’t just a blip, should it work.

patrick II

They should put all of the newly uninsured on a medicaid based public option. One small bite at a time.

David Anderson

@iAnonymous at Work: State regulators did not have power to do much if anything on pricing until PY2023 so no egg on the state’s face.

David Anderson

@patrick II: No new uninsured unless the other insurers go kablooie if the money that they relied on does not show up on time.