The Fed speaks: (via TPM):

To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. In particular, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. The Committee views these thresholds as consistent with its earlier date-based guidance. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent.

The Post’s Neil Irwin on what it means:

This is a big deal. The Federal Open Market Committee has abandoned its practice of talking about its future policy in terms of the calendar, such as pledging low rates until 2014, and instead making clearer 1) That the path of monetary policy will depend on the economy, not some arbitrary date, and 2) What exact economic conditions it would need to see to change course.

(DeLong has several posts up with various reax.)

IANCB*, but here’s my take. (1) Free of the politics of the election, Bernanke has managed to push through the Fed a significant policy initiative that, among much else, stands in considerable contrast to the austerity obsessions of, say, our European cousins. Basically, Bernanke and the Fed are saying that in times of lack of demand, more demand helps the economy.

This is not rocket science, but it is still a conceptual bridge too far for the Republican Party — and the pressure to keep from appearing to meddle in a democratic process impinged the Fed from belaboring the obvious for several months. I have no way of knowing whether or not that pressure actually blocked more dramatic decisions before Nov. 6, but it can’t have helped.

The other thing I think is that this is very good news for Barack Obama (and the rest of us). The Fed’s move provides at least a bit of stimulus, and even more, some of that much desired “certainty” for businesses making capital spending or hiring decisions. Both of those would serve to cushion some of the negative economic effects of going off the fiscal slope. It would be nice to have more revenue and to make sure the worst-off among us don’t lose critical support (unemployment and all that) — and I use the word “nice” to mean “both enormously good policy to help the economy and a moral essential” – but at the least, this gives the administration a bit of back up when it tells Boehner, McConnell and the gang that they do not wish — nor need — to negotiate with hostage takers.

You should, of course, take any punditing by yours truly with the metric tonne of salt appropriate. What William Goldman says of the movies is doubly true for me.

Good times!

*CB=Central Banker, in case you were wondering.

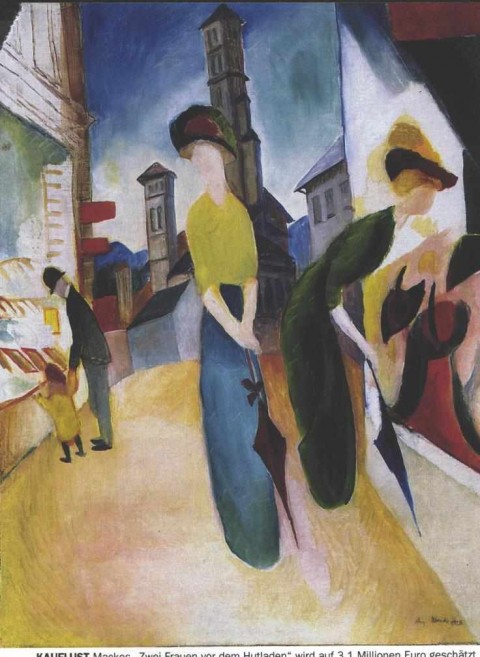

Image: August Macke, Two women in front of a hat shop, 1913-1914

aimai

Thanks for this post, Tom. I’m still not clear about how cheap money to people who are hoarding it lowers the unemployment rate. I’m going to hop over to Brad’s saloon to see what he has to say.

aimai

Villago Delenda Est

Duh.

Some obscure Scotsman figured this out over two fucking centuries ago, and these dumbfucks (the Rethugs) claim to revere him.

Just like they claim to revere a document written by men who had no use for the fucked up invisible sky buddy of some barbarous sheep herders in the Middle East, but then claim that said fucked up asshole invisible sky buddy dictated the damn thing.

Maude

The Fed tied monetary policy to unemployment. That is very good for us. It also gives Obama a club to beat the Repubs in Congress about the ears.

Thanks for posting this.

I’ll listen to Bloomberg radio in the morning and see who gripes about it.

Linda Featheringill

Not a central banker either, but to me it looks like a slap in the face to the austerity-mongers. Good.

Actually, we might come out of this mess one day. That would be grand.

Patricia Kayden

Looks like even CEOs are breaking from Republicans on the fiscal cliff fight.

http://thehill.com/blogs/on-the-money/domestic-taxes/272413-corporate-ceos-break-with-republicans-on-rate-hikes

Tonal Crow

I’ve never seen this usage of “impinged”. “Discouraged” would be better.

TooManyJens

DeLong’s blog seems to be broken. Tough blogging day.

Tonal Crow

@aimai:

In theory it encourages people to buy stocks by making short-term government debt relatively unattractive. Buying stocks increases their price, increasing the potential amount of capital available to companies that want to issue stock. And that potentially encourages companies to issue stock and use the proceeds to expand or create operations. But it’s a pretty slender rope to push upon, because companies want to see solid demand before they expand.

ThatLeftTurnInABQ

@Patricia Kayden:

Somebody thinks he is more Catholic than The Pope, apparently.

Tonal Crow

In 8 I also should have said that low short-term rates in theory encourage banks to lend out their cash, rather than keeping it on deposit at the Fed and earning a pittance.

Publius39

@Villago Delenda Est:

THIS.

The Moar You Know

@Patricia Kayden: I said this on the thread before last and stand by it: Money is sick and tired of the TeaTard brinksmanship bullshit, which as it turns out is really fucking bad for the business that Money needs to keep making that sweet, sweet cash.

And the House is listening, although you wouldn’t know it from the rhetoric. Four teatards relieved of committee positions just this week, more to follow.

? Martin

@aimai: They’re not hoarding it. At least, the people borrowing from the Fed aren’t. Banks are refinancing people at a frightful rate – and a lot of people are getting their mortgage payments down as much as 40% from what they were paying in 2008. (We refinanced a 30 year to a 15 year with our monthly payment only going up about 10%.) That’s helping keep a lot of people in their homes, and creating new housing demand. We’re getting unsolicited offers on our house again, and homes are selling for more than asking. Is another bubble forming? Maybe, but though prices are going up, mortgages aren’t because the rates are dropping. It’s maybe not the best way to fix housing, but it’s not horrible. Auto loans are similarly cheap, as are business loans.

The people that are hoarding cash are the non-banking corporations. Low interest rates contribute to the hoarding because why should a company not in the business of loaning money take on the risk for such a low return. They should be building things and expanding – and some are. Many aren’t though, but the interest rates likely don’t make any difference one way or another to that outcome, so there’s no harm done. Other things are needed there, and things that really only Congress can help with, rather than the Fed.

ThatLeftTurnInABQ

@The Moar You Know:

Dans ce pays-ci, il est bon de tuer de temps en temps un teadiste, pour encourager les autres

FlipYrWhig

@Tonal Crow: Or “impeded.”

aimai

@Tonal Crow:

Oh, I never thought of it that way. I thought that people actually borrowed the money, at the reduced rate and then gambled with it instead of investing it-and, in fact, the buying and selling of stocks without regard to the actual fundamental nature of the companies involved seems to be part of the problem so I’m not sure that this makes me any easier in my mind.

aimai

Chris T.

It’s “good” news but it’s not “very” good news, as it simply means the Fed is promising not to stomp on the economic brakes. Their accelerator is not really connected to anything at this point, so they can’t make the economy go, they can only make it stop. They’ve changed the wording from “we promise not to hit the brakes immediately” to “we promise not to hit the brakes even when it looks like we’re speeding up a little bit”.

Sly

I don’t think this is particularly earth-shattering news. The Fed announced this change a few months ago, but didn’t give specific targets. And even then, they only announced officially what everyone knew was the unofficial policy anyway. They just couldn’t announce it because… well… there are members of the FOMC who are not quite so distant from their European counterparts on the question of austerity as Bernanke.

The targets are probably more aggressive than many thought but, as Neil Irwin wrote, they reflect the figures endorsed by the Chicago Fed from last year. The real story is the softening of the stance taken by the inflation hawks on the FOMC, especially since Kansas City Fed President Tom Hoenig (the most outspoken critic of expansionary monetary policy) reached his term limit last year and retired.

? Martin

@aimai: Well, it’s done at all levels from the investment banks down, but it has limited impact as Tonal has described it.

Large businesses aren’t going to issue stock – they’ll float bonds if they don’t have the cash (and even if they do). Those bond rates are going to be similarly low, so there is a stimulative effect there. Even if they only expect to see the same return as the expected 3% GDP growth, if they can borrow at that rate, it’s a lot more likely to happen than if rates were at 6%.

Small business is a different story. They’re borrowing straight up, or they’re getting venture capital. By providing liquidity and low rates, that capital is fairly easy to come by, so it’s a lot easier to get your startup funded, or get that next round of financing to expand. That’s good, but outside of tech, starting a new business is pretty hairy mainly because Congress won’t stop threatening to blow everything up. If your business has a govt contract that you’re dependent on to make payroll (like paving roads), you’ve got to be terrified that the govt is going to effectively stop spending again for 3 months while the next hostage crisis plays out. That might be enough to put you under. Businesses like stability way more than they dislike taxes.

Boosting stock values isn’t terribly beneficial to the economy except where that is turning into retirement income, etc. That’s not worthless (particularly after the pasting the market took in 2008/2009) but it’s not very efficient either.

Scoobydoo

So, can anyone explain infinite growth on a finite planet? Anyone? Bueller? Therein lies the major flaw of our current system.

Tonal Crow

@? Martin: Yes, those are good points on corporate bonds. I don’t have a good idea of how difficult it is to get small business financing. Is it really “fairly easy to come by” for non-tech small businesses? If I want to start a pizza joint, will the bank kick me out of the door after my first sentence?

aimai

@Tonal Crow:

I thought that actually was part of the debate–were we in a liquidity crunch? a credit crunch? what? at the beginning of the crash. We bailed out a ton of people with the belief they would turn around and start lending again but it turns out that they didn’t–small businesses and start ups couldn’t get money. Still, everyone here seems very upbeat so I’ll be upbeat too.

aimai

Bill Murray

Yeah for the Auguste Macke

Julia Grey

Heh.

Chris T.

@Scoobydoo: You can have infinities that fit in a suitcase, as it were. Consider fractals, like shorelines. The California coastline is nominally 840 miles, but its tidal shoreline is 3,427 miles long (again, nominally). (And the driving distance on I-5 from the Mexican border to the Oregon border is under 800 miles.)

As in Zeno’s paradox, the sum of an infinite series can be finite. Of course, that depends on the terms inside the series, too. There’s one flaw in our current system right there: the terms in the infinite series are not promising. :-)

The Institute For A Meaningful Apocalypse

What it might do, is temper some of the adverse effects with all the demand negatives with going over the FC. Particularly, the immediate loss of spending power that would be lost if the 98 percent sees a sudden loss of take home pay that would have been spent otherwise. From both the expiration of Bush’s tax cut, and the other payroll tax sweeteners that Obama has kept in place as stimulus.

It is the same conundrum we faced in 2010, you know, when Obama sold us out and extended all the tax cuts, that didn’t cause another recession and Obama losing re election. It is more a message to the House wingnuts that there are other ways to skin a nihilistic cat for the coming battles, especially over raising the debt ceiling.

hoodie

Which is why Obama is on solid ground on reforming the debt ceiling process and Reid is on solid ground reforming the filibuster. Both have been become destabilizing, which is the irony of Republicans whinging about “uncertainty.” Most of the uncertainty is of their own doing, by fetishizing tax cuts and reduction of government. They may have inadvertently maneuvered themselves into alienating their original base — businesses.

Scamp Dog

@Scoobydoo: Any physical growth process has limits, but what are the physical concomitants of economic growth? For several centuries, it seemed to track energy use, but that link got broken sometime like the ’80s or ’90s, if I recall correctly. So unless somebody can give me a definite physical limit to the economy, I figure economic growth can continue for quite a long time (or long enough to outlast me, in any case).

None of this is to imply that significant economic growth is likely to happen with the current bunch of austerian bozos in charge, both here and in Europe.

Mnemosyne

@Scoobydoo:

As I understand it (and I am not an economist), you do it by changing industries. Fossil fuels are nearly played out, but you can create new industries with solar and wind power. Basically, you can’t have an ever-expanding economy using the same old industries, but you can replace old industries with new ones to provide that same growth. It’s less continuous growth than continuous regression of old industries and expansion of new ones that take their place (the old “buggy whips” theory) that give the illusion of constant growth.

Roger Moore

@aimai:

I think a key goal is to drive inflation up enough that people stop hoarding cash and start spending it instead. That’s why they’re promising to keep dumping money into the economy until they’re confident that we’re away from the zero bound. If they can create an expectation that inflation is going to go up, people may start spending their money and make the expectation come true.

mainmati

@Tonal Crow: Exactly. The monetary side is the pushing on a string approach. Fiscal stimulus would be far more effective, especially targeted towards investment in the future (infrastructure, education and green energy). But, of course, the Goopers and the Blue Dogs don’t give a shite about the future so for at least the next ten years this country is screwed.

Brother Shotgun of Sweet Reason

@Chris T.: Yes but it appears that our infinite growth is an exponential, not a fractal.

But I’m sure you know that.

From what I understand there was a scenario in 1972’s “Limits to Growth” where we could get to a soft landing. It required backing off of the energy use and ramping up the environmental protection. With or without stomping on the accelerator, if we didn’t do the second we could still end up wallowing in our own wastes as the crash came.

Hell, I need another drink.

Brother Shotgun of Sweet Reason

@Scamp Dog: I think about it by looking at cathedrals. The fruit of labor (and food powered by sunlight) is a building that has stood 400 years. True, our economic growth for the last 200 years has been driven by fossil fuels, but there should be lasting economic benefits from the work of each succeeding generation.

JoyfulA

@Tonal Crow: “Fairly easy to come by” if you have real estate equity or other assets to pledge. Financing a new small business isn’t something banks usually want to do unless you have immense experience, a great business plan, and financial backing.

Banks that work with small businesses are typically more into financing stock (as in stuff to sell), receivables, and the like.

Or things may have changed since my experience.

Yutsano

I. Adore. That. Painting.

That is all.

mclaren

About fucking time.

Obama needs to jettison Geithner and eject Bernanke and get some people in those positions who actually care about getting unemployment down below 6%.

If he can do that and hang tough on the debt ceiling, we may get somewhere.

Knowing Obama, I won’t hold my breath. Most likely he’ll appoint fucking Jamie Dimon as his new Treasury secretary.

Yutsano

@mclaren: Uhh…you do realise Geithner is resiging, amirite?

mclaren

@Scamp Dog:

Yes, it’s an absolute mystery why Obama has bought into the insane and ignorant economic austerity fairytale.

Cuttings deficits in times of recession is something every basic macroeconomics textbook warns against. You want to increase aggregate demand by ramping up government spending during a recession; the time to cut deficits is during the booms, not during recessions.

Why doesn’t Obama realize this?

He can’t be that ignorant, he went to Harvard.

Villago Delenda Est

@mclaren:

George W. Bush and Mitt Romney both went to Harvard, too.

liberal

@Villago Delenda Est:

Yeah, well, Bush certainly didn’t cut the deficit, recession or no.

The prophet Nostradumbass

@mclaren:

which is why he pushed the American Recovery and Reinvestment Act, aka the Stimulus bill. That was some serious austerity, all right.